South East Asia Generic Drug Market Size, Share, Trends and Forecast by Therapy Area, Drug Delivery, Distribution Channel, and Country, 2025-2033

Market Overview:

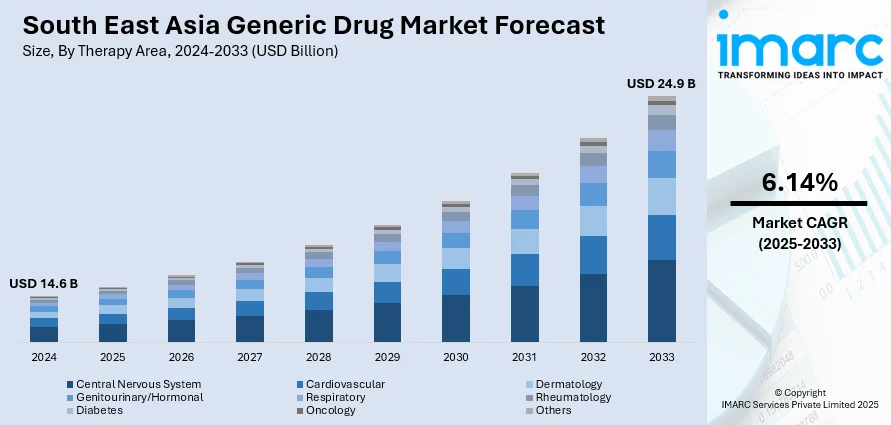

South East Asia generic drug market size reached USD 14.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033. The rising prevalence of several chronic diseases, such as diabetes, hypertension, and cardiovascular problems, the increasing aging population, and the growing awareness among healthcare professionals about the therapeutic equivalence and safety of generic drugs represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.6 Billion |

|

Market Forecast in 2033

|

USD 24.9 Billion |

| Market Growth Rate 2025-2033 | 6.14% |

Generic drugs are pharmaceutical products that are identical or bioequivalent to brand-name drugs in terms of active ingredients, quality, dosage, and intended use. They are absorbed into the bloodstream at the same rate as the brand-name drug when administered at the same dosage. They are available in a variety of dosage forms, including tablets, capsules, and injectables. They are usually more affordable as compared to their brand-name counterparts, thereby reducing the financial burden on patients, healthcare systems, and insurers. They enhance access to essential medications, particularly in underserved and low-income populations. They are subject to rigorous regulatory scrutiny by health authorities to ensure their safety, efficacy, and quality. They are widely used to treat several chronic conditions, such as hypertension, diabetes, and high cholesterol. They are prescribed for acute illnesses like infections, pain management, and allergies. Moreover, as they allow patients to maintain their treatment regimens without interruptions, the demand for generic drugs is increasing across South East Asia.

To get more information on this market, Request Sample

South East Asia Generic Drug Market Trends:

The increasing population and the growing healthcare needs in the region represent one of the primary factors catalyzing the demand for affordable and accessible pharmaceuticals. Additionally, the rising prevalence of several chronic diseases, such as diabetes, hypertension, and cardiovascular conditions is driving the demand for long-term medications. Apart from this, the increasing focus on healthcare infrastructure development and universal healthcare coverage in several Southeast Asian nations is strengthening the growth of the market. Furthermore, the robust pharmaceutical manufacturing capabilities in some Southeast Asian countries, such as India and Thailand, are enabling the production of high-quality generic drugs at competitive prices. Moreover, the governing authorities across Southeast Asia are actively promoting the use of generic drugs through various healthcare policies and initiatives. This includes incentivizing healthcare providers to prescribe generics, promoting generic substitution, and supporting local generic drug manufacturing. These policies help reduce healthcare expenditures while maintaining high-quality healthcare services. Besides this, the rising awareness among healthcare professionals about the therapeutic equivalence and safety of generic drugs is encouraging their prescription and usage. Educational campaigns by pharmaceutical associations and healthcare institutions are helping dispel misconceptions about generic medications, contributing to their wider acceptance. Additionally, the ongoing emphasis on maternal and child healthcare is driving the demand for generic drugs in the pediatric and women's health segments, which is acting as a major growth-inducing factor. Moreover, the rising collaborations between pharmaceutical companies and healthcare professionals, including doctors and pharmacists, are facilitating the market growth. These collaborations promote the appropriate use of generics, ensuring that patients receive high-quality, affordable treatments that align with their healthcare needs and preferences across the region.

South East Asia Generic Drug Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on therapy area, drug delivery, and distribution channel.

Therapy Area Insights:

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others.

Drug Delivery Insights:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

A detailed breakup and analysis of the market based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers.

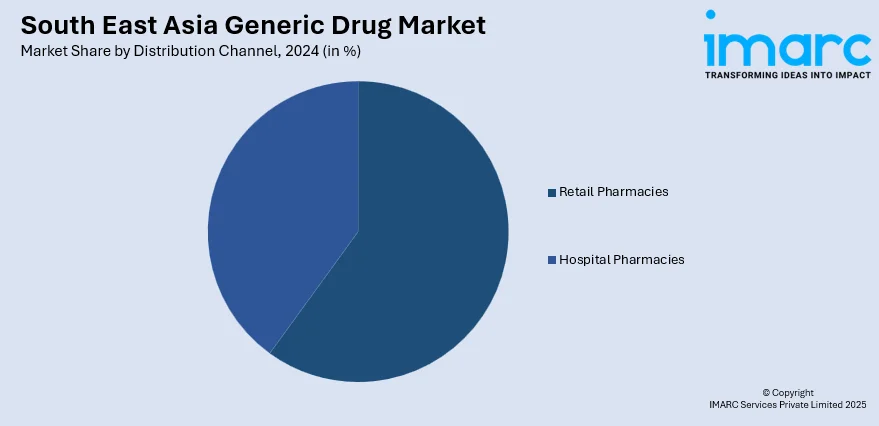

Distribution Channel Insights:

- Retail Pharmacies

- Hospital Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies and hospital pharmacies.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Generic Drug Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia generic drug market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South East Asia generic drug market?

- What is the breakup of the South East Asia generic drug market on the basis of therapy area?

- What is the breakup of the South East Asia generic drug market on the basis of drug delivery?

- What is the breakup of the South East Asia generic drug market on the basis of distribution channel?

- What are the various stages in the value chain of the South East Asia generic drug market?

- What are the key driving factors and challenges in the South East Asia generic drug?

- What is the structure of the South East Asia generic drug market and who are the key players?

- What is the degree of competition in the South East Asia generic drug market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia generic drug market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia generic drug market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia generic drug industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)