South East Asia Tire Market Size, Share, Trends and Forecast by Design, End Use, Vehicle Type, Distribution Channel, Season, and Country, 2025-2033

Market Overview:

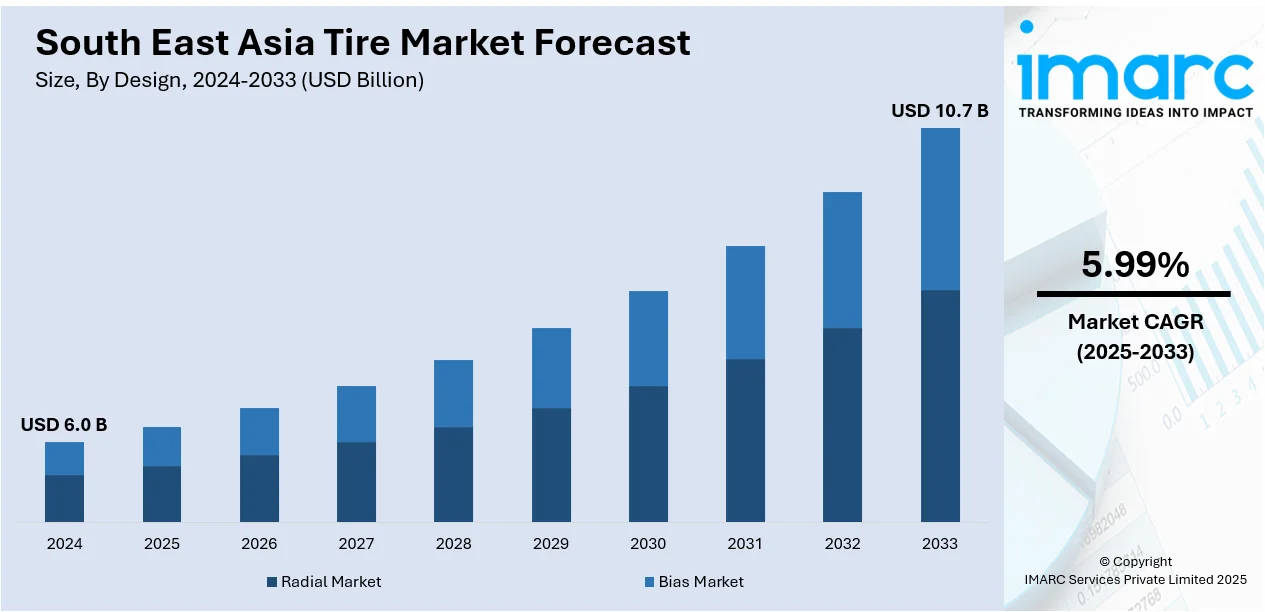

South East Asia tire market size reached USD 6.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.99% during 2025-2033. The market is growing due to rising automobile production, expanding fleet sizes, increasing disposable incomes, and greater demand for high-performance and replacement tires, driven by logistics, construction activities, and a focus on vehicle maintenance and safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.0 Billion |

| Market Forecast in 2033 | USD 10.7 Billion |

| Market Growth Rate (2025-2033) | 5.99% |

A tire is a circular component designed to surround a wheel, enabling vehicles to gain traction on various surfaces like roads, tracks, or terrain. They are typically produced using a range of materials, including rubber compounds, carbon black, metal components, chemicals, fillers, and textiles. Tires are robust and highly resilient products that offer properties such as resistance to wear, friction, shock absorption, and cushioning. They aid vehicles in bearing loads, safeguarding them from harm, and minimizing vibrations as the tire moves over uneven surfaces, consequently enhancing vehicle performance and contributing to better mileage and passenger safety. As a result, tires find widespread use in a variety of commercial and passenger vehicles, encompassing motorcycles, bicycles, aircraft, carts, casters, lawnmowers, wheelbarrows, and heavy machinery.

To get more information on this market, Request Sample

South East Asia Tire Market Trends:

The South East Asia tire market is experiencing a notable surge in demand, driven by several key factors. The escalating production of automobiles, coupled with the expansion of the regional fleet size, is a significant driver of this growth. Moreover, the increasing standards of living among consumers, supported by their rising disposable income levels, have led to a notable uptick in automobile sales, consequently fueling the demand for tires across the region. Additionally, the heightened use of both light and heavy commercial vehicles in logistics and construction activities has contributed to the robust expansion of the market. Furthermore, the growing preference for next-generation and high-performance tires designed for luxury and premium vehicles has emerged as a critical factor driving market growth. This shift is in response to the rising demand for enhanced driving experiences and improved vehicle performance among consumers in the region. Moreover, the escalating need for replacement tires, attributable to the substantial consumer base of passenger cars and the frequent replacement of tires upon reaching a certain usage threshold, has further bolstered the demand for tires in the Southeast Asian market. This heightened demand for replacement tires is a result of the region's expanding automotive aftermarket, which is driven by the growing need for vehicle maintenance and safety, which is anticipated to fuel the market growth over the forecasted period.

