South East Asia Jewellery Market Size, Share, Trends and Forecast by Product, Material, and Country, 2026-2034

South East Asia Jewellery Market Size and Share:

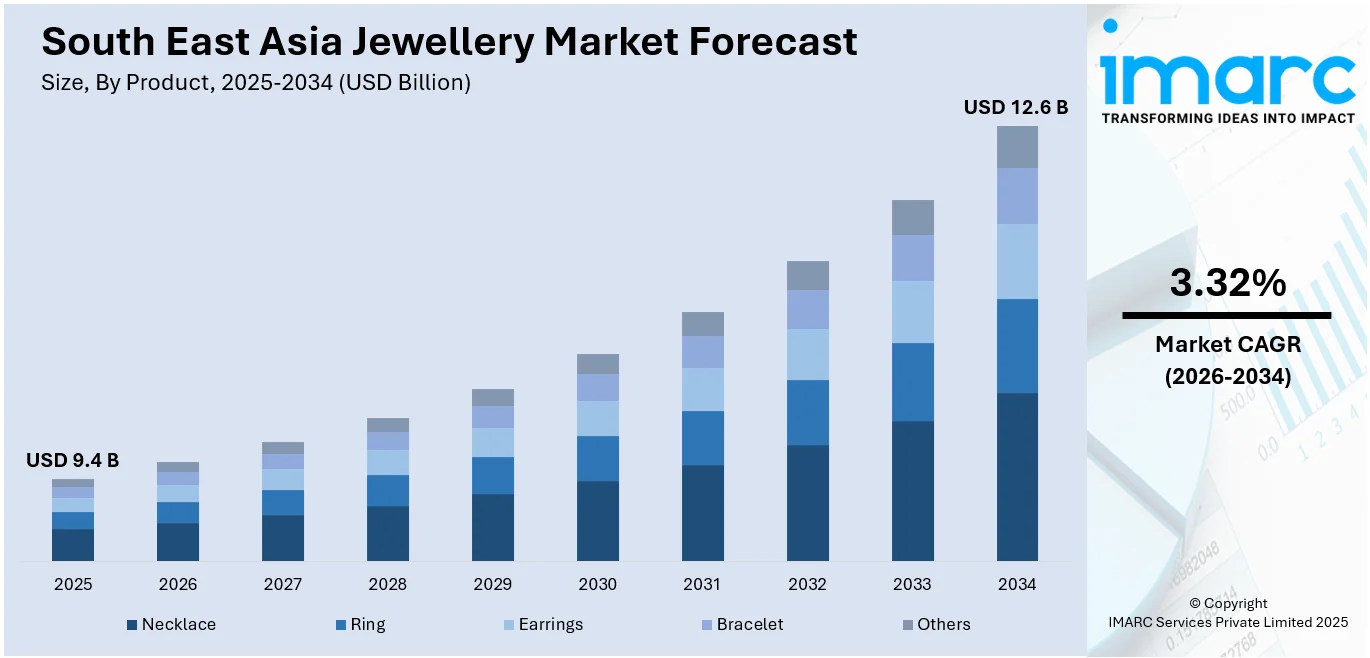

The South East Asia jewellery market size was valued at USD 9.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.6 Billion by 2034, exhibiting a CAGR of 3.32% from 2026-2034. The market is growing at a steady pace driven by rising disposable incomes, tourism and cultural affinity for gold. Demand for customisation, premium designs and sustainable materials is increasing with digital channels expanding consumer access and driving market engagement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.4 Billion |

| Market Forecast in 2034 | USD 12.6 Billion |

| Market Growth Rate (2026-2034) | 3.32% |

The rising disposable incomes and evolving consumer preferences in Southeast Asia drive the demand for fine and fashion jewelry. Urbanization especially in Indonesia, Thailand and Vietnam is driving the sales of gold, diamond and gemstone jewelry. According to the industry reports, as of February 2025, Indonesia's population is 284,804,394 estimated at 285,721,236 by mid-year. Urbanization stands at 59.6% equating to 170,361,295 people. Younger consumers are opting for modern designs, light ornaments and customization. Digitalization expands market reach and increases brand awareness and consumer involvement through ecommerce and social media which increases the influence on purchase decisions of influencer marketing and online showrooms.

