Soup Market Size, Share, and Trends and Forecasts by Type, Category, Packaging, Distribution Channel, and Region, 2026-2034

Soup Market Size and Share:

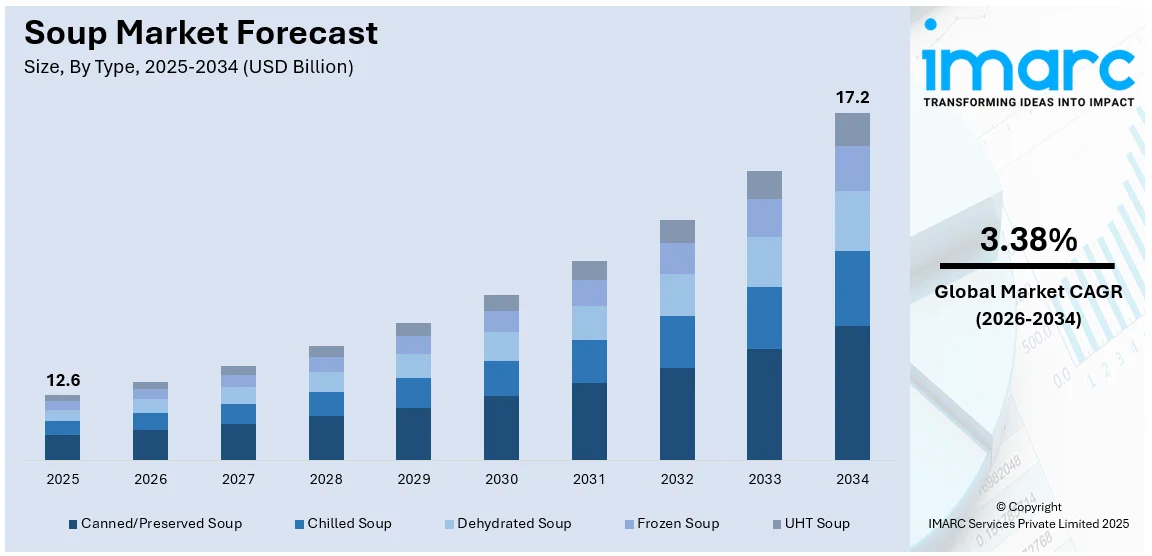

The global soup market size was valued at USD 12.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 17.2 Billion by 2034, exhibiting a CAGR of 3.38% during 2026-2034. North America currently dominates the market, holding a significant market share of over 28.7% in 2025. The rising demand for soups with clean ingredients in reusable and sustainable packaging solutions, shifting consumer preferences toward ready-to-eat (RTE) food products, and increasing adoption of vegan and vegetarian dietary habits among individuals are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.6 Billion |

| Market Forecast in 2034 | USD 17.2 Billion |

| Market Growth Rate (2026-2034) | 3.38% |

The global soup market is primarily driven by growing consumer demand for convenient, ready-to-eat (RTE), packaged food products. Along with this, rising health consciousness is leading to a rise in preference for nutrient-rich and low-calorie soups, aligning with trends toward healthier lifestyles. On 3rd October 2024, Freja Foods, launched Instant Bone Broth sachets in Beef and Chicken flavors that are nutrient-rich, all-natural alternatives to traditional stock cubes. Each of the sachets, high in protein (11g per serving) and collagen, is usable for cooking or mixed with hot water, providing a low-calorie version of the broth, 56 kcal for beef and 52 kcal for chicken. The sachets are contained in packs costing £5.99 RRP and contain four 15g sachets. Additionally, the rapid expansion of retail and e-commerce channels is making soups more accessible to a broader consumer base. Moreover, innovations in flavors, packaging, and product variety, such as organic and vegan offerings, are also fueling market growth, catering to changing consumer preferences and dietary needs. In addition to this, rapid urbanization and busy schedules are further contributing to the popularity of easy-to-prepare meal options such as soups.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by the growing trend of premiumization, with consumers seeking high-quality, artisanal, and locally sourced ingredients in their food products. Seasonal demand, particularly during colder months, significantly enhances soup consumption. Considerable rise in the uptake of meal delivery services and subscription-based meal kits are also contributing to the popularity of soups, as they are versatile and easy to include in prepared meals. On 13th February 2024, Cigna Healthcare partnered with HelloFresh to make HelloFresh meal kits available to up to 12 million Cigna customers at discounted rates through their employers, helping them to cook healthy meals at home. Flexible options for employees include discounted subscriptions and one-time meal deliveries-all with pre-portioned ingredients for wholesome meals, such as soups. The collaboration also supports HelloFresh's "Meals with Meaning" initiative to combat food insecurity in local communities. Furthermore, changing dietary habits, such as the growing demand for plant-based and gluten-free options, are encouraging manufacturers to innovate.

