South Korea Gaming Market Report by Device Type (Consoles, Mobiles and Tablets, Computers), Platform (Online, Offline), Revenue (In-Game Purchase, Game Purchase, Advertising), Type (Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, and Others), Age Group (Adult, Children), and Region 2025-2033

South Korea Gaming Market Size:

South Korea gaming market size reached USD 4,595.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,605.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The rising disposable incomes, technological advancements, expanding internet penetration, increasing youth population, government support for the gaming industry, and the growing popularity of e-sports and online gaming platforms are some of the key factors creating a positive outlook for the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,595.0 Million |

| Market Forecast in 2033 | USD 8,605.2 Million |

| Market Growth Rate (2025-2033) | 7.22% |

South Korea Gaming Market Analysis:

- Major Market Drivers: Rising disposable incomes and widespread smartphone use have made gaming more accessible, driving South Korea gaming market growth. Besides this, government support for the gaming industry, including funding and infrastructure development, has created a conducive environment for gaming companies to thrive.

- Key Market Trends: The rise of esports, live streaming platforms, and emerging technologies like virtual reality (VR) / augmented reality (AR) are some of the key trends influencing the market growth. While regulatory changes and a focus on localization underscore the market's evolving nature. Moreover, the increasing internet penetration and advanced connectivity, including the fifth generation (5G), have facilitated seamless online gaming experiences, thus impelling the South Korea gaming demand.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry.

- Challenges and Opportunities: The market faces challenges such as regulatory scrutiny and concerns over gaming addiction, necessitating balanced growth strategies. Opportunities abound in the burgeoning VR and AR segments, with significant potential for educational and training applications beyond entertainment. The rise of e-commerce and digital platforms presents opportunities for game distribution and monetization, enabling companies to reach a global audience and enhance profitability.

South Korea Gaming Market Trends:

Expansion of mobile gaming

According to the 2019 White Paper on Korean Games by the Ministry of Culture, Sports and Tourism, Korea's game market is valued at $12.9 billion. The widespread use of smartphones and high-speed internet access has made mobile gaming highly accessible to a broad audience. With one of the highest global gamer penetration rates, mobile games generated $6.3 billion, comprising 90% of total app revenue in 2019. These games appeal to a wide range of demographics, from casual gamers to hardcore enthusiasts, due to their convenience and the vast array of genres available. Popular mobile games such as "Lineage M" and "PUBG Mobile" have garnered millions of players, generating significant revenue and fostering a vibrant gaming culture through social and multiplayer capabilities, providing an impetus to the market growth.

Rise of e-sports

South Korea is recognized as a global e-sports hub with a highly developed infrastructure supporting competitive gaming. Professional e-sports leagues and tournaments, such as the League of Legends Champions Korea (LCK) and the Overwatch League, attract massive audiences and significant investment. At Seoul Game Academy, a chain of schools in South Korea's capital, 3,000 students aged nine and up (roughly 99% of them boys) hone their skills at nine games in hopes of becoming full-time "e-sports" athletes. The popularity of competitive gaming has increased due to the success of South Korean e-sports teams on the international scene. E-sports has gained mainstream acceptance, with extensive media coverage and broadcasts on major television networks, attracting sponsorships and partnerships from prominent brands and thus aiding in the market expansion and visibility.

Increasing integration of advanced technologies

The increasing integration of advanced technologies such as VR and AR is transforming the South Korean gaming industry. These technologies offer immersive gaming experiences that enhance player engagement and satisfaction. VR and AR games enable users to interact with virtual environments in novel ways, providing a sense of presence and immersion unmatched by traditional gaming. Additionally, the development and commercialization of VR and AR hardware, such as headsets and motion controllers, have made these experiences more accessible. For instance, South Korean operator SK Telecom has introduced three 5G AR and VR services for eSports fans. Named 'Jump AR,' 'LCK VR Live Broadcasting,' and 'VR Replay'. Concurrent with this, VR gaming cafes and arcades are becoming increasingly popular, and offering a social and interactive gaming experience, which is strengthening the market growth.

South Korea Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue, type, and age group.

Breakup by Device Type:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets and computers.

Consoles remain a popular choice for gaming in South Korea, offering high-quality graphics and exclusive game titles. Several brands provide immersive gaming experiences, fostering a strong community of dedicated console gamers.

Concurrently, mobile and tablet gaming is rapidly expanding due to its convenience and accessibility. High smartphone penetration and advances in mobile technology enable graphically rich and engaging games, attracting a diverse audience ranging from casual players to serious gamers.

Apart from this, in South Korea, PC gaming is very popular because of its powerful hardware and vast game selection. Thus, the surging demand for gaming PCs and peripherals, such as advanced graphics cards and gaming keyboards, is bolstering the South Korea gaming market size.

Breakup by Platform:

- Online

- Offline

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes online and offline.

South Korea's online gaming market is flourishing due to the country's high internet penetration rate and the demand for multiplayer and cloud-based games. Online platforms facilitate social interactions and competitive play by providing a vast selection of games that can be accessed through subscriptions or one-time purchases. This increases user engagement and helps online platforms hold a significant South Korea gaming market share.

Whereas offline gaming remains widely popular because console and PC games don't need to be online all the time. Those who prefer single-player games or have limited internet access are catered to in this section. Physical game copies, retail locations, and gaming cafes all contribute to the offline gaming ecosystem by retaining a devoted user base.

Breakup by Revenue:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue. This includes in-game purchase, game purchase, and advertising.

In-game purchases are a major revenue stream, allowing players to buy virtual goods, enhancements, and cosmetic items within the game. This model boosts user engagement and monetization by offering customization options, power-ups, and exclusive content, encouraging players to spend more on enhancing their gaming experience.

In addition to this, game purchases involve the one-time sale of a game, either digitally or as a physical copy. This traditional revenue model remains significant, especially for premium games on consoles and PCs. It provides developers with upfront revenue and players with complete access to the game content without ongoing costs.

Furthermore, advertising within games includes banner ads, video ads, and sponsored content integrated into the gaming experience. This model generates revenue by leveraging the large and engaged player base, providing advertisers with a targeted audience, thereby positively impacting the South Korea gaming market outlook.

Breakup by Type:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes adventure/role playing games, puzzles, social games, strategy, simulation, and others.

Adventure and role-playing games (RPGs) offer immersive storylines and character development, allowing players to embark on quests and explore expansive worlds. These games emphasize narrative and player choice, attracting gamers who enjoy deep, engaging experiences with complex plots and rich, interactive environments.

Moreover, puzzle games provide a form of relaxation and mental stimulation. In a society where work and academic pressures are high, many individuals turn to gaming as a way to unwind and challenge themselves mentally, driving the market growth.

Social games focus on interaction and collaboration with other players, often integrated with social media platforms. They encourage community building and social engagement, attracting players who enjoy competing with or against friends.

Meanwhile, strategy games require players to plan and execute tactics to achieve objectives, often involving resource management and decision-making. Besides this, the rise of online and multiplayer strategy games is contributing to the genre's popularity.

Also, simulation games replicate real-world activities, allowing players to control virtual environments and scenarios. These games can cover various aspects, such as life simulation, city-building, and vehicle operation, which is further propelling South Korea's gaming market scope.

Breakup by Age Group:

- Adult

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adult and children.

The adult gaming segment encompasses a wide range of genres, from action and adventure to strategy and simulation. Adults often seek immersive and complex gaming experiences, with many engaging in multiplayer and competitive games. This group drives demand for high-quality graphics, deep narratives, and advanced gaming technologies.

In contrast, the children's gaming segment focuses on educational and entertainment games designed to be age-appropriate and engaging. These games often feature simple controls, colorful graphics, and educational content to promote learning and development. Parents prioritize safe and enriching experiences, driving demand for games that are both fun and educational.

