South East Asia Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2025-2033

South East Asia Health Insurance Market Size and Share:

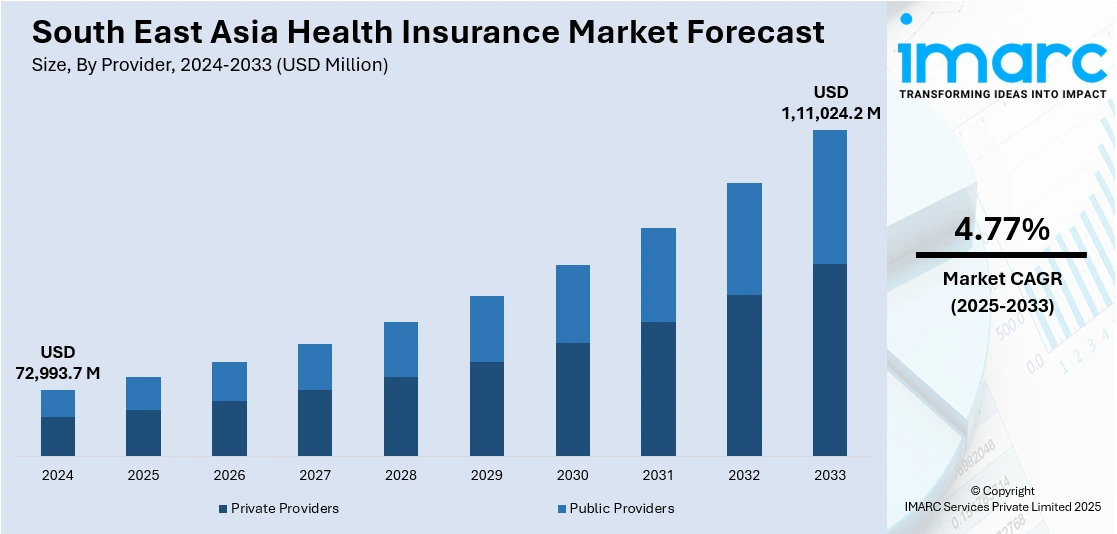

The South East Asia health insurance market size reached USD 72,993.7 Million in 2024. The market is expected to reach USD 1,11,024.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.77% during 2025-2033. The market growth is attributed to rising healthcare costs, an expanding middle-class population, growing awareness of health protection, increased government support for universal health coverage, digitalization of insurance services, and the surge in lifestyle-related diseases, prompting greater demand for comprehensive and accessible health insurance solutions across the region.

Market Insights:

- Based on region, the market is divided into Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and others.

- On the basis of provider, the market is categorized as private providers and public providers.

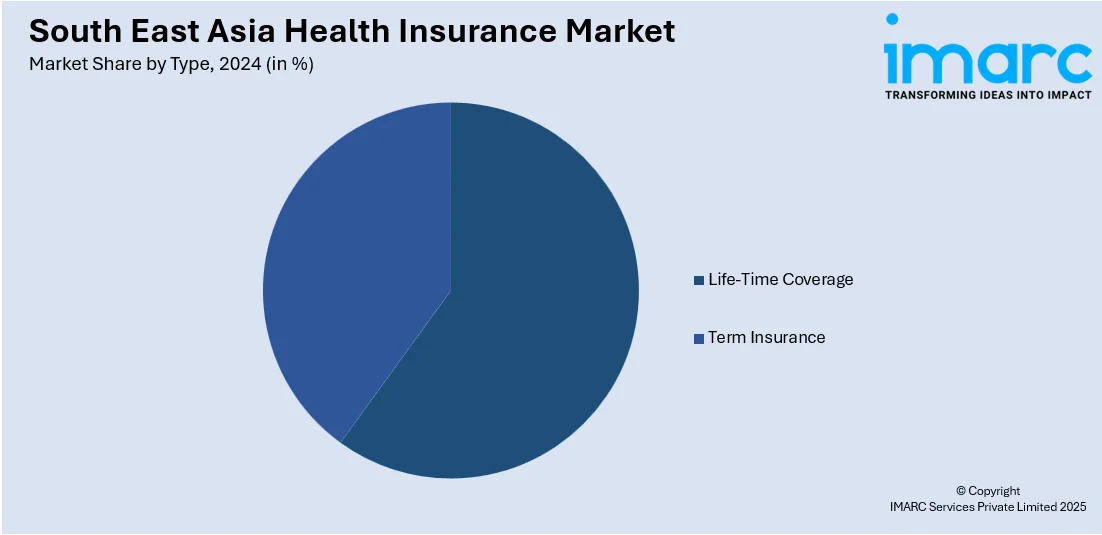

- Based on type, the market is segmented into life-time coverage and term insurance.

- On the basis of plan type, the market is categorized as medical insurance, critical illness insurance, family floater health insurance, and others.

- Based on demographics, the market is segmented into minor, adults, and senior citizen.

