South Korea Dog Food Market Size, Share, Trends and Forecast by Product type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033

South Korea Dog Food Market Size and Share:

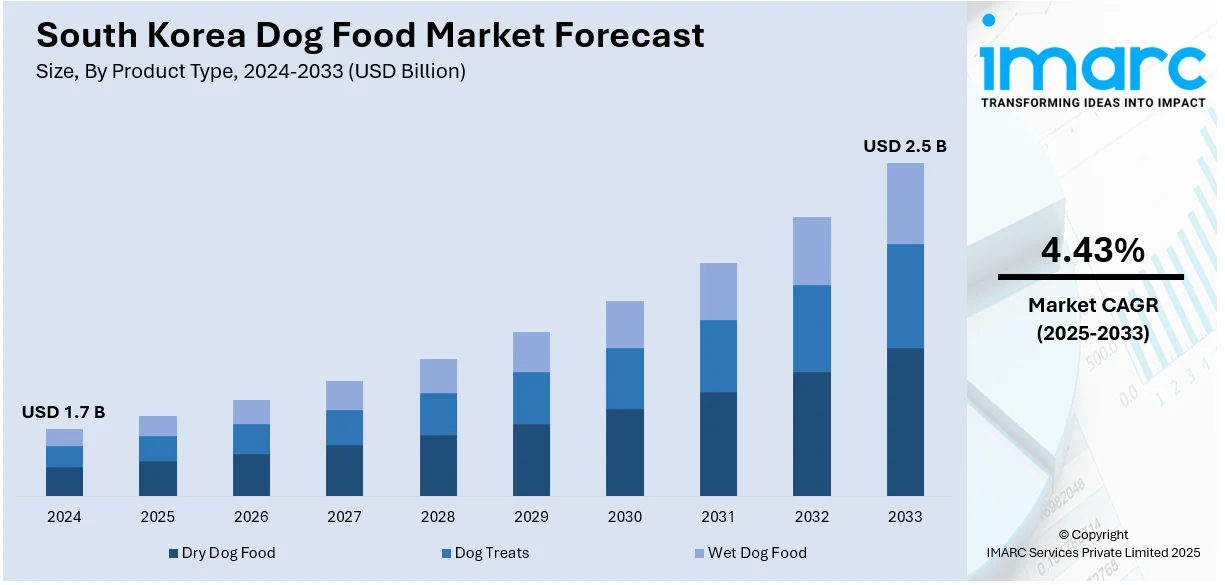

The South Korea dog food market size was valued at USD 1.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.5 Billion by 2033, exhibiting a CAGR of 4.43% from 2025-2033. The increasing trend of humanization pets among the masses, heightened need for premium and organic pet nutrition products to improve their health, and expansion of e-commerce platforms providing easy access to pet food products are some of the factors influencing the South Korea dog food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.7 Billion |

|

Market Forecast in 2033

|

USD 2.5 Billion |

| Market Growth Rate (2025-2033) | 4.43% |

The South Korean dog food sector has been undergoing significant transformations, driven by changing preferences of dog parents, demographic shifts, and an increased awareness about pet nutrition. Pet ownership in South Korea is also increasing, particularly among young generations and urban dwellers, as societal attitudes toward pets shipped from viewing them as companions you're treating them as family members. This pet humanization trend is also driving the demand for premium, natural, and functional dog food products, thereby offering a favorable South Korea dog food market outlook. South Korean pet owners are constantly looking for high quality ingredients and formulations in the pet food they are purchasing owing to specific health needs, such as age specific diets, weight management solutions, and recipes and dressing allergies or digestive complications in dogs.

The inflating income levels and changing lifestyle habits are also contributing to the market growth in South Korea. Busy urban professionals often turn to convenient, ready to serve products like canned or freeze-dried food for dogs while others prioritize organic and grain free options, reflecting broader health conscious trends. The increasing number of e-commerce platforms selling dog food is also making it easier for dog parents to purchase high quality products for their pets. These platforms have also become key channels for educating pet parents through reviews, expert recommendations, and detailed nutritional information helping customers make informed decisions yeah subscriptions or rises, which deliver regular supplies of dog food, are also gaining traction, particularly among younger, takes heavy pet parents seeking convenience and consistency.

