Solvent Recycling Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Solvent Recycling Market Size and Share:

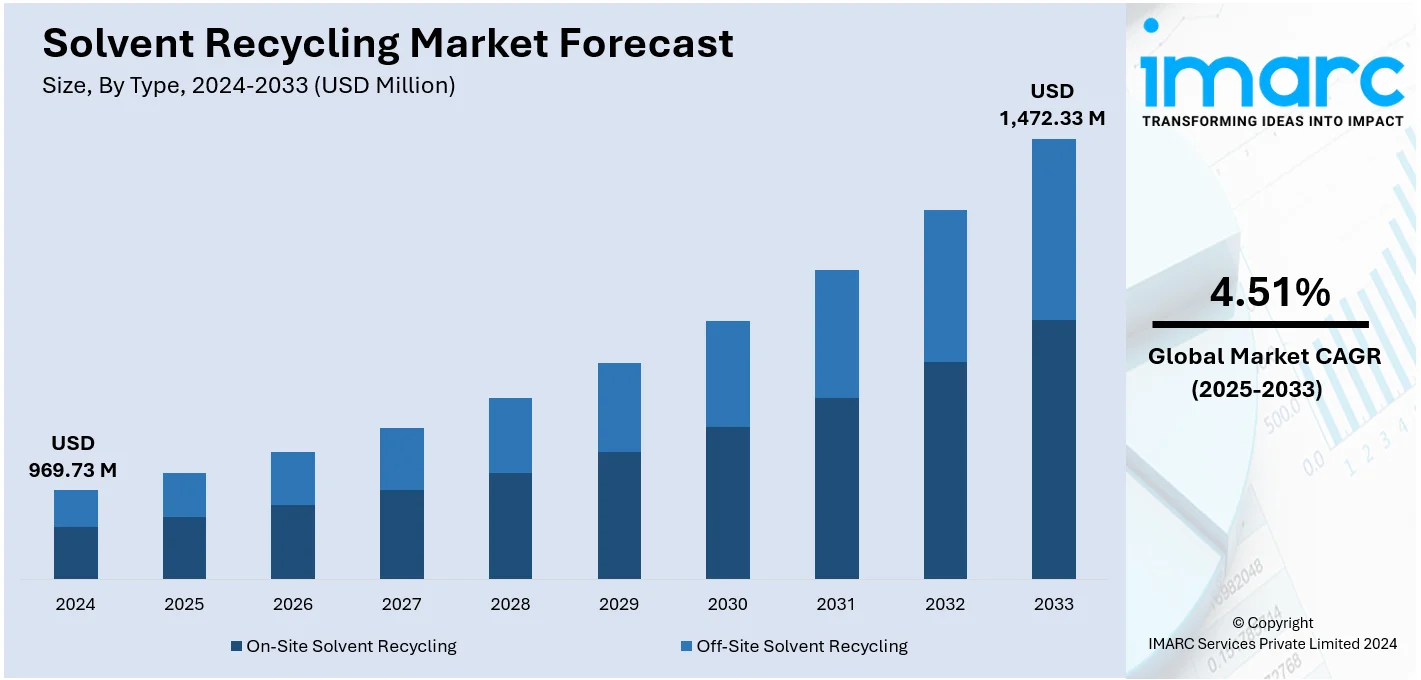

The global solvent recycling market size was valued at USD 969.73 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,472.33 Million by 2033, exhibiting a CAGR of 4.51% from 2025-2033. Asia Pacific currently dominates the market. Heightened environmental concerns and governmental regulations aimed at reducing greenhouse gas emissions, along with increased applications in laboratories, cosmetics, and dry cleaning are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 969.73 Million |

|

Market Forecast in 2033

|

USD 1,472.33 Million |

| Market Growth Rate (2025-2033) | 4.51% |

Solvents play a critical role in numerous industrial processes, ranging from manufacturing and cleaning to chemical synthesis, and the ability to recycle these materials not only minimizes waste but also reduces operational costs. Governments and regulatory bodies are implementing stricter waste management policies and emission controls to reduce the environmental impact of industrial activities. Solvents, often classified as hazardous waste, require proper disposal or recycling to comply with these regulations. Companies are increasingly turning to solvent recycling systems to avoid hefty fines, reduce waste disposal costs, and meet compliance requirements. These regulatory pressures are driving the market and supporting the usage of innovative and efficient recycling technologies.

