Solid Oxide Fuel Cell Market Size, Share, Trends and Forecast by Application, End User, and Region, 2025-2033

Solid Oxide Fuel Cell Market Size and Share:

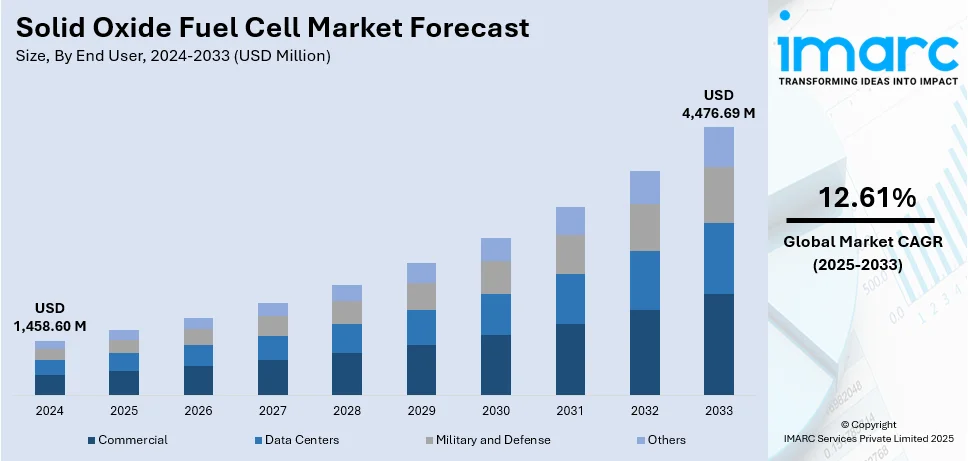

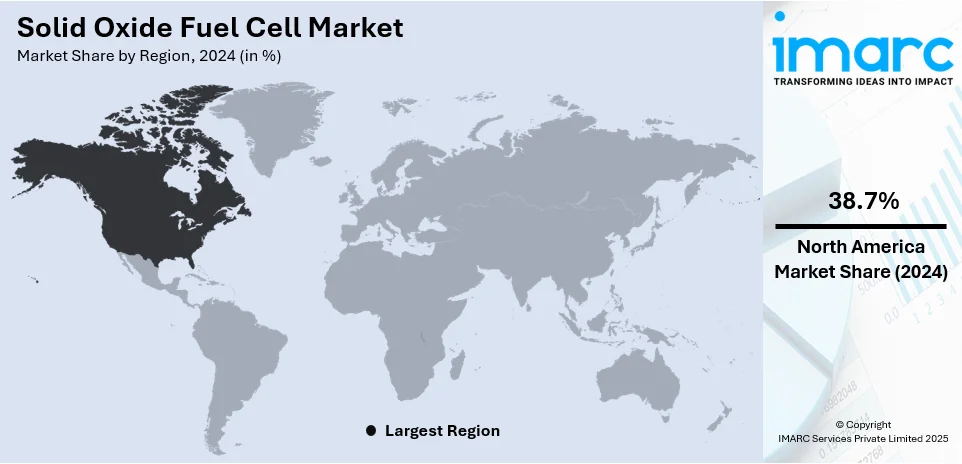

The global solid oxide fuel cell market size was valued at USD 1,458.60 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,476.69 Million by 2033, exhibiting a CAGR of 12.61% during 2025-2033. North America currently dominates the market in 2024, with a significant share of 38.7%. Stringent environmental regulations, significant technological advancements in SOFCs, the trend towards decentralized power generation, the versatility and cogeneration potential of stationary SOFCs, and cost-efficiency in commercial applications are some of the factors creating a positive outlook for the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,458.60 Million |

| Market Forecast in 2033 | USD 4,476.69 Million |

| Market Growth Rate 2025-2033 | 12.61% |

The global solid oxide fuel cell (SOFC) market is driven by the increasing demand for clean and efficient energy systems, coupled with rising concerns about reducing greenhouse gas emissions. Moreover, the versatility of SOFCs in utilizing various fuels, including hydrogen, natural gas, and biogas, enhances their appeal across multiple applications. Also, strategic partnerships aimed at innovations and advancements are providing a boost to market growth. For instance, on October 28, 2024, FuelCell Energy, based in U.S., and Korea Hydro & Nuclear Power (KHNP) signed a memorandum of understanding to develop advanced energy solutions in South Korea jointly. This collaboration is expected to combine FuelCell Energy's solid oxide electrolysis hydrogen platform with KHNP's nuclear power plants to produce cost-effective, domestic clean hydrogen, thereby reducing reliance on imported fuels. In addition to this, continuing improvement in technology, such as increased durability, efficiency, and scalability of SOFC systems, is positively impacting the solid oxide fuel cell market share.

