South East Asia Reinsurance Market Report by Type (Facultative Reinsurance, Treaty Reinsurance), Mode (Online, Offline), Distribution Channel (Direct Writing, Broker), Application (Property and Casualty Reinsurance, Life and Health Reinsurance), and Country 2025-2033

Market Overview:

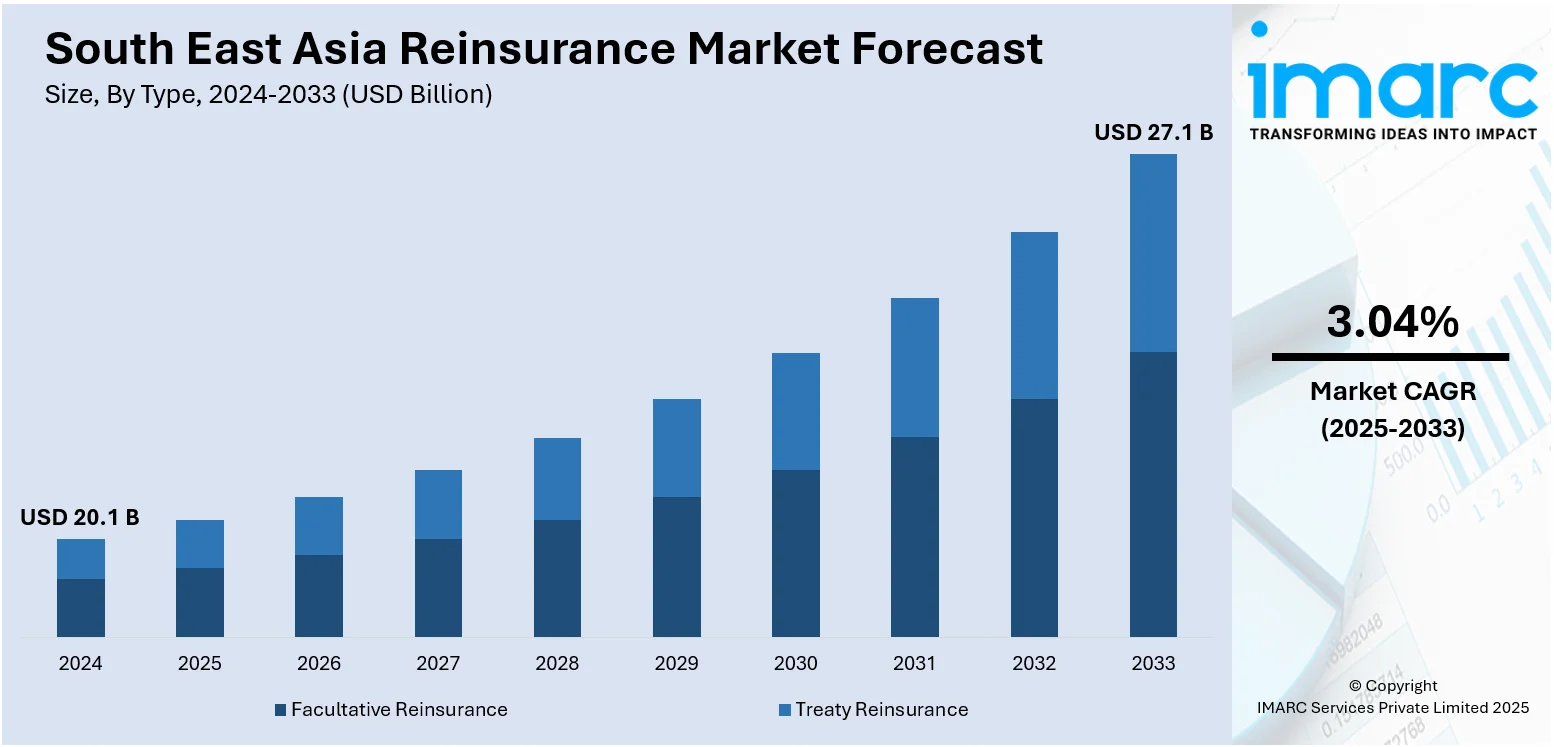

South East Asia reinsurance market size reached USD 20.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.04% during 2025-2033. The increasing technological innovations, such as artificial intelligence, data analytics, and blockchain, that can impact the way insurers and reinsurers assess risk, process claims, and manage their operations, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.1 Billion |

|

Market Forecast in 2033

|

USD 27.1 Billion |

| Market Growth Rate 2025-2033 | 3.04% |

Reinsurance is a financial arrangement in which insurance companies transfer a portion of their risk to other insurers to mitigate potential losses. In this process, the primary insurer, known as the ceding company, pays a premium to a reinsurer in exchange for the latter assuming a share of the risks associated with the policies underwritten by the former. Reinsurance serves several purposes, including spreading risk across multiple entities, enhancing financial stability, and ensuring that insurers can handle large or catastrophic claims without jeopardizing their solvency. Reinsurers, equipped with extensive risk assessment and management expertise, play a critical role in supporting the stability of the insurance industry. This practice enables insurers to maintain a healthy balance between risk and capital, fostering resilience and sustainability within the broader financial landscape.

To get more information on this market, Request Sample

South East Asia Reinsurance Market Trends:

The reinsurance market in South East Asia is continually shaped by a myriad of dynamic factors that contribute to its evolution. Primarily, the increasing frequency and severity of catastrophic events serve as a fundamental driver for the expansion of the reinsurance sector. As climate change escalates, insurers seek to mitigate their exposure to unprecedented risks, fueling a growing demand for reinsurance coverage. Moreover, the regional interconnectedness of economies and financial markets plays a pivotal role in steering the reinsurance market. Besides this, technological advancements also serve as a significant impetus for change in the reinsurance sector. The integration of sophisticated analytics, artificial intelligence, and big data analytics enables reinsurers to refine risk assessment models, enhancing their underwriting capabilities. This technological metamorphosis not only streamlines operations but also empowers reinsurers to respond more adeptly to emerging risks. In conclusion, the reinsurance market in South East Asia is a dynamic ecosystem influenced by a confluence of factors. The increasing occurrence of catastrophic events and technological innovations collectively propel the evolution of the reinsurance landscape, compelling stakeholders to adapt and innovate in response to these multifaceted drivers.

