South East Asia Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, Vendor Type, Fuel Type, and Country, 2025-2033

Market Overview:

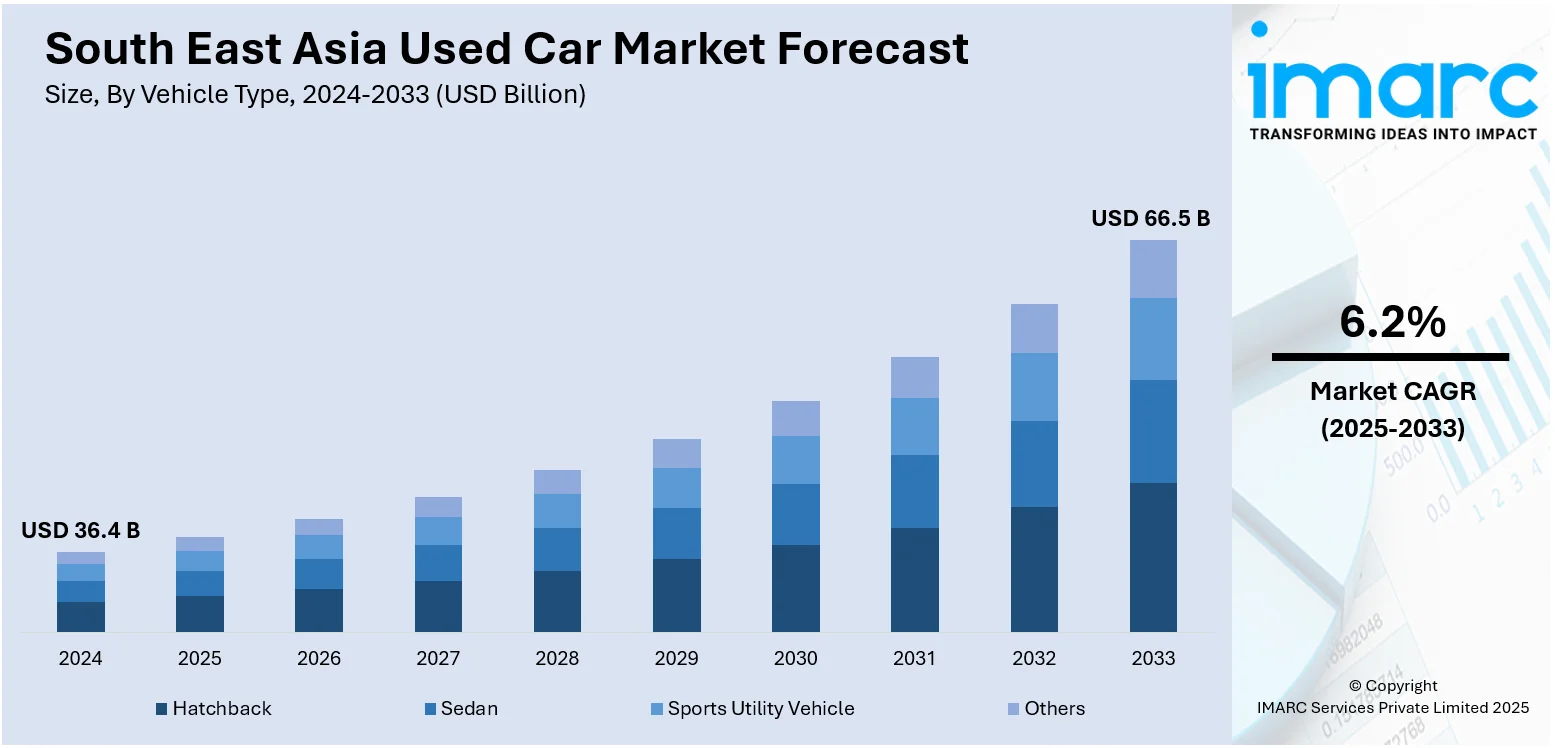

South East Asia used car market size reached USD 36.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 66.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The rising number of broad spectrum of consumers seeking reliable transportation without the higher costs associated with brand-new vehicles is primarily augmenting the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36.4 Billion |

| Market Forecast in 2033 | USD 66.5 Billion |

| Market Growth Rate (2025-2033) | 6.2% |

A used car, commonly referred to as a pre-owned vehicle, is a previously owned automobile that is made available for resale following a thorough inspection, refurbishment, and necessary repairs. This category encompasses a variety of vehicle types, including hatchbacks, sedans, minivans, SUVs (sports utility vehicles), convertibles, station wagons, luxury cars, hybrids, and coupes. Used cars are distributed through a range of channels, including independent and franchise car dealerships, rental car companies, private party sales, auctions, and leasing offices. This market caters to diverse buyers, including first-time car purchasers, users of car subscription services, and individuals with budget constraints. In contrast to new cars, they have several advantages. They are more cost-effective, experience a slower rate of depreciation, and typically come with lower expenses for insurance, registration, and customization.

To get more information on this market, Request Sample

South East Asia Used Car Market Trends:

The South East Asia used car market has become a pivotal and burgeoning sector, reflecting the region's diverse economic landscape, changing consumer preferences, and a growing demand for affordable transportation solutions. Comprising countries such as Indonesia, Malaysia, Thailand, Vietnam, and the Philippines, the used car market in South East Asia is witnessing significant growth driven by various factors. One key driver is the region's expanding middle-class population, which seeks cost-effective and reliable transportation options. Additionally, independent and franchise car dealerships, private party sales, auctions, and rental car companies serve as crucial outlets through which used cars are bought and sold in the region. The South East Asia used car market is particularly attractive to first-time buyers, individuals facing budget constraints, and those who prefer cost-effective alternatives to brand-new cars. Besides this, the market caters to the evolving preferences of consumers, including a rising interest in eco-friendly options such as used hybrid vehicles. Moreover, as the region's economies continue to grow, the South East Asia used car market is expected to remain a dynamic and integral component of the automotive industry over the forecasted period.

