South East Asia B2B Payments Market Size, Share, Trends and Forecast by Payment Type, Payment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033

South East Asia B2B Payments Market Size and Share:

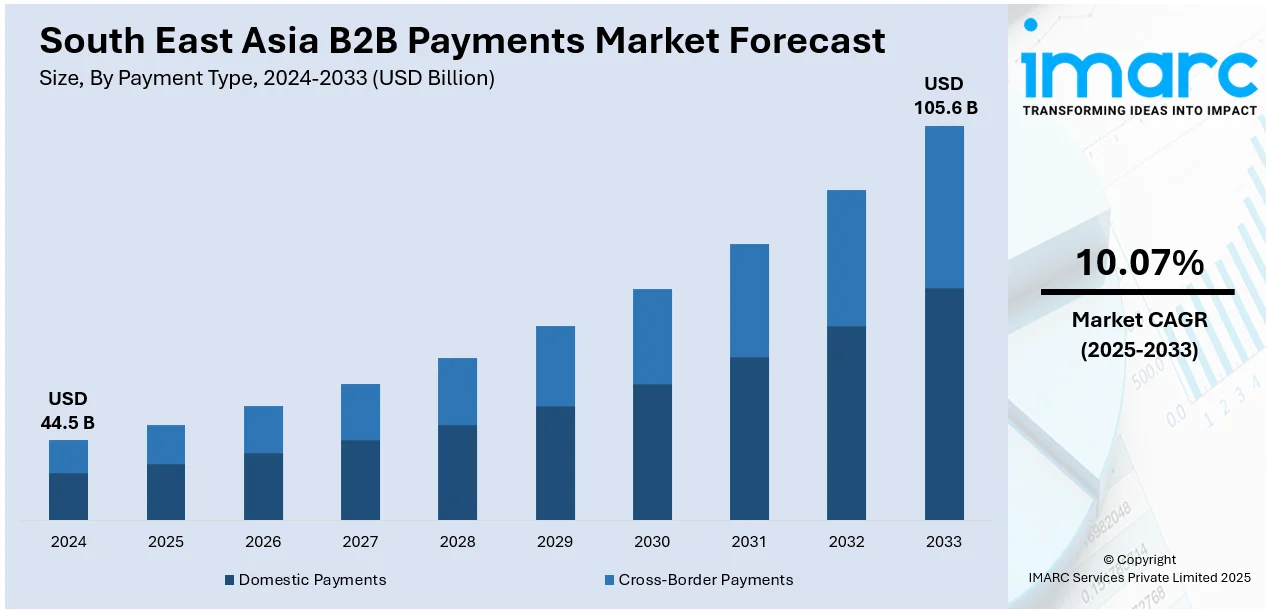

The South East Asia B2B payments market size reached USD 44.5 Billion in 2024. The market is expected to reach USD 105.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10.07% during 2025-2033. The market growth is attributed to the growing focus among businesses to accelerate payment processes, rapid digital adoption, expansion of cross-border trade, government support for cashless economies, rising SME participation, demand for faster and cost-efficient payment solutions, and the growing integration of fintech platforms that enhance transparency, security, and efficiency in business transactions.

Market Insights:

- On the basis of region, the market is divided into Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and others.

- Based on the payment type, the market is categorized as domestic payments and cross-border payments.

- On the basis of the payment mode, the market is segmented into traditional and digital.

- Based on the enterprise size, the market is categorized as large enterprises and small and medium-sized enterprises.