The United States stands out as a key regional market, which is experiencing significant growth due to the rising focus on energy resilience and grid independence, particularly in critical sectors such as healthcare, data centers, and defense. The country's increasing investments in renewable energy integration have enhanced the adoption of SOFCs for distributed energy systems. For instance, on September 26, 2024, the U.S. Department of Energy's Office of Fossil Energy and Carbon Management announced up to USD 4 Million in federal funding to advance solid oxide fuel cell (SOFC) technology, focusing on reversible systems (R-SOFCs). This initiative aims to enhance the versatility and applicability of SOFCs for efficient, low-cost electricity generation from hydrogen or natural gas, supporting clean hydrogen production, energy storage, and renewable energy integration. Additionally, a strong presence by top SOFC manufacturers and constant innovation in cost efficiency and scalability. There is also growing consumer awareness regarding sustainable energy solutions and corporate initiatives toward net-zero emissions that fuel the SOFC market demand across the United States.

Solid Oxide Fuel Cell Market Trends:

Stringent Environmental Regulations

Global initiatives, such as the Paris Agreement, intensify the call for lower greenhouse gas emissions, which compels governments to enforce stricter environmental regulations. As a result, traditional, carbon-intensive energy generation methods are being phased out, which triggers the shift towards cleaner alternatives. This policy by the European Commission focuses on having an economy and a society that will have become climate neutral by 2050, meanwhile setting an intermediate target for its member states and the community in reducing net greenhouse gas emissions by at least 55% by 2030 from its 1990 levels. The new global and regional policies on climate change also accelerate these trends, as this provides innovation in the deployment of cleaner technologies to increase efficiency by deploying SOFCs with lesser emissions. SOFCs boast high operating temperature that allows converting chemical energy to electricity directly as this minimizes wastage in terms of energy while maximizing efficiency. Importantly, SOFCs are not limited to hydrogen fuel alone. They can be used efficiently with a wide range of fuels, including renewables, thereby broadening their potential application, and further cementing their environmental credentials. Besides this, incentives in the form of subsidies and tax credits for green technologies have further catalyzed the adoption of SOFCs.

Ongoing Technological Advancements and Innovations

Significant advancements in SOFC technology, such as breakthroughs in electrode materials and electrolyte designs, improve the tolerance of SOFCs to fluctuating temperatures, reduce thermal stress, and improve durability, which facilitates the solid oxide fuel cell market growth. In addition to this, system-level improvements lead to the creation of more compact and modular SOFC designs. These streamlined systems can be easily integrated into existing infrastructure, significantly broadening the range of potential applications. Moreover, continual innovation in the fuel flexibility of SOFCs is creating a favorable outlook for market growth. Additionally, consistent research breakthroughs aimed at reducing the operating temperatures of SOFCs are making these systems safer and more economical to maintain, which, in turn, is expanding their potential use cases. SOFCs are also gaining ground because of increasing energy efficiency requirements. Data centers are one such sector that is known to be a high energy consumer. The International Energy Agency estimated that in 2022, data centers would consume approximately 240-340 TWh of electricity, accounting for almost 1-1.3% of the world's electricity demand. Therefore, this energy-efficient requirement for critical infrastructure sectors contributes to the growth of the market.

Expanding Decentralization of Power Generation

The trend towards decentralized power generation, largely driven by the growing desire for energy autonomy, improved grid resiliency, and more efficient energy utilization, is contributing to the market's growth. Besides this, SOFCs and their high efficiency and fuel flexibility make them an optimal solution for on-site power generation, especially in areas where grid connectivity is challenging or unreliable. Their ability to provide consistent, uninterrupted power is particularly crucial for critical facilities like hospitals or data centers. Moreover, the cogeneration capabilities of SOFCs, generating both heat and power, provide another advantage. By harnessing the waste heat produced during the power generation process, they deliver improved overall energy utilization, contributing to more sustainable and cost-effective energy systems. Furthermore, the scalability of SOFC technology enables its deployment across a wide spectrum of applications, including individual residential units, industrial sites, and grid support systems. Aligning with this trend, innovative digital infrastructure is being established in the electricity grids-both in the transmission and distribution with around 7% investment growth in 2022 than that of the previous year of 2021-according to the International Energy Agency.