South East Asia Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2025-2033. Our report has categorized the market based on design, end use, vehicle type, distribution channel, and season.

Design Insights:

- Radial Market

- Bias Market

The report has provided a detailed breakup and analysis of the market based on the design. This includes radial market and bias market.

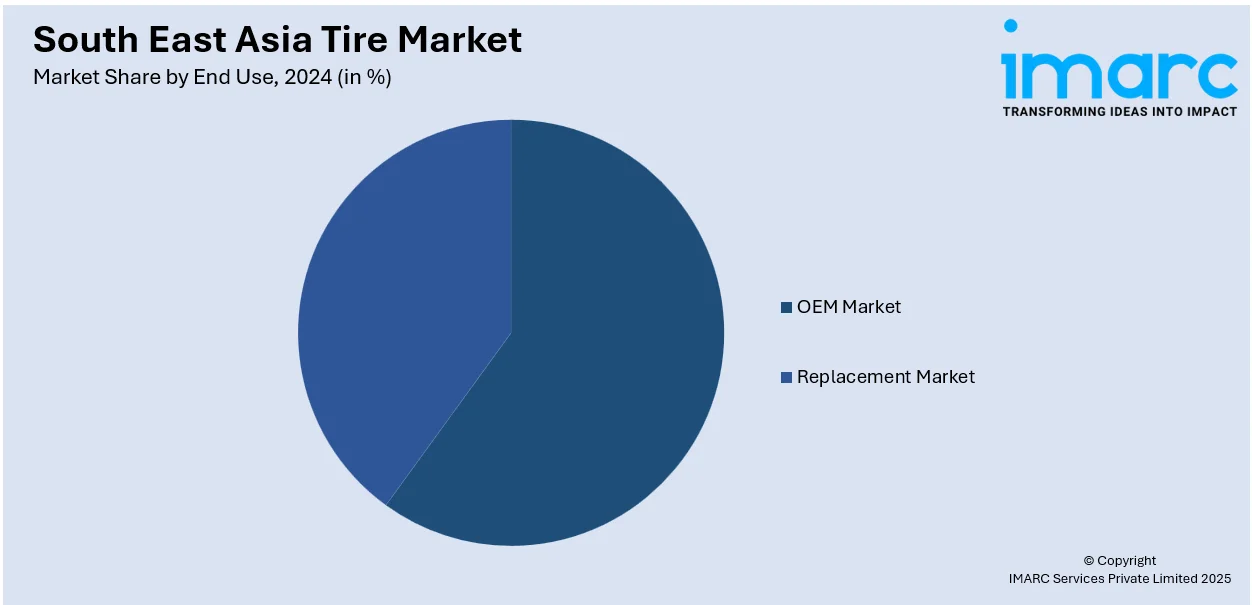

End Use Insights:

- OEM Market

- Replacement Market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes OEM market and replacement market.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, three wheelers, and off-the-road (OTR).

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Season Insights:

- All Season Tires

- Winter Tires

- Summer Tires

The report has provided a detailed breakup and analysis of the market based on the season. This includes all season tires, winter tires, and summer tires.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Bridgestone Sales (Thailand) Co. Ltd.

- Continental AG

- Michelin

- The Goodyear Tire & Rubber Company

- The Yokohama Rubber Co. Ltd. (Furukawa Group)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

South East Asia Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Designs Covered | Radial Market, Bias Market |

| End Uses Covered | OEM Market, Replacement Market |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Seasons Covered | All Season Tires, Winter Tires, Summer Tires |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Bridgestone Sales (Thailand) Co. Ltd., Continental AG, Michelin, The Goodyear Tire & Rubber Company, The Yokohama Rubber Co. Ltd. (Furukawa Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia tire market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia tire market on the basis of design?

- What is the breakup of the South East Asia tire market on the basis of end use?

- What is the breakup of the South East Asia tire market on the basis of vehicle type?

- What is the breakup of the South East Asia tire market on the basis of distribution channel?

- What is the breakup of the South East Asia tire market on the basis of season?

- What are the various stages in the value chain of the South East Asia tire market?

- What are the key driving factors and challenges in the South East Asia tire?

- What is the structure of the South East Asia tire market and who are the key players?

- What is the degree of competition in the South East Asia tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia tire market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)