South Korea Health Insurance Market Report by Provider (Private Providers, Public Providers), Type (Life-Time Coverage, Term Insurance), Plan Type (Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, and Others), Demographics (Minor, Adults, Senior Citizen), Provider Type (Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs)), and Region 2025-2033

South Korea Health Insurance Market:

South Korea health insurance market size is projected to exhibit a growth rate (CAGR) of 4.85% during 2025-2033. The increasing advancements in healthcare technology that can impact the insurance industry by influencing the types of coverage offered, pricing models, and the overall efficiency of healthcare delivery, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 4.85% |

South Korea Health Insurance Market Analysis:

- Major Market Drivers: The increasing awareness of healthcare risks among individuals has propelled a surge in demand for comprehensive coverage. Additionally, advancements in medical technology and treatments have contributed to higher healthcare costs, prompting individuals to seek reliable insurance plans to mitigate financial burdens, thereby propelling the South Korea health insurance market demand.

- Key Market Trends: Technological advancements, including the integration of artificial intelligence and data analytics, have streamlined insurance processes, making it easier for individuals to access and manage their health coverage, further propelling the regional health insurance market forward. Moreover, demographic shifts, such as an aging population and the rising prevalence of chronic diseases, are influencing the South Korea health insurance market growth.

- Competitive Landscape: The South Korea health insurance market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

