South East Asia Flooring Market Size, Share, Trends and Forecast by Type, End User, and Country, 2025-2033

South East Asia Flooring Market Size and Share:

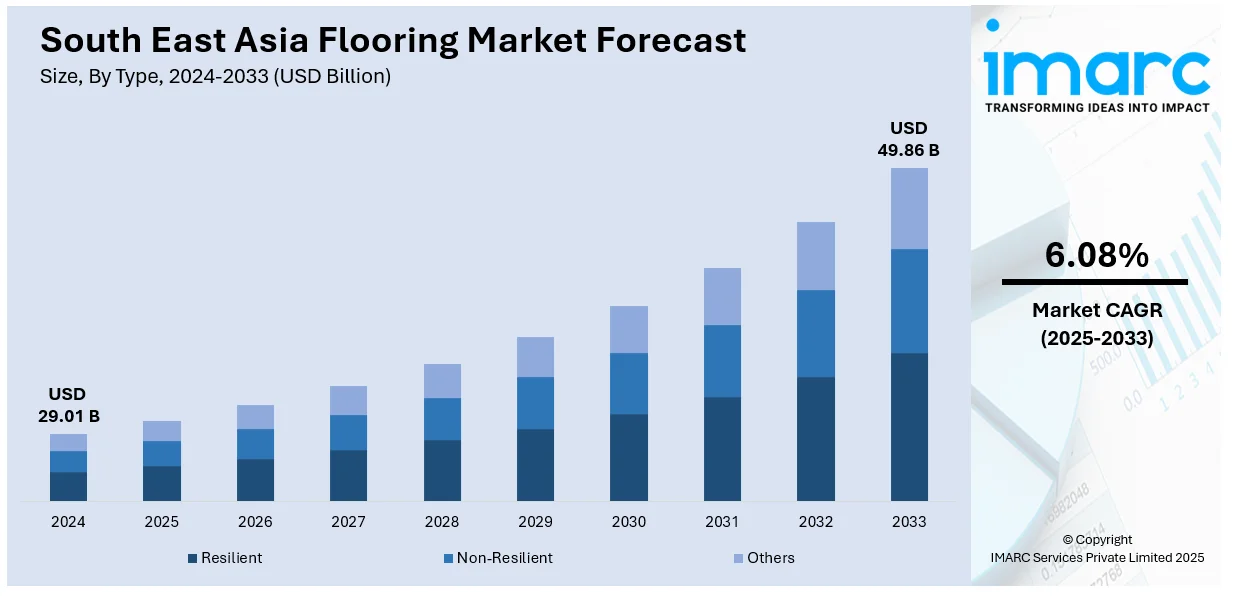

The South East Asia flooring market size was valued at USD 29.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 49.86 Billion by 2033, exhibiting a CAGR of 6.08% from 2025-2033. The market is expanding due to urbanization, infrastructure projects, and rising demand for sustainable materials. Growth in residential, commercial, and industrial sectors drive adoption of SPC, LVT, engineered wood, and eco-friendly flooring solutions, supported by foreign investments and government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.01 Billion |

|

Market Forecast in 2033

|

USD 49.86 Billion |

| Market Growth Rate 2025-2033 | 6.08% |

The Southeast Asia flooring market is driven by rapid urbanization and infrastructure development, fueled by economic growth and government investments in residential, commercial, and industrial construction projects. For instance, in February 2024, the government of Vietnam announced plans to allocate 657 trillion VND (26.82 billion USD) in public investment, primarily funding transport infrastructure projects to support economic growth and improve connectivity. The needs for tough and economical flooring products along with attractive designs have grown due to growing cities and larger urban areas. Furthermore, government support for smart cities along with green buildings and public infrastructure projects leads to increased flooring requirements across hospitals, educational institutions, and office spaces.

