South Korea Cloud Computing Market Report by Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), Workload (Application Development and Testing, Analytics and Reporting, Data Storage and Backup, Integration and Orchestration, Resource Management, and Others), Deployment Mode (Public, Private, Hybrid), Organization Size (Large Enterprise, Small and Medium Enterprise), Vertical (BFSI, IT and Telecom, Retail and Consumer Goods, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, and Others), and Region 2025-2033

South Korea Cloud Computing Market:

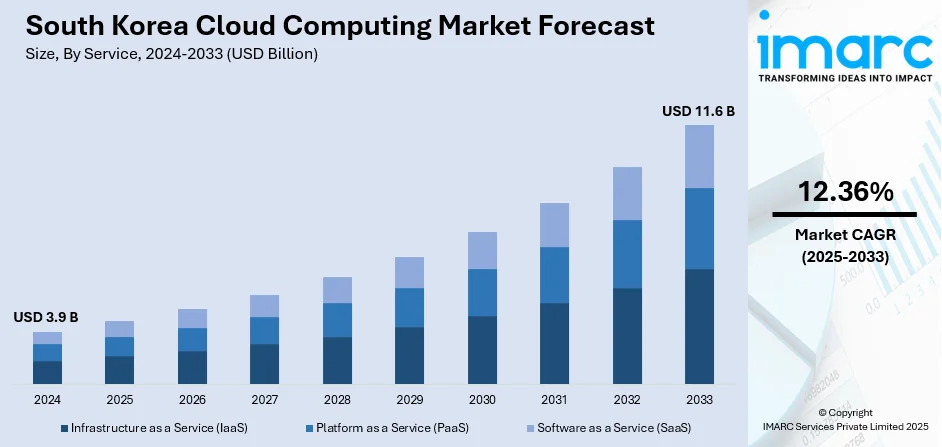

The South Korea cloud computing market size reached USD 3.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.6 Billion by 2033, exhibiting a growth rate (CAGR) of 12.36% during 2025-2033. The rising incidences of cybersecurity threats and data breaches, increasing emphasis on digital education and e-learning, and the widespread adoption of cloud computing solutions in the healthcare industry are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.9 Billion |

|

Market Forecast in 2033

|

USD 11.6 Billion |

| Market Growth Rate 2025-2033 | 12.36% |

South Korea Cloud Computing Market Analysis:

- Major Market Drivers: Rising incidences of cybersecurity threats and data breaches are primarily catalyzing the demand for cloud computing solutions. Furthermore, the increasing adoption of a multi-cloud approach to avoid vendor lock-in and optimize the capabilities of different cloud service providers is significantly contributing to the market growth.

- Key Market Trends: The integration of artificial intelligence (AI) and machine learning (ML) solutions in cloud computing is improving data analytics and decision-making processes, which is creating a positive outlook for the market.

- Geographical Trends: According to the South Korea cloud computing market report, the West region of South Korea exhibits a clear dominance in the market. The west region has a well-established IT infrastructure, including high-speed internet and state-of-the-art data centers. Additionally, leading corporations and financial institutions are headquartered in cities like Seoul and Incheon. Apart from this, the availability of a highly skilled and tech-savvy workforce in the western part of South Korea supports the complex needs of the cloud computing market.

- Challenges and Opportunities: Challenges in the South Korea cloud computing market include data security concerns, regulatory complexities, and the need for infrastructure modernization. Opportunities lie in the growing demand for cloud services driven by digital transformation initiatives, potential partnerships with local tech firms, and the country's supportive government policies promoting cloud adoption.

