South East Asia Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Country, 2026-2034

Market Overview:

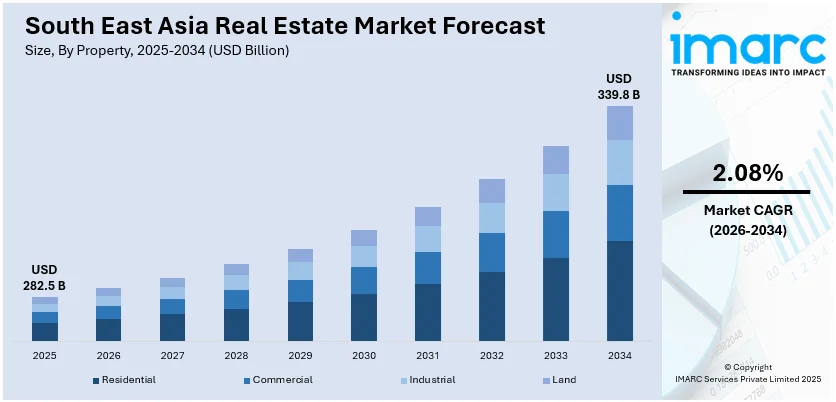

South East Asia real estate market size reached USD 282.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 339.8 Billion by 2034, exhibiting a growth rate (CAGR) of 2.08% during 2026-2034. The increasing infrastructure developments, such as the construction of highways, public transportation systems, and commercial centers, that can enhance the value of properties in the vicinity, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 282.5 Billion |

|

Market Forecast in 2034

|

USD 339.8 Billion |

| Market Growth Rate 2026-2034 | 2.08% |

Real estate refers to physical properties, including land, buildings, and any structures or improvements on them. It encompasses residential, commercial, and industrial properties, as well as undeveloped land. Real estate can be bought, sold, rented, or leased, and it is a fundamental component of the economy. Investors often consider real estate as an attractive asset class due to its potential for appreciation and rental income. It's subject to market fluctuations and influenced by factors like location, demand, and economic conditions. Real estate transactions involve legal and financial complexities, such as property deeds, mortgages, and property taxes. Real estate plays a crucial role in urban development, housing markets, and infrastructure growth. It also impacts individuals and communities by providing housing, generating employment, and influencing the overall quality of life. Real estate professionals, such as real estate agents, brokers, and appraisers, help facilitate these transactions and provide expertise in the industry.

To get more information on this market Request Sample

South East Asia Real Estate Market Trends:

The real estate market in South East Asia is influenced by various factors, and these factors collectively shape its dynamics. Firstly, demographic trends play a crucial role in dictating the direction of the market. As the population grows, the demand for housing increases, resulting in upward pressure on prices. Additionally, economic indicators also significantly impact the real estate sector. For instance, low unemployment rates often indicate a strong economy, leading to higher consumer confidence and increased real estate investment. Moreover, government policies can act as a powerful driving force in the real estate market. Subsidies, tax incentives, and interest rates set by regulatory bodies can all influence the accessibility of property and the willingness of investors to engage in the market. Furthermore, regional events and geopolitical factors can reverberate through the real estate market, impacting investor sentiment and market stability. The interplay of these diverse drivers underscores the complex and interconnected nature of the real estate market in South East Asia, highlighting the necessity for stakeholders to remain attuned to a myriad of internal and external forces to make informed decisions and anticipate market fluctuations.

South East Asia Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2026-2034. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

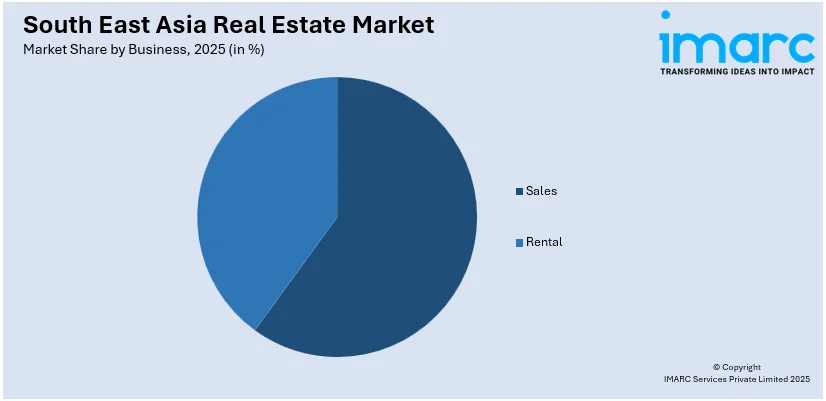

Business Insights:

Access the comprehensive market breakdown Request Sample

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia real estate market on the basis of property?

- What is the breakup of the South East Asia real estate market on the basis of business?

- What is the breakup of the South East Asia real estate market on the basis of mode?

- What are the various stages in the value chain of the South East Asia real estate market?

- What are the key driving factors and challenges in the South East Asia real estate?

- What is the structure of the South East Asia real estate market and who are the key players?

- What is the degree of competition in the South East Asia real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)