There are many reasons due to which the United States has turned into a leading region of the solvent recycling market. One of the major drivers of the market in the US is the growing emphasis on sustainability. Across various industries of the country, businesses are facing rising pressure to adopt sustainable practices and reduce their ecological footprint. Recycling solvents is an efficient method of reducing the use of virgin materials and at the same time reducing waste production. As people and businesses are becoming increasingly concerned about environmental degradation, companies have started adopting solvent recovery systems as a part of general sustainability measures. With such technological innovations taking place, solvent recycling has become easier, cheaper, and more environment friendly. Key market players are also adopting technologies to improve their operations. For instance, during 2024, Veolia increased its facility to recover solvent at the Garston, Liverpool plant to 86000 tons every year.

Solvent Recycling Market Trends:

Widespread Application Areas

At present, the increasing demand for recycled solvents in laboratories to reduce the need to purchase new solvents represents one of the key factors impelling the growth of the market. Apart from this, the increasing demand for recycled solvents by dry cleaners to clean the clothes of individuals worldwide is propelling the growth of the market. According to reports, the global dry cleaning and laundry industry to reach US$ 127 Billion by 2025. In addition, the rising adoption of recycling solvents, as they minimize disposal costs, fresh chemical purchase, and storage costs of a business, is offering lucrative growth opportunities to industry investors. Additionally, as people become more conscious of the environmental impact of their purchasing decisions, businesses that adopt sustainable practices such as solvent recycling are likely to gain a competitive edge in the marketplace. This shift toward environment friendly operations is further bolstered by advancements in recycling technologies that make the process more efficient and cost-effective.

Technological Advancements

A rising demand for solvent recyclers that efficiently, conveniently, and at low costs recycle significant amounts of solvents is contributing to the optimistic market view. Several technological improvements in the recycling process for enhanced performance by solvents are contributing to the market's growth. With automation and process optimization technology gaining grounds, it presents new avenues for the growth of the industry. Automated recovery systems include controllers, sensors, and robotic equipment to facilitate processes for smooth recycling and improvement of efficiency through minimizing error occurrences related to human activity. In addition, solvent recyclers can optimize the performance of their equipment by analyzing process optimization data and further alleviating downtime and minimizing operating costs. Advancements in solvent recovery techniques including advanced distillation (vacuum and fractional), membrane filtration, adsorption, and supercritical fluid extraction (SFE) are revolutionizing the global market dynamics. In 2024, Donaldson Company Inc., along with PolyPeptide group AG, initiated a collaboration for making a production scale solvent recovery system, which can be used in peptide purification.

Growth in Demand for Green Solvents

The increasing demand for green solvents across various industries is creating new growth opportunities for market participants. With rising awareness regarding sustainability and stringent regulatory mandates to reduce emissions and reduce environmental impact, industries are steadily shifting toward the adoption of green solvents. The International Energy Agency (IEA) reports that the global energy-related CO2 emissions grew by 1.1% in 2023, increasing 410 Million Tons (Mt) to reach a new record high of 37.4 Billion Tons (Gt). Green solvents are obtained from renewable sources or sources involving a minimal environmental footprint. Solvent recovery and recycling facilitate the reuse capability of green solvents. These technologies enable solvent recovery from waste streams, allowing their purification and reintroduction into the production processes. This also aids in extending their lifecycle and limiting the dependability on virgin solvents. As the green solvent demand continues to grow, the need for advanced solutions for solvent recovery and recycling becomes ever more prominent.

