South Korea Factoring Market Report by Type (International, Domestic), Organization Size (Small and Medium Enterprises, Large Enterprises), Application (Transportation, Healthcare, Construction, Manufacturing, and Others), and Region 2025-2033

Market Overview:

South Korea factoring market size is projected to exhibit a growth rate (CAGR) of 5.51% during 2025-2033. The rapid economic growth in South Korea, rising number of small and medium-sized enterprises (SMEs), integration of new technologies, introduction of supportive government initiatives, and rising importance of credit risk management represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 5.51% |

Factoring refers to a financial service in modern business that involves a business selling its accounts receivable to a third party at a discount. It enables businesses to obtain immediate cash flow, which is necessary for smooth operational functioning. Factoring is available in various forms, including recourse, non-recourse, domestic, and international factoring. It encompasses several key features, such as credit management, collection services, and protection against bad debts. Factoring is comprised of several components, such as accounts receivable, the factor, and the debtor. It finds extensive application across various sectors like manufacturing, services, transportation, wholesale, and retail. Factoring aids in providing immediate working capital, improving cash flow, reducing administration costs, and offering credit risk protection. In addition, it provides several advantages, such as enhanced liquidity, effective receivables management, credit risk mitigation, balance sheet management, and the provision of a collateral-free financing option.

South Korea Factoring Market Trends:

The rapid economic growth in South Korea, which fosters an environment favorable to the flourishing of factoring services, is supporting the market growth. Additionally, the growing demand for factoring services, due to the rising number of small and medium-sized enterprises (SMEs), which struggle with cash flow issues, is propelling the market growth. Besides this, the increasing demand for international factoring services to manage cross-border transactions is strengthening the market growth. Furthermore, the integration of new technologies like artificial intelligence (AI) and blockchain in factoring processes to enhance efficiency, security, and transparency is contributing to the market growth. In addition, the introduction of supportive government initiatives to promote the financing of SMEs and startups is acting as a growth-inducing factor. Apart from this, the rising importance of credit risk management in business operations, boosting the appeal of factoring, which provides credit protection, is catalyzing the market growth. Moreover, the widespread service utilization as a tool for financial inclusion, aiding businesses that might not have access to traditional banking services, is positively influencing the market growth. Along with this, the growing adoption of factoring by businesses to optimize supply chain financing is fueling the market growth. Additionally, the rapid expansion of e-commerce businesses, which require quick turnover of inventory, is stimulating the market growth. Furthermore, the presence of a supportive regulatory environment in South Korea, which supports financial innovations, is bolstering the market growth. Besides this, the emerging corporate restructuring trends that focus on core competencies, making factoring an attractive option for managing receivables, are accelerating the market growth. In addition to this, the rapid diversification of financial products, including various types of factoring solutions that cater to a broader range of business needs, is favoring the market growth.

South Korea Factoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, organization size, and application.

Type Insights:

- International

- Domestic

The report has provided a detailed breakup and analysis of the market based on the type. This includes international and domestic.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

Application Insights:

- Transportation

- Healthcare

- Construction

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes transportation, healthcare, construction, manufacturing, and others.

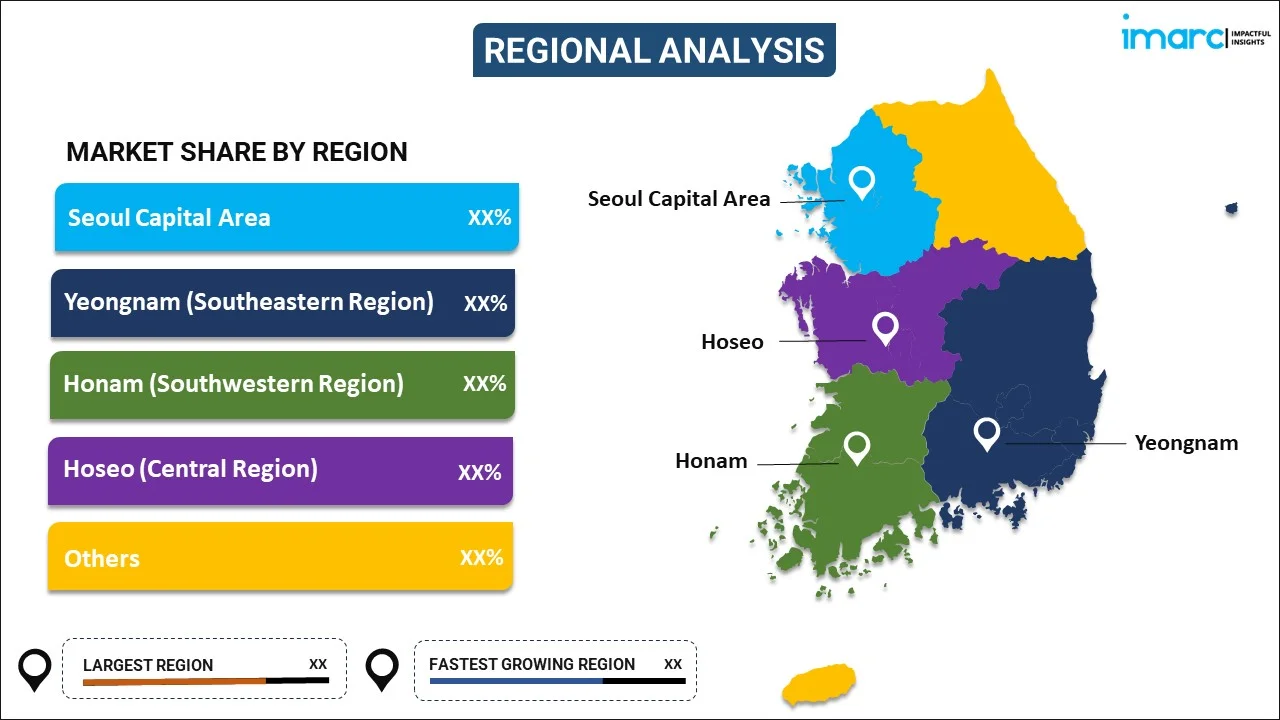

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region) and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Factoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | International, Domestic |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Applications Covered | Transportation, Healthcare, Construction, Manufacturing, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea factoring market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South Korea factoring market?

- What is the breakup of the South Korea factoring market on the basis of type?

- What is the breakup of the South Korea factoring market on the basis of organization size?

- What is the breakup of the South Korea factoring market on the basis of application?

- What are the various stages in the value chain of the South Korea factoring market?

- What are the key driving factors and challenges in the South Korea factoring?

- What is the structure of the South Korea factoring market and who are the key players?

- What is the degree of competition in the South Korea factoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea factoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea factoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea factoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)