To get more information on this market Request Sample

The cultural significance and investment value continue to shape the market with gold remaining a favorite asset for preserving wealth in India-influenced Malaysia and Singapore. Festivals, weddings and religious ceremonies continue to support steady demand for traditional jewelry while international brands are expanding their footprint through strategic partnerships and localized designs. For instance, in December 2024, Thai tourism authorities celebrated surpassing two million Indian tourist arrivals in 2024 aiming for 2.5 million in 2025. To attract more Indian weddings Thailand plans to ease high-end jewelry import regulations and collaborate with airlines to increase flights while promoting new attractions to boost spending and extend tourist stays. Sustainability concerns are also reshaping the sector pushing ethical sourcing and lab-grown diamonds into mainstream acceptance among environmentally conscious buyers. These factors are contributing positively to the South East Asia jewellery market growth.

South East Asia Jewellery Market Trends:

Luxury and Branded Jewelry Expansion

Global jewelry brands are making their way into Southeast Asia by forming partnerships, opening flagship stores and adjusting designs to the local taste. Companies such as Malabar Gold & Diamonds and Cartier are strengthening their presence in Malaysia, Thailand and Singapore to tap into the affluent consumer base growing in the region. For instance, in November 2023, Malabar Gold & Diamonds launched a new showroom at Ampang Point Shopping Centre, Kuala Lumpur dedicated to the Malay audience. The showroom features an extensive collection of gold and diamond jewellery including unique designs tailored to local tastes aiming to establish itself as a premier jewellery retailer in Malaysia. Luxury brands are introducing collections that blend traditional motifs with contemporary aesthetics which is in tune with cultural preferences. Strategic collaborations with local retailers and online platforms enhance accessibility. With increased disposable income and demand for premium products international jewellery houses are investing in personalized shopping experiences exclusive collections, and high-end marketing to capture market share.

Influence of International Brands

Luxury jewelry brands are now moving into the major cities of Southeast Asia where increasing disposable incomes and changing consumer tastes are opening new avenues. Luxury brands are setting up flagship stores and boutiques in urban centers like Singapore, Bangkok and Kuala Lumpur. For instance, in June 2024, French luxury jeweller Fred announced the launch of its first store in Malaysia at Seibu The Exchange TRX. The outlet featuring a sleek gold and white design showcases the new Pretty Woman Sunlight Message necklace which reveals a hidden message under light. Collaborations with local influencers and customized marketing strategies further enhance brand positioning. This shift is driving increased preference for certified diamonds, minimalist designs and exclusive collections reshaping the market towards more aspirational and globally aligned purchasing behaviors.

E-Commerce & Digital Sales Growth

E-commerce expansion is reshaping the market dynamics allowing digital-first brands to gain traction. Jewellery brands in Southeast Asia are increasingly adopting a hybrid retail approach, blending physical showrooms with digital platforms to enhance customer engagement. The rapid expansion of e-commerce is reshaping jewellery retail with digital transactions playing a crucial role in market growth. Brands leverage social media, virtual try-on tools and live-stream shopping to reach tech-savvy consumers. According to industry reports, in December 2024, Malaysia's ecommerce income reached RM109.2 billion in 2024 growing 4% overall. Despite a dip to RM35.9 billion in Q3 the ICT and e-commerce sectors contributed RM118.7 billion or 23.5% of GDP. With 78,236 establishments B2B transactions comprised RM79.5 billion highlighting the sectors' significance in the digital economy. The purchasing experience is being enhanced by online catalog browsing, click-and-collect services, and AI-driven recommendations. This digital shift caters to younger buyers seeking convenience and personalization, which further reinforces omnichannel strategies as a critical driver of sales growth in the jewellery market.