Solvent Recycling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solvent recycling market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- On-Site Solvent Recycling

- Off-Site Solvent Recycling

Off-site solvent recycling makes up the highest share in terms of industry distribution. Processing off-site usually is an extremely expensive proposition from an investment or capital viewpoint and includes investment not only in equipment needed to recycle a particular solvent but also requires adequate spaces and experienced work forces that are always dedicated to executing recycling processes properly. Business units on smaller budgets typically lack such ability. This way, a business can stay focused on the core operations of the business and not get involved in managing complicated recycling processes at the place of operation. Furthermore, off-site solvent recycling minimizes interruptions caused by waste management of solvents. Because of the prompt collection services from off-site recycling companies, used solvents are removed from the site regularly and minimize the possibilitiesso of storage problems like spillage, leakage, or contamination. This enhances safety at work, minimizes liabilities, and effectively utilizes on-site storage space, which would otherwise be used to meet other needs at the operation.

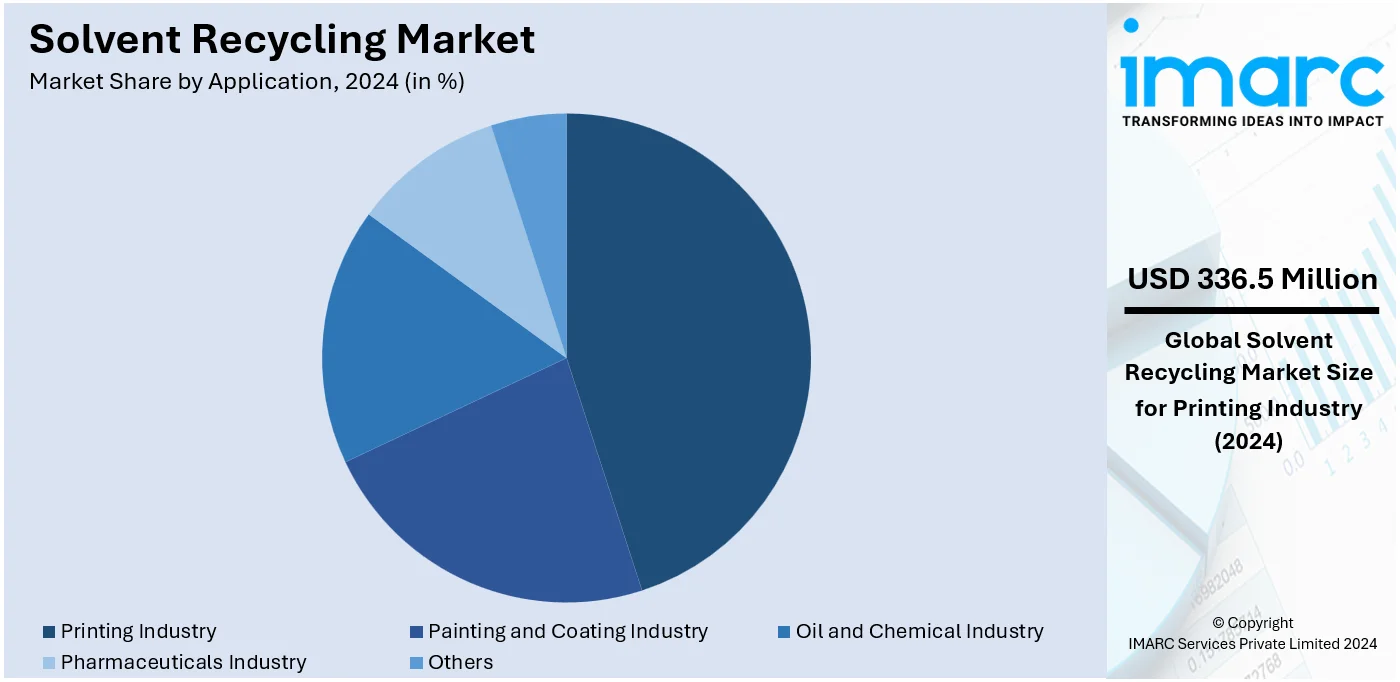

Analysis by Application:

- Printing Industry

- Painting and Coating Industry

- Oil and Chemical Industry

- Pharmaceuticals Industry

- Others

The printing industry accounts for a sizeable share of the solvent recycling market because it significantly uses solvents in different processes, including producing ink, cleaning printing equipment, and maintaining its operational efficiency. Toluene, acetone, and alcohols are commonly used for dissolving pigments, roller cleaning, and removing residues on machinery. However, the frequent use of solvents generates considerable amounts of waste, which must be managed in compliance with environmental regulations. Solvent recycling systems allow printing companies to recover and reuse solvents, reducing both the price of buying new solvents and the expenses related with waste disposal.

The painting and coating industry is one of the biggest solvent consumers as they act as a carrier for pigments, binders, and additives for proper application and drying of coatings. Further, solvents are important for cleaning spray guns, brushes, and other painting equipment. All this has brought about considerable volumes of hazardous wastes, and so the requirement for a solvent recycling system is constantly on the increase. This industry also used recycled solvents for purposes besides cleaning. Recycled solvents formed part of a raw material to formulate new raw materials that considerably reduced costs.

The oil and chemical industry is also one of the most prominent sectors driving the solvent recycling sector. The segment requires solvents for many purposes, such as extraction, separation and chemical synthesis. Furthermore, the usage of solvents is quite vast for cleaning purposes in pipelines, storage tanks, and processing equipment.

The pharmaceuticals industry represents a rapidly growing application area for solvent recycling due to its heavy dependence on solvents for drug formulation, synthesis, and purification processes. Solvents such as methanol, ethanol, and acetone are critical to manufacturing active pharmaceutical ingredients (APIs) and intermediates. However, the production of pharmaceuticals generates significant amounts of solvent waste, much of which is classified as hazardous. Solvent recycling in this sector offers dual benefits of cost savings and environmental sustainability, as it allows companies to recover high-purity solvents that meet stringent quality standards required for pharmaceutical production.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is the biggest segment led by rapid innovation in industries, high environmental awareness, and stringent government rules on waste management across the region. Increased industrial activities generate much solvent waste; thus, to avoid extra expenses and promote the environment, these solvent recycling solutions will be favored as a suitable, cost-effective option compared with waste disposal in their traditional form. In the region, governments are enforcing more stringent regulations on hazardous waste and carbon emissions, which forces industries to adopt solvent recovery systems to be in compliance. The Asia Pacific region is also facing developments in the solvent recycling technology that has now made it quite efficient and is accessible for diverse industries. Advances in the integration of the more modern technologies related to the operations of a fractional distillation system and vacuum distillation membrane separation make solvent recovery processes successful in offering improved purity in recycle solvents against the requirements imposed by rigorous standards. Innovations are particularly vital in sectors like pharmaceuticals and electronics, which directly relate the quality of the solvent to that of the end product.

Key Regional Takeaways:

United States Solvent Recycling Market Analysis

The United States solvent recycling market is driven by economic, regulatory and environmental factors. One of the primary drivers is the increasing focus on sustainability and environmental responsibility. Solvent recycling helps industries reduce hazardous waste and lower their carbon footprint, aligning with the growing demand for eco-friendly practices. As per the Nature Conservancy, the average carbon footprint for an individual in the United States is sixteen Tons, one of the highest rates in the world. In line with this, companies are increasingly adopting solvent recycling to meet stringent environmental regulations, such as those enforced by the Environmental Protection Agency (EPA), which mandate the safe disposal and recycling of hazardous waste. Cost-saving opportunities also play a significant role in driving the market. Recycling solvents allows companies to recover and reuse high-value materials, reducing the need for purchasing virgin solvents. This is particularly appealing in sectors, such as chemicals, pharmaceuticals, automotive, and paints and coatings, where solvents are widely used and can represent a substantial operational cost. The industrial growth across these sectors further propels the demand for solvent recycling. Manufacturing processes often require significant volumes of solvents, making recycling a cost-effective and efficient solution to maintain supply while minimizing waste. Besides this, technological advancements in solvent recycling equipment and processes are another critical driver. Modern systems offer higher recovery rates, energy efficiency, and improved safety, making solvent recycling more accessible and attractive to a broader range of industries.

Asia Pacific Solvent Recycling Market Analysis

The Asia Pacific solvent recycling market is driven by rapid industrialization, stringent environmental regulations, and growing awareness about sustainable practices. India's industrial production increased to 3.8% in December 2023 as against 2.4% in November 2023, revealed the data provided by the Ministry of Statistics and Programme Implementation (MoSPI). The region's expanding manufacturing sector generates significant demand for solvents. This drives the need for efficient recycling solutions to manage waste and reduce costs. One of the key drivers is the increasing stringency of environmental regulations in countries like China, India, and Japan. Moreover, governing agencies in the region are implementing policies to curb industrial pollution and promote waste management practices. Solvent recycling helps industries comply with these regulations by reducing hazardous waste generation and minimizing environmental impact. Economic considerations also play a pivotal role. Recycling solvents allows companies to recover high-value materials and reduce dependency on purchasing virgin solvents, resulting in significant cost savings. In industries where solvent consumption is high, such as automotive and electronics, recycling offers an efficient way to manage resources and enhance profitability. Besides this, technological advancements in solvent recycling systems are another critical driver. Newer technologies provide improved recovery rates, energy efficiency, and scalability, making recycling solutions more appealing and accessible to a wider range of industries across the region.

Europe Solvent Recycling Market Analysis

The solvent recycling market in Europe is driven by a strong focus on environmental sustainability, regulatory compliance, and economic benefits. Europe has some of the world's most stringent environmental regulations, including the European Union's Waste Framework Directive and the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation. These laws encourage the recycling and reuse of hazardous materials, including solvents, to minimize waste and environmental impact, significantly boosting the solvent recycling market. Sustainability is a major driver as European industries strive to align with the EU's circular economy goals. Solvent recycling enables companies to reduce waste generation, lower their carbon footprint, and contribute to resource efficiency. This is particularly critical in sectors, such as automotive, chemicals, and pharmaceuticals, where solvent usage is extensive. There is a rise in the demand for vehicles among individuals in the region due to changing living standards. According to the international Council on Clean Transportation, around 10.6 Million new cars were registered in the 27 Member States of EU in 2023. Economic incentives also fuel the market's growth. Recycling solvents reduces the need to purchase virgin materials, offering significant cost savings for companies. In high-consumption industries, this becomes a key strategy to optimize operational efficiency and remain competitive in the market. Public awareness, in confluence with people’s demand for environmentally responsible products are also driving companies to prioritize recycling.

Latin America Solvent Recycling Market Analysis

The solvent recycling market in Latin America is driven by increasing industrialization, rising environmental awareness, and growing regulatory pressures. Key industries, such as automotive, chemicals, pharmaceuticals, and paints and coatings are expanding across the region, driving significant demand for solvents and creating opportunities for recycling solutions. As per a research report, the Brazilian Drug Market Regulation System (CMED) published a report in which the country’s pharmaceutical market marks a growth of 8.53% in 2023 as compared to the previous year. Besides this, environmental regulations, particularly in countries like Brazil, Mexico, and Argentina, are becoming stricter, encouraging industries to adopt sustainable waste management practices. Solvent recycling helps companies meet their sustainability goals, comply with regulations, and contribute to the region's growing emphasis on sustainable development.

Middle East and Africa Solvent Recycling Market Analysis

Increasing industrial activities, stricter environmental regulations, and a growing focus on sustainability are major factors that are propelling the market growth. Key industries, including petrochemicals, pharmaceuticals, automotive, and paints and coatings, are expanding in the region, generating substantial demand for solvents while creating opportunities for recycling solutions. As per research report, Audi saw impressive sales figures in 2023, increasing by 6% year-over-year in the Middle East. Apart from this, governing agencies in countries like the UAE, Saudi Arabia, and South Africa are implementing regulations to curb industrial waste and promote environmental stewardship. Solvent recycling helps industries comply with these regulations by minimizing hazardous waste and conserving resources. Additionally, increasing awareness about sustainability and corporate responsibility encourages businesses to adopt eco-friendly practices, making solvent recycling a practical and valuable strategy in the region's evolving industrial landscape.

Competitive Landscape:

Key market players in the market are implementing various strategies to improve their business operations, expand market share, and enhance their value propositions to customers. One of the most prominent strategies employed by key players is the adoption and development of advanced recycling technologies. Companies are continuously investing in research and development (R&D) to improve the efficiency and effectiveness of solvent recycling processes. Additionally, the integration of automation, artificial intelligence (AI), and Internet of Things (IoT)-based monitoring systems into recycling equipment is becoming more prevalent. These technologies improve operational efficiency, minimize human intervention, reduce downtime, and ensure consistent solvent recovery. Strategic partnerships and collaborations are also playing a crucial role in driving business growth among key solvent recycling companies. By partnering with industrial customers, waste management firms, and technology providers, market players are strengthening their position in the value chain and creating mutually beneficial relationships. Such collaborations help companies gain access to a steady stream of solvent waste while enabling customers to benefit from customized recycling solutions and streamlined waste management.

The report provides a comprehensive analysis of the competitive landscape in the solvent recycling market with detailed profiles of all major companies, including:

- CBG Biotech

- Clean Harbors Inc.

- CleanPlanet Chemical

- GFL Environmental Inc.

- Grupo Tradebe Medio Ambiente Sociedad Limitada

- Maratek Environmental Inc

- Polaris Srl

- Shinko Organic Chemical Industry Ltd (Osaka Organic Chemical Industry Ltd)

- Veolia Environnement S.A.

Latest News and Developments:

- October 2024: LyondellBasell (LYB) acquired solvent-based recycling company APK. LYB's goal is to further shape the company's distinctive solvent-based technology for low density polyethylene (LDPE) and construct commercial plants in the future.

- November 2024: SepPure announced its plans to cut emissions and costs with solvent recovery technology.

Solvent Recycling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | On-Site Solvent Recycling, Off-Site Solvent Recycling |

| Applications Covered | Printing Industry, Painting and Coating Industry, Oil and Chemical Industry, Pharmaceuticals Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CBG Biotech, Clean Harbors Inc., CleanPlanet Chemical, GFL Environmental Inc., Grupo Tradebe Medio Ambiente Sociedad Limitada, Maratek Environmental Inc, Polaris Srl, Shinko Organic Chemical Industry Ltd (Osaka Organic Chemical Industry Ltd), Veolia Environnement S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solvent recycling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solvent recycling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solvent recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Solvent recycling is the process of recovering and purifying used solvents from industrial waste streams for reuse in production processes. This sustainable practice minimizes waste generation, reduces the need for virgin solvent purchases, and lowers hazardous waste disposal costs, benefiting both the environment and businesses.

The solvent recycling market was valued at USD 969.73 Million in 2024.

IMARC Group estimates the global solvent recycling market to exhibit a CAGR of 4.51% during 2025-2033.

Key factors driving the global solvent recycling market include heightened environmental concerns, stringent governmental regulations on hazardous waste management, and the growing need for cost-effective solutions to minimize operational costs. Expanding applications in laboratories, cosmetics, and dry cleaning industries also contribute to market growth.

In 2024, off-site solvent recycling represented the largest segment by type, driven by its ability to reduce on-site management burdens and operational costs for businesses.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the global market, driven by rapid industrialization and stringent environmental regulations.

Some of the major players in the global solvent recycling market include CBG Biotech, Clean Harbors Inc., CleanPlanet Chemical, GFL Environmental Inc., Grupo Tradebe Medio Ambiente Sociedad Limitada, Maratek Environmental Inc, Polaris Srl, Shinko Organic Chemical Industry Ltd (Osaka Organic Chemical Industry Ltd), Veolia Environnement S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)