South East Asia Reinsurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, mode, distribution channel, and application.

Type Insights:

- Facultative Reinsurance

- Treaty Reinsurance

- Proportional Reinsurance

- Non-proportional Reinsurance

The report has provided a detailed breakup and analysis of the market based on the type. This includes facultative reinsurance and treaty reinsurance (proportional reinsurance and non-proportional reinsurance).

Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes online and offline.

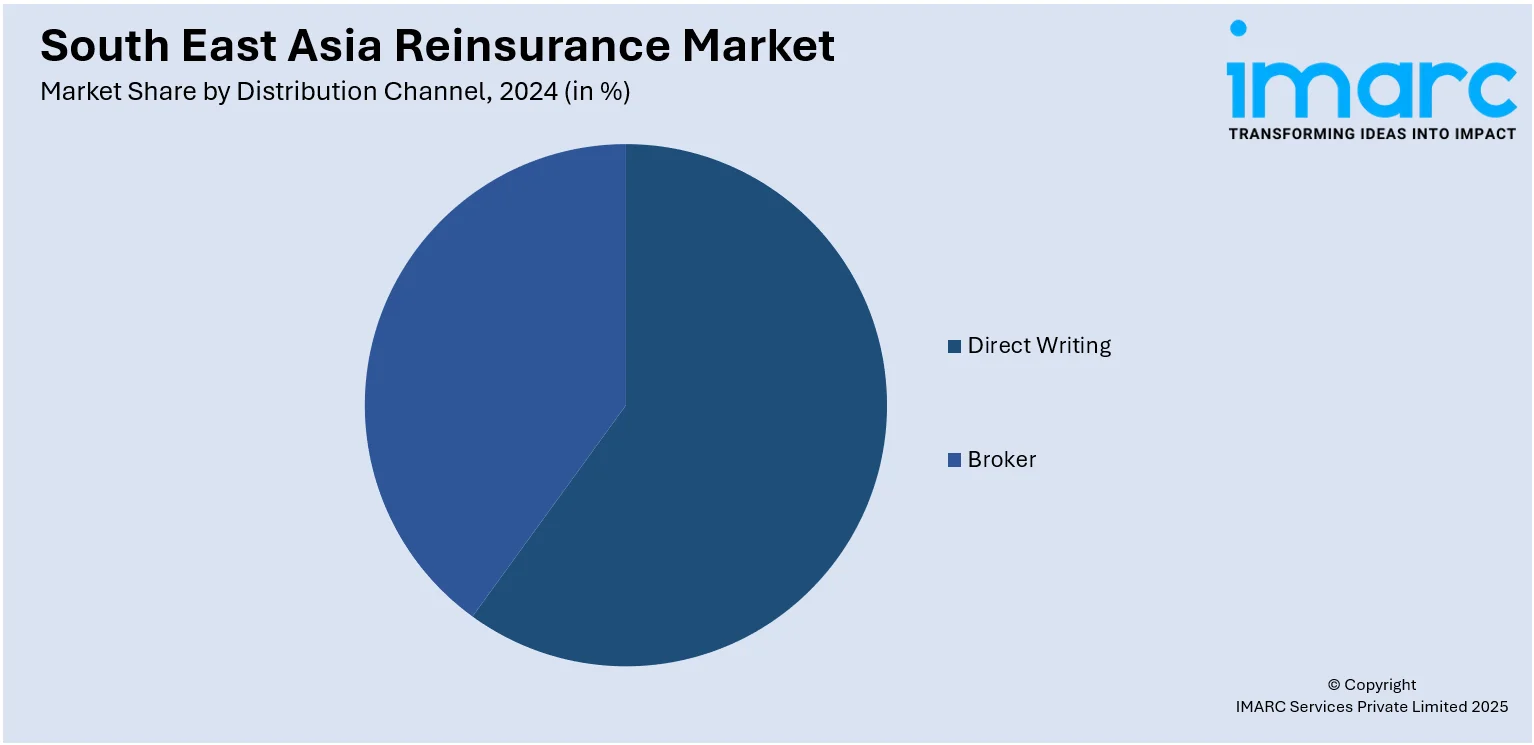

Distribution Channel Insights:

- Direct Writing

- Broker

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct writing and broker.

Application Insights:

- Property and Casualty Reinsurance

- Life and Health Reinsurance

- Disease Insurance

- Medical Insurance

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes property and casualty reinsurance and life and health reinsurance (disease insurance and medical insurance).

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Reinsurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Modes Covered | Online, Offline |

| Distribution Channels Covered | Direct Writing, Broker |

| Applications Covered |

|

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia reinsurance market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia reinsurance market on the basis of type?

- What is the breakup of the South East Asia reinsurance market on the basis of mode?

- What is the breakup of the South East Asia reinsurance market on the basis of distribution channel?

- What is the breakup of the South East Asia reinsurance market on the basis of application?

- What are the various stages in the value chain of the South East Asia reinsurance market?

- What are the key driving factors and challenges in the South East Asia reinsurance?

- What is the structure of the South East Asia reinsurance market and who are the key players?

- What is the degree of competition in the South East Asia reinsurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia reinsurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia reinsurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia reinsurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)