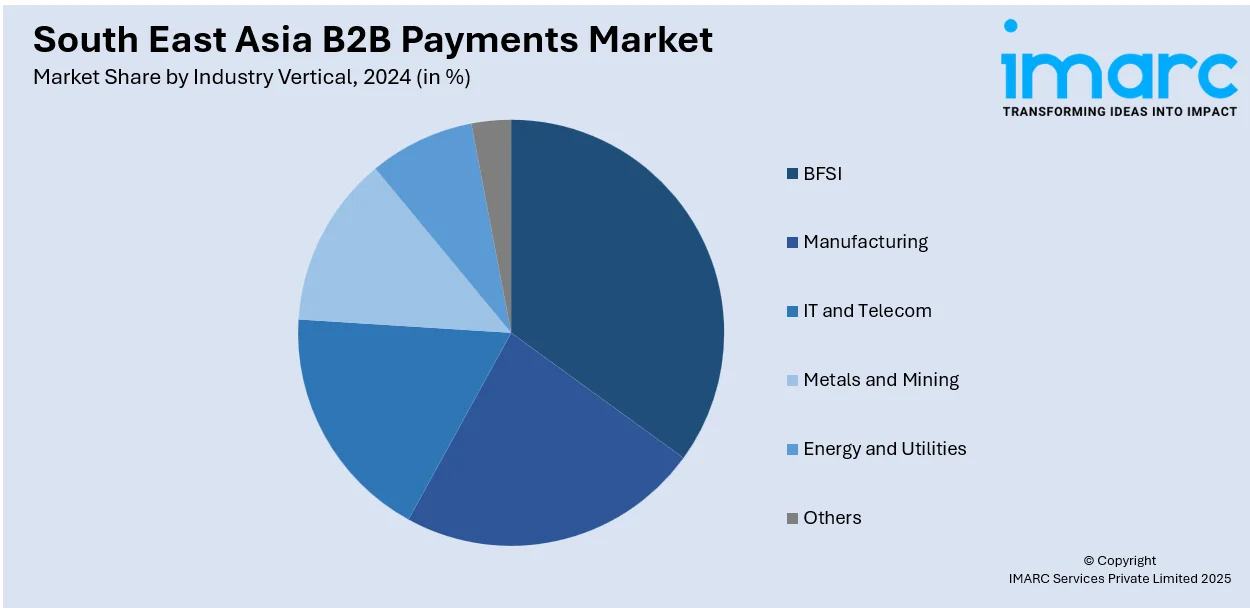

- On the basis of the industry vertical, the market is segmented into BFSI, manufacturing, IT and telecom, metals and mining, energy and utilities, and others.

Market Size and Forecast:

- 2024 Market Size: USD 44.5 Billion

- 2033 Projected Market Size: USD 105.6 Billion

- CAGR (2025-2033): 10.07%

B2B payments refer to financial transactions involving two or more businesses in the exchange of goods or services. These transactions play a crucial role in facilitating prompt payments, enhancing cash flow, and mitigating potential issues of ambiguity and discrepancies between merchants. B2B payment solutions contribute to the streamlining of both accounts payable and receivable processes. With these solutions, payments are systematically recorded through the use of software tools and applications, leading to increased efficiency and accuracy in financial management. The applications of B2B payments extend across various industries, including but not limited to telecom, information and technology (IT), manufacturing, energy and utilities, metals and mining, as well as banking, financial services, and insurance (BFSI). As businesses across these sectors increasingly recognize the advantages of B2B payment solutions, their adoption continues to grow, contributing to more seamless and transparent financial transactions within and between enterprises.

To get more information on this market, Request Sample

The South East Asia B2B payments market has emerged as a pivotal sector, reflecting the region's dynamic economic landscape and the increasing digitalization of financial transactions between businesses. B2B payments in South East Asia involve the exchange of funds for goods or services between two or more enterprises, playing a vital role in facilitating smoother and more efficient financial interactions. Additionally, the widespread adoption of B2B payment solutions in these sectors underscores the versatility and applicability of such systems across diverse business environments, which is a significant factor propelling South East Asia B2B payments market growth. Besides this, as the South East Asian business landscape continues to embrace digital transformation, the B2B payments market is poised for further growth. Furthermore, the ongoing development of financial technologies, coupled with the region's expanding e-commerce and trade activities, positions B2B payments as a cornerstone for efficient, secure, and transparent financial transactions between enterprises in South East Asia. This, in turn, is expected to fuel the market growth over the forecasted period.

South East Asia B2B Payments Market Trends:

Rapid Digitalization and Automation of Payments

The industry is experiencing a rapid digitalization as businesses are increasingly moving away from manual, paper-based transactions towards automated, real-time payment systems. Businesses are adopting cloud-based financial platforms that automate the invoice processing, reconciliation, and settlement processes. Automation minimizes the risk of human error, speeds up the payment cycle, and improves liquidity management so that companies can maximize cash flow. Moreover, financial technology (fintech) companies are bringing innovative solutions using artificial intelligence and machine learning to identify anomalies, predict cash needs, and address regulatory guidelines. The implementation of Application Programming Interfaces (APIs) is making it easy for company accounting systems to integrate with banking networks, allowing quicker, more transparent transactions. Small and medium-sized businesses are also benefiting from scalable solutions that were previously exclusive to large corporations, thereby making sophisticated financial tools more accessible. The digital transformation is reshaping operational efficiency, transparency, and velocity in the B2B payments system, thereby augmenting the South East Asia B2B payments market share.

Expansion of Cross-Border and Regional Payment Solutions

Cross-border commerce across Southeast Asia is growing due to regional economic integration and increasing intra-ASEAN trade. This expansion has raised the need for effective B2B payment systems that can process multiple currencies and varied banking regulations. Businesses are increasingly using digital platforms that enable secure, real-time cross-border transfers, reducing transaction fees and settlement times. Regional payment networks and fintech collaborations are arising that help standardize procedures, streamline compliance, and improve traceability for cross-border payments. Further, the growth in e-commerce and global supply chains has raised the demand for end-to-end visibility of payments, reconciliation, and currency conversion. Companies are also investigating hedging solutions and dynamic FX management to manage currency risk, which is positively impacting the South East Asia B2B payments market outlook. The take-up of such regional and cross-border payment platforms fortifies commerce ties, lowers the cost of doing business, and allows businesses to grow operations throughout Southeast Asia cost-effectively, delivering a more unified and responsive B2B financial infrastructure.