South East Asia Jewellery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South East Asia jewellery market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product and material.

Analysis by Product:

- Necklace

- Ring

- Earrings

- Bracelet

- Others

Necklaces remain a staple in Southeast Asia's jewellery market driven by cultural traditions, weddings and luxury fashion trends, and is expected to hold a significant South Asia jewellery market share. Gold necklaces dominate with an increasing demand for lightweight and modern designs. Lab-grown diamonds and gemstone-embedded pieces are gaining traction. Online platforms are boosting accessibility while customization services appeal to younger buyers. International brands influence premium purchases and sustainability-focused consumers are opting for ethically sourced materials.

The ring market is driven by engagement, wedding and investment purchases. Diamonds and gold continue to be favorites with increased interest in lab-grown diamonds and minimalist styles. Customized and personalized orders are driving sales particularly for younger consumers. Ecommerce enables virtual try-on capabilities opening up digital channels. Traditional gold rings remain investment-driven whereas fashion-forward styles appeal to consumers interested in newer designs. The need for ethically sourced certified products increases.

Earrings are demanded across each demographic in form of daily wear or statement pieces. Both gold and diamond earrings have been leading whereas the pearl and gemstone varieties follow appealing according to the cultural preference of every region. The modern and minimalist designs appeal to young buyers and traditional designs are still necessary for weddings and ceremonies. E-commerce and social media drive sales while environmentally conscious consumers prefer recycled metals and fair-trade gemstones. Luxury brands dominate premium purchases.

Bracelets hold significance in both fashion and cultural traditions with gold bangles widely purchased for weddings and investments. Contemporary designs featuring charms, gemstones and minimalist styles attract younger consumers. Branded bracelets particularly luxury and designer labels are growing in popularity. Digital platforms enable personalized engravings and online customization enhancing consumer engagement. Ethical sourcing and sustainability drive purchasing decisions with rising interest in recycled materials and fair-trade jewellery.

