South Korea Aviation Market Report by Aircraft Type (Commercial Aviation, General Aviation, Military Aviation), and Region 2026-2034

South Korea Aviation Market Size Overview:

South Korea aviation market size reached USD 2.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.03% during 2026-2034. The growing number of business and leisure trips for traveling to distant places quickly and efficiently, increasing investments in strengthening the defense system, and rising adoption of fuel-efficient aircraft and advanced avionics represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.3 Billion |

| Market Forecast in 2034 | USD 3.3 Billion |

| Market Growth Rate (2026-2034) | 4.03% |

South Korea Aviation Market Analysis:

- Major Market Drivers: The increasing utilization of flights for business and leisure trips and traveling to distant places quickly and efficiently represents one of the crucial factors impelling the growth of the market in South Korea. Besides this, the adoption of cutting-edge technologies, such as more fuel-efficient aircraft, advanced avionics, and the emergence of electric and hybrid propulsion systems are contributing to the market growth in the country.

- Key Market Trends: The integration of artificial intelligence (AI), data analytics, and automation in various aspects of aviation operations, from air traffic management to maintenance procedures, is enhancing safety, efficiency, and cost-effectiveness, further propelling the market's growth. Moreover, the increasing investments in strengthening the defense system by employing efficient fighter jets, transport planes, and helicopters are bolstering the market growth in the country.

- Competitive Landscape: Some of the prominent South Korean aviation market companies include Airbus SE, Dassault Aviation, Korea Aerospace Industries, Leonardo S.p.A, Lockheed Martin Corporation, and The Boeing Company, among many others.

- Geographical Analysis: The Seoul Capital Area (which includes Seoul and Incheon) experiences robust demand for both commercial and business aviation owing to the high concentration of international business activities. Moreover, the Hoseo region is served by several smaller regional airports, such as Cheongju International Airport, which are critical for facilitating regional air travel and connectivity.

- Challenges and Opportunities: High competition among key players and the rising airport congestion are hampering the market's growth. However, the increasing middle-class affluence and a growing number of international and domestic travelers create opportunities for growth.

South Korea Aviation Market Trends:

Expanding Tourism

South Korea has become a popular tourist destination, attracting millions of international visitors each year. For instance, the World Travel & Tourism Council's (WTTC) 2024 Economic Impact Research (EIR) anticipated an outstanding year for South Korean travel and tourism, with considerable increases in economic contribution, employment, and tourist spending. In 2023, South Korea's Travel & Tourism sector increased by 18.2% to ₩84.71TN, accounting for 3.8% of the country's overall economic output. These factors further contribute to the South Korean aviation market.

Rising Middle-Class Population

The growing middle class in South Korea has led to higher travel demand. For instance, the proportion of the middle class in South Korea with a median income of between 50 and 150% grew to 62.8% in 2022 from 54.9% in 2011. During this time, the middle-class population increased by 17% to 32.19 million from 27.51 million. As more people reach middle-class status, they have greater access to international and domestic travel opportunities. These factors are positively influencing the South Korean aviation market forecast.

Increasing Government Support

The South Korean government has actively supported the aviation industry through investments in infrastructure, such as expanding and modernizing airports, and through favorable policies and regulations. For instance, in March 2024, South Korea planned to transform Incheon International Airport into a global mega hub airport capable of accommodating 130 million international travelers by 2030. The Korean government planned to complete the fourth phase of its airport expansion project in October 2024, which would include enlarging Incheon Airport Terminal 2 to increase passenger capacity by more than 30 million. These factors are further contributing to the South Korea aviation market share.

South Korea Aviation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on aircraft type.

Breakup by Aircraft Type:

- Commercial Aviation

- Freighter Aircraft

- Passenger Aircraft

- Narrowbody Aircraft

- Widebody Aircraft

- General Aviation

- Business Jets

- Large Jet

- Light Jet

- Mid-Size Jet

- Piston Fixed-Wing Aircraft

- Others

- Business Jets

- Military Aviation

- Fixed-Wing Aircraft

- Multi-Role Aircraft

- Training Aircraft

- Transport Aircraft

- Others

- Rotorcraft

- Multi-Mission Helicopter

- Transport Helicopter

- Others

- Fixed-Wing Aircraft

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes commercial aviation [freighter aircraft and passenger aircraft (narrowbody aircraft and widebody aircraft)], general aviation [business jets (large jet, light jet, and mid-size jet), piston fixed-wing aircraft, and others)], and military aviation [fixed-wing aircraft (multi-role aircraft, training aircraft, transport aircraft, and others] and rotorcraft (multi-mission helicopter, transport helicopter, and others)].

According to the South Korea aviation market overview, increased economic activity typically leads to higher travel demand. As economies grow, so do business and leisure travel, boosting commercial aviation. Moreover, economic stability and growth impact the purchasing power of private individuals and businesses, affecting demand for general aviation services. Increased interest in flying for recreational purposes, including private pilot ownership and flying clubs, can drive demand. Besides this, increased geopolitical tensions and conflicts can drive higher demand for military aircraft and readiness. The need for ongoing pilot and crew training and operational readiness impacts demand for military aviation resources.

