South Korea General Surgical Devices Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

South Korea General Surgical Devices Market Size and Share:

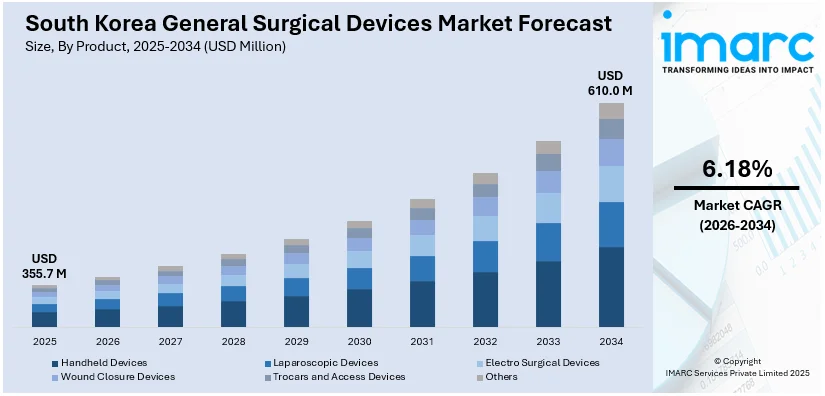

The South Korea general surgical devices market size was valued at USD 355.7 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 610.0 Million by 2034, exhibiting a CAGR of 6.18% from 2026-2034. The South Korea general surgical devices market is driven by factors such as advancements in minimally invasive (MI) surgical technologies, a growing aging population requiring surgical interventions, and increasing demand for high-quality healthcare services. Additionally, rising healthcare awareness and government investments in medical infrastructure contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 355.7 Million |

|

Market Forecast in 2034

|

USD 610.0 Million |

| Market Growth Rate (2026-2034) | 6.18% |

Technological innovations in minimally invasive surgical devices are a key driver of the South Korea General Surgical Devices market. These advancements enable smaller incisions, leading to reduced patient recovery time, lower complication rates, and shorter hospital stays. The demand for laparoscopic and robotic-assisted surgeries is increasing as healthcare professionals seek precision, improved outcomes, and quicker patient recovery. South Korea's strong focus on cutting-edge medical technologies, supported by its thriving healthcare sector and high adoption rates, boosts the demand for these advanced surgical devices, fostering market growth in the region.

To get more information on this market Request Sample

South Korea's rapidly aging population is another major driver in the general surgical devices market. With rising life expectancy, older adults are increasingly in need of surgeries to address age-related health conditions, including cardiovascular diseases, orthopedic disorders, and cancer. The aging demographic creates a substantial demand for surgical devices that cater to these specific needs. As of 2024, individuals aged 65 and older constitute 20% of the country's 51 million people, officially classifying South Korea as a "super-aged" society. Additionally, the government’s efforts to address aging-related healthcare challenges, through policy reforms and increased medical investments, further support the growth of surgical device adoption. This trend fuels the market's expansion as the need for advanced surgical solutions rises.

South Korea General Surgical Devices Market Trends:

Rising Demand for Robotic-Assisted Surgery

In South Korea, the demand for robotic-assisted surgery is rapidly increasing, driven by the country's emphasis on technological innovation in healthcare. Robotic systems provide enhanced precision, flexibility, and control during surgeries, particularly in complex procedures like urology, orthopedics, and cardiology. Hospitals and surgical centers are increasingly adopting systems like the da Vinci Surgical System for their ability to enhance patient outcomes, shorten recovery periods, and reduce human error. A 14-month single-center study in spine surgery observed 495 attempted robotic-assisted pedicle screw fixation procedures on 100 patients, highlighting the feasibility and safety of robotic assistance in spinal procedures. The South Korean government has also been supportive of integrating robotic technology into healthcare infrastructure, ensuring that healthcare facilities have access to these advanced surgical tools, contributing to the trend’s growth.