Objectives Established by Governments to Decrease Dependence on Fossil Fuels

Government initiatives play a pivotal part in shaping the growth trajectory of the market. Notably, South Korea’s Hydrogen Economy Roadmap stands out as a comprehensive strategy to reduce dependence on fossil fuels and accelerate the adoption of hydrogen-based energy solutions. This roadmap includes ambitious targets, such as achieving widespread hydrogen production, creating hydrogen-fueled urban areas, and deploying fuel cell technologies across power generation and transportation sectors. The government’s commitment to fostering a robust hydrogen economy is complemented by substantial investments in research and development, infrastructure development, and supportive regulatory frameworks. Similarly, countries like Japan, Germany, and the United States are also introducing policies and incentives to promote renewable energy technologies, including SOFCs, as part of their energy transition strategies. These initiatives aim to reduce greenhouse gas emissions, enhance energy security, and drive technological innovation, thereby creating a fertile environment for the global SOFC market's expansion. Moreover, in 2023-24 Union Budget, the Government of India declared the introduction of mandate of 5% compressed biogas to be adopted in every entities marketing biogas in the country.

Solid Oxide Fuel Cell Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solid oxide fuel cell market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on application and end user.

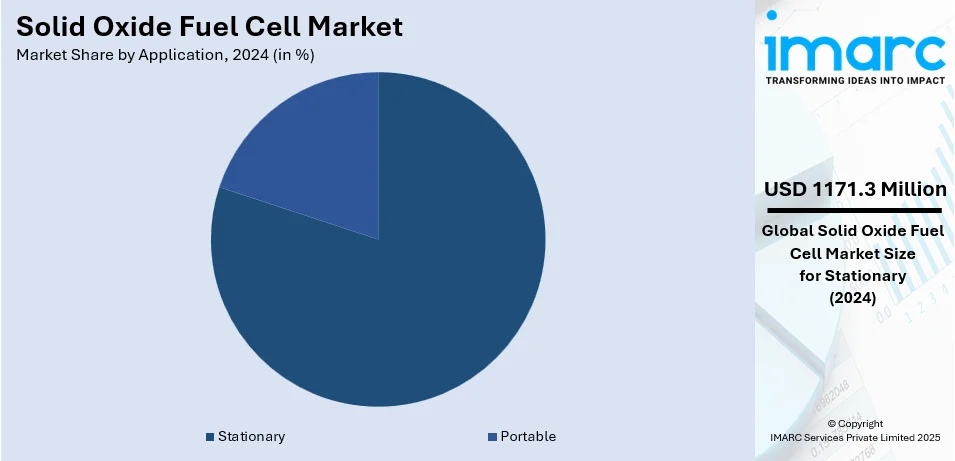

Analysis by Application:

- Portable

- Stationary

Stationary leads the market with around 80.3% of market share in 2024. The demand for stationary SOFCs is being propelled by the unique combination of their adaptability and their potential for cogeneration. SOFCs can be deployed in diverse settings due to their scalability. This broad usability opens a wide range of potential markets for stationary SOFCs. Additionally, they offer the potential for cogeneration or combined heat and power (CHP), where the heat generated during electricity production is captured and used for heating purposes. This enhances overall energy utilization, leading to significant energy cost savings. Furthermore, growing urbanization and industrialization, particularly in developing countries, are spurring the need for reliable, efficient power solutions. In line with this, there is an emerging trend in smart grid technology, where SOFCs, as a part of distributed generation systems contribute to grid stability and reliability. This presents a lucrative landscape for stationary SOFCs, further driving their requirement upwards.

Analysis by End User:

- Commercial

- Data Centers

- Military and Defense

- Others

Commercial leads the market in 2024. The high need for SOFCs in commercial applications is due to their cost-efficiency, resilience, and versatility. SOFCs provide an excellent solution to these demands, offering high energy conversion efficiency, which significantly reduces energy costs. They provide a dependable power supply for ongoing business operations due to their resilience to power outages, which is a growing concern considering climate change and grid vulnerabilities. SOFCs are also fuel agnostic, able to operate on a diverse array of fuel sources, allowing businesses to select the most cost-effective or readily available fuel. They align with corporate sustainability goals, given their lower emissions profile compared to traditional energy sources. The market is seeing lucrative potential due to the commercial sector's increasing focus on data centers and the electrification of numerous operations. Furthermore, businesses appreciate the minimal noise and vibration from SOFCs, which can be critical for certain environments such as hospitals, data centers, and offices.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.7%. Energy policies, regional resource availability, and the region's commitment to innovation and technological advancement are the primary drivers for the increasing demand for SOFCs in North America. There are ample natural gas reserves that make an ideal setting for the deployment of SOFCs, as this fuel type is compatible with it. North America is an innovation hub for technology, as several SOFC manufacturers are based in the region and, therefore, require an internal supply chain for the product. The region houses several organizations that promote research and development (R&D) activities, and deployment of advanced energy technologies, such as SOFCs. Federal- and state-level policies, including the ITC for fuel cells, encourage the adoption of SOFCs. Furthermore, the increased focus on grid modernization and infrastructure resilience in North America is fueling the growth of the market.

Key Regional Takeaways:

United States Solid Oxide Fuel Cell Market Analysis

In 2024, the United States represented 80.67% of the North America solid oxide fuel cell market. The market is experiencing significant growth due to immense government support and funding. In 2021, the U.S. Department of Energy (DOE) unveiled plans to provide up to USD 32.5 million in federal funding for cost-shared research and development (R&D) to speed the commercialization of SOFC technology. This program reflects the U.S. government's commitment to clean energy technologies and innovation in fuel cell solutions. The implementation of favorable programs and initiatives further increases adoption in residential, commercial, and industrial applications of SOFCs. In addition to incentives, regulatory measures such as tax credits and subsidies for green technologies are making SOFC systems more attractive. By gaining more federal funds and technological assistance, the domestic U.S. market for SOFCs seems destined to become increasingly large enough to help with the country's efforts toward further sustainable and less energy-intensive efficiency.

Europe Solid Oxide Fuel Cell Market Analysis

The European SOFC market will grow robustly, as large investments in electricity grid infrastructure will be made within the region. The action plan of the European Union, released at the end of 2022, foresees the investment of about EUR 584 Billion (USD 633 Billion) in the electricity grid by 2030, according to International Energy Agency data. Of this, around EUR 400 Billion (USD 434 Billion) will be spent on the distribution grid, of which EUR 170 Billion (USD 184 Billion) will go to digitalization. These investments will improve grid efficiency and further facilitate the introduction of more sophisticated technologies like SOFCs. High efficiency and flexibility in the fuel of SOFCs make them suitable for decentralized power generation, especially in digitally advanced grids. According to the solid oxide fuel cell market forecast, increased focus on clean energy and digital infrastructure, the SOFC market in Europe is expected to grow significantly and in line with these strategic plans and increasing demands for sustainable sources of energy solutions.

Asia Pacific Solid Oxide Fuel Cell Market Analysis

The Asia Pacific Solid Oxide Fuel Cell (SOFC) market is expected to grow significantly due to the rising energy generation capacity in the region. According to the Indian Electrical and Electronics Manufacturers' Association (IEEMA), India's energy generation capacity is expected to grow from 200 GW in 2010 to over 800 GW by 2032, driven by rising power demand. Power equipment production in India is likely to require around USD 300 Billion investments over the next 3-4 years to meet the increasing demand. It is likely to open a wide scope for SOFC technologies that can provide higher efficiency, flexibility of fuel, and low emission. Increasing importance towards sustainable energy sources, in conjunction with the vast investment going into power infrastructure, makes SOFCs a natural fit to fill the gaps for the Asia Pacific region's growing energy requirements. With such improvements, it will be likely to see more widespread adoption in the Asia Pacific SOFC market both through policy enforcement and an overall demand for cleaner, efficient generation.

Latin America Solid Oxide Fuel Cell Market Analysis

The Latin America SOFC market will grow as the region develops energy infrastructure. In 2022, Brazil invested an estimated USD 5.5 Billion in transmission and distribution, however that is a one-third drop from the annual average investment that occurred during the years 2017 through 2021, according to the International Energy Agency. Despite the decline in this investment, opportunities for deploying advanced energy solutions like SOFCs continue to grow through investing in transmission and distribution infrastructure. High efficiency with low emissions mark the fuel cells as suitable candidates for supporting cleaner alternatives to satisfy the region's energy needs. As Latin America moves to diversify its energy mix and improve the reliability of the grid, SOFCs are becoming a viable option for on-site power generation, particularly in remote areas with unreliable grid connectivity. The increasing demand for cleaner, decentralized energy sources will continue to propel the adoption of SOFC technology across the region.

Middle East and Africa Solid Oxide Fuel Cell Market Analysis

The Middle East and Africa (MEA) Solid Oxide Fuel Cell (SOFC) market is expected to grow with substantial investments in the region's energy infrastructure. As reported by the International Trade Administration (ITA), it has been said that the UAE government would invest over USD 163 Billion before 2050 with a growing demand for energy to promote sustainable economic growth. Such an investment will critically play a key role in developing cleaner energy technology, like SOFCs, boasting high efficiency and low emissions. Since MEA countries try to reduce reliance on fossil fuels and gradually expand energy supply through greener sources, SOFCs provide the ideal solution to decentralized power generation. These fuel cells can operate efficiently at high temperatures, and they are capable of being used with many different types of fuels. Due to the advantages, SOFC technology will be used for a wide variety of applications in industrial facilities, residential units, and remote power generation. Energy transformation in the region and an increased focus on sustainability further fuels market growth in the region.

Competitive Landscape:

The global SOFC market is highly competitive, with a mix of established companies and emergent players competing for market share. Companies' investments in research and development (R&D) activities of SOFC to improve performance, efficiency, and durability are gaining attention. The ability to operate at low temperatures extends the fuel cell life span, and the wider the application range is a factor contributing to competition. The industry is witnessing more collaborations and partnerships as companies look to integrate complementary capabilities for market expansion. The regulatory environment and government incentives shape this competitive landscape, influencing both market entry and the pace of innovation.

The report provides a comprehensive analysis of the competitive landscape in the solid oxide fuel cell market with detailed profiles of all major companies, including:

- Adaptive Energy LLC

- Aisin Seiki Co. Ltd.

- Bloom Energy

- Convion Ltd.

- Elcogen AS

- Fuji Electric Co. Ltd.

- Mitsubishi Heavy Industries Ltd.

- POSCO Energy

- SOLIDpower Group

- Sunfire GmbH

- Watt Fuel Cell Corporation

Recent Developments:

- March 2024: Nissan started testing a power generation system that runs on bioethanol and is powered by Solid Oxide Fuel Cells (SOFC). The testing, at the company's Tochigi Plant, is part of Nissan's efforts to boost the power generation capacity of the system, which aims to expand its operations by 2030.

- November 2024: Bloom Energy, a global leader in solid oxide fuel cell generation (SOFC) and solid oxide fuel cell electrolyzer (SOEC) technologies, revealed a groundbreaking project to provide fuel cells for the largest single-site installation ever recorded. Under the financing agreement, Bloom Energy will provide its top-tier SOFCs and oversee equipment management and maintenance.

- January 2024: Frost & Sullivan has evaluated the solid oxide electrochemical cell sector and, according to its findings, honors Elcogen with the 2024 European Enabling Technology Leadership Award. The firm is a worldwide frontrunner in clean energy, focusing on solid oxide fuel cells (SOFC), solid oxide electrolyzer cells (SOEC), stacks, and modules.

- January 2025: Elcogen , a prominent European producer of technology that facilitates the provision of effective, cost-efficient green hydrogen and zero-emission electricity, has today revealed that it has obtained a €5 million investment from SmartCap, a venture capital fund backing Estonian Greentech firms.

- May 2024: WATT Fuel Cell has today revealed the enlargement of its U.S. Advanced Manufacturing Plant and Headquarters located in Mt. Pleasant, Pennsylvania. This growth enhances WATT's production abilities for large-scale commercial manufacturing of the company's latest distributed energy, small-scale fuel cell products: WATT HOME™, WATT REMOTE™, and WATT NOMAD™. The expansion of the WATT Fuel Cell increases the manufacturing plant and office area by 20,000 square feet. WATT's headquarters now features the most sophisticated tubular solid oxide fuel cell manufacturing facilities globally.

Solid Oxide Fuel Cell Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Portable, Stationary |

| End Users Covered | Commercial, Data Centers, Military and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Adaptive Energy LLC, Aisin Seiki Co. Ltd., Bloom Energy, Convion Ltd., Elcogen AS, Fuji Electric Co. Ltd., Mitsubishi Heavy Industries Ltd., POSCO Energy, SOLIDpower Group, Sunfire GmbH, Watt Fuel Cell Corporation. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solid oxide fuel cell market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solid oxide fuel cell market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solid oxide fuel cell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global solid oxide fuel cell market was valued at USD 1,458.60 Million in 2024.

IMARC estimates the global solid oxide fuel cell market to exhibit a CAGR of 12.61% during 2025-2033.

The global solid oxide fuel cell market is driven by increasing demand for clean and efficient energy systems, advancements in fuel cell technology, growing interest in hydrogen-based economies, supportive government policies, and rising applications in distributed power generation and combined heat and power systems.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global solid oxide fuel cell market include Adaptive Energy LLC, Aisin Seiki Co. Ltd., Bloom Energy, Convion Ltd., Elcogen AS, Fuji Electric Co. Ltd., Mitsubishi Heavy Industries Ltd., POSCO Energy, SOLIDpower Group, Sunfire GmbH, and Watt Fuel Cell Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)