To get more information on this market, Request Sample

Another key factor includes increasing awareness among consumers regarding sustainable and environmentally friendly flooring products. The increasing requirement for low-emission, recycled, and biodegradable materials is forcing manufacturers to create eco-friendly alternatives like bamboo flooring, reclaimed wood, and water-based adhesives. For instance, in April 2024, Floorrich, a Singapore based company, launched SPCPlus, an eco-friendly flooring solution with synchronized texture technology for a realistic wood grain finish, highlighting the growing adoption of environmentally friendly flooring materials. In addition, legislative standards and green building incentives to get certified are stimulating developers to include LEED-compatible and low-VOC flooring options in commercial and residential buildings. Moreover, innovation in smart flooring in terms of anti-microbial finishes, sound-reducing materials, and temperature-management products is increasing in popularity, particularly in hospitals and upscale commercial applications

South East Asia Flooring Market Trends:

Rising Demand for Sustainable and Eco-Friendly Flooring Materials

The Southeast Asia floor market is seeing growing demand for sustainable floor products, propelled by environmental concerns, green building standards, and increasing regulations. Customers and builders opt for bamboo, reclaimed wood, and recycled vinyl due to their strength and lower environmental footprint. The rising inclination towards sustainable city living and environmentally aware consumers are transforming product offerings and shaping manufacturers to advance their green technology and material sourcing plans. For instance, in November 2024, Shera, a Philippines based company, launched Fybertec Technology, a patented innovation designed to provide durable, eco-friendly fiber cement solutions, revolutionizing construction with stronger, smoother, and more flexible boards that enhance sustainability and reduce costs.

Growth of Luxury Vinyl Tile (LVT) and Engineered Wood Flooring

The use of luxury vinyl tile (LVT) and engineered wood flooring is increasing in Southeast Asia, prompted by urbanization, cost-effectiveness, and enhanced beauty. For instance, as per industry reports, Singapore's urbanization strategy focuses on collaborative planning and sustainable real estate development. In line with this, projects like Suzhou Industrial Park and Tianjin Eco-City showcase smart urban growth, integrating technology, real estate innovation, and sustainable infrastructure. In addition, engineered wood, providing the appearance of solid hardwood with increased durability, is also contributing heavily to the demand of wood flooring in heavy-traffic locations. Furthermore, developers and homeowners are prioritizing cost-effective, stylish, and easy-to-install options, leading to technological advancements in wear-resistant coatings, click-lock systems, and digital printing techniques for realistic textures.

Expansion of Smart and Modular Flooring Solutions

The Southeast Asia flooring market is embracing smart and modular flooring systems, catering to commercial spaces, healthcare facilities, and smart homes. Innovations such as anti-microbial surfaces, soundproof flooring, and temperature-regulating materials are enhancing user comfort and functionality. Modular flooring, including interlocking tiles and raised access flooring, is gaining traction due to its flexibility, quick installation, and easy replacement. The rise of smart homes and connected buildings is pushing manufacturers to integrate sensor-based flooring solutions that support energy efficiency and indoor air quality improvements. For instance, according to industry reports, it is estimated that in Singapore, over 588,000 households will adopt smart technologies by 2033, with a projected figure to surpass 1.5 million by 2028, fueled by awareness for energy efficiency, cost-effective smart devices, and increased demand for connected living solutions.

South East Asia Flooring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South East Asia flooring market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Resilient

- Non-Resilient

- Others

Resilient flooring in Southeast Asia is gaining popularity due to its durability, flexibility, and cost-effectiveness. Vinyl, linoleum, and rubber flooring dominate this segment, offering resistance to moisture, stains, and heavy foot traffic. Increasing demand from commercial spaces, healthcare facilities, and educational institutions is driving South East Asia flooring market growth. Consumers prefer resilient flooring for its ease of maintenance, diverse design options, and long lifespan. As urbanization accelerates and sustainability concerns rise, eco-friendly resilient flooring solutions, such as recycled vinyl and bio-based linoleum, are becoming more widely adopted.

Non-resilient flooring, including ceramic tiles, natural stone, and hardwood, remains a preferred choice in Southeast Asia for its aesthetic appeal and premium quality. Residential and high-end commercial spaces favor these materials for their durability, sophisticated appearance, and long-term value. Despite higher installation costs, demand is driven by rising disposable incomes and evolving interior design trends. Technological advancements, such as digitally printed tiles and engineered hardwood, are enhancing product offerings. While non-resilient flooring requires more maintenance, its ability to enhance property value makes it a strong market segment in the region.