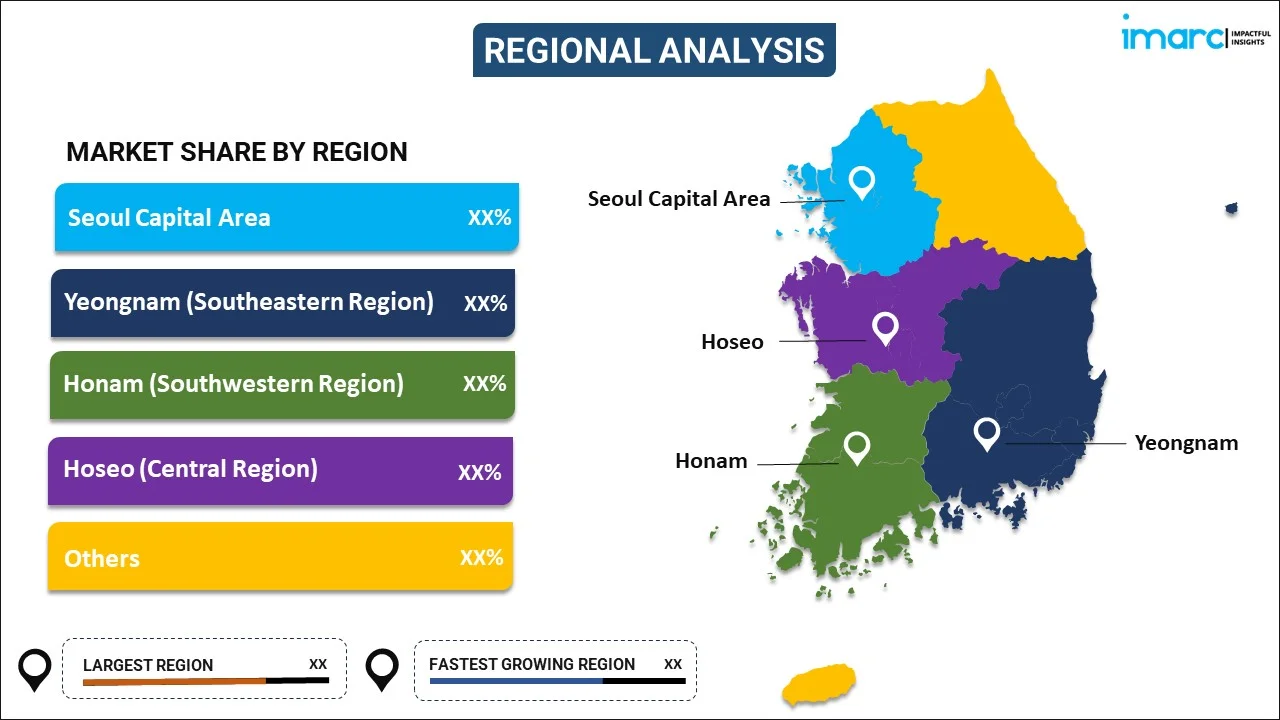

- Geographical Trends: The Seoul Capital Area, including Seoul and Incheon, is the most densely populated region in South Korea. This high population density drives significant demand for health insurance services. Moreover, the presence of major industrial hubs in Yeongnam means that there is a demand for both individual and group health insurance plans, particularly from large companies providing employee benefits.

- Challenges and Opportunities: High competition among key players and the rising healthcare premium owing to surging healthcare costs are hampering the market's growth. However, the growing awareness about preventive health and wellness presents opportunities for insurers to offer products that incentivize healthy behaviors and provide preventive care benefits.

South Korea Health Insurance Market Trends

Aging Population

South Korea has one of the fastest aging populations in the world. For instance, according to Statista, in 2023, people aged 65 and up in South Korea accounted for nearly 19% of the total population. By 2025, South Korea is anticipated to be a "super-aged society," with more than 20% of the population aged 65 or older. As the proportion of elderly citizens increases, there is a growing need for health insurance products that cater to chronic illnesses, long-term care, and age-related health issues. These factors are further bolstering the South Korea health insurance market revenue.

Rising Healthcare Expenditure

The rising healthcare expenditure is significantly driving the growth in the South Korean health insurance market. For instance, according to Statista, in 2022, total health expenditures in South Korea amounted to around 9.7% of the country's GDP. Furthermore, in 2022, the country's population spent around US$ 4.6K per capita on healthcare. With rising healthcare expenditures, people are seeking more comprehensive health insurance plans that offer extensive coverage. These plans often include benefits for a wide range of medical services, including advanced treatments and elective procedures. These factors are positively influencing the South Korea healthcare insurance market forecast.

Expansion of Telemedicine

The rising demand for telemedicine is a significant growth driver for the South Korean health insurance market. For instance, according to IMARC, the South Korea telemedicine market size is projected to exhibit a growth rate (CAGR) of 13.00% during 2024-2032. Telemedicine provides greater accessibility to healthcare services, particularly for those in remote or underserved areas. As more people use telemedicine, there’s a corresponding increase in demand for health insurance plans that cover virtual consultations and remote care, thereby contributing to the South Korea health insurance market share.

South Korea Health Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with South Korea health insurance market forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on provider, type, plan type, demographics, and provider type.

Breakup by Provider:

- Private Providers

- Public Providers

The report has provided a detailed breakup and analysis of the market based on the provider. This includes private providers and public providers.

According to the South Korea health insurance market outlook report, the NHIS is the primary public health insurance provider in South Korea, responsible for the National Health Insurance (NHI) system. It provides basic health coverage to all residents, ensuring that medical services are accessible and affordable. The South Korean government provides subsidies and funding to the NHIS, which helps keep premiums relatively affordable for most residents. This financial support encourages continued enrollment and participation. Moreover, the rising healthcare costs drive demand for private insurance that can help cover the expenses not fully addressed by public insurance. This includes out-of-pocket costs for expensive treatments and specialized care.

Breakup by Type:

- Life-Time Coverage

- Term Insurance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes life-time coverage and term insurance.

According to the South Korea health insurance market outlook, life-time coverage refers to insurance plans that provide coverage for the insured individual's entire life-time, as long as the premiums are paid. As South Korea has one of the fastest-aging populations globally, there is a growing demand for life-time coverage to ensure continuous health care as people age. This type of coverage is appealing to older individuals who seek long-term security and financial protection against rising medical costs. Moreover, term insurance provides coverage for a specified period, after which the policy may expire or require renewal. Term insurance typically has lower premiums compared to life-time coverage, making it a more budget-friendly option. This is particularly appealing to younger individuals or families looking for affordable coverage.