South East Asia Used Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on vehicle type, sales channel, vendor type, and fuel type.

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, sedan, sports utility vehicle, and others.

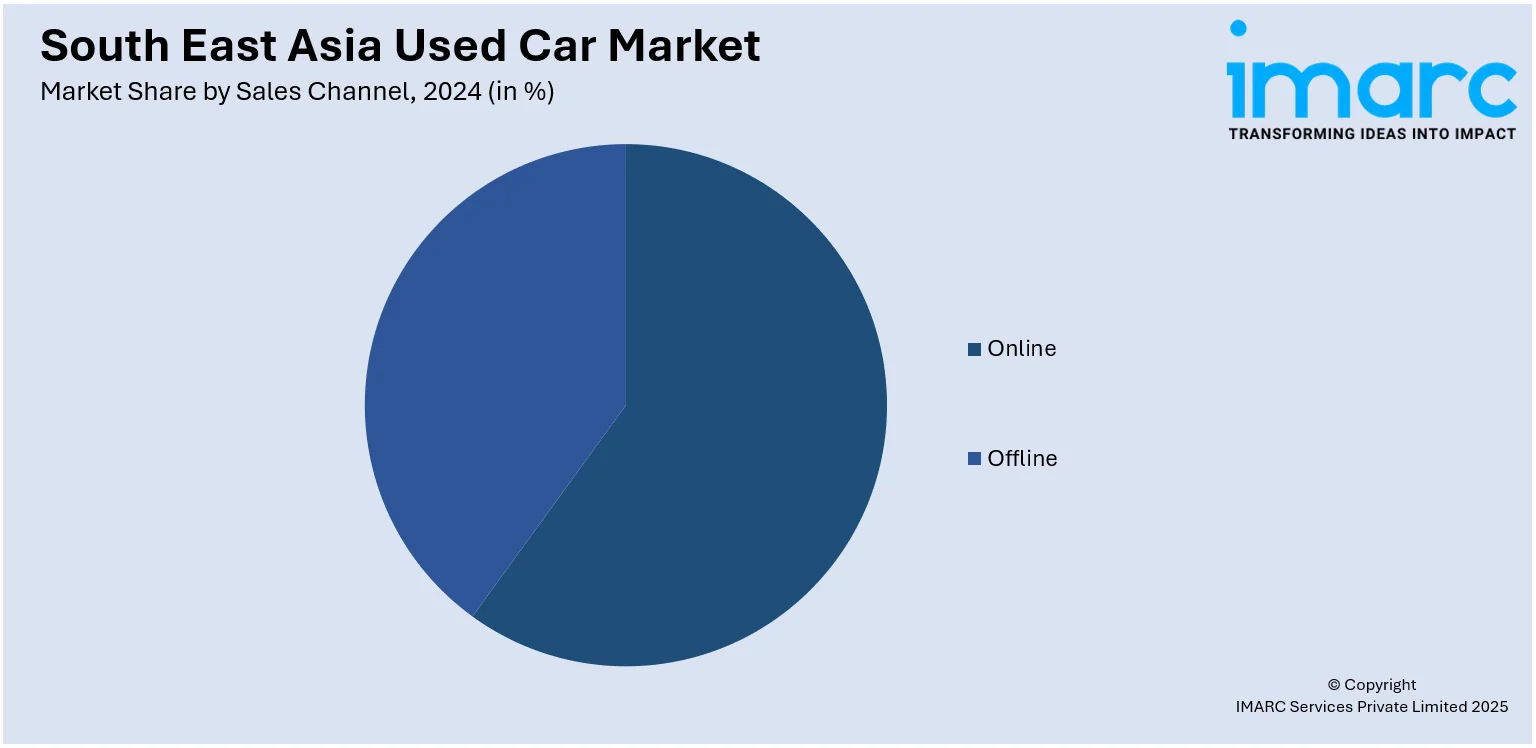

Sales Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes online and offline.

Vendor Type Insights:

- Organized

- Unorganized

The report has provided a detailed breakup and analysis of the market based on the vendor type. This includes organized and unorganized.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes gasoline, diesel, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Carousell

- Cars24 Services Private Limited

- Carsome Sdn Bhd

- iCarAsia Limited

- Nissan Motor Co. Ltd.

- Trusty Cars Pte Ltd

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

South East Asia Used Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicle, Others |

| Sales Channels Covered | Online, Offline |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Carousell, Cars24 Services Private Limited, Carsome Sdn Bhd, iCarAsia Limited, Nissan Motor Co. Ltd., Trusty Cars Pte Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia used car market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia used car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The used car market in South East Asia was valued at USD 36.4 Billion in 2024.

The South East Asia used car market is projected to exhibit a CAGR of 6.2% during 2025-2033, reaching a value of USD 66.5 Billion by 2033.

The South East Asia used car market is driven by growing middle-class demand for affordable vehicles, increased availability of certified pre-owned programs, and digital platforms that simplify transactions. Economic uncertainty and rising new car prices also make used cars a more attractive option for value-conscious buyers.

Some of the major players in the South East Asia used car market include Carousell, Cars24 Services Private Limited, Carsome Sdn Bhd, iCarAsia Limited, Nissan Motor Co. Ltd., Trusty Cars Pte Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)