South Korea Cloud Computing Market Trends:

Government support and initiatives

The governing authorities of South Korea are undertaking various initiatives to promote the adoption of cloud computing technologies across the country. They are investing in building robust cloud infrastructure, including state-of-the-art data centers, to create a reliable and efficient environment for businesses. For instance, in May 2024, the South Korean Ministry of Science and ICT introduced an ambitious plan to invest US$ 91.5 Million to bolster the local cloud computing industry, representing a significant increase of US$ 12.9 Million from the previous year's budget allocation. Out of this investment, approximately US$ 18.1 Million will be directed toward the development and commercialization of cutting-edge cloud services. Another US$ 6.0 Million will be allocated to facilitate the transformation of traditional software into SaaS models, while about US$ 5.3 Million will be invested in nurturing cloud-based Software as a Service (SaaS) solutions. Apart from this, strategic collaborations with the private sector to expedite the adoption of cloud services in different industries, such as healthcare and finance, are propelling the South Korea cloud computing market share.

Rapid Digitalization and Technological Advancements

The rising popularity of remote working models is driving the need for reliable and secure access to data and applications from anywhere. For instance, between 2015 and 2021, the number of employees who worked from home or remotely increased from about 66 thousand to 1.1 million. A 17-fold increase that occurred mainly in 2020 and 2021. Moreover, the development of advanced technologies like big data and machine learning is increasing the demand for robust computing power. Cloud services enable quick deployment of applications and resources, which allows businesses to stay competitive in a fast-paced digital landscape. Additionally, South Korea is one of the leading countries in terms of technological advancements. For instance, South Korea was ranked 5th in the Global Innovation Index in 2021. As of 2022, South Korea held the sixth-largest private investment in artificial intelligence. The increasing integration of advanced technologies in various businesses is further augmenting the South Korea cloud computing market demand.

Increasing Number of Data Breaches

Cloud computing helps prevent data breaches by offering robust security measures such as encryption, access controls, and regular security updates, reducing the risk of vulnerabilities. Centralized data storage and backup services enhance data protection and disaster recovery capabilities, minimizing the impact of breaches. The rising case of data breaches across the country is creating a positive outlook for the market. For instance, in May 2024, North Korean hackers stole sensitive data, including individuals' financial records, from a South Korean court computer network over two years. South Korean national police said the hackers stole 1,014 gigabytes of data from a court's computer system between 2021 and 2023, citing a joint investigation with the country's spy agency and prosecutors. The rising prevalence of unnotarized access to private data is augmenting the employment of cloud computing solutions, which is anticipated to propel the South Korea cloud computing market revenue.

South Korea Cloud Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea cloud computing market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on service, workload, deployment mode, organization size, and vertical.

Breakup by Service:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Software as a service (SaaS) dominates the market

A detailed breakup and analysis of the market based on the service has also been provided in the report. This includes infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). According to the report, software as a service (SaaS) holds the largest market share.

SaaS eliminates the need for businesses to purchase, install, and maintain software applications, thereby reducing upfront costs and ongoing maintenance expenses. Additionally, it allows businesses to deploy solutions quickly without involving an extensive IT infrastructure. Its scalable nature enables companies to easily add or remove users, adjusting to their needs without incurring significant expenses. Apart from this, SaaS applications come with various integrated features like analytics and reporting, which provide businesses with valuable insights into their operations. Furthermore, it usually operates on a subscription basis, providing flexibility to businesses.

Breakup by Workload:

- Application Development and Testing

- Analytics and Reporting

- Data Storage and Backup

- Integration and Orchestration

- Resource Management

- Others

Resource management holds the majority of the market share

A detailed breakup and analysis of the market based on the workload has also been provided in the report. This includes application development and testing, analytics and reporting, data storage and backup, integration and orchestration, resource management, and others. According to the report, resource management accounted for the largest market share.

As per the South Korea cloud computing market forecast by IMARC, the growth of this segment can be attributed to the ability of resource management solutions to allow businesses to streamline the deployment and reduce the complexity of managing multiple assets. Additionally, efficient resource management helps in optimal utilization of computing resources, leading to cost savings. Businesses can allocate or deallocate resources based on real-time needs, minimizing wastage and operational costs. Apart from this, resource management aids in compliance with various industry regulations by ensuring that resources are allocated and used in a manner that meets regulatory standards for data handling, storage, and processing. Moreover, the adoption of resource management helps in optimal utilization of computing resources, leading to cost savings.