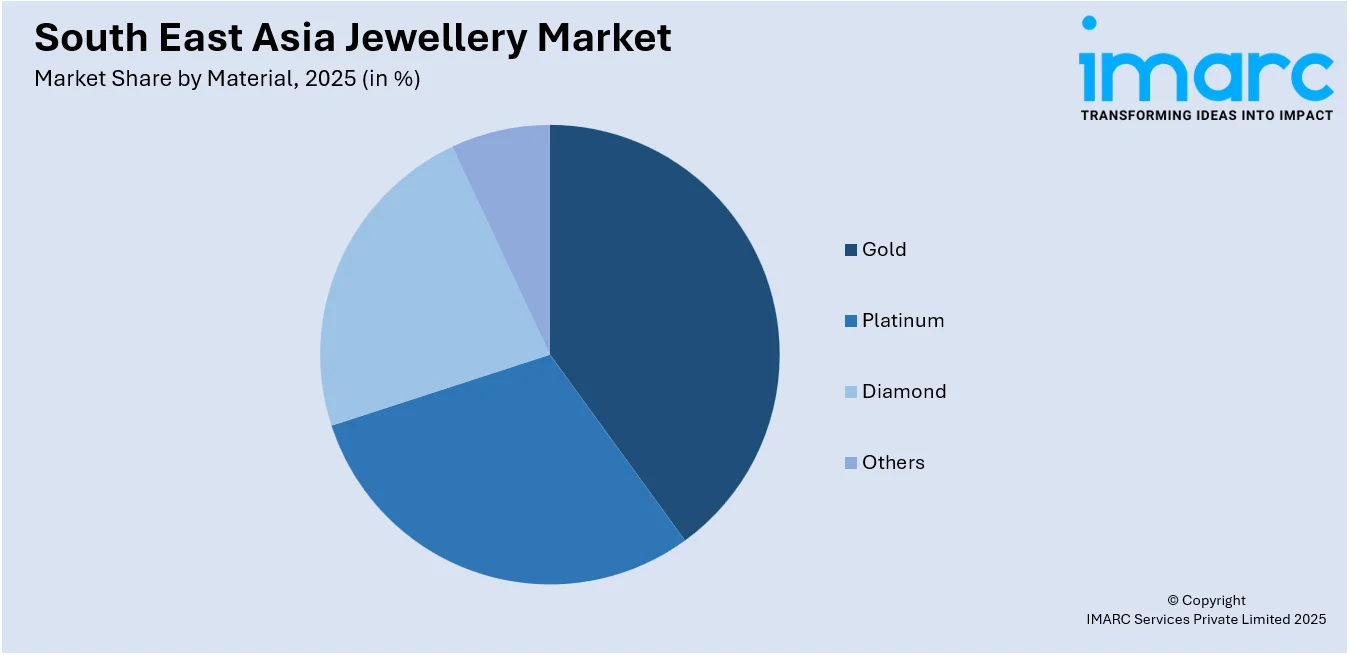

Analysis by Material:

Access the comprehensive market breakdown Request Sample

- Gold

- Platinum

- Diamond

- Others

Gold remains the most sought-after material in Southeast Asia’s jewellery market due to cultural significance, investment value and traditional preferences. High-purity gold jewellery dominates wedding and festival purchases while lightweight and modern designs attract younger buyers. Government hallmarking regulations impact authenticity and pricing. Digital sales are rising with online retailers offering certified gold pieces. Ethical sourcing concerns are driving demand for responsibly mined and recycled gold. International brands are influencing premium gold jewellery trends increasing demand for branded authenticity.

Platinum jewellery is gaining traction among urban consumers driven by its durability, rarity and modern appeal. Platinum engagement rings and wedding bands are becoming more popular due to their hypoallergenic properties and sleek aesthetics. High-net-worth individuals prefer platinum for its exclusivity and association with luxury. Customization services enhance consumer interest especially in bridal jewellery. International brands promote platinum collections while sustainability-conscious buyers favor responsibly sourced metals. Digital platforms support online customization and virtual fittings boosting platinum’s presence in the market.

The diamond jewellery market is expanding due to increasing disposable income, rising engagement ring sales and demand for certified and high-quality stones. Lab-grown diamonds are gaining popularity due to affordability and ethical sourcing concerns. Branded diamond jewellery attracts premium buyers while digital sales channels enhance accessibility. Social media marketing and influencer endorsements drive aspirational purchases. Consumers prefer customized designs encouraging jewellers to offer tailored services. Ethical certifications and blockchain-based authenticity tracking are influencing purchasing decisions strengthening consumer trust in both natural and lab-grown diamond jewellery.

Country Analysis:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

Indonesia’s jewellery market thrives on strong gold demand, cultural influences, and rising middle-class spending. Gold jewellery dominates, especially for weddings and investments. Luxury brands are expanding in Jakarta and Bali, influencing premium purchasing trends. E-commerce is growing, driven by social media promotions and digital retail platforms. Local artisans maintain demand for handcrafted jewellery, while sustainability concerns are increasing interest in recycled metals and ethically sourced gemstones.

Thailand is a major jewellery hub, known for its gold, silver, and gemstone craftsmanship. Bangkok is home to key trading centers and manufacturing hubs. High tourism levels drive luxury jewellery sales, while local consumers prefer gold and intricate handcrafted designs. Lab-grown diamonds and contemporary styles are gaining traction. E-commerce growth, driven by younger buyers, is expanding the market, with omnichannel strategies enhancing customer engagement.

Singapore’s jewellery market is luxury-driven, with strong demand for high-end gold, diamond, and platinum jewellery. International brands dominate, catering to affluent consumers. Customization and investment in lab-grown diamonds are increasing, reflecting sustainability preferences. E-commerce plays a crucial role, with online jewellers leveraging digital marketing and AI-driven recommendations. Blockchain-based jewellery authentication is growing, reinforcing trust in premium and investment-grade jewellery purchases.

