South East Asia Aviation Fuel Market Size, Share, Trends, and Forecast by Fuel, Aircraft, End Use, and Country, 2025-2033

South East Asia Aviation Fuel Market Size and Share:

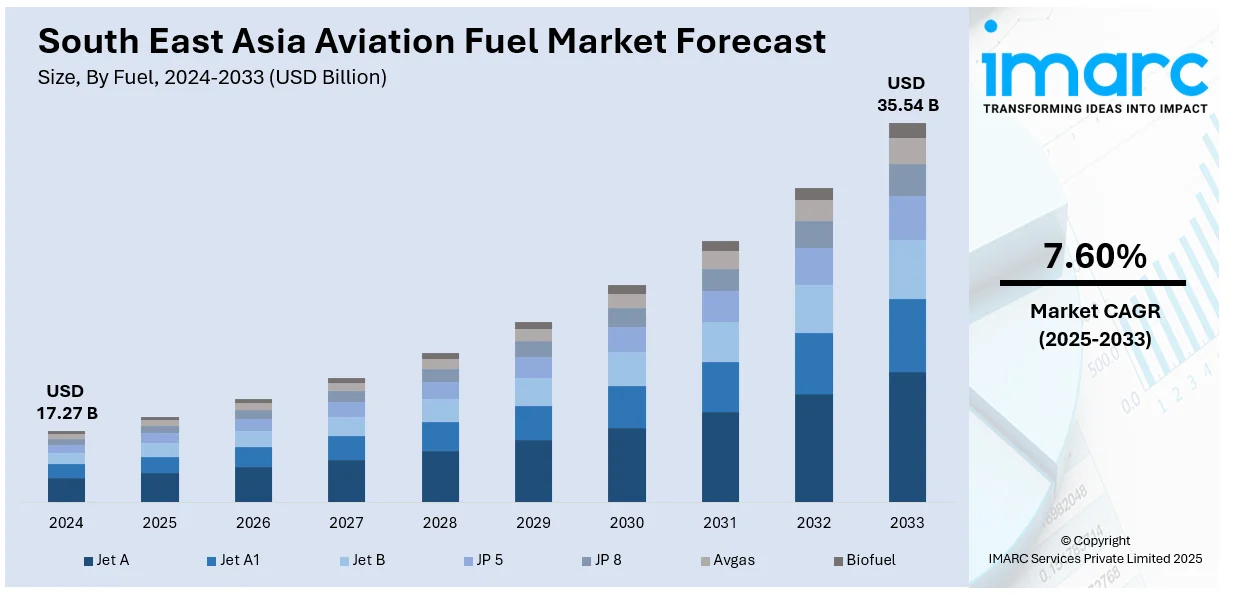

The South East Asia aviation fuel market size was valued at USD 17.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.54 Billion by 2033, exhibiting a CAGR of 7.60% from 2025-2033. The market in the region is primarily driven by rising air travel demand, expanding tourism, surging economic growth, rising infrastructure development, stringent government policies, fluctuating fuel prices, and increasing awareness of environmental regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.27 Billion |

| Market Forecast in 2033 | USD 35.54 Billion |

| Market Growth Rate (2025-2033) | 7.60% |

The South East Asia aviation fuel market growth is significantly expanding due to the increasing demand for air travel, fueled by expanding middle-class populations and tourism. In addition to this, the rising disposable incomes and better connectivity between countries contribute to greater regional and international travel, aiding the market growth. Moreover, economic growth in countries like India and Indonesia strengthens the demand for aviation fuel. Furthermore, government policies supporting infrastructure development in airports are strengthening the South East Asia aviation fuel market share. For instance, Malaysia has launched a decarbonization plan aiming for net-zero emissions in its aviation sector by 2050, with significant increases in SAF usage. The plan focuses on reducing emissions from aircraft technology and increasing SAF adoption, including biofuels, to help the country meet its sustainability goals, and strengthen the region’s commitment to reducing aviation sector emissions.

To get more information on this market, Request Sample

Concurrently, the volatility in global fuel prices, impacts the aviation sector's operational costs, acting as another growth-inducing factor. The shift toward sustainable aviation fuel (SAF) is also a growing trend, driven by environmental concerns and stricter carbon emissions regulations. For example, Asia's jet fuel imports reached multi-year highs in November 2024, driven by peak winter demand and supply constraints caused by refinery outages and reduced exports from China, exacerbating fuel price fluctuations. The shift toward sustainable aviation fuel (SAF) is also a growing trend, driven by environmental concerns and stricter carbon emissions regulations. Besides this, airlines and governments are increasingly focusing on sustainability, which supports the adoption of cleaner fuel alternatives, fueling the market demand. Furthermore, ongoing advancements in fuel efficiency technology help reduce fuel consumption, supporting the market growth. Apart from this, the increasing competition among airlines encourages the expansion of flight routes and frequencies, resulting in higher aviation fuel consumption, thereby propelling the market forward.

South East Asia Aviation Fuel Market Trends:

Adoption of Sustainable Aviation Fuel (SAF)

The adoption of SAF has gained prominence throughout Southeast Asia to cut carbon emissions and fulfill environmental standards worldwide, influencing the South East Asia aviation fuel market trends. The air transportation sector throughout Southeast Asia investigates SAF production together with government support for green technology investments and incentives. Moreover, the adoption of SAF by airlines allows them to cut their reliance on traditional jet fuel while complying with environmental regulations thus advancing sustainable aviation development. For instance, Cebu Pacific has entered into a five-year agreement with Neste for the supply of Sustainable Aviation Fuel (SAF), marking a major milestone in its sustainability efforts. This partnership underscores the airline’s commitment to lowering its carbon footprint and advancing sustainable aviation practices in the region. Furthermore, SAF infrastructure development throughout the region is fostered due to the increase in substantially because of the 2050 carbon neutrality target for aviation operations, thus impelling the market growth.

Growing Demand for Air Travel and Tourism

The aviation fuel market in Southeast Asia is benefiting from a strong rebound in air travel and tourism. A growing number of international visitors in Thailand along with Singapore and Indonesia has led airlines to increase their flight routes to serve expanding passenger needs. Besides this, Southeast Asia serves as a strategic location connecting tourism destinations with business centers which increases regional air traffic demand. Apart from this, the growing air travel volume directly drives up aviation fuel requirements because airlines invest in additional aircraft and more flight frequencies to benefit from the travel industry recovery in the Association of Southeast Asia Nations (ASEAN), which is enhancing the South East Asia aviation fuel market outlook. For example, in 2024, the Asia Sustainable Aviation Fuel Association (ASAFA) was launched in Singapore to accelerate the production and use of low-carbon aviation fuels across Asia. This initiative will play a key role in promoting cleaner fuel alternatives to meet the region's growing air travel demand sustainably.

Technological Advancements and Fuel Efficiency

The development of modern aircraft technology and innovative fuel management approaches enhances both aircraft performance and decreases aviation fuel demands. Airlines make investments in newer fuel-efficient aircraft that use less aviation fuel while carrying passengers one kilometer. For example, Cebu Pacific has taken delivery of the Airbus A321NEO, which offers improved fuel efficiency compared to previous generations. This investment demonstrates airlines' commitment to cutting operational costs while meeting environmental standards. Additionally, modern fuel additives coupled with management technologies enable airlines to maximize fuel utilization while cutting down on waste therefore driving down costs. The market for aviation fuel in Southeast Asia has become more sustainable and cost-effective because of these developments and operational efficiency enhancements which support both rising fuel price management and regulatory compliance for airlines, thereby propelling the South East Asia aviation fuel market demand.

South East Asia Aviation Fuel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South East Asia aviation fuel market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on fuel, aircraft, and end use.

Analysis by Fuel:

- Jet A

- Jet A1

- Jet B

- JP 5

- JP 8

- Avgas

- Biofuel

Jet A is the most commonly used aviation fuel in Southeast Asia, primarily for commercial airliners. Its market growth is driven by rising passenger demand, expanding air traffic, and the region’s growing airline fleet, making it a preferred fuel type in the market.

Jet A1, widely used for international flights, is witnessing strong growth in Southeast Asia due to increasing long-haul travel and expanding airports. Its low freezing point and global availability make it the preferred choice for international airlines operating across the region.

Jet B, a mixture of kerosene and gasoline, is less commonly used in Southeast Asia but sees demand in regions with colder climates. Its growth potential in the region is limited but is supported by specific operational needs for certain aircraft and conditions.

JP 5, a military-grade aviation fuel, is primarily used by naval and military aircraft. In Southeast Asia, demand is driven by military expansion and defense activities. The region’s growing defense budget and strategic importance lead to increased use of JP 5 in military operations.

JP 8 functions widely across Southeast Asia for military purposes within defense and military applications. The region's extensive military infrastructure expansion together with enhanced defense partnerships and rising demand for dependable aviation fuel for military aircraft drives JP 8's growth.

Avgas is predominantly used for smaller aircraft, including general aviation and recreational flying. The expansion of general aviation services in Southeast Asia because of rising household earnings and private flight popularity leads to rising Avgas consumption throughout the area.

Biofuel has become a promising sustainable replacement for traditional aviation fuel across Southeast Asian regions. The area pursues biofuel development and adoption under environmental standards and sustainability targets while it directs more investments toward green aviation technology to minimize flying emissions.

Analysis by Aircraft:

- Fixed Wings

- Rotorcraft

- Others

The Southeast Asia aviation fuel market is predominantly controlled by fixed-wing aircraft because of the rapid expansion of commercial aviation. The rising air travel needs coupled with expanding regional airlines and infrastructure improvements drive the expansion of fixed-wing aircraft across the region. Additionally, this aircraft demands high quantities of Jet A1 and Jet A aviation fuel because airlines continue upgrading their fleets to serve rising passenger numbers, impelling the market growth.

The rotorcraft segment, which includes helicopters and other vertical take-off aircraft, is growing in Southeast Asia due to increased demand for air mobility services, including tourism, medical evacuations, and logistics. The aviation fuel Jet A and Jet B power rotorcraft operations while their market expansion stems from new industrial applications in the oil & gas sector and search and rescue operations alongside infrastructure projects in remote locations, fostering the market demand.

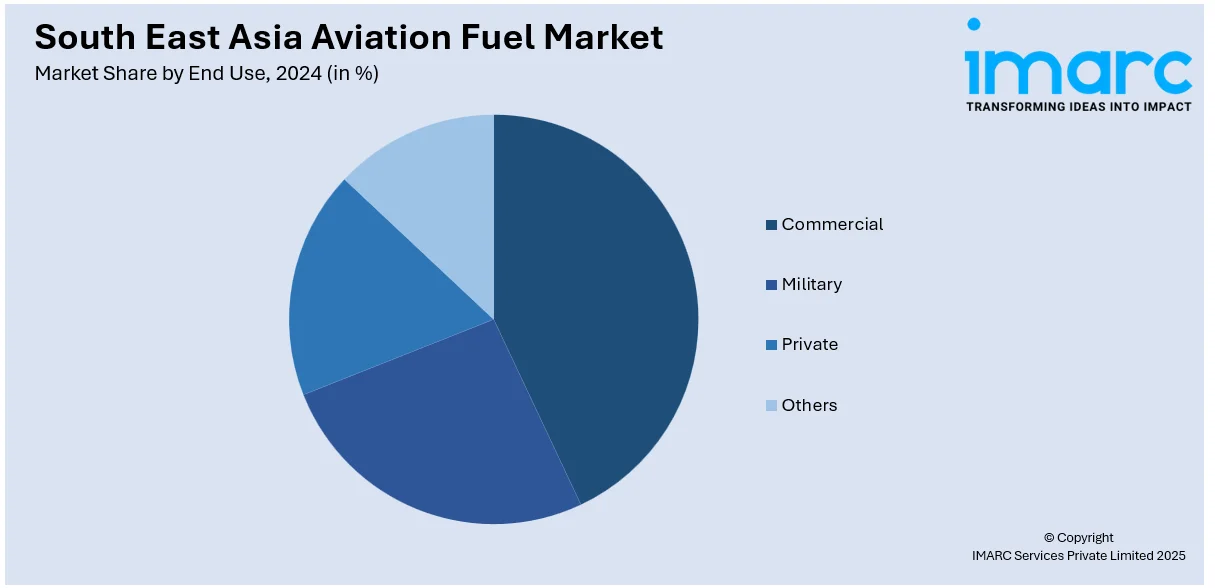

Analysis by End Use:

- Commercial

- Military

- Private

- Others

The commercial segment is spurring the Southeast Asia aviation fuel market, driven by rising air travel and tourism. The growing demand for domestic and international flights, coupled with expanding airline fleets, increases consumption of aviation fuel, particularly Jet A1 and Jet A.

The military segment sees growth in Southeast Asia due to increased defense spending and strategic military expansions. The increasing military defense requirements across the region push up the market demand for specialized fuels JP 5 and JP 8 which serve military aircraft.

The private aviation sector in Southeast Asia is expanding because more people possess growing wealth, and they desire private travel by air. The increasing demand for private jet travel along with smaller aircraft requires rising usage of Avgas and Jet A1 fuel types.

Country Analysis:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

In Indonesia, the aviation fuel market is growing due to the expanding domestic and international air travel, a rising middle class, and increased tourism. The country's strategic location as an aviation hub in Southeast Asia drives the demand for commercial and military aviation fuel.

The aviation fuel market in Thailand benefits from a booming tourism industry and its role as a regional airline hub. With increasing air traffic to and from popular tourist destinations, the demand for Jet A1 and other fuels continues to rise, supporting the market growth.

Singapore is a major aviation hub, which drives strong demand for aviation fuel due to its extensive air transport infrastructure and role as a global transit point. Its status as a key international airport increases the demand for aviation fuels like Jet A1 and biofuels.

The Philippines' aviation fuel market is growing alongside rising domestic air travel, tourism, and business activity. The increased infrastructure development, along with expanding regional and international connectivity, supports higher demand for aviation fuel, particularly Jet A1, for commercial and private aviation sectors.

In Vietnam, the aviation fuel market is expanding with increasing air travel demand, economic growth, and tourism. As the country upgrades its airports and airline fleets, the demand for Jet A1 and other aviation fuels grows, supporting both domestic and international air traffic.

The aviation fuel market in Malaysia is seeing growth from both domestic travel and regional air connectivity. As the tourism industry expands and airline fleets modernize, fuel consumption for commercial flights, including Jet A1, increases, contributing to steady market growth in the region.

Competitive Landscape:

The competitive landscape of the Southeast Asia aviation fuel market is shaped by numerous international and regional fuel suppliers vying for market share. Different companies battle to supply aviation fuel across Southeast Asia as air travel and tourism grow alongside infrastructure improvements. Airlines together with airport operators and governments form strategic partnerships to help companies expand their market footprint. Furthermore, the growing interest in sustainable aviation fuel has led to more innovation while boosting competition as companies invest in environmentally friendly technologies to claim positions in the evolving sustainable fuel sector.

The report provides a comprehensive analysis of the competitive landscape in the South East Asia aviation fuel market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, ExxonMobil Aviation collaborated with Changi Airport Group to develop infrastructure for SAF supply at Singapore's Changi Airport, facilitating the adoption of sustainable fuel by airlines operating in the region.

- In November 2024, TotalEnergies Aviation secured an SAF supply agreement with Thai Airways, supporting the airline's sustainability initiatives and the broader adoption of sustainable aviation fuel in Thailand.

- In September 2024, Shell Aviation announced plans to produce SAF in Singapore by 2025, aiming to supply airlines with sustainable fuel options and support the region's transition to greener aviation practices.

- In May 2024, Singapore Airlines partnered with Neste to supply 1000 Tonnes of neat Neste MY SAF for their flights, demonstrating a commitment to reducing carbon emissions in the aviation sector.

South East Asia Aviation Fuel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuels Covered | Jet A, Jet A1, Jet B, JP 5, JP 8, Avgas, Biofuel |

| Aircrafts Covered | Fixed Wings, Rotorcraft, Others |

| End Uses Covered | Commercial, Military, Private, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia aviation fuel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South East Asia aviation fuel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia aviation fuel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aviation fuel market was valued at USD 17.27 Billion in 2024.

Key players in the Southeast Asia aviation fuel market include major international and regional fuel suppliers, airlines, airport operators, and government bodies, all competing to meet the growing demand for aviation fuel and invest in sustainable alternatives such as sustainable aviation fuel (SAF).

IMARC estimates the aviation fuel market to exhibit a CAGR of 7.60% during 2025-2033, reaching a value of USD 35.54 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)