Breakup by Deployment Mode:

- Public

- Private

- Hybrid

Public represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes public, private, and hybrid. According to the report, public accounts for the majority of the market share

Public cloud services are designed to be easily accessible over the internet, requiring no special infrastructure or software for access. Furthermore, various industries are increasingly shifting from traditional on-premises information technology (IT) infrastructure, which requires high investment, to public cloud providers since they are affordable as companies pay only for the resources they use. This convenience encourages widespread adoption across various industries and is propelling the South Korea cloud computing market’s recent price. As a result, several key market players are offering public cloud platforms. For instance, in April 2024, Gcore, a Korean AI firm, announced the launch of its first AI public cloud service in Korea, powered by NVIDIA’s H100. The Gcore data center will be equipped with 40 NVIDIA H100 servers, which are recognized as the most effective GPUs available for AI training – that’s 320 GPUs. Additionally, businesses can quickly deploy applications and services on a public cloud and adapt swiftly to changing market demands.

Breakup by Organization Size:

- Large Enterprise

- Small and Medium Enterprise

Large enterprise holds the largest market share

A detailed breakup and analysis of the market based on the organization size has also been provided in the report. This includes large enterprise and small and medium enterprise. According to the report, large enterprise accounted for the largest market share.

South Korea cloud computing market statistics by IMARC indicate that the large enterprises have complex and resource-intensive operations that require robust computing power, storage, and networking capabilities. For instance, in 2022, around 94% of companies in the real estate industry in South Korea were actively using cloud computing services. The majority of industries in the country showed a high usage rate of such services. Furthermore, many large enterprises operate across different geographical regions, which drives the demand for cloud computing solutions as they enable seamless operations and facilitate data sharing, communication, and collaboration among dispersed teams.

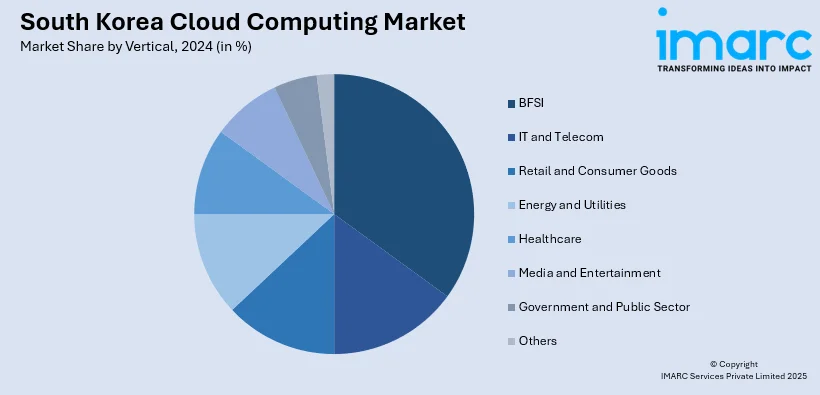

Breakup by Vertical:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

BFSI represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, IT and telecom, retail and consumer goods, energy and utilities, healthcare, media and entertainment, government and public sector, and others. According to the report, BFSI represented the largest segment.

The BFSI sector leverages cloud computing services for a wide range of applications, such as data analytics, risk management, fraud detection, and customer relationship management (CRM). Cloud-based solutions enable agility and scalability in responding to market dynamics and regulatory changes. Various market players are increasingly working on providing robust cloud services to the BSFI sector.

Breakup by Region:

- East

- West

- Southwest

- Southeast

West holds the majority of the market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include east, west, southwest, and southeast. According to the report, West exhibits a clear dominance in the market.

