South Korea Fintech Market Report by Service (Digital Payments, Personal Finance, Alternative Financing, Insurtech, B2C Financial Services Market Places, E-Commerce Purchase Financing, and Others), and Region 2026-2034

South Korea Fintech Market Size Overview:

South Korea fintech market size reached USD 4,170.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 7,861.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.3% during 2026-2034. The continuous advancements in technology, particularly in areas like artificial intelligence, blockchain, and cloud computing, which have enabled the creation of innovative fintech solutions, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,170.0 Million |

| Market Forecast in 2034 | USD 7,861.9 Million |

| Market Growth Rate (2026-2034) | 7.3% |

Fintech, short for financial technology, refers to the innovative use of technology to enhance and streamline financial services. It encompasses a broad range of applications, including online banking, mobile payments, robo-advisors, and blockchain-based transactions. Fintech companies leverage cutting-edge technologies like artificial intelligence, data analytics, and machine learning to improve efficiency, reduce costs, and provide more accessible financial services. This industry disrupts traditional banking models by offering digital solutions that cater to evolving consumer needs, fostering financial inclusion, and democratizing access to financial tools. Fintech's impact extends across diverse sectors, such as lending, insurance, wealth management, and payment systems, reshaping the financial landscape. As a dynamic and rapidly evolving field, fintech continues to drive financial innovation, creating new opportunities and challenges in the ever-changing landscape of modern finance.

South Korea Fintech Market Trends:

The fintech market in South Korea has witnessed unprecedented growth over the past few years, driven by a confluence of factors that have reshaped the financial landscape. Primarily, technological advancements have played a pivotal role in creating an environment conducive to innovation and efficiency. Moreover, the increasing prevalence of smartphones and internet connectivity has facilitated widespread access to financial services, fostering the growth of fintech solutions. Furthermore, regulatory developments have played a dual role as both catalysts and navigators in the fintech space. Regulatory frameworks that promote competition and consumer protection have encouraged the emergence of new players while simultaneously ensuring the stability of the financial ecosystem. Additionally, the growing demand for seamless and user-friendly financial experiences has pushed fintech companies to continuously evolve and refine their offerings. Collaborations between traditional financial institutions and fintech startups have also emerged as a key driver, leveraging the strengths of both sectors to deliver enhanced services. Besides this, the integration of artificial intelligence and machine learning in financial processes, which has significantly improved risk management, fraud detection, and customer personalization, thereby attracting a wider user base, is expected to drive the fintech market in South Korea during the forecast period.

South Korea Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service.

Service Insights:

- Digital Payments

- Online Purchases

- POS (Point of Sales) Purchases

- Personal Finance

- Digital Asset Management Services

- Remittance/ International Money Transfers

- Alternative Financing

- P2P Lending

- SME Lending

- Crowdfunding

- Insurtech

- Online Life Insurance

- Online Health Insurance

- Online Motor Insurance

- Online Other General Insurance

- B2C Financial Services Market Places

- Banking and Credit

- Insurance

- E-Commerce Purchase Financing

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes digital payments (online purchases and POS (point of sales) purchases), personal finance (digital asset management services and remittance/ international money transfers), alternative financing (P2P lending, SME lending, and crowdfunding), insurtech (online life insurance, online health insurance, online motor insurance, and online other general insurance), B2C financial services market places (banking and credit and insurance), E-commerce purchase financing, and others.

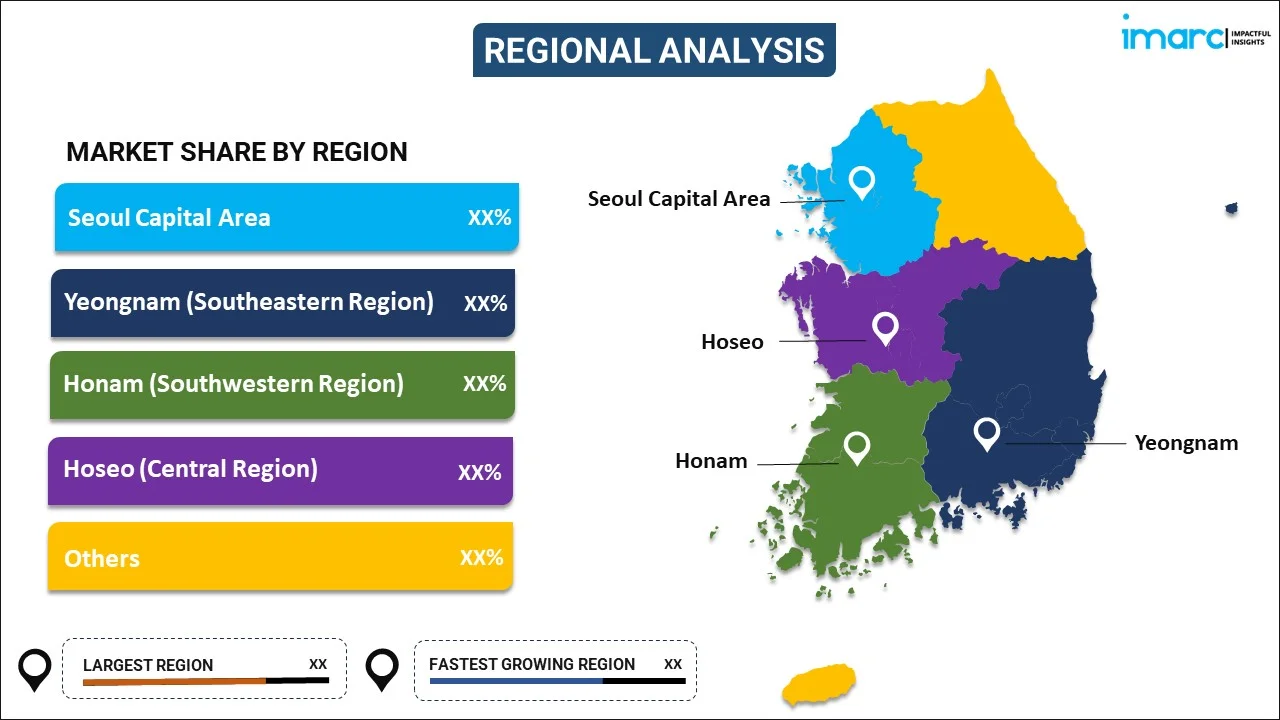

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea fintech market on the basis of service?

- What are the various stages in the value chain of the South Korea fintech market?

- What are the key driving factors and challenges in the South Korea fintech?

- What is the structure of the South Korea fintech market and who are the key players?

- What is the degree of competition in the South Korea fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea fintech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)