South East Asia Construction Equipment Rental Market Size, Share, Trends and Forecast by Equipment Type, Propulsion System, Application, and Country, 2025-2033

Market Overview:

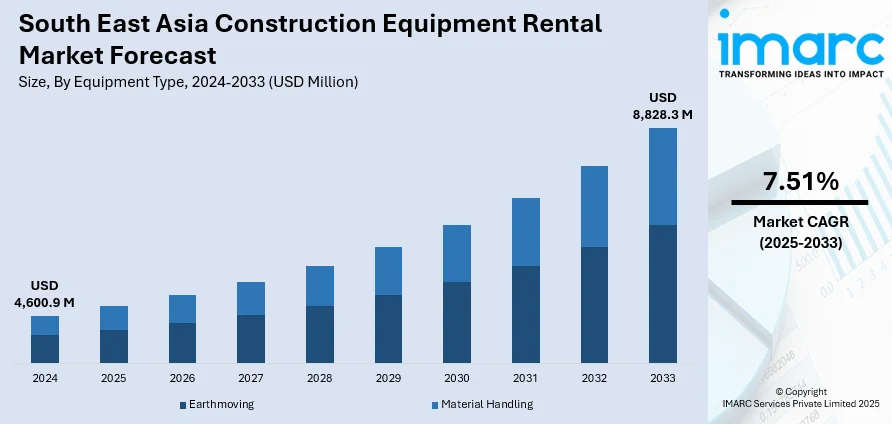

South East Asia construction equipment rental market size reached USD 4,600.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,828.3 Million by 2033, exhibiting a growth rate (CAGR) of 7.51% during 2025-2033. The rising investments by key players in infrastructural development activities are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,600.9 Million |

| Market Forecast in 2033 | USD 8,828.3 Million |

| Market Growth Rate (2025-2033) | 7.51% |

Construction equipment rental involves leasing heavy machinery for tasks such as earthmoving, material handling, and concrete mixing. There are primarily two equipment rental models in the market. The wet hiring model includes both the construction equipment and personnel for operation and maintenance, while the dry hiring model involves using in-house specialists to operate and maintain the equipment. Renting proves to be more cost-effective, as it entails lower maintenance fees and fewer technical charges. Additionally, this practice helps organizations avoid initial purchase costs, navigate market fluctuations, and address concerns related to depreciation and storage, in contrast to the acquisition of brand-new equipment.

To get more information on this market, Request Sample

South East Asia Construction Equipment Rental Market Trends:

The South East Asia construction equipment rental market stands as a dynamic and integral sector within the region's booming construction and infrastructure development landscape. This practice has gained significant traction due to its cost-effectiveness and strategic advantages for businesses operating in the region. One of the key advantages driving the adoption of construction equipment rental in South East Asia is its cost-effectiveness. Renting eliminates the need for substantial upfront capital investment, helping businesses avoid initial purchase costs, depreciation, and storage expenses. Additionally, it shields organizations from the volatility of market fluctuations, offering financial flexibility in a rapidly changing economic environment, which is acting as another significant growth-inducing factor. Besides this, the South East Asia construction equipment rental market is witnessing robust growth, fueled by the region's increasing urbanization, infrastructure development projects, and a surge in construction activities. Countries like Indonesia, Vietnam, and Thailand are experiencing a rise in demand for heavy machinery to meet the requirements of ambitious construction projects. As the region continues its economic expansion, the construction equipment rental market is poised to play a pivotal role in providing flexible and efficient solutions for the construction industry's evolving needs over the forecasted period.

South East Asia Construction Equipment Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on equipment type, propulsion system, and application.

Equipment Type Insights:

- Earthmoving

- Excavator

- Loader

- Backhoe

- Motor Grader

- Others

- Material Handling

- Crawler Crane

- Trailer-Mounted Crane

- Truck-Mounted Crane

- Concrete and Road Construction

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes earthmoving (excavator, loader, backhoe, motor grader, and others) and material handling (crawler crane, trailer-mounted crane, truck-mounted crane, and concrete and road construction).

Propulsion System Insights:

- Electric

- ICE

A detailed breakup and analysis of the market based on the propulsion system have also been provided in the report. This includes electric and ICE.

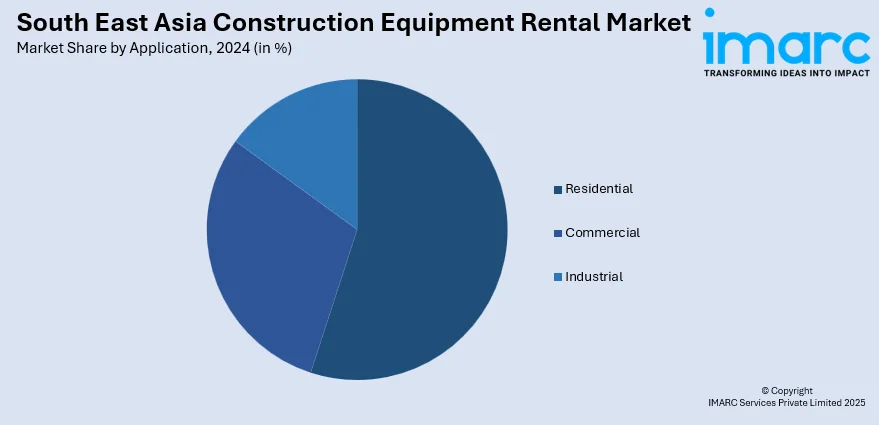

Application Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and industrial.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Asia Machinery Solutions Vietnam Co., Ltd.

- Guzent Inc.

- Nishio Holdings Co Ltd

- PT. Uniteda Arkato.

- Rent (Thailand) Company Limited

- Sin Heng Heavy Machinery Limited

- Superkrane Mitra Utama

- Tat Hong Holdings Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

South East Asia Construction Equipment Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Propulsion Systems Covered | Electric, ICE |

| Applications Covered | Residential, Commercial, Industrial |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Asia Machinery Solutions Vietnam Co., Ltd., Guzent Inc., Nishio Holdings Co Ltd, PT. Uniteda Arkato., Rent (Thailand) Company Limited, Sin Heng Heavy Machinery Limited, Superkrane Mitra Utama, Tat Hong Holdings Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia construction equipment rental market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia construction equipment rental market on the basis of equipment type?

- What is the breakup of the South East Asia construction equipment rental market on the basis of propulsion system?

- What is the breakup of the South East Asia construction equipment rental market on the basis of application?

- What are the various stages in the value chain of the South East Asia construction equipment rental market?

- What are the key driving factors and challenges in the South East Asia construction equipment rental?

- What is the structure of the South East Asia construction equipment rental market and who are the key players?

- What is the degree of competition in the South East Asia construction equipment rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia construction equipment rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia construction equipment rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia construction equipment rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)