Focus on Minimally Invasive Procedures

Minimally invasive surgeries (MIS) continue to be a dominant trend in South Korea’s general surgical devices market. Surgeons increasingly prefer MIS techniques due to their ability to reduce patient trauma, enhance recovery speed, and lower the risk of infection. The trend is fueled by the availability of advanced surgical tools such as laparoscopes, endoscopes, and small, precision-driven instruments, all of which are improving surgical outcomes. The rise in outpatient procedures and a growing preference for quick recovery are also pushing healthcare providers to adopt MIS. With increasing demand for faster, less invasive solutions, the adoption of these devices continues to accelerate across the country’s medical institutions.

Integration of Artificial Intelligence (AI) in Surgery

The integration of Artificial Intelligence (AI) in general surgical devices is transforming the South Korean surgical landscape. AI technologies are being embedded in surgical systems to enhance accuracy, predict patient outcomes, and optimize surgery planning. AI-driven robotic systems, for instance, are designed to assist surgeons with real-time decision-making, such as analyzing imaging data or detecting abnormalities during procedures. These technologies contribute to more personalized care, reducing human error, and improving overall efficiency in the operating room. As AI continues to evolve and gain trust in South Korea’s healthcare sector, its role in shaping the future of general surgical devices is expected to expand along with a South Korea significant general surgical devices market share.

South Korea General Surgical Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea General Surgical Devices market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product and application.

Analysis by Product:

- Handheld Devices

- Laparoscopic Devices

- Electro Surgical Devices

- Wound Closure Devices

- Trocars and Access Devices

- Others

Handheld devices, including scalpels, forceps, and scissors, remain the backbone of general surgery. These instruments are precise and controlled and are used for a wide range of procedures. As surgical techniques evolve, the need for ergonomic, durable, and high-quality handheld devices continues to grow, ensuring their steady presence in the market.

In addition, the laparoscopic devices are cameras, graspers, and trocars. The main drivers for these devices are minimally invasive surgeries, which are becoming more popular as people prefer procedures that have minimal recovery time and small incisions. Advanced laparoscopic technologies are also leading to increased market growth in South Korea.

However, the electrosurgical devices, such as diathermy units and electrosurgical pencils, are very important in coagulating tissue and cutting during surgeries. They provide precision and minimize bleeding, which enhances surgical outcomes. More efficient, compact, and safer electro surgical devices are emerging due to technological advancement, and they are being increasingly used in operating rooms.

Additionally, wound closure devices such as sutures, staples, and surgical adhesives play a vital role in supporting post-surgical healing. The more complex the surgical procedure, the greater the need for effective, efficient, and minimally invasive closure devices. Innovations in wound closure materials, such as bioabsorbable sutures, are improving the market's growth.

Additionally, for minimally invasive surgeries, trocars and access devices are integral for accessing body cavities. These thereby create safety in patients during the procedure because proper tools are placed without causing much damage to body tissues. Increasingly, the trend is adopting more laparoscopic and robot-assisted surgeries due to the increasing demand for advanced, user-friendly trocars and access devices.

Besides this, the other surgical devices encompass a wide range of specialized instruments such as surgical retractors, suction devices, and diagnostic tools. These devices are essential for specific surgeries, and as medical procedures diversify, demand for specialized products continues to rise. Technological innovations are also improving functionality and patient outcomes in this category.

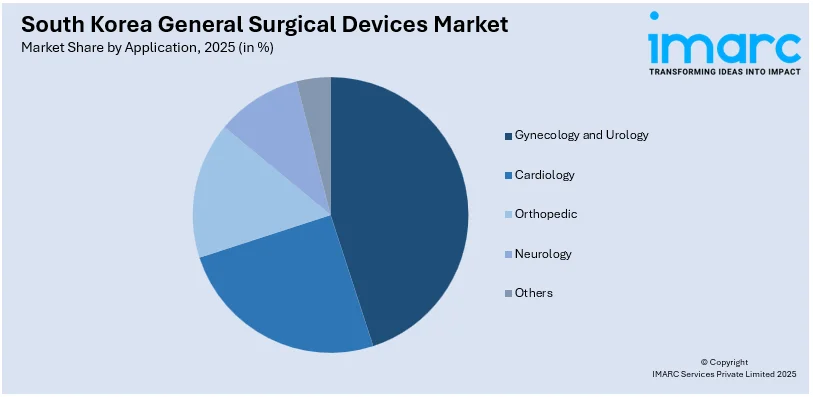

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Gynecology and Urology

- Cardiology

- Orthopedic

- Neurology

- Others

Based on the South Korea general surgical devices market forecast, in gynecology and urology, surgical devices are used for procedures like hysterectomies, prostate surgeries, and kidney treatments. With advancements in minimally invasive techniques, demand for specialized laparoscopic tools, electrosurgical devices, and urological instruments is increasing. These innovations aim to improve precision, minimize recovery time, and enhance patient outcomes.

Concurrently, the cardiology applications require surgical devices for procedures such as coronary artery bypass grafting (CABG), pacemaker implantation, and valve replacement. The growing prevalence of heart diseases has driven demand for advanced cardiac surgical instruments, including catheterization tools, electro-surgical devices, and robotic-assisted systems, aimed at improving surgical success rates and patient recovery.

Moreover, the orthopedic surgeries often involve the use of devices like bone drills, joint replacements, and fracture fixation tools. As the aging population increases, so does the need for orthopedic surgeries such as hip and knee replacements. Technological advancements in these devices focus on improving surgical precision and enhancing recovery time for patients.

Also, in neurology, surgical devices are crucial for brain and spinal surgeries, including tumor removals, spinal fusions, and deep brain stimulation procedures. Demand for neuro-surgical tools like microscopes, retractors, and electrosurgical devices is rising as these surgeries become more complex and precision-driven, allowing for better patient outcomes and minimal complications.

Apart from this, the "Others" category includes surgical devices used in a range of specialized fields such as ENT (ear, nose, throat), ophthalmology, and plastic surgery. These applications require niche surgical instruments designed for specific procedures. As medical technology progresses, innovations in these devices aim to improve precision, safety, and overall surgical efficiency across diverse medical fields.

Regional Analysis:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area is a region with the highest concentration of hospitals and medical facilities in South Korea, and its demand for general surgical devices is high. The region is advanced in its healthcare infrastructure with high adoption rates of cutting-edge technologies such as robotic surgery, thus experiencing substantial growth among surgical device manufacturers.

Another key area is the Yeongnam, with Busan and Daegu being its major cities, which represents a large part of South Korea's general surgical device market. Healthcare facilities are well developed in the region, with a rising elderly population, thereby increasing the number of surgeries and, subsequently, surgical devices in the region, especially in orthopedics and cardiology.

In addition, Honam, especially cities like Gwangju, has grown with considerable infrastructure development in medical fields and healthcare sectors. Investments in health facilities and surgical technology by the region and increased demand for surgeries have further propelled the growth of general surgical devices market, especially minimally invasive surgeries.

In addition, the Hoseo region, with cities including Daejeon and Cheonan, is developing quickly in the fields of healthcare and medical equipment technologies. Although much smaller than Seoul, the increasing number of hospitals and health centers together with government investment in medicine has stimulated demand for general surgical equipment.

Other regions in South Korea also play a role in the growth of the general surgical devices market, though on a smaller scale. The demand in these areas is localized and driven by regional healthcare needs. Hospitals are increasingly adopting advanced surgical technologies to improve healthcare outcomes, especially in specialized surgical procedures.

Competitive Landscape:

South Korea's general surgical devices market features a highly competitive landscape with a blend of local and global players. Product offerings here vary from simple traditional surgical instruments to the latest robotic and minimally invasive (MI) devices, and key competitors focus on product innovation, especially greater precision, patient safety, and faster recovery times. Companies are investing in research and development to combine technologies like artificial intelligence and robotics into their products, thereby increasing performance and the outcomes of surgeries. Hospital collaborations, government associations, and further distribution networks help companies gain a competitive edge in the market. Regulatory standards have also been influential in the South Korea general surgical devices market, as they govern the quality and safety of products, thus also having a positive impact on the South Korea general surgical devices market outlook.

The report provides a comprehensive analysis of the competitive landscape in the South Korea general surgical devices market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, CG MedTech, formerly Innosys, partnered with CGBIO to host the International Spine Endoscopy Training Course, showcasing Korea’s expertise in advanced spine surgery. The event featured 12 medical professionals from nine countries, led by Professor Jin-Sung Kim of Seoul St. Mary's Hospital. Attendees used advanced simulators from Germany, Canada, and Italy to learn full-endoscopic and biportal endoscopic techniques, highlighting Korea’s leadership in minimally invasive spine surgery and medical device innovation.

- In October 2024, Intuitive Surgical Korea launched the da Vinci 5 robotic surgery system, enhancing patient outcomes with improved precision and 3D imaging for minimally invasive procedures. Following FDA approval in March 2024, the da Vinci 5 is the second global release after its debut in the U.S. This marks the introduction of South Korea’s first fifth-generation platform since the da Vinci SP was launched in 2018.

- In July 2024, Stryker acquired MOLLI Surgical Inc., a company focused on wire-free soft tissue localization technology for breast-conserving surgery. MOLLI’s portfolio, including the MOLLI 2 localization system and smallest 3.2mm MOLLI Marker, enhances Stryker's breast cancer care solutions. The acquisition reinforces Stryker's dedication to enhancing surgical tools for oncology surgeons, complementing its existing technologies such as SPY fluorescence imaging.

- In May 2024, South Korea’s Koh Young Technology, known for its 3D optical inspection devices, plans to launch its brain surgery robot, Kymero, in the US in 2025. The company will apply for premarket approval from the FDA in the coming week. Koh Young aims to expand its medical equipment business, with a focus on entering the US, Asia, and European markets, following a comprehensive FDA review expected to take at least six months.

- In February 2024, South Korea-based start-up MediThinQ launched XR wearable surgical displays for surgeons, aiming to enhance surgical precision. The company has established major agreements with Medtronic, a $30 billion medical device leader, for exclusive distribution in the U.S. and Japan. Backed by healthcare tech incubator VentureBlick, MediThinQ's CEO, Seungjoon Im, highlighted the six-year development of this groundbreaking technology, setting a new standard in the market.

- In February 2024, MediThinQ, an innovative South Korean startup, became the first Asian company to globally launch XR surgical displays. The startup has secured key partnerships with Medtronic for distribution in the US and Japan, alongside a multimillion-dollar investment from Singapore’s JLK Technology, which will support mass production. MediThinQ's Scopeye XR displays provide surgeons with real-time critical information, enhancing surgical precision with superior image fidelity and seamless equipment integration.

South Korea General Surgical Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Handheld Devices, Laparoscopic Devices, Electro Surgical Devices, Wound Closure Devices, Trocars and Access Devices, Others |

| Applications Covered | Gynecology and Urology, Cardiology, Orthopedic, Neurology, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea general surgical devices market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South Korea general surgical devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea general surgical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South Korea general surgical devices market was valued at USD 355.7 Million in 2025.

The South Korea general surgical devices market was valued at USD 610.0 Million in 2034 exhibiting a CAGR Of 6.18% by 2026-2034.

The growth of South Korea's general surgical devices market is driven by advancements in minimally invasive surgery, increasing demand for robotic systems, and a rising geriatric population. Additionally, the government's investment in healthcare infrastructure and innovations in AI technologies for surgical precision and efficiency further fuel market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)