- On the basis of provider type, the market is categorized as preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs).

Market Size and Forecast:

- 2024 Market Size: USD 72,993.7 Million

- 2033 Projected Market Size: USD 1,11,024.2 Million

- CAGR (2025-2033): 4.77%

Health insurance is a financial agreement designed to offer individuals and families protection against medical expenses. It operates as a contractual arrangement between an individual (referred to as the policyholder) and an insurance company or healthcare provider. In this agreement, the policyholder commits to making regular premium payments, and in return, the insurance company agrees to bear a portion or the entirety of the eligible medical costs, contingent upon the stipulations outlined in the policy. The terms of the policy explicitly outline the medical services and expenses that fall under coverage. These can span a spectrum, encompassing doctor's visits, hospitalization, prescription medications, preventive care, surgeries, and a range of other healthcare services. Depending on the specific policy, health insurance coverage might also extend to include dental and vision care, mental health services, and various other healthcare needs. Essentially, health insurance serves as a mechanism to mitigate the financial burden associated with medical care, offering policyholders financial security and access to essential healthcare services in exchange for their ongoing premium payments. The comprehensive nature of coverage varies based on the specifics outlined in each individual policy.

The South East Asia health insurance market stands as a pivotal sector within the region's evolving healthcare landscape, reflecting the growing recognition of the importance of financial protection against escalating medical costs. Comprising nations, such as Indonesia, Malaysia, Thailand, Vietnam, and the Philippines, the health insurance market in South East Asia has witnessed substantial expansion due to various factors. Additionally, the South East Asia health insurance market operates through agreements between policyholders and insurance companies or healthcare providers. Besides this, the market's dynamism is evident in the diversity of coverage options, with policies tailored to address specific healthcare needs. The market features a mix of local and international insurers, offering a range of products to cater to the diverse healthcare requirements and preferences of the population. Moreover, as per the South East Asia health insurance market forecast, as the region continues to experience economic growth and increased awareness of healthcare, the market is poised for sustained growth over the forecasted period.

To get more information on this market, Request Sample

South East Asia Health Insurance Market Trends:

Shift Toward Value-Based Health Insurance Models

Health insurers in Southeast Asia are gradually moving from fee-for-service models to value-based insurance design (VBID). The traditional structure, which reimburses based on volume rather than outcomes, has led to inefficiencies, over-utilization, and unsustainable cost escalation. In contrast, VBID ties reimbursement to health outcomes, incentivizing both providers and patients to focus on prevention, adherence, and long-term management. This model appeals particularly to employers offering group health plans, as it promises better cost control and improved workforce health. Moreover, implementation requires collaboration with healthcare providers, integration of digital health records, and advanced analytics to track metrics like hospital readmission rates, medication adherence, and preventive screening uptake. Besides this, insurers are piloting outcome-based contracts with private hospital networks, focusing on chronic diseases such as diabetes and hypertension. This, in turn, is creating a positive South East Asia health insurance market outlook. Although uptake varies across countries, markets like Singapore and Thailand are emerging as early adopters due to mature provider ecosystems and stronger data infrastructure.

Expanding Microinsurance and Low-Cost Coverage Options

Insurers are increasingly offering microinsurance and simplified health coverage products to serve underinsured and low-income populations across Southeast Asia. These are tailored to meet the affordability constraints of informal workers, rural communities, and first-time insurance users. Traditional full-benefit health plans remain inaccessible to large segments of the population, either due to high premiums, complex documentation, or limited provider access. In response, insurers are bundling low-cost health benefits with mobile money platforms, retail purchases, or employer benefits in the informal sector. Moreover, products often feature minimal underwriting, instant enrolment, and digital claims processing, with payouts tied to specific events like hospital admission or diagnosis. Insurers view this segment as high-volume, low-margin, but strategically important for long-term market expansion. Distribution models are also evolving to suit this demographic, which includes agent-assisted apps, community outreach, and partnerships with NGOs.

Growth Drivers of the South East Asia Health Insurance Market:

The market is driven by rapid urbanization, which has led to improved access to medical facilities, which in turn drives demand for financial protection. As disposable incomes rise, individuals and families are more inclined to invest in private health insurance to complement limited public coverage. Furthermore, governments in the region are also actively encouraging insurance adoption through regulatory initiatives and support for digital distribution. Besides this, demographic changes, including a growing middle class and aging populations, increase pressure on public health systems, creating a strong case for private sector involvement. Moreover, employers are expanding employee benefit programs, often including private health insurance, to attract and retain talent. Apart from this, greater digital penetration allows insurers to reach previously underserved populations through mobile platforms, which is augmenting the South East Asia health insurance market share.