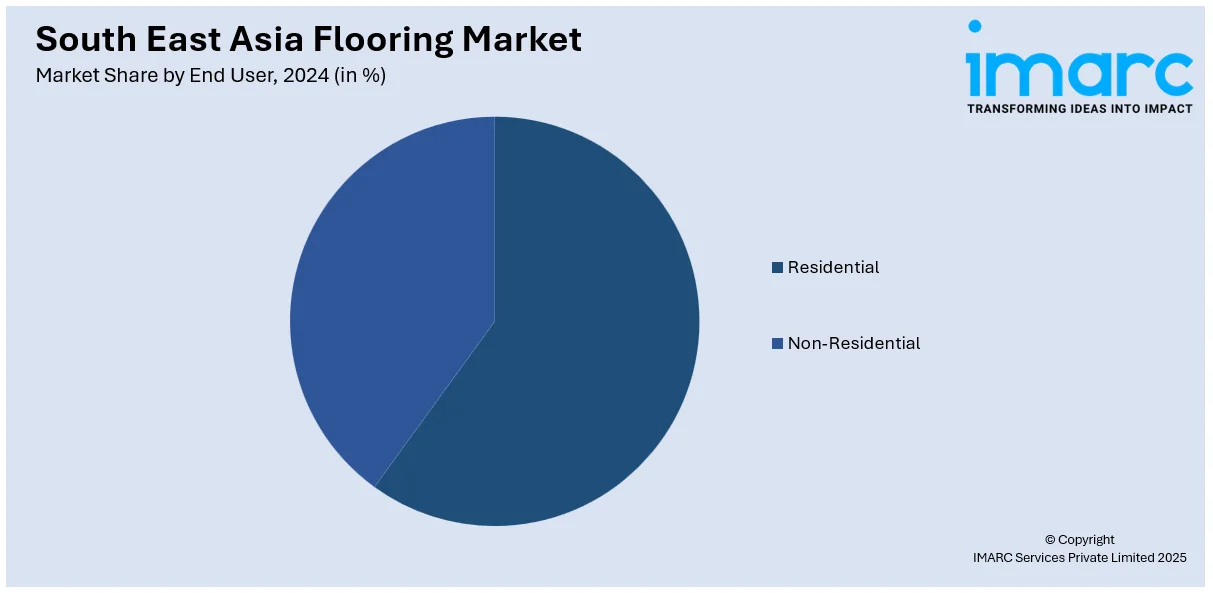

Analysis by End User:

- Residential

- Non-Residential

The residential flooring market in Southeast Asia is expanding due to rapid urbanization, rising disposable incomes, and evolving home design preferences. Homeowners prefer materials such as ceramic tiles, vinyl, and engineered wood for durability and aesthetics. Affordable and easy-to-maintain flooring solutions are in demand, particularly in high-rise apartments and modern housing developments. Sustainable and eco-friendly options, including bamboo and recycled flooring, are gaining traction. As renovation and remodeling activities increase, the residential segment continues to drive innovation in design, texture, and material choices.

The non-residential flooring market in Southeast Asia is driven by commercial, healthcare, hospitality, and industrial projects. Offices, hotels, retail spaces, and public infrastructure developments demand high-performance, durable flooring solutions such as polished concrete, resilient vinyl, and carpet tiles. Growing investments in smart cities and sustainable buildings are influencing material choices, with a focus on energy-efficient and low-maintenance options. Heavy foot traffic and safety regulations shape product selection, with anti-slip, moisture-resistant, and acoustically optimized flooring solutions gaining prominence across various industries.

Country Analysis:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

Indonesia’s flooring market is expanding due to rapid urbanization, infrastructure growth, and rising disposable incomes. The government’s focus on residential and commercial construction projects, including smart cities and sustainable developments, is driving demand for luxury vinyl tiles (LVT), engineered wood, and SPC flooring. Increasing awareness of eco-friendly materials is influencing market trends, with bamboo and recycled flooring options gaining traction. The growing real estate and hospitality industries further support market expansion, making Indonesia a key player in Southeast Asia’s flooring industry.

Thailand’s flooring market is fueled by booming tourism, commercial real estate growth, and a strong manufacturing sector. The rising number of hotels, shopping malls, and office spaces is increasing demand for durable and aesthetic flooring options like laminate, SPC, and engineered wood. Government incentives for green building materials and a push toward energy-efficient infrastructure are further shaping market trends. Thailand’s expanding home renovation sector also contributes to the growing preference for premium flooring solutions, including water-resistant and anti-scratch surfaces.

