South East Asia Phenol Market Size, Share, Trends and Forecast by End Use, and Country, 2025-2033

Market Overview:

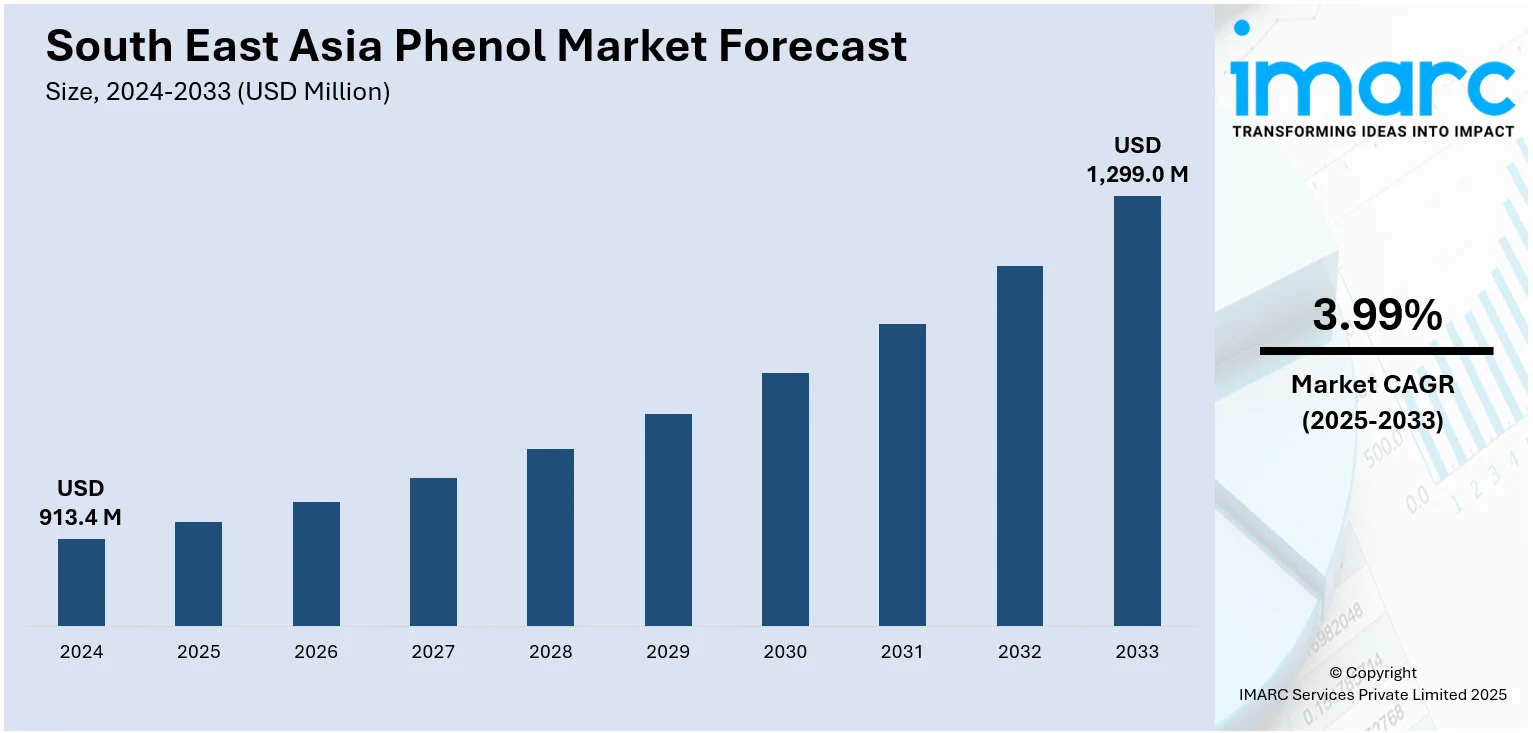

South East Asia Phenol market size reached USD 913.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,299.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. The increasing demand for nylon in the textile industry, the development of more efficient and sustainable production processes, and continuous innovations in catalysis and process optimization represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 913.4 Million |

| Market Forecast in 2033 | USD 1,299.0 Million |

| Market Growth Rate (2025-2033) | 3.99% |

Phenol, also known as carbolic acid, is an aromatic organic compound characterized by a hydroxyl group (-OH) attached to a carbon atom within a benzene ring. This volatile compound, featuring a distinctive sweet and tar-like odor, is a crucial ingredient in the manufacture of various industrial products. It is produced primarily through the cumene process, which involves the catalytic conversion of cumene into phenol and acetone. The versatility of phenol is evident in its various derivatives, including bisphenol-A (BPA), phenolic resins, caprolactam, alkyl phenols, and an array of pharmaceuticals. These derivatives cater to diverse applications, particularly in the production of plastic resins and as intermediates in synthetic fibers such as nylon. Phenol stands out for its high reactivity and ability to undergo sulfonation, nitration, and halogenation, making it a fundamental component in the synthesis of numerous chemicals. The compound's advantages include its efficacy as an antiseptic, its role in producing robust and heat-resistant plastics, and its application in the creation of drugs such as aspirin and penicillin. Additionally, its utility in the automotive and electronics industries, where durability and reliability are paramount.