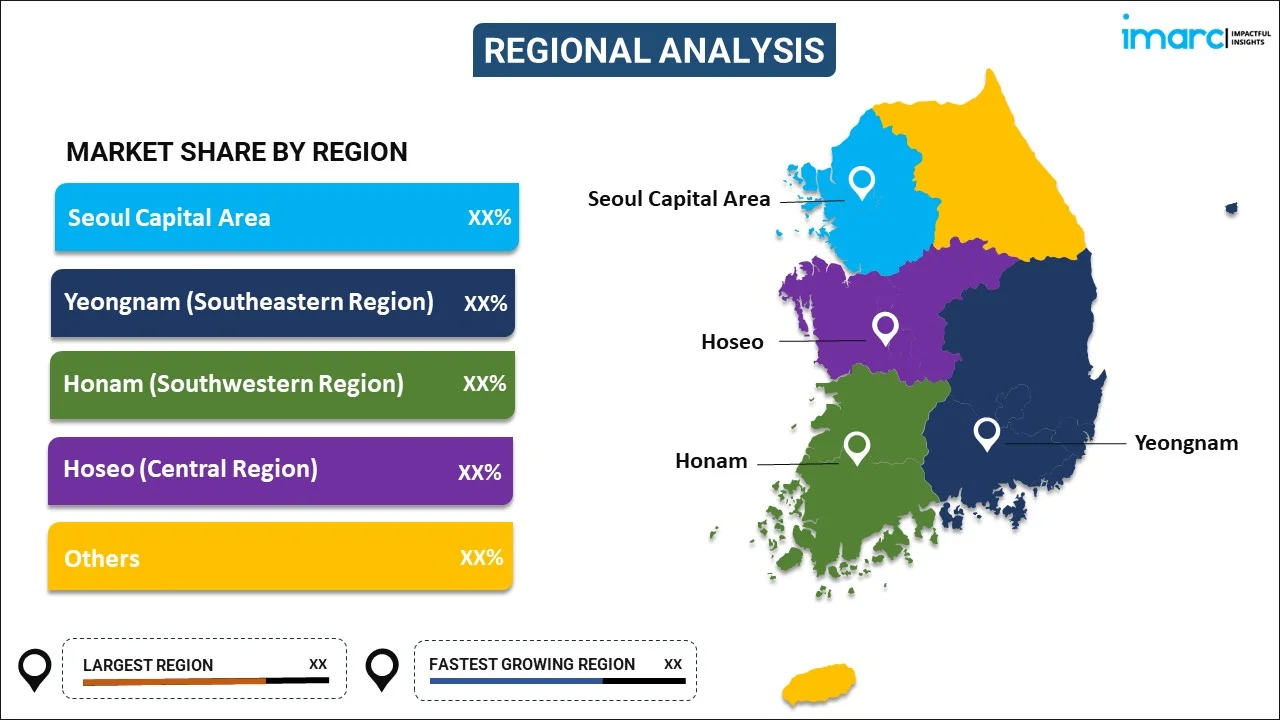

Breakup by Region:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major markets in the region, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), and Hoseo (Central Region).

South Korea gaming market insights show the Seoul Capital Area as the primary economic and cultural hub, driving significant demand for diverse gaming products. This region boasts high internet penetration, advanced infrastructure, and a dense population, fostering a thriving gaming community and extensive e-sports activities.

Yeongnam encompasses a key industrial and economic region with a strong gaming culture. The region's active e-sports scene, numerous gaming cafes, and growing technology sector contribute to a vibrant gaming market, attracting both casual and competitive gamers.

On the other hand, Honam is known for its rich cultural heritage and growing technology adoption. The region is seeing increased interest in gaming, driven by younger populations and improving internet infrastructure, supporting both traditional and mobile gaming markets.

Moreover, Hoseo benefits from its strategic location and expanding urbanization. The region's diverse population and increasing disposable incomes drive demand for various gaming platforms and genres, supported by a growing number of gaming cafes and technology-focused educational institutions.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The South Korea gaming market report revealed that the competitive landscape is highly dynamic and dominated by both established companies and innovative startups. Major players lead the market with their successful franchises and strong financial backing, continually investing in new game development and global expansion. These companies leverage their extensive experience and resources to produce high-quality games across various platforms, including mobile, PC, and consoles. Additionally, the market is characterized by the significant presence of e-sports organizations and streaming platforms, which contribute to the popularity and monetization of games. Emerging technologies such as VR and AR are also shaping the competitive landscape.

South Korea Gaming Market News:

- In May 2024, South Korea announced a bold five-year plan to boost its console game industry, aiming to expand its 1.5% global market share. The Ministry of Culture, Sports, and Tourism will support local companies and collaborate with global giants like Microsoft, Sony, and Nintendo. With USD 1.74 trillion allocated for Korean content, including games, videos, cartoons, and webtoons, the plan seeks to reduce reliance on online and mobile platforms.

South Korea Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenues Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea gaming market performed so far, and how will it perform in the coming years?

- What is the breakup of the South Korea gaming market on the basis of device type?

- What is the breakup of the South Korea gaming market on the basis of platform?

- What is the breakup of the South Korea gaming market on the basis of revenue?

- What is the breakup of the South Korea gaming market on the basis of type?

- What is the breakup of the South Korea gaming market on the basis of age group?

- What are the various stages in the value chain of the South Korea gaming market?

- What are the key driving factors and challenges in the South Korea gaming market?

- What is the structure of the South Korea gaming market, and who are the key players?

- What is the degree of competition in the South Korea gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea gaming market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea gaming industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)