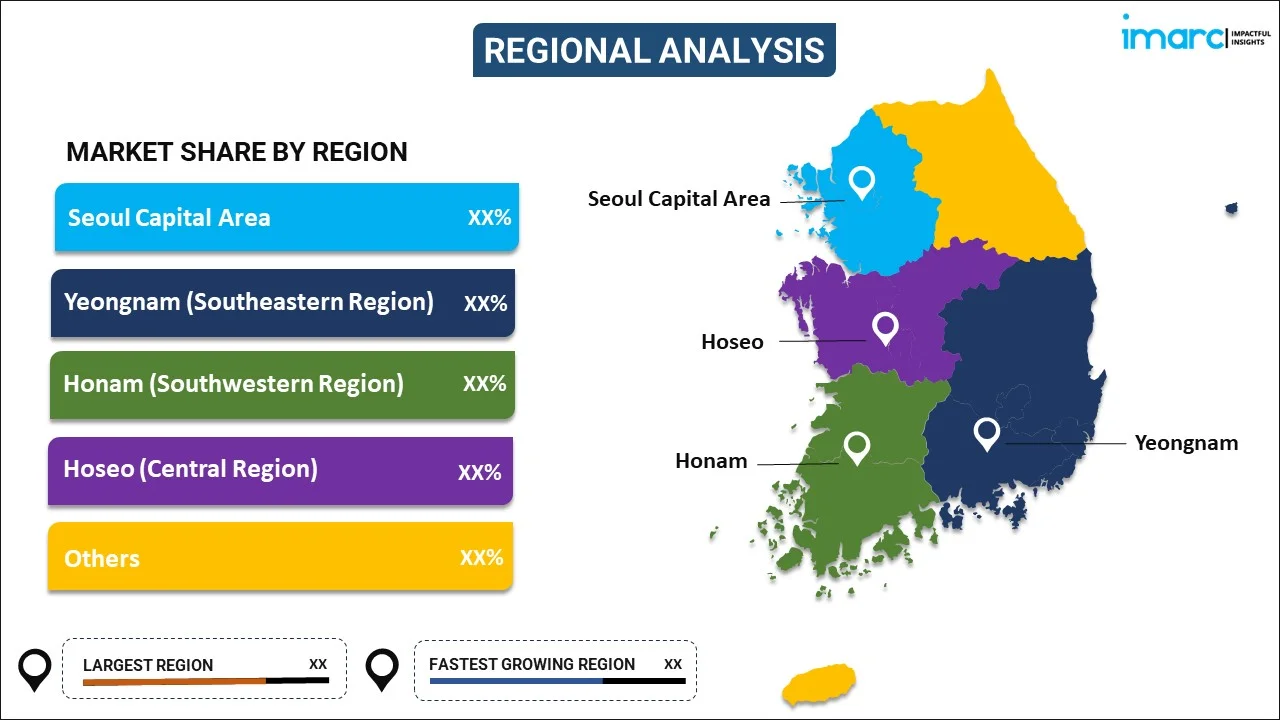

Breakup by Region:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others.

The Seoul Capital Area is a major tourist destination, attracting millions of visitors annually. Increased tourism contributes to higher demand for both domestic and international flights. Moreover, the Yeongnam region, which includes major cities like Busan, Ulsan, and Daegu, is a significant industrial hub, particularly for shipbuilding, automotive, and heavy industries. This industrial activity creates substantial demand for cargo and business aviation.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Airbus SE

- Dassault Aviation

- Korea Aerospace Industries

- Leonardo S.p.A

- Lockheed Martin Corporation

- The Boeing Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

South Korea Aviation Market News:

- September 2024: Korean Air used domestically generated sustainable aviation fuel (SAF) for the first time on flight KE719 from Seoul Incheon to Tokyo Haneda.

- June 2024: A South Korean aviation start-up launched a helicopter taxi service, offering a route from Seoul's Gangnam district to the airport. It cuts travel time from nearly 2 hours to 20 minutes.

- May 2024: Hanwha Aviation, South Korea's business firm, launched a vertically integrated engine leasing and trade platform for newer generation assets.

South Korea Aviation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Aircraft Types Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Companies Covered | Airbus SE, Dassault Aviation, Korea Aerospace Industries, Leonardo S.p.A, Lockheed Martin Corporation, The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea aviation market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South Korea aviation market?

- What is the breakup of the South Korea aviation market on the basis of aircraft type?

- What are the various stages in the value chain of the South Korea aviation market?

- What are the key driving factors and challenges in the South Korea aviation?

- What is the structure of the South Korea aviation market, and who are the key players?

- What is the degree of competition in the South Korea aviation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea aviation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea aviation market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea aviation industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)