Soup Market Trends:

Rise in the Demand for Convenience

Convenience is a significant growth-inducing factor in the soup market due to the hectic lifestyles and busy work schedules of consumers. With the rise of dual-income households and an increase in time constraints, many individuals are looking for ready-to-eat (RTE) and convenience foods, including soup, that are quick and easy to prepare. For instance, according to PLFS data conducted by the Ministry of Statistics & Program Implementation, India, the working population ratio (WPR) in the country for people increased to 56% in 2022-23 from 52.9% in 2021-22 and 52.6% in 2020-21. As a result, the rise in the working population and inflating disposable incomes are catalyzing the market for convenient food options such as soups. Moreover, with the increased demand for ready-to-eat food items, companies are rapidly coming up with convenient packaging formats to consume and dispose of. For example, Campbell offers soup in microwavable cups, making it a more suitable packaging format than powdered soup in regular packets. Such innovations are anticipated to propel the soup market share in the coming years.

Growing Focus on Health and Wellness

The rising focus on health and wellness is significantly influencing the market for soups. Consumers are becoming increasingly conscious of their dietary choices and are seeking nutritious food options. Reports indicate that 2 in 5 (40%) of consumers place significant emphasis on selecting food and beverage options that contribute positively to their health as a key component of their wellness strategy, while an equivalent proportion prioritizes maintaining a nutritionally balanced diet. Soups provide an opportunity to incorporate a variety of vegetables, lean proteins, legumes, and whole grains into a single dish, making them a popular choice for health- and fitness-conscious individuals. In response to this, various key market players are increasingly investing in research and development activities to launch soups made from natural, organic, and healthy ingredients. For instance, in January 2022, Zoup! Eatery, a local restaurant chain, launched Zoup! Good, Really Good Soups, a line of premium soups and broths free of gluten, artificial ingredients, and preservatives, and features one of Zoup!'s homestyle bases. Similarly, in November 2021, Herbalife Nutrition launched into the soup category in the U.S. with Instant Soup, a tasty, protein-packed snack. The soup mix is formulated with 15 grams of plant-based protein to help satisfy hunger and provide long-lasting energy, as well as three grams of fiber. Additionally, in October 2021, Campbell Soup Company announced the launch of Full Futures, a program to foster a school nutrition environment that ensures all students are well-nourished and ready to thrive at school and in life. Such initiatives, along with the introduction of soups in healthy variants, are expected to bolster the soup market demand over the forecasted period.

Expanding Flavor Diversity

Flavor diversity is another major driving force in the market for soups. Consumers are becoming more open to exploring new and unique flavors, seeking a taste experience beyond traditional soup options. Additionally, the escalating demand for ethnic and exotic flavors is prompting manufacturers to introduce soups in Thai, Mexican, Indian, Mediterranean, and other culinary traditional flavors. Reports reveal that 1 in 4 (25%) of global consumers are drawn to unique and diverse flavor profiles inspired by international cuisines. For instance, in September 2022, Tideford Organics, the UK's plant-based, vegan, and gluten-free soup brand, launched a range of new soup flavors and improved recipes and doubled its retail distribution from last year. Its inspired line launched Indian Cauliflower Masala, Lebanese Lentil + Kale, and Malaysian Coconut + Noodle soups. Similarly, in June 2021, the Campbell Soup Company introduced Chunky Spicy Chicken Noodle Soup with bold chili pepper flavors and lasting vinegar notes, which attracted a significant number of consumers. By offering a wide variety of soup flavors, the market players are catering to the changing tastes and preferences of consumers, encouraging culinary exploration and enjoyment, and positively impacting the soup market outlook.

Soup Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global soup market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, category, packaging, and distribution channel.

Analysis by Type:

- Canned/Preserved Soup

- Chilled Soup

- Dehydrated Soup

- Frozen Soup

- UHT Soup

Canned/preserved soup stands as the largest component in 2025, holding around 44.9% of the market. Canned or preserved soups are commercially processed, cooked at high temperatures, and sealed in cans or jars to extend their shelf life without refrigeration. These soups play a significant role in fueling the market growth due to their convenience, accessibility, and variety. Canned/preserved soups offer consumers a quick and easy meal solution that requires minimal preparation or cooking. They have a longer shelf life, making them suitable for emergency situations or individuals without access to cooking facilities. As a result, various soup brands are introducing canned soups. For instance, in March 2024, the New Jersey-based canned soup company Campbell introduced a new grilled cheese and tomato soup product. It comes in a can and is infused with the flavors of a grilled cheese sandwich for the ultimate spoonful of flavor and comfort.

Analysis by Category:

- Vegetarian Soup

- Non-Vegetarian Soup

Non-vegetarian soup leads the market with around 55.0% of market share in 2025. Non-vegetarian soups play a significant role in propelling the market growth owing to their unique flavors, high nutritional value, and appeal to meat-loving consumers. These soups offer a rich and savory taste profile that is distinct from vegetarian soup options. They also provide an excellent source of protein and essential nutrients, making them a satisfying and nourishing choice for individuals seeking a delicious and appetizing meal. According to soup market statistics by IMARC, numerous key market players are adding non-vegetarian soups to their portfolio. For instance, in November 2023, the Peninsular Export Company launched SAARRU, India’s first native soup with local variants. The brand offers three varieties of soup, including mutton soup masala, chicken soup masala, and chicken coriander rasam masala. Available in both the B2C and B2B markets across Tamil Nadu, the soups are also available on SAARRU’s e-commerce website and other e-commerce platforms, such as Flipkart and Jiomart.

Analysis by Packaging:

- Canned

- Pouched

- Others

Canned leads the market in 2025. Canned packaging involves the use of sealed metal cans to store and preserve soups. Canned packaging plays a pivotal role in driving the market growth by ensuring convenience, preservation, and widespread availability. Cans provide a durable and airtight container that helps protect the packed contents from contaminants, spoilage, and bacterial growth, resulting in a longer shelf life of soup without the need for refrigeration. This extended shelf life makes canned soups a convenient food option for consumers, as they can be stored for prolonged periods and easily accessed when needed. Canned packaging also enables easy and safe transportation and distribution, allowing soup manufacturers to reach a broader market. Moreover, cans are durable, portable, and widely accepted in retail settings, making them a popular choice for both manufacturers and consumers.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

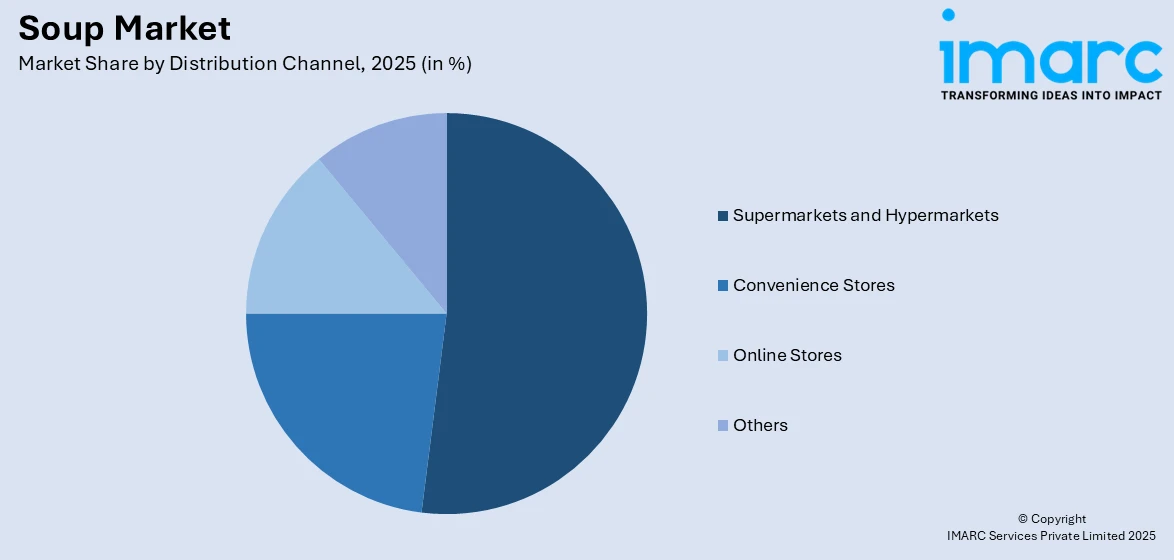

Supermarkets and hypermarkets lead the market with around 52.0% of the market share in 2025. Supermarkets and hypermarkets are huge retail outlets offering a large assortment of grocery items, household items, and consumer goods. The size of a supermarket can vary between medium and large sizes, while hypermarkets are even bigger, sometimes being an integration of a supermarket and a department store. The market growth is thus supported to a large extent by these formats of retail, providing consumers with convenient access to the large diversity of soup products. Supermarkets and hypermarkets provide massive shelf space that is exclusively used for soups. The stores have a number of brands, flavors, and packaging available. The supermarkets and hypermarkets also increase product visibility, thus allowing soup manufacturers to launch new flavors, innovative packaging, and brand extensions that attract consumer attention and stimulate market growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 28.7%. North America had the largest market share because the culture of soup consumption is highly entrenched in the region, with most households having a bowl of soup as a standard staple. Such traditional favorites including chicken noodle soup, tomato soup, and clam chowder have become more iconic dishes for North American cuisine. In addition, the lifestyle of people living in countries such as the United States and Canada has increasingly become busier, with the majority preferring to take ready-to-go meals. For instance, in July 2022, Upton's Naturals introduced three new flavorful, vegan, Ready-to-Eat soups that can be cooked on a stovetop or microwaved. Besides this, there is also a demand for soups with different ethnic flavors in the Canadian market, owing to the higher ex-pat population in the country. Key players are, thus, focusing on developing and launching healthier and memorable soup options in the country, which is anticipated to further propel the soup market revenue in the region.

Key Regional Takeaways:

United States Soup Market Analysis

In 2025, the US accounted for around 88.40% of the total North America soup market. The United States soup market is driven by several key factors, reflecting changing consumer preferences and broader food industry trends. Consumers are increasingly prioritizing health-conscious eating habits, seeking nutrient-dense and low-calorie options to maintain a healthy body. According to reports, 50% of Americans claim to actively try to eat healthily. Soups, often viewed as a wholesome meal solution, align with this trend. Organic, plant-based, and clean-label products drive innovation in healthier recipes, including vegan and gluten-free options. In addition, the inclusion of functional ingredients such as collagen, bone broth, and superfoods is a growing trend for soups as consumers pursue wellness. Lifestyles are hectic and busy; thus, the consumer seeks convenient RTE meals. Canned, frozen, and microwaveable formats allow for the soup to provide fast and satisfying meal options. It also is expanding the appeal to working professionals and students with growing demand for single-serving and convenient packaging. Apart from that, consumer demand for varied and international flavors is the other key driver of premiumization in the soup market. Companies are bringing out gourmet variants and region-specific flavors to reach adventurous palates. Products, such as bisques, chowders, and spicy ethnic recipes, are growing in popularity with the country's consumers. Premium ingredients and artisanal preparation methods are attracting more high-income customers looking for dining experiences at home. Hence, these drivers are building a dynamic market landscape in the country.

Asia Pacific Soup Market Analysis

The market is experiencing robust growth propelled by several key factors such as the region's diverse culinary traditions. Urbanization across region is leading to busier lifestyles, with consumers seeking convenient and time-saving meal solutions. As per the Press Information Bureau (PIB), it is expected that by 2030, more than 40% of India's population will live in urban areas. In addition, packaged and ready-to-eat soups are gaining popularity as they provide a quick and nutritious alternative to traditional cooking. Single-serve and instant soup formats, in particular, are thriving among working professionals, students, and nuclear families. Apart from this, the increasing awareness among individuals about health and wellness is catalyzing the demand for soups perceived as healthy meal options. Consumers in the region are looking for low-fat, low-sodium, and nutrient-rich products. Manufacturers are incorporating natural ingredients and eliminating artificial additives to meet the demand. The soups with herbal extracts, traditional medicinal ingredients, and superfoods, including ginseng and turmeric, are most popular in markets such as China, Japan, and India. With the growth of middle-class population in Asia-Pacific, where the inflating income levels result in a significant amount of expenditure on premium and gourmet food products, the trend is going to be high in the near future. This is impacting the demand for exotic soups featuring international flavors and artisanal preparation methods. Such trends are even more prevalent in the rapidly expanding economies of China, India, and Indonesia.

Europe Soup Market Analysis

Soups are witnessing growing demand due to health and wellness considerations in Europe. Consumers have a growing affinity for organic, vegan, and gluten-free labels on soups. The emphasis of manufacturers is now more on using nutrient-rich ingredients, such as lentils, quinoa, and superfoods, for appealing to health-conscious consumers. Functional soups, containing added vitamins and probiotics, are also seeing growing acceptance in Germany and the UK. Moreover, the individuals in the region are having heavy workloads and living a busier schedule, which is encouraging them to purchase convenient and on-the-go meal options, such as soup. According to reports, employees in London officially work longer hours than those in any other European city, averaging 2,003 hours annually. Besides this, innovations in packaging, for example, pouches that seal and single-serve cups are making these more attractive. Urban areas are quite prominent in adopting this trend of hassle-free meals by working professionals and students. Sustainability has also become one of the top concerns for the European consumers. Buyers are often looking for soup products made locally and produced following sustainable practices. Another innovation in soup production is being led by the focus on reducing food waste, as some brands use surplus vegetables or imperfect produce. This trend is in line with Europe's commitment to environmental consciousness and supports brands that emphasize ethical practices.

Latin America Soup Market Analysis

Soups hold a significant place in Latin American cuisine, with traditional recipes including sancocho, pozole, and caldo resonating across the region. This cultural attachment supports steady demand for both homemade and packaged varieties. Urbanization in countries such as Brazil and Mexico is catalyzing the demand for convenient meal options. According to the CIA, the urban population in Mexico was 81.6% of the total population in 2023. The rise of read-to-eat and instant soups is often now becoming part of busy households, especially with young professionals in Brazil, Mexico, and Argentina. Moreover, growing health and nutrition awareness is changing consumer preference toward low-fat, organic, and nutrient-rich soup options, prompting brands to use natural ingredients and communicate wellness attributes. Furthermore, the growth of supermarkets and e-commerce is improving access to packaged soups, broadening their appeal beyond urban centers, and driving regional market growth.

Middle East and Africa Soup Market Analysis

The soup market in the Middle East and Africa is shaped by unique cultural traditions. Soups are widely integrated in local cuisines, with traditional varieties such as lentil soup and harira widely consumed. This cultural significance ensures consistent demand, especially during religious and festive occasions. In addition, the increasing demand for nutritious meal alternatives among individuals is impelling the market growth. Soups made with natural ingredients and offering functional benefits, such as those enriched with vitamins or local superfoods, are gaining traction. Apart from this, improving retail infrastructure, along with the thriving e-commerce platforms, are enhancing access to packaged soups. People in the region are increasing preferring online channels for the purchase of food items. According to the reports, the e-commerce sector in the Middle East is forecasted to reach a market volume of USD 50 Billion by 2025.

Competitive Landscape:

The competitive landscape of soup market is characterized by fierce competition among key players through innovation in products, expansion of portfolio, and strategic marketing initiatives. Companies are moving towards offering healthier products-organic, plant-based, low-sodium soups. Packaging innovation such as designs that are green-friendly, portion-controlled, and other variations can be employed by companies for the environmentally conscious consumers. Furthermore, the companies are using e-commerce platforms and direct-to-consumer approaches to make products more accessible and able to reach a better deal of customers. Retailers' partnerships, advertising campaigns investments, as well as launching limited-edition flavors, all further fuel the competition. Regional flavors and premium offerings have also fast-tracked efforts towards making products stand out in this dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the soup market with detailed profiles of all major companies, including:

- B&G Foods Inc.

- Baxters Food Group Limited

- Blount Fine Foods

- Campbell Soup Company

- Conagra Brands Inc.

- General Mills Inc.

- Nestlé S.A.

- Ottogi Corporation

- Premier Foods Group Limited

- The Hain Celestial Group Inc.

- The Kraft Heinz Company

- Unilever plc

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- January 2025: Natural Grocers®, the largest family-operated retailer of organic and natural groceries in the United States, has expanded its Natural Grocers® Brand Products line with six new savory soup varieties. Each option is Certified Organic, Non-GMO, and made entirely from plant-based, gluten-free, and dairy-free ingredients.

- November 2024: Amy's Kitchen, a national leader in organic and natural food, unveiled five new soups that highlight both international cuisines and classic American Southern dishes. The soups are prepared using organic ingredients including farm-fresh vegetables and grains.

- April 2024: NotCo created a plant-based solution to turtle soup aimed at preserving the global green sea turtle population while respecting the culinary traditions of the many countries that still consume turtle meat. The newly developed NotTurtle Soup leverages NotCo’s advanced AI technology coupled with the culinary expertise of Peruvian Chef Diego Oka to create a dish that replicates the taste and texture of real turtle meat without the turtle.

- November 2023: The Peninsular Export Company launched SAARRU, India's first native soup with local variants. The brand offers three varieties of soup mixes based on regional cuisine and will soon be expanding its portfolio by adding more flavors.

Soup Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Canned/Preserved Soup, Chilled Soup, Dehydrated Soup, Frozen Soup, UHT Soup |

| Categories Covered | Vegetarian Soup, Non-Vegetarian Soup |

| Packagings Covered | Canned, Pouched, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B&G Foods Inc., Baxters Food Group Limited, Blount Fine Foods, Campbell Soup Company, Conagra Brands Inc., General Mills Inc., Nestlé S.A., Ottogi Corporation, Premier Foods Group Limited, The Hain Celestial Group Inc., The Kraft Heinz Company, Unilever plc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the soup market from 2020-2034.

- The soup market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the soup industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soup market was valued at USD 12.6 Billion in 2025.

IMARC estimates the soup market to exhibit a CAGR of 3.38% during 2026-2034, reaching USD 17.2 Billion by 2034.

The soup market is driven by rising demand for convenient and ready-to-eat (RTE) food products, and health-conscious consumers favoring nutrient-rich, low-calorie, and clean-label options. Additionally, urbanization and busier lifestyles accelerate the need for quick meal solutions. Innovations in flavors, packaging, and sustainable solutions, along with expanding vegan and vegetarian dietary preferences are propelling the market.

North America currently dominates the soup market, accounting for a share exceeding 28.7%. This dominance is fueled by a strong culture of soup consumption, seasonal demand, innovative product launches, and premiumization trends.

Some of the major players in the soup market include B&G Foods Inc., Baxters Food Group Limited, Blount Fine Foods, Campbell Soup Company, Conagra Brands Inc., General Mills Inc., Nestlé S.A., Ottogi Corporation, Premier Foods Group Limited, The Hain Celestial Group Inc., The Kraft Heinz Company, and Unilever plc, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)