South East Asia Cryptocurrency Market Size, Share, Trends and Forecast by Component, Type, Process, Application, and Country, 2025-2033

Market Overview:

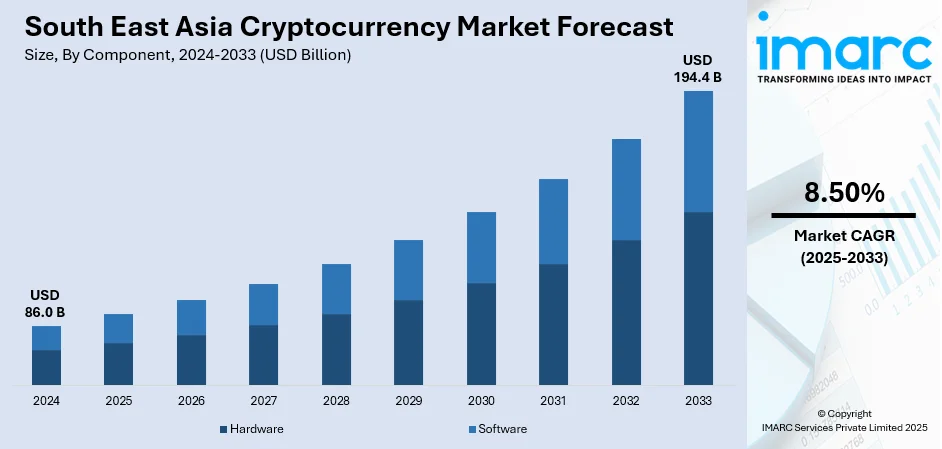

South East Asia cryptocurrency market size reached USD 86.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 194.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The inflating need for alternative form of currency and investment, along with the growing popularity of digital assets, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 86.0 Billion |

|

Market Forecast in 2033

|

USD 194.4 Billion |

| Market Growth Rate 2025-2033 | 8.50% |

Cryptocurrency is a form of digital or virtual currency that utilizes cryptography to ensure security. In contrast to conventional currencies issued by governments and central banks, it operates on decentralized networks using blockchain technology. The key features of cryptocurrency include enhanced security and dependability in transactions, guaranteeing transparency and mitigating the risk of double spending. Notably, it facilitates quicker and more cost-effective cross-border transactions, minimizing the need for intermediaries. The adoption of cryptocurrency is driven by its ability to offer financial services to populations without access to traditional banking systems. It addresses the needs of the unbanked, providing them with financial inclusion opportunities.

To get more information on this market, Request Sample

South East Asia Cryptocurrency Market Trends:

The South East Asia cryptocurrency market is emerging as a dynamic and transformative sector, reflecting the region's receptiveness to innovative financial technologies. Comprising countries such as Singapore, Malaysia, Thailand, Indonesia, Vietnam, and the Philippines, South East Asia has witnessed a notable surge in cryptocurrency adoption and blockchain technology. Additionally, governments and regulatory bodies in South East Asia have taken diverse approaches, with some embracing and regulating the industry, while others remain cautious. Besides this, the South East Asia cryptocurrency market is characterized by a growing awareness of the advantages offered by digital currencies. Moreover, the blockchain technology that underpins these currencies ensures immutability, reducing the risk of fraud and enhancing overall security, thereby acting as another significant growth-inducing factor. One significant impact of cryptocurrency in South East Asia is its potential to facilitate cross-border transactions. With a diverse population and a robust regional economy, the need for efficient and cost-effective remittance solutions has fueled the adoption of cryptocurrencies. This is particularly beneficial in a region where a substantial portion of the population remains unbanked or underbanked. Furthermore, collaborations between industry players, regulators, and financial institutions will play a crucial role in shaping its trajectory and ensuring a secure and sustainable ecosystem for digital currencies in the region. This, in turn, is expected to fuel the South East Asia cryptocurrency market in the coming years.

South East Asia Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on component, type, process, and application.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

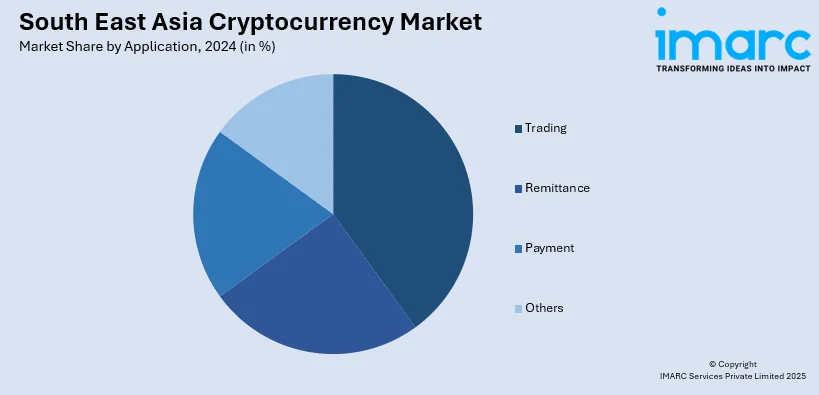

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia cryptocurrency market on the basis of component?

- What is the breakup of the South East Asia cryptocurrency market on the basis of type?

- What is the breakup of the South East Asia cryptocurrency market on the basis of process?

- What is the breakup of the South East Asia cryptocurrency market on the basis of application?

- What are the various stages in the value chain of the South East Asia cryptocurrency market?

- What are the key driving factors and challenges in the South East Asia cryptocurrency?

- What is the structure of the South East Asia cryptocurrency market and who are the key players?

- What is the degree of competition in the South East Asia cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)