South East Asia Rigid Plastic Packaging Market Size, Share, Trends and Forecast by Product, Material, Production Process, End Use Industry, and Country, 2025-2033

Market Overview:

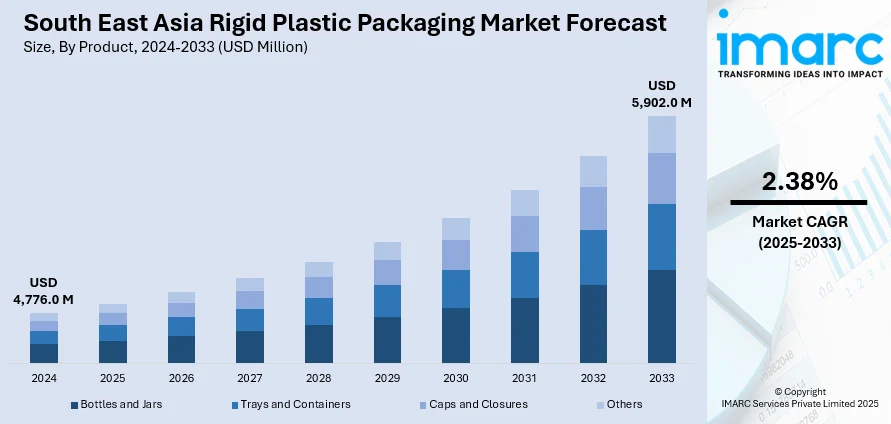

South East Asia rigid plastic packaging market size reached USD 4,776.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,902.0 Million by 2033, exhibiting a growth rate (CAGR) of 2.38% during 2025-2033. The increasing innovations in materials, which lead to enhanced performance characteristics, such as increased durability, reduced environmental impact, and improved recyclability, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,776.0 Million |

| Market Forecast in 2033 | USD 5,902.0 Million |

| Market Growth Rate (2025-2033) | 2.38% |

Rigid plastic packaging refers to containers and packaging materials made from sturdy and inflexible plastic materials. These containers are designed to provide durability, strength, and protection to various products during storage, transportation, and display. Common examples include bottles, jars, tubs, and trays made from materials such as polyethylene, polypropylene, and PET (polyethylene terephthalate). Rigid plastic packaging offers several advantages, including lightweight construction, resistance to breakage, and versatility in design, allowing for a wide range of shapes and sizes. It is widely used in industries such as food and beverage, pharmaceuticals, and personal care due to its ability to preserve product freshness, extend shelf life, and enhance product visibility. Additionally, rigid plastic packaging is often chosen for its cost-effectiveness and sustainability, as many types of rigid plastics are recyclable and contribute to reducing overall environmental impact.

To get more information on this market, Request Sample

South East Asia Rigid Plastic Packaging Market Trends:

The rigid plastic packaging market in South East Asia is experiencing robust growth, driven by several key factors. Firstly, the increasing demand for convenient and durable packaging solutions has propelled the market forward. Consumers' preferences for lightweight, shatter-resistant, and tamper-evident packaging have led to a surge in the adoption of rigid plastic materials. Additionally, the burgeoning e-commerce sector has significantly contributed to the market's expansion, as rigid plastic packaging offers excellent protection during transportation, reducing the risk of damage to goods. Furthermore, the growing awareness and emphasis on sustainability have influenced market dynamics positively. Manufacturers are increasingly focusing on producing eco-friendly rigid plastic packaging materials, incorporating recyclable and biodegradable components. This eco-conscious approach aligns with regional efforts to reduce environmental impact and fosters a positive perception among environmentally conscious consumers. Moreover, technological advancements in the rigid plastic packaging industry, such as innovations in barrier coatings and printing technologies, which have enhanced the functionality and aesthetic appeal of these materials, are expected to drive the market in South East Asia during the forecast period.

South East Asia Rigid Plastic Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product, material, production process, and end use industry.

Product Insights:

- Bottles and Jars

- Trays and Containers

- Caps and Closures

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bottles and jars, trays and containers, caps and closures, and others.

Material Insights:

- Polyethylene (PET)

- Polypropylene (PP)

- High Density Polypropylene (HDPE)

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes polyethylene (PET), polypropylene (PP), high density polypropylene (HDPE), and others.

Production Process Insights:

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Others

The report has provided a detailed breakup and analysis of the market based on the production process. This includes extrusion, injection molding, blow molding, thermoforming, and others.

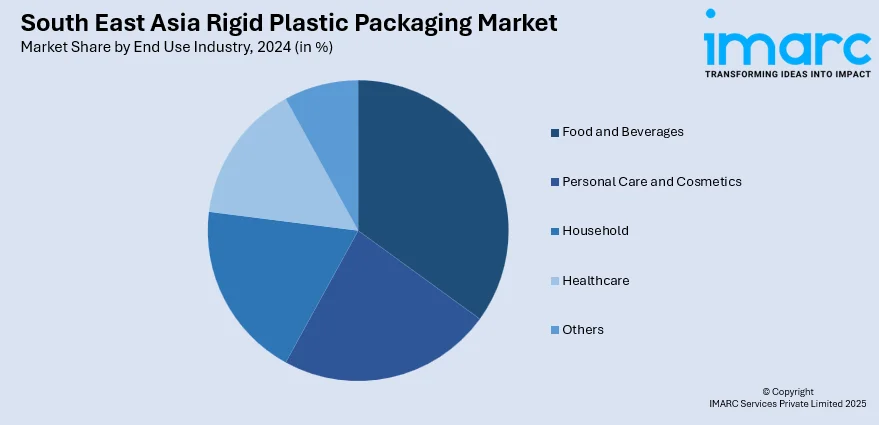

End Use Industry Insights:

- Food and Beverages

- Personal Care and Cosmetics

- Household

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes food and beverages, personal care and cosmetics, household, healthcare, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Duy Tan Plastic Company

- Dynapack Asia

- PT. Hasil Raya Industries

- Thai Plaspac Public Company Limited

- Vektropack

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

South East Asia Rigid Plastic Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Bottles and Jars, Trays and Containers, Caps and Closures, Others |

| Materials Covered | Polyethylene (PET), Polypropylene (PP), High Density Polypropylene (HDPE), Others |

| Production Processes Covered | Extrusion, Injection Molding, Blow Molding, Thermoforming, Others |

| End Use Industries Covered | Food and Beverages, Personal Care and Cosmetics, Household, Healthcare, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Duy Tan Plastic Company, Dynapack Asia, PT. Hasil Raya Industries, Thai Plaspac Public Company Limited, Vektropack, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia rigid plastic packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia rigid plastic packaging market on the basis of product?

- What is the breakup of the South East Asia rigid plastic packaging market on the basis of material?

- What is the breakup of the South East Asia rigid plastic packaging market on the basis of production process?

- What is the breakup of the South East Asia rigid plastic packaging market on the basis of end use industry?

- What are the various stages in the value chain of the South East Asia rigid plastic packaging market?

- What are the key driving factors and challenges in the South East Asia rigid plastic packaging?

- What is the structure of the South East Asia rigid plastic packaging market and who are the key players?

- What is the degree of competition in the South East Asia rigid plastic packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia rigid plastic packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia rigid plastic packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia rigid plastic packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)