To get more information on this market, Request Sample

South East Asia Phenol Market Trends:

The market in South East Asia is majorly driven by the region's expanding industrial sector, particularly the automotive and electronics industries. In line with this, the rapid product utilization in producing high-quality plastics and resins, essential for manufacturing components in these sectors, is positively influencing the market. Additionally, the construction industry in Southeast Asia, experiencing growth due to urbanization and economic development, is leveraging phenolic resins for insulation and laminates, further fueling the market's expansion. Along with this, the escalating demand for nylon in the textile industry, where phenol is a key precursor for caprolactam, aligns with the growing fashion and apparel sector in the region, adding another layer of demand. In addition, technological advancements, such as the development of more efficient and sustainable production processes, are also playing a crucial role in the market's growth. These include innovations in catalysis and process optimization, which enhance production efficiency and align with the increasing environmental concerns and regulatory policies. Apart from this, the region's strategic position as a global manufacturing hub, coupled with favorable government policies encouraging industrial growth are also acting as significant growth inducing factors for the market. Some of the other factors contributing to the market include Southeast Asia's commitment to economic development and industrial diversification, inflating disposable income levels, and extensive research and development (R&D) activities.

South East Asia Phenol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on end use.

End Use Insights:

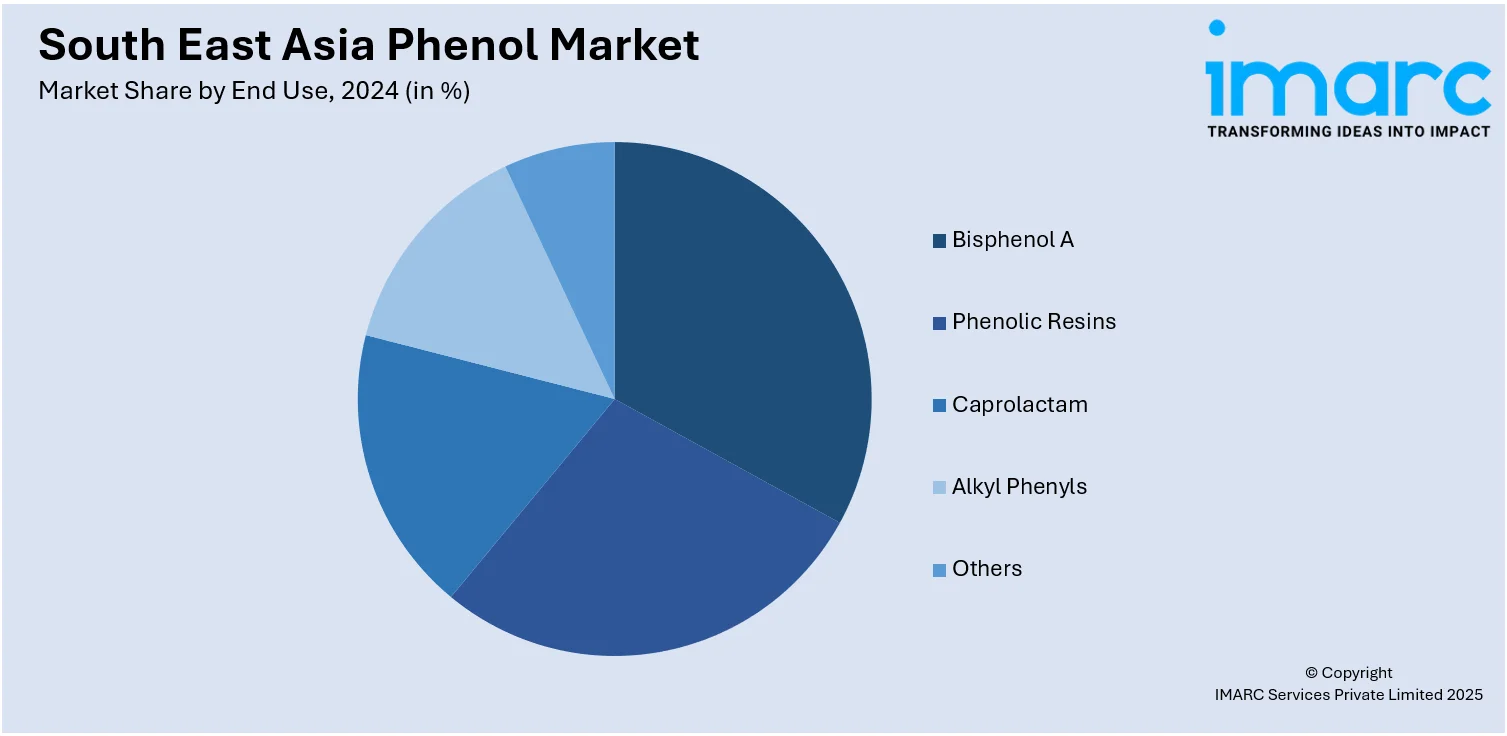

- Bisphenol A

- Phenolic Resins

- Caprolactam

- Alkyl Phenyls

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes bisphenol A, phenolic resins, caprolactam, alkyl phenyls, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Phenol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Bisphenol A, Phenolic Resins, Caprolactam, Alkyl Phenyls, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia phenol market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia phenol market on the basis of end use?

- What are the various stages in the value chain of the South East Asia phenol market?

- What are the key driving factors and challenges in the South East Asia phenol?

- What is the structure of the South East Asia phenol market and who are the key players?

- What is the degree of competition in the South East Asia phenol market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia phenol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia phenol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia phenol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)