Growth, Opportunities, and Barriers in the South East Asia B2B Payments Market:

- Growth Drivers: The rapid adoption of digital payment solutions and automation is driving efficiency across B2B transactions in Southeast Asia. Increasing regional trade and integration within ASEAN are stimulating demand for cross-border payment platforms. The rise of fintech innovation, including cloud-based solutions and AI-enabled financial tools, is enhancing transaction speed, transparency, and security. Growing e-commerce activity and complex supply chains are pushing businesses to adopt real-time, scalable payment systems. Additionally, as per the South East Asia B2B payments market forecast, regulatory support and initiatives aimed at promoting digital finance adoption are expected to further propel market’s growth.

- Market Opportunities: The expansion of cross-border trade presents opportunities for platforms offering multi-currency and regional payment solutions. SMEs, previously underserved by traditional banking, can leverage digital B2B payment systems for greater financial inclusion. Flexible payment models, such as installment plans or trade credit, offer businesses improved cash flow management. Integration of B2B payment solutions with ERP and accounting systems creates opportunities for seamless operational efficiency. Furthermore, partnerships between fintech providers and banks can foster innovation, creating tailored solutions for sector-specific payment needs.

- Market Challenges: According to the South East Asia B2B payments market research report, fragmented regulatory frameworks across Southeast Asian countries can complicate cross-border payment operations. Concerns around cybersecurity, fraud, and data privacy remain significant barriers for adoption. Limited digital literacy and technological readiness among smaller enterprises can slow the transition to automated payment platforms. High costs of integrating legacy systems with modern payment solutions can discourage some businesses. Additionally, inconsistencies in banking infrastructure and payment standards across the region pose operational challenges for widespread implementation.

South East Asia B2B Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on payment type, payment mode, enterprise size, and industry vertical.

Payment Type Insights:

- Domestic Payments

- Cross-Border Payments

The report has provided a detailed breakup and analysis of the market based on payment type. This includes domestic payments and cross-border payments.

Payment Mode Insights:

- Traditional

- Digital

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes traditional and digital.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

Industry Vertical Insights:

- BFSI

- Manufacturing

- IT and Telecom

- Metals and Mining

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, manufacturing, IT and telecom, metals and mining, energy and utilities, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- August 2025: PayMate, a Mumbai-based B2B payments firm backed by investors, announced its expansion into Indonesia and its intent to acquire Indonesian FinTech-as-a-Service provider, DigiAsia Bios Pte Ltd., in a deal valued at USD 400 Million. The agreement includes a commitment from PayMate to invest up to an additional USD 25 Million in cash, with the final financing structure and regulatory approvals expected to be concluded within 60 days of the agreement.

- August 2025: Ireland-headquartered B2B paytech firm TransferMate has secured in-principle approval from the Monetary Authority of Singapore (MAS) to broaden its Major Payment Institution (MPI) licence. The expansion covers account issuance, domestic money transfers, and e-money services in Singapore. With this regulatory clearance, the company can provide its Asia-based clients with dedicated local Global Accounts, supporting fund storage, regional transfers, currency exchange, payroll processing, and supplier payments through a single integrated platform.

- July 2025: Mastercard announced the global rollout of two B2B payment automation solutions, including Singapore, which is its Asia Pacific headquarters. Mastercard Receivables Manager, now upgraded with multi-language support and secure card-on-file functionality, and Commercial Direct Payments, a new straight-through processing tool for buyer-initiated virtual card transactions. Receivables Manager, first launched two years ago, is already being adopted by partners.

- September 2024: Mastercard, together with NTT DATA and OneHotel, unveiled a new B2B payment solution in Thailand designed to streamline and digitize the traditionally manual and error-prone process of settling hotel bookings made through online travel agents (OTAs). The system automates the processing of anonymized virtual card payments—reducing reconciliation workload, accelerating fund transfers, and enhancing security, all of which significantly improve operational efficiency for hoteliers.

South East Asia B2B Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payment Types Covered | Domestic Payments, Cross-Border Payments |

| Payment Modes Covered | Traditional, Digital |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Manufacturing, IT and Telecom, Metals and Mining, Energy and Utilities, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia B2B payments market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia B2B payments market on the basis of payment type?

- What is the breakup of the South East Asia B2B payments market on the basis of payment mode?

- What is the breakup of the South East Asia B2B payments market on the basis of enterprise size?

- What is the breakup of the South East Asia B2B payments market on the basis of industry vertical?

- What are the various stages in the value chain of the South East Asia B2B payments market?

- What are the key driving factors and challenges in South East Asia B2B Payments?

- What is the structure of the South East Asia B2B payments market and who are the key players?

- What is the degree of competition in the South East Asia B2B payments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia B2B payments market from 2019-2033.

- This research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia B2B payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia B2B payments industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)