Solar Tracker Market Size, Share, Trends and Forecast by Type, Tracking Type, Technology, Application, and Region, 2025-2033

Solar Tracker Market 2024, Size and Overview:

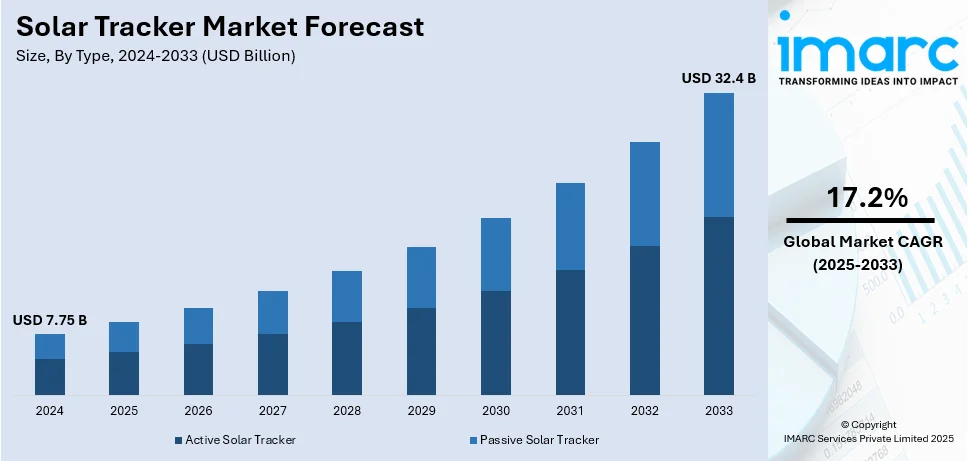

The global solar tracker market size was valued at USD 7.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.4 Billion by 2033, exhibiting a CAGR of 17.2% from 2025-2033. North America currently dominates the market, holding a significant solar tracker market share of over 32.0% in 2024. The market is majorly driven by heightened adoption of renewable energy, continual technological advancements, cost reductions in solar technology, rising demand for utility-scale projects, substantial investments in renewable energy infrastructure, and supportive regulatory policies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.75 Billion |

|

Market Forecast in 2033

|

USD 32.4 Billion |

| Market Growth Rate (2025-2033) | 17.2% |

The global market is primarily driven by the expanding adoption of renewable energy projects aimed at meeting sustainability targets and reducing carbon emissions. In accordance with this, continual technological advancements, such as artificial intelligence (AI) and Internet of Things (IoT) integration for real-time optimization, are enhancing tracker efficiency and reliability. For instance, on October 17, 2024, Nextracker introduced the NX Horizon solar tracker, which incorporates AI for performance optimization and efficient solar tracking, alongside IoT-enabled features to enhance real-time operational insights. With a 35% reduced carbon footprint and Carbon Trust certification, the tracker supports decarbonization in solar energy. Moreover, the rising emphasis on energy security and efficient land use in large-scale solar farms drives the adoption of trackers designed to maximize energy output and minimize spatial demands.

The United States is a key regional market and is experiencing robust growth due to the rising investments in utility-scale solar projects and increasing renewable energy demand to meet decarbonization goals. Notably, on May 16, 2024, the Biden-Harris Administration announced a USD 71 Million investment, including USD 16 Million from the Bipartisan Infrastructure Law, to enhance U.S. solar manufacturing and innovation. This initiative funds 18 projects across 10 states, addressