South East Asia Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Country, 2026-2034

Market Overview:

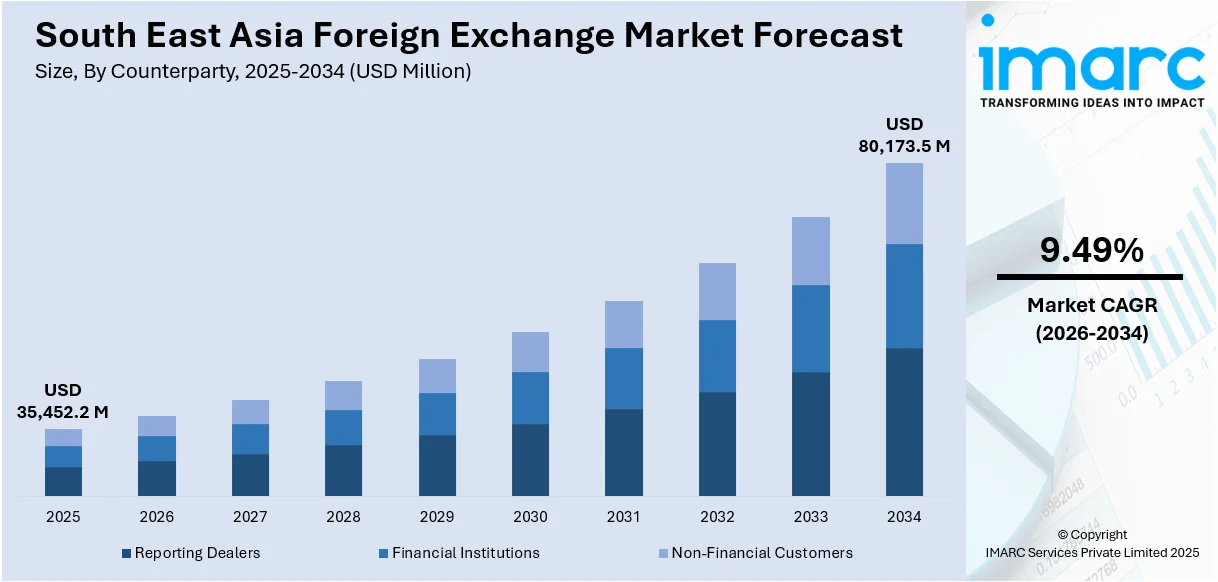

The South East Asia foreign exchange market size reached USD 35,452.2 Million in 2025. Looking forward, the market is projected to reach USD 80,173.5 Million by 2034, exhibiting a growth rate (CAGR) of 9.49% during 2026-2034. The market growth is majorly fueled by the increasing prevalence of speculative trading across regional markets, extreme and frequent currency fluctuations that are inducing hedging and arbitrage activities. In addition to this, the growing popularity of electronic trading platforms, considerable growth in the access by retail investors, the rising level of cross-border trade and financial transactions, and increasing integration of Southeast Asia with global capital flows are also driving the growth of the market.

Market Insights:

- Based on the country, the market covers Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and others.

- On the basis of counterparty, the market is segmented into reporting dealers, financial institutions, and non-financial customers.

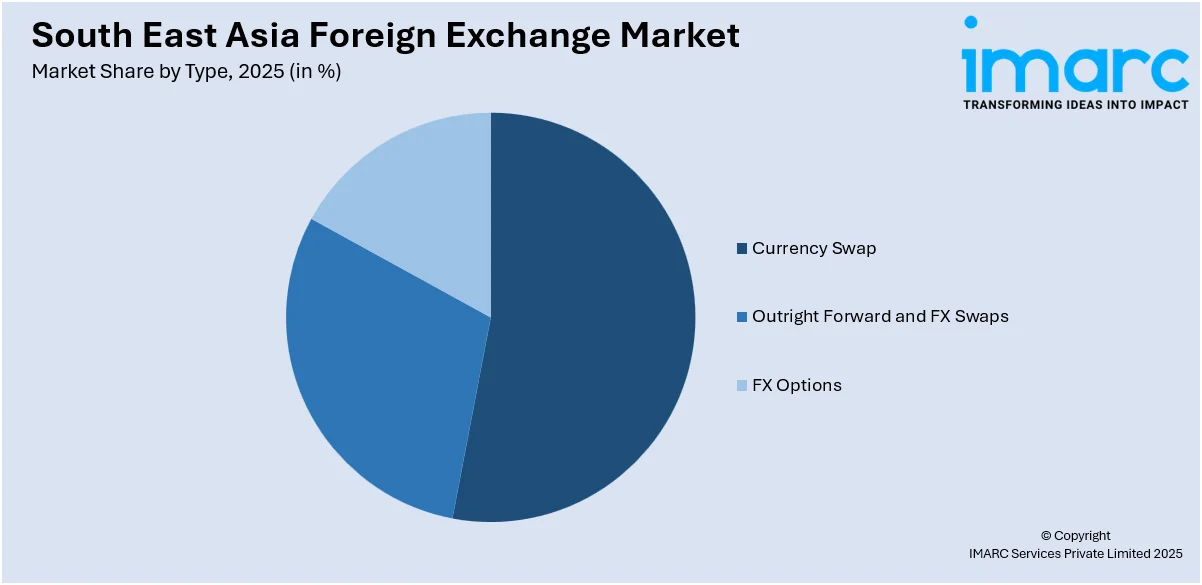

- Based on type, the market is divided into currency swap, outright forward and FX swaps, and FX options.

Market Size and Forecast:

- 2025 Market Size: USD 35,452.2 Million

- 2034 Projected Market Size: USD 80,173.5 Million

- CAGR (2026-2034): 9.49%

Foreign exchange, commonly known as forex or FX, refers to the decentralized market for trading currencies. It involves the buying, selling, and exchanging of currencies at current or determined prices. Tracing its origins back to ancient times when traders exchanged different forms of money, modern foreign exchange markets have evolved into a complex network facilitating trade and investment. Participants in the forex market include banks, corporations, governments, investors, and speculators, with trading volumes exceeding trillions of dollars daily. Exchange rates, determined by various factors such as economic indicators, geopolitical events, and market sentiment, fluctuate constantly, impacting commerce and financial stability. Central banks play a critical role in regulating currency values, often employing monetary policies to stabilize their domestic economies. While offering lucrative investment opportunities, forex trading carries inherent risks due to its volatile nature, requiring participants to stay informed and employ effective risk management strategies.

To get more information on this market Request Sample

The foreign exchange market in South East Asia is influenced by various factors, and these can be examined through a range of key drivers. Firstly, macroeconomic indicators play a crucial role in shaping the dynamics of the market. Moreover, government policies and interventions significantly affect the foreign exchange market. Central banks, through their monetary policies, can directly influence the value of their respective currencies, leading to fluctuations in the market. Furthermore, geopolitical events, such as political instability or trade disputes, can instigate volatility in the foreign exchange market. Such events often create uncertainty, prompting investors to alter their positions, thereby influencing exchange rates. Additionally, market sentiment and investor confidence play a pivotal role in driving foreign exchange rates; for instance, positive market sentiment can strengthen a currency. Overall, these interrelated factors underscore the complex nature of the foreign exchange market in South East Asia and its susceptibility to multifaceted influences.

South East Asia Foreign Exchange Market Trends:

Rise of Digital Remittances and Mobile Payments

The rapid expansion of digital financial services has significantly impacted the South East Asia foreign exchange market growth, particularly through the rise of mobile payments and cross-border remittances. The region is home to a large number of migrant workers, both within ASEAN countries and abroad, who regularly send money to their families. Traditionally, these transactions relied on conventional money transfer operators, which were often slow and costly. However, the growing adoption of mobile wallets, online banking platforms, and fintech-driven remittance services has transformed this landscape. Digital channels now allow instant transfers at lower fees, encouraging more frequent usage and increasing transaction volumes, thereby augmenting the South East Asia foreign exchange market share. Additionally, partnerships between fintech companies and local banks have enhanced accessibility in rural areas, further expanding participation. This trend has not only improved efficiency but also deepened financial inclusion, making digital remittances a vital driver of forex flows in Southeast Asia.

Growing Role of Regional Trade Agreements

Another key trend shaping the Southeast Asia foreign exchange market is the growing importance of regional trade agreements, particularly the Regional Comprehensive Economic Partnership (RCEP). As one of the largest trade blocs in the world, RCEP has strengthened economic ties among ASEAN member states and key partners like China, Japan, and South Korea, creating a positive South East Asia foreign exchange market outlook. The agreement reduces tariffs, streamlines customs procedures, as well as promotes greater trade flows across the region, directly driving demand for currency exchange. Intra-regional trade has seen notable growth, as businesses increasingly settle transactions in local currencies rather than relying solely on the U.S. dollar. This shift not only enhances liquidity in regional currencies but also reduces transaction costs for exporters and importers. Moreover, the harmonization of trade policies fosters investor confidence, leading to higher capital inflows, according to the latest South East Asia foreign exchange market research report. As Southeast Asia deepens its economic integration, regional agreements like RCEP are set to play an even greater role in shaping forex market dynamics.

Growth, Opportunities, and Barriers in the South East Asia Foreign Exchange Market:

- Growth Drivers: Rising trade volumes, cross-border investments, and expanding intra-ASEAN commerce are fueling higher foreign exchange activity. In addition, a growing middle class with increasing demand for overseas education, tourism, and remittances further contributes to consistent forex market expansion.

- Market Opportunities: As per the South East Asia foreign exchange market forecast, the increasing digitization of banking services and cross-border payment platforms offers new opportunities for efficiency and cost reduction. Moreover, the global shift toward de-dollarization provides Southeast Asian economies with a chance to strengthen local currency usage and enhance regional financial integration.

- Market Challenges : High exposure to external shocks, such as U.S. monetary tightening or commodity price swings, makes regional currencies vulnerable to volatility. Additionally, uneven regulatory frameworks across ASEAN countries pose barriers to harmonized market growth and investor confidence.

South East Asia Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Financial Institutions

- Non-Financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, financial institutions, and non-financial customers.

Type Insights:

Access the comprehensive market breakdown Request Sample

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025, ASEAN leaders agreed to expand local currency settlement (LCS) and regional payment connectivity to reduce reliance on the U.S. dollar and curb forex volatility. The Regional Payment Connectivity initiative now links nine ASEAN central banks, with full interoperability of systems like PromptPay, QRIS, and PayNow expected by end-2025. This move strengthens Southeast Asia’s forex stability while boosting intra-regional trade, tourism, and SME cross-border activity.

South East Asia Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Financial Institutions, Non-Financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia foreign exchange market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South East Asia foreign exchange market?

- What is the breakup of the South East Asia foreign exchange market on the basis of counterparty?

- What is the breakup of the South East Asia foreign exchange market on the basis of type?

- What are the various stages in the value chain of the South East Asia foreign exchange market?

- What are the key driving factors and challenges in the South East Asia foreign exchange?

- What is the structure of the South East Asia foreign exchange market and who are the key players?

- What is the degree of competition in the South East Asia foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia foreign exchange market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)