South East Asia Precious Metals Market Size, Share, Trends and Forecast by Metal Type, Application, and Country, 2026-2034

Market Overview:

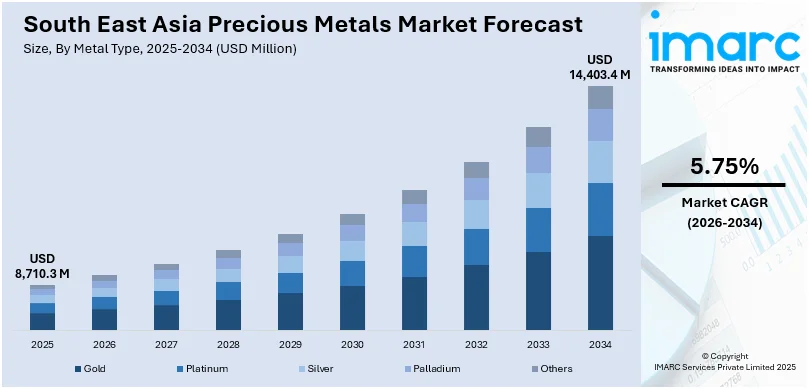

South East Asia precious metals market size reached USD 8,710.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,403.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.75% during 2026-2034. The increasing prevalence of speculative trading activities, as well as investment trends in precious metals exchange-traded funds (ETFs) and other financial products, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8,710.3 Million |

| Market Forecast in 2034 | USD 14,403.4 Million |

| Market Growth Rate (2026-2034) | 5.75% |

Precious metals are rare, naturally occurring metallic elements with high economic value, often used for investment, industrial purposes, and jewelry. The most widely recognized precious metals include gold, silver, platinum, and palladium. Gold, known for its malleability and resistance to corrosion, has been sought after for centuries as a store of value and a symbol of wealth. Silver, with its unique electrical conductivity and antibacterial properties, finds use in various industries, including electronics and medicine. Platinum, prized for its durability and resistance to corrosion, is predominantly utilized in catalytic converters, jewelry, and the chemical industry. Palladium, similar to platinum in many of its properties, is also employed in catalytic converters, electronics, and dentistry. These metals have historically held intrinsic value due to their rarity, aesthetic appeal, and industrial applications, making them crucial components of trade and financial systems.

To get more information on this market Request Sample

South East Asia Precious Metals Market Trends:

The precious metals market in South East Asia is influenced by various factors, driving its dynamics and shaping investor sentiment. Firstly, the regional economic outlook serves as a crucial determinant, with market participants closely monitoring indicators such as GDP growth and inflation rates. Consequently, as economic uncertainty looms, investors often seek refuge in safe-haven assets like gold and silver. Additionally, geopolitical tensions play a pivotal role in steering the precious metals market, as political instability or conflicts can trigger a flight to safety, bolstering demand for these commodities. Moreover, monetary policy decisions implemented by central banks significantly impact the market, with interest rate changes and quantitative easing measures directly influencing the appeal of precious metals as alternative investments. Furthermore, currency fluctuations also exert a substantial influence on the precious metals market, as a weakening dollar typically leads to increased demand for these commodities. Moreover, the burgeoning interest in sustainable and green technologies, which has fueled the demand for metals like platinum and palladium in various eco-friendly applications, is expected to drive the precious metals market in South East Asia during the forecast period.

South East Asia Precious Metals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on metal type and application.

Metal Type Insights:

- Gold

- Platinum

- Silver

- Palladium

- Others

The report has provided a detailed breakup and analysis of the market based on the metal type. This includes gold, platinum, silver, palladium, and others.

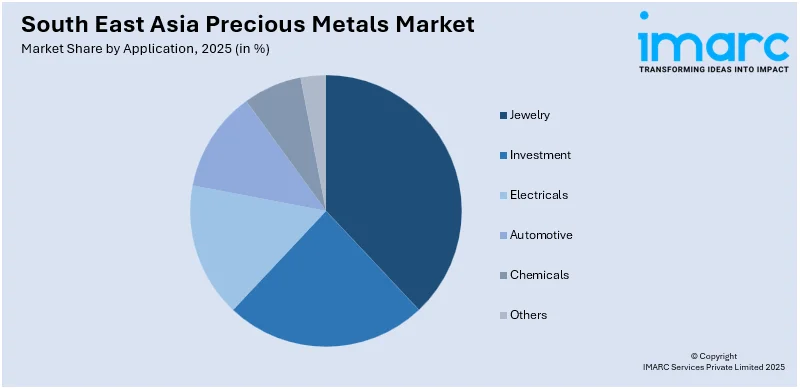

Application Insights:

Access the comprehensive market breakdown Request Sample

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes jewelry, investment, electricals, automotive, chemicals, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Precious Metals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metal Types Covered | Gold, Platinum, Silver, Palladium, Others |

| Applications Covered | Jewelry, Investment, Electricals, Automotive, Chemicals, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia precious metals market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South East Asia precious metals market?

- What is the breakup of the South East Asia precious metals market on the basis of metal type?

- What is the breakup of the South East Asia precious metals market on the basis of application?

- What are the various stages in the value chain of the South East Asia precious metals market?

- What are the key driving factors and challenges in the South East Asia precious metals?

- What is the structure of the South East Asia precious metals market and who are the key players?

- What is the degree of competition in the South East Asia precious metals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia precious metals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia precious metals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia precious metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)