According to South Korea cloud computing market overview by IMARC, the west region has a well-established IT infrastructure, including high-speed internet and state-of-the-art data centers. Additionally, leading corporations and financial institutions are headquartered in cities like Seoul and Incheon. Apart from this, the availability of a highly skilled and tech-savvy workforce in the western part of South Korea supports the complex needs of the cloud computing market. Furthermore, the western part of South Korea, particularly areas around Seoul, is known as a technological and innovation hub. Moreover, the presence of leading educational and research institutions in this area contributes to continuous research and development (R&D) activities in cloud technology.

Competitive Landscape:

Companies are constantly expanding their service offerings to include not just storage solutions but also computing power, networking services, and more specialized products like machine learning and analytics tools. Additionally, many South Korea cloud computing market companies are extending their reach by setting up data centers in different regions. This enables them to better comply with local data regulations and improve service delivery by reducing latency. Apart from this, they are investing heavily in enhancing the security features of their cloud services, including encryption, multi-factor authentication, and compliance certifications. Moreover, various cloud computing firms are entering into partnerships with other technology companies, software developers, and even traditional businesses to create bundled solutions that offer more value to the end-user.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

South Korea Cloud Computing Market Recent Developments:

- April 2024: Gcore, a Korean AI firm, announced the launch of its first AI public cloud service in Korea, powered by NVIDIA's H100. The Gcore data center will be equipped with 40 NVIDIA H100 servers, which are recognized as the most effective GPUs available for AI training.

- January 2024: Korea Quantum Computing (KQC) collaborated with IBM to use IBM's latest AI software, infrastructure, and quantum computing services. This collaboration allowed KQC to use IBM's full range of AI tools, including Watsonx, to help businesses train, adjust, and use advanced AI models and software.

- January 2024: Samsung Electronics, a South Korea-based consumer electronics company, and Google Cloud announced a new multi-year partnership to bring Google Cloud’s generative artificial intelligence (AI) technology to Samsung smartphone users.

South Korea Cloud Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Services Covered | Infrastructure As A Service (Iaas), Platform As A Service (Paas), Software As A Service (Saas) |

| Workloads Covered | Application Development and Testing, Analytics and Reporting, Data Storage and Backup, Integration and Orchestration, Resource Management, Others |

| Deployment Modes Covered | Public, Private, Hybrid |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Verticals Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | East, West, Southwest, Southeast |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea cloud computing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea cloud computing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea cloud computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South Korea cloud computing market was valued at USD 3.9 Billion in 2024.

We expect the South Korea cloud computing market to exhibit a CAGR of 12.36% during 2025-2033.

The rising adoption of cloud computing for application development and testing, resource management, data storage and backup, orchestration services and the rising initiatives by government authorities to deploy cloud computing solutions to prevent data breaches are some of the South Korea cloud computing market recent opportunities, driving the growth of the market.

The sudden outbreak of the COVID-19 pandemic has led to the growing deployment of cloud computing solutions across the nation, as they increase the productivity and efficiency of organizations by ensuring that the data is always accessible.

Based on the service, the South Korea cloud computing market can be segmented into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Currently, Software as a Service (SaaS) holds the majority of the total market share.

Based on the workload, the South Korea cloud computing market has been divided into application development and testing, analytics and reporting, data storage and backup, integration and orchestration, resource management, and others. Among these, resource management currently exhibits a clear dominance in the market.

Based on the deployment mode, the South Korea cloud computing market can be categorized into public, private, and hybrid. According to the South Korea cloud computing market outlook, public accounts for the majority of the global market share.

Based on the organization size, the South Korea cloud computing market has been segregated into large enterprise and small and medium enterprise, where large enterprise currently holds the largest market share.

Based on the vertical, the South Korea cloud computing market can be bifurcated into BFSI, IT and telecom, retail and consumer goods, energy and utilities, healthcare, media and entertainment, government and public sector, and others. Currently, the BFSI sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into East, West, Southwest, and Southeast, where West currently dominates the South Korea cloud computing market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)