South Korea Dog Food Market Trends:

Rising Pet Ownership and Pet Humanization

In the last years, South Korea has witnessed an upsurge in pet ownership among younger generations and urban households. An article by the Korean Times stated that in 2024, 4 out of 10 Korean individuals obtain their pets from acquaintances free or without charge. This trend is a result of changes in social conditions, such as delayed marriages, low birth rates, and a high percentage of single-person households. Pets serve as emotional substitutes for many people, so they treat them more like family members rather than pets. This "pet humanization" has driven demand for high-quality dog food products that prioritize nutrition, taste, and specialized health benefits. Premium offerings, such as organic and grain-free and hypoallergenic recipes targeted to specific needs like age and breed, are increasingly required by owners. Since people have developed greater emotional attachments to their pets, this results in higher spending on functional food for joint health and digestive or coat quality. This trend further signifies a more emotional relationship between owner and pet, thereby sustaining growth in the dog food market.

E-commerce Expansion and Digitalization

The rapid expansion of e-commerce platforms in South Korea has revolutionized the way pet parents purchase dog food. Online marketplaces offer wide variety of products, serving to various dietary preferences and price points. These platforms also provide added convenience through subscription services, ensuring regular deliveries without the hassle of reordering. Brands have used the digital space to reach out directly to pet parents through user reviews, social media, and influencer partnerships that create trust and increase visibility. E-commerce enables detailed descriptions of products and ingredient transparency so that the customer may make an informed choice. Finally, the online platform offers savings and loyalty opportunities that have attracted price-sensitive buyers. The advantage of 24/7 access along with door-to-door delivery has made e-commerce a popular shopping channel for busy urban professionals and younger demographics. Many international companies are also entering the South Koren market as e-commerce provides them with the following benefits. For example, Kormotech, Ukranian pet food manufacturer entered South Korea in 2024. The company joined forces with distributor Careside Co.Ltd. to manage its products appropriately. It is also focusing on e-commerce platforms and is planning further expansion towards pet stores and vet clinics.

Growing Focus on Sustainability and Natural Ingredients

Sustainability is coming out as a critical factor influencing the choices of pet parents when it comes to purchasing nutrition products for their pets. Many pet parents, particularly millennials and Gen Z, are adopting more eco-conscious lifestyles and expect the same value in products purchased for their pets. This fuels demand for dog food brands that focus on being as environmentally friendly as possible through things such as the sourcing of ingredients from sustainable sources and recyclable or biodegradable packaging. At the same time, the demand for natural and lightly processed dog food continues to rise. Pet owners seek products without artificial additives, preservatives, or fillers in line with greater health consciousness in general. The functional ingredients trend also reflects increased demand for such products containing superfoods, probiotics, and omega fatty acids as perceived healthy elements for pets. Brands that focus on sustainability and natural formulations have managed to create a niche for themselves by being in line with these preferences. This is a major driver for the market's growth trajectory. The IMARC Group also projects that the South Korea organic and natural pet food market will reach USD 210.9 million by 2033.

South Korea Dog Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea dog food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, pricing type, ingredient type and distribution channel.

Analysis by Product Type:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Dry dog food is the most widely consumed product type in South Korea’s dog food market due to its convenience, affordability, and long shelf life. Its ease of storage and feeding, combined with cost-effectiveness, makes it a popular choice for households with multiple pets. Dry food also supports dental health by reducing tartar build-up during chewing, a feature appreciated by pet owners focused on preventative care. Manufacturers have diversified offerings to include breed-specific formulas, age-specific diets, and functional dry foods enriched with nutrients like glucosamine for joint health or omega fatty acids for coat quality.

Dog treats occupy a major portion of the South Korea dog food market share. They have witnessed rapid growth as pet owners increasingly view them as essential for training, rewarding, and bonding with their pets. South Koreans often prioritize treats made with natural ingredients and functional benefits, such as dental care, weight management, or joint health. Small, bite-sized treats are especially popular for their suitability during training sessions. Brands have responded by offering innovative options like freeze-dried meats, plant-based treats, and probiotic-infused snacks to cater to diverse preferences.