Opportunities in the South East Asia Health Insurance Market:

The market presents significant expansion potential in both urban and rural segments. In urban areas, rising expectations for personalized healthcare open up opportunities for insurers to offer tiered and modular products with preventive care, wellness tracking, and mental health support. Rural and informal sectors, which remain largely underinsured, offer potential through microinsurance models and community-based distribution. Additionally, the increasing use of technology for claims automation, customer engagement, and fraud detection creates scope for operational efficiency and customer satisfaction. Besides this, partnerships between insurers and digital health providers in health insurance market in South East Asia can enhance service delivery while reducing long-term costs. Furthermore, regulatory bodies in some countries are moving toward creating more transparent and standardized frameworks, which could foster investor confidence and encourage market entry. In addition, cross-border insurance solutions are becoming relevant due to increased regional mobility, enabling insurers to design products for expatriates, migrant workers, and frequent travellers. The diversity in income levels and healthcare infrastructure allows insurers to build a broad portfolio strategy across markets.

Challenges in the South East Asia Health Insurance Market

Despite its growth potential, according to the South East Asia health insurance market research report, the market faces several challenges that require careful navigation. One key concern is the fragmented healthcare infrastructure, which varies significantly across countries and even within regions, complicating provider network development and claims processing. Limited data availability and quality hinder accurate risk assessment, leading to issues in underwriting and pricing. Moreover, regulatory inconsistency across jurisdictions also creates compliance difficulties for insurers operating regionally. In line with this, consumer education levels regarding insurance products are still low in many markets, resulting in underutilization or misinformed purchasing decisions. Affordability remains a barrier for a large portion of the population, particularly in lower-income and rural areas, making it difficult to scale comprehensive insurance products without significant subsidies or cross-subsidization. Additionally, balancing innovation with data privacy requirements is an ongoing concern, especially as insurers increasingly rely on digital health information to personalize offerings.

South East Asia Health Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on provider, type, plan type, demographics, and provider type.

Provider Insights:

- Private Providers

- Public Providers

The report has provided a detailed breakup and analysis of the market based on the provider. This includes private providers and public providers.

Type Insights:

- Life-Time Coverage

- Term Insurance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes life-time coverage and term insurance.

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes medical insurance, critical illness insurance, family floater health insurance, and others.

Demographics Insights:

- Minor

- Adults

- Senior Citizen

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes minor, adults, and senior citizen.

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs).

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- July 2025: The Philippines' President officially launched the Yaman ng Kalusugan Program (YAKAP) Para Malayo sa Sakit, an enhanced outpatient primary care package under the Philippine Health Insurance Corporation (PhilHealth). This revamped benefit scheme expands PhilHealth's coverage for essential outpatient services, including a significant increase in the availability of free medicines and screenings. The initiative underscores the administration's commitment to strengthening universal health coverage and improving access to affordable care for Filipinos.

- February 2025: AXA Philippines officially launched Health Max Elite, a critical illness insurance plan offering coverage for more than 150 conditions, including mental health disorders such as depression, mild schizophrenia, and bipolar disorder. The plan features industry-first multi‑claim capability—up to nine claims, allowing policyholders to receive as much as 400 % of the sum insured, with up to four claims for major illnesses, additional claims for minor conditions, extended ICU stays, or life-saving surgeries. It also introduces pre‑early stage protection, granting partial payouts for early diagnoses like benign tumours or suspected malignancies, alongside enhanced diagnosis benefits and recovery support, with coverage capped at PHP 10 Million (approx. USD 172,300).

- November 2024: Everest Insurance International launched "Innovator," an AI-powered international private medical insurance (IPMI) product in Singapore. Developed in collaboration with DocDoc Pte. Ltd. and AXA Life & Health Reinsurance Solutions, the solution leverages artificial intelligence to connect patients with optimal healthcare providers, streamline administrative processes, and enhance treatment outcomes. This launch is part of Everest's broader strategy to expand its Accident & Health portfolio and drive digital innovation in Asia's employee health insurance sector.

- October 2024: Poni Insurtech Pte. Ltd., through its Vietnam subsidiary Global Care Consulting JSC, launched GlobalCare.vn, a new health insurance comparison platform in Vietnam. This solution positions itself as an "insurance supermarket," offering Vietnamese consumers a transparent, user‑friendly portal for searching, customizing, and comparing health insurance packages. Aligning with Poni's broader ASEAN expansion strategy, the platform aims to streamline customer experience, accelerate digitalization for insurers, and empower agents with tools to efficiently match customers with right-fit policies.

South East Asia Health Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia health insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia health insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia health insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health insurance market in South East Asia was valued at USD 72,993.7 Million in 2024.

The South East Asia health insurance market is projected to exhibit a CAGR of 4.77% during 2025-2033, reaching a value of USD 1,11,024.2 Million by 2033.

Rising incidence of lifestyle-related diseases and an aging population are creating the need for long-term and chronic care coverage. Government agencies across South East Asia are also working to strengthen national health schemes and promote public-private partnerships to improve healthcare accessibility. The digitalization of insurance services, including online policy comparison, purchase, and claim processing, is making it easier for users to choose and manage plans.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)