Breakup by Plan Type:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes medical insurance, critical illness insurance, family floater health insurance, and others.

Medical insurance typically covers general healthcare needs, including hospitalization, outpatient visits, and prescription medications. The increasing cost of medical services and treatments drives demand for supplemental medical insurance to help manage out-of-pocket expenses and reduce financial burdens associated with healthcare. Moreover, critical illness insurance provides coverage specifically for serious and life-threatening conditions such as cancer, heart disease, or stroke. Rising rates of chronic diseases and critical illnesses drive the demand for this coverage. Individuals want financial protection against the high costs of treating severe health conditions. Besides this, family floater health insurance covers the entire family under a single policy, providing coverage for various health needs. These plans are often more cost-effective than purchasing individual policies for each family member. This makes them an attractive option for families looking to save on insurance premiums.

Breakup by Demographics:

- Minor

- Adults

- Senior Citizen

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes minor, adults, and senior citizen.

Parents are typically responsible for securing health insurance for their children. They seek insurance plans that offer comprehensive coverage for routine care, vaccinations, and treatment of common childhood illnesses. Moreover, adults face various medical expenses, from routine visits to chronic disease management. Health insurance helps cover these costs and offers financial protection against unexpected medical expenses. Besides this, as people age, they typically experience more frequent and complex health issues. Senior citizens require comprehensive health insurance that covers a wide range of services, including hospitalization, long-term care, and treatments for age-related conditions.

Breakup by Provider Type:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs).

According to the South Korea health insurance market analysis report, PPOs are a type of health insurance plan that offers a network of preferred providers. PPOs provide a network of healthcare providers that have agreed to offer services at reduced rates. Moreover, POS plans combine features of PPOs and Health Maintenance Organizations (HMOs). In POS plans, members are required to choose a primary care physician who acts as a gatekeeper for accessing specialists and other healthcare services. Furthermore, HMOs are a type of health insurance plan that emphasizes preventive care and cost control. HMOs typically require members to use a network of providers for all services except emergencies. Out-of-network care is usually not covered.

Breakup by Regions:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

The Seoul Capital Area, which includes Seoul and surrounding cities like Incheon and Gyeonggi Province, has a high demand for health insurance. This is due to the high population density, greater economic activity, and higher average income levels. Residents in this area are more likely to seek comprehensive health insurance plans to cover a wide range of medical services. Moreover, Yeongnam, encompassing cities like Busan, Daegu, and Ulsan, generally exhibits a strong demand for health insurance. This is influenced by a mix of industrial activity, a relatively large urban population, and an aging population, which increases the need for health coverage.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Health Insurance Market News:

- July 2024: MetLife Korea, a life insurance business, received the Customer Service Initiative of the Year - Korea category at the prestigious Insurance Asia Awards 2024 for its 360Future holistic retirement package.

- June 2024: South Korea's National Health Insurance Service approved the reimbursement XPOVIO (selinexor) for adult patients with relapsed or refractory multiple myeloma.

- June 2024: South Korea announced to revamp its national health insurance system under the Second Stage Comprehensive Insurance Plan, which will increase patients' access to healthcare support from 2024 to 2028.

South Korea Health Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea health insurance market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South Korea health insurance market?

- What is the breakup of the South Korea health insurance market on the basis of provider?

- What is the breakup of the South Korea health insurance market on the basis of type?

- What is the breakup of the South Korea health insurance market on the basis of plan type?

- What is the breakup of the South Korea health insurance market on the basis of demographics?

- What is the breakup of the South Korea health insurance market on the basis of provider type?

- What are the various stages in the value chain of the South Korea health insurance market?

- What are the key driving factors and challenges in the South Korea health insurance?

- What is the structure of the South Korea health insurance market and who are the key players?

- What is the degree of competition in the South Korea health insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea health insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea health insurance market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea health insurance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)