Wet dog food, known for its palatability and higher moisture content, appeals particularly to picky eaters and older dogs with dental issues. It is favored for its rich taste and texture, which mimic fresh food, aligning with the humanization trend in pet care. Although wet food is generally more expensive than dry food, its perceived quality and nutritional value have made it a popular choice among premium segment.

Analysis by Pricing Type:

- Premium Products

- Mass Products

The premium segment in South Korea’s dog food market has seen significant growth, driven by pet humanization and the increasing willingness of people to invest in high-quality nutrition for their pets. Premium products often feature natural, organic, and grain-free formulations, catering to health-conscious pet owners. These products frequently include functional ingredients such as probiotics, omega fatty acids, and glucosamine, targeting specific health benefits like improved digestion, joint health, or a shinier coat.

Mass-market dog food products dominate the South Korean market in terms of volume due to their affordability and accessibility. These products cater to budget-conscious pet owners seeking balanced nutrition at competitive prices. Available in dry, wet, and treat formats, mass products are commonly distributed through supermarkets, convenience stores, and e-commerce platforms. Many brands in this segment focus on essential nutritional requirements, offering simple formulations without additional functional benefits.

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Animal-derived dog food dominates the South Korean market, as meat-based formulations align with the natural dietary preferences of dogs. Products in this segment primarily include chicken, beef, lamb, and fish as protein sources, providing essential amino acids for muscle development and overall health. Additionally, fish-based recipes enriched with omega-3 fatty acids are particularly popular for promoting a healthy coat and skin.

Plant-derived dog food caters to a niche but growing market in South Korea, driven by pet owners seeking alternative, hypoallergenic, or environmentally sustainable diets. This segment often includes grains, legumes, and vegetables like sweet potatoes, lentils, and peas, which serve as carbohydrate and protein sources. Plant-based oils, such as flaxseed or coconut oil, are also incorporated for their healthy fats and antioxidant properties.

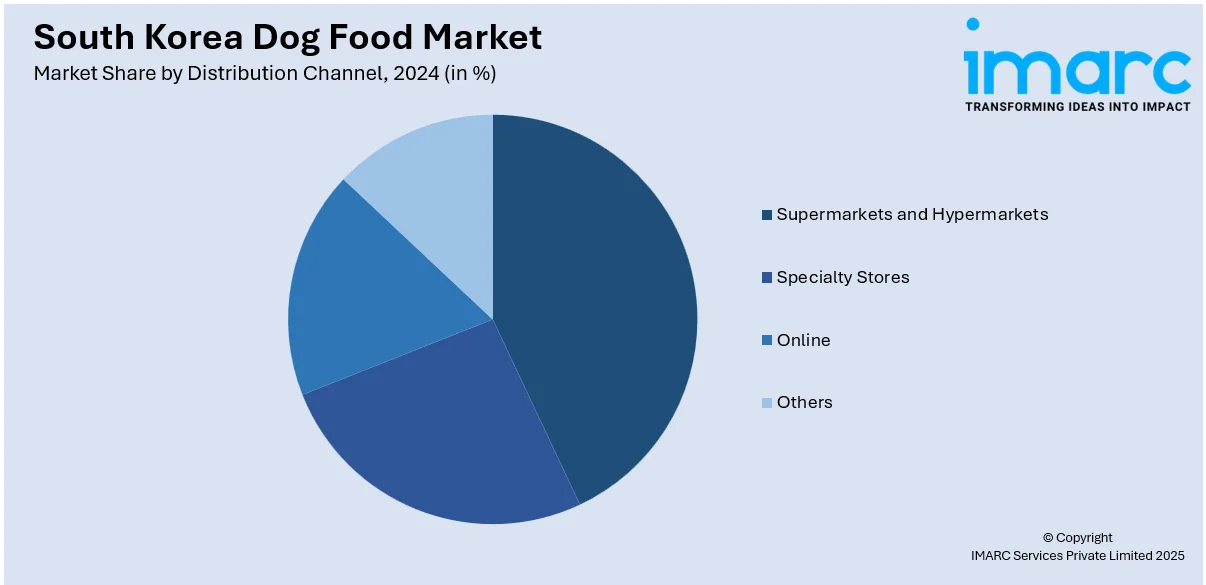

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets remain a vital distribution channel for dog food in South Korea, offering convenience and accessibility to a wide range of buyers. These outlets stock a diverse selection of mass-market and premium dog food products, catering to various budgets and preferences. Shoppers appreciate the ability to compare brands and access frequent promotional discounts or bulk-buy offers.

Specialty pet stores play a key part in the dispersal of superior and niche dog food products in South Korea. These stores often focus on offering high-quality, natural, and functional food options that may not be readily available in general retail outlets. Staff at specialty stores are typically knowledgeable, providing expert advice to customers on selecting diets tailored to their pets’ specific health needs.

The online channel has experienced exponential growth in South Korea’s dog food market, driven by the rise of e-commerce platforms and changing purchase behaviors. Platforms offer unmatched convenience, allowing pet owners to browse an extensive range of products from local and international brands.

Regional Analysis:

- East

- West

- Southwest

- Southeast

The eastern region of South Korea, encompassing areas such as Gangwon Province, is characterized by a relatively smaller but steadily growing dog food market. This growth is driven by the rising number of pet owners in suburban and rural areas who are gradually shifting from feeding homemade meals to purchasing commercially prepared dog food. The availability of products in local supermarkets and specialty stores plays a key role in catering to this market.

The western region, including major cities such as Incheon and Daejeon, represents a significant portion of South Korea’s market. Urbanization and rising disposable income in these areas have contributed to higher pet adoption rates, fueling demand for both premium and functional dog food.

The southwestern region, including Gwangju and surrounding areas, is a developing market with growing awareness about pet nutrition. While mass-market products dominate due to cost sensitivity among pet parents, there is a gradual shift toward higher-quality options as disposable incomes rise.

The southwestern region, including Gwangju and surrounding areas, is a developing market with growing awareness about pet nutrition. While mass-market products dominate due to cost sensitivity among the masses, there is a gradual shift toward higher-quality options as disposable incomes rise.

Competitive Landscape:

Key players in the South Korea dog food market are employing diverse strategies to strengthen their position and cater to the evolving needs of pet owners. One significant focus is on product innovation, with companies developing tailored solutions such as breed-specific diets, functional foods, and organic or grain-free options. These products align with the demand for premium and specialized offerings, reflecting trends in human nutrition. The digital shift has been a game-changer for the market, with key players leveraging e-commerce platforms to reach a broader audience. Companies are optimizing their online presence through detailed product descriptions, customer reviews, and engaging digital campaigns. To foster customer trust, many companies are prioritizing transparency by providing clear ingredient sourcing and nutritional information. This is especially crucial in the premium segment, where buyers are willing to pay a premium for quality and safety. Certifications, such as those for organic or human-grade ingredients, further reinforce trust and differentiate brands in a competitive market.

The report provides a comprehensive analysis of the competitive landscape in the South Korea dog food market with detailed profiles of all major companies.

Latest News and Developments:

- April 2022: Royal Canin signed an MoU with Jeollabuk-do for expansion of its manufacturing plant. This partnership is made to respond to the heightened need for pet food.

South Korea Dog Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Dog Food, Dog Treats, Wet Dog Food |

| Pricing Types Covered | Premium Products, Mass Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, and Others |

| Regions Covered | East, West, Southwest, Southeast |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, South Korea dog food market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South Korea dog food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea dog food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South Korea dog food market was valued at USD 1.7 Billion in 2024.

IMARC estimates the South Korea dog food market to exhibit a CAGR of 4.43% during 2025-2033.

The market is driven by the increasing trend of pet humanization, rising disposable income, growing demand for premium and organic pet nutrition, and the expansion of e-commerce platforms offering easy access to diverse dog food products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)