Singapore’s flooring market is driven by sustainable urban development and high demand for premium materials. With stringent building regulations and a focus on eco-friendly construction, there is increasing adoption of engineered wood, recycled materials, and low-VOC flooring. The rise of luxury residential projects and commercial spaces boosts demand for LVT, SPC, and smart flooring solutions. Singapore’s real estate sector, combined with its advanced logistics and infrastructure, makes it a leading hub for innovative and high-quality flooring products in Southeast Asia, contributing significantly to the South East Asia flooring market share.

The Philippines’ flooring market is expanding with rising real estate investments, urbanization, and infrastructure projects. The government’s push for affordable housing and commercial developments is increasing demand for cost-effective and durable flooring like SPC, LVT, and ceramic tiles. The country’s tropical climate also influences consumer preferences, with a focus on moisture-resistant and heat-durable flooring solutions. The growing middle class and foreign investments in the retail and hospitality sectors further fuel the adoption of modern, aesthetic, and easy-to-maintain flooring options.

Vietnam’s flooring market is expanding due to industrialization, urbanization, and increasing foreign investments. The growth of residential and commercial buildings, manufacturing plants, and industrial zones is boosting demand for SPC, laminate, and resilient flooring solutions. With a strong export market for flooring materials, Vietnam is becoming a key manufacturing hub in Southeast Asia. The rise of eco-conscious construction trends is also driving interest in bamboo and engineered wood flooring, as developers seek sustainable and long-lasting options.

Malaysia’s flooring market benefits from strong real estate growth, infrastructure expansion, and high consumer demand for luxury interiors. The rise of mixed-use developments, commercial hubs, and residential projects is increasing demand for engineered wood, LVT, and SPC flooring. The government’s sustainability initiatives and green building certifications encourage eco-friendly flooring choices. Additionally, Malaysia’s position as a regional manufacturing and export hub for flooring materials supports the market’s growth, with local and international players investing in high-quality and innovative flooring solutions.

Competitive Landscape:

The Southeast Asia flooring market is highly competitive, driven by rapid urbanization, infrastructure projects, and rising consumer demand. Key players, including local manufacturers and global brands, compete through product innovation, sustainability initiatives, and cost-effective solutions. The market includes ceramic tiles, vinyl, wood, and laminate flooring, with increasing adoption of eco-friendly and durable materials. Government regulations on building standards and environmental compliance influence competition, while technological advancements enhance manufacturing efficiency and design customization. Major industry participants focus on expanding distribution networks and strategic partnerships to strengthen market presence, catering to both residential and commercial construction sectors across the region. For instance, in January 2024, Jufeng New Materials, a Vietnam based company, signed an agreement with i4F to use drop-lock and AquaProtect technologies, improving laminate flooring installation, water resistance, and mass production efficiency.

The report provides a comprehensive analysis of the competitive landscape in the South East Asia flooring market with detailed profiles of all major companies, including:

- Akzo Nobel NV

- CoGri Group Ltd.

- Indomas Interior

- Rumah Lantai Indonesia

- Sika AG

- Thai Plastic Industries Co. Ltd.

Latest News and Developments:

- In June 2024, Unilin Technologies announced a license agreement with NEO Floor, a Vietnam based company for ClickControl, an advanced quality measurement device that enhances click profile accuracy, production efficiency, and safety, reducing waste and reliance on experienced milling operators.

- In August 2024, CFL Flooring announced its new manufacturing facility in northern Vietnam, with shipments starting in Q4 2024. This expansion increases production capacity, improves global distribution, and supports sustainability efforts in flooring innovation.

South East Asia Flooring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Resilient, Non-Resilient, Others |

| End Users Covered | Residential, Non-Residential |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Akzo Nobel NV, CoGri Group Ltd., Indomas Interior, Rumah Lantai Indonesia, Sika AG, Thai Plastic Industries Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia flooring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South East Asia flooring market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South East Asia flooring market was valued at USD 29.01 Billion in 2024.

The market include urbanization, rising construction activities, increased demand for residential and commercial spaces, and growing disposable incomes. Additionally, advancements in flooring technology, sustainability trends, and evolving consumer preferences further contribute to market growth.

IMARC estimates the global South East Asia flooring market to reach USD 49.86 Billion in 2033, exhibiting a CAGR of 6.08% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)