Gold jewellery remains highly popular in the Philippines due to cultural traditions and investment appeal. Engagement and wedding rings drive diamond sales, with rising interest in lab-grown alternatives. E-commerce adoption is accelerating, with social media marketing playing a significant role. Younger consumers prefer minimalist and lightweight designs, while luxury brands are expanding in urban centers like Manila. Sustainable and ethically sourced jewellery is slowly gaining traction.

Vietnam’s jewellery market is driven by gold investment, cultural gifting traditions, and rising disposable incomes. Ho Chi Minh City and Hanoi are key retail hubs. Gold remains dominant, but interest in contemporary and luxury jewellery is growing. E-commerce expansion and digital payment adoption are reshaping the market. International brands are influencing design preferences, and ethical sourcing awareness is increasing among younger consumers.

Malaysia’s jewellery market is evolving with a mix of traditional gold jewellery demand and growing interest in branded, contemporary designs. Kuala Lumpur serves as a key retail hub, attracting luxury brands and high-end buyers. E-commerce is expanding, with digital platforms enhancing accessibility. Lab-grown diamonds and ethically sourced jewellery are gaining popularity. Hybrid retail strategies, blending physical showrooms with digital experiences, are becoming increasingly common.

Competitive Landscape:

The Southeast Asia jewellery market is highly competitive, with a mix of international luxury brands, regional manufacturers, and local artisans. Established brands dominate premium segments, leveraging strong brand recognition, exclusive collections, and digital engagement strategies. Regional players compete through craftsmanship, affordability, and traditional designs, catering to cultural preferences. E-commerce platforms and social media-driven sales are intensifying competition, allowing smaller jewellers to reach wider audiences. Customization, ethical sourcing, and lab-grown diamonds are key differentiators in a shifting consumer landscape. Retailers are adopting omnichannel strategies, integrating offline showrooms with digital experiences to enhance customer engagement and maintain market relevance.

The report provides a comprehensive analysis of the competitive landscape in the South East Asia jewellery market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Solitario, India's luxury lab-grown diamond brand, announced the launch of its first flagship store in Malaysia at the TRX Exchange Mall. Managed by Shreya Gems, the store aims to meet the growing demand for sustainable luxury, offering a curated collection of exquisite jewellery while promoting eco-conscious shopping for modern consumers.

- In September 2024, the 70th Bangkok Gems & Jewelry Fair, presided over by Commerce Ministry's Permanent Secretary Vuttikrai Leewiraphan, opened at QSNCC from September 9-13. With over 1,100 exhibitors and an expected trade value exceeding $100 million, the event showcased Thailand's pivotal role in the global gems and jewelry industry.

- In April 2023, Malaysian jeweller Wanderlust + Co opened its first physical store in Singapore at Takashimaya Shopping Centre. Founded by Jenn Low 12 years ago, the brand focuses on high-quality, ethically produced jewellery. This expansion follows a trend of foreign retailers entering Singapore as the country rebounds from the pandemic.

- In February 2023, Emporium Department Store in Thailand announced the launch of a fine jewellery zone promoting it through a Mother's Day campaign titled “The Legacy of Love” in partnership with HELLO! Thailand.

South East Asia Jewellery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessmen:

|

| Products Covered | Necklace, Ring, Earrings, Bracelet, Others |

| Materials Covered | Gold, Platinum, Diamond, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia jewellery market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South East Asia jewellery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia jewellery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The jewellery market was valued at USD 9.4 Billion in 2025.

The market is growing due to rising disposable incomes, urbanization, and increasing tourism. Digitalization is expanding market reach, while demand for customization, premium designs, and sustainable jewellery is increasing. The cultural significance of gold and international brand expansions also contribute to growth.

IMARC estimates the jewellery market to reach USD 12.6 Billion by 2034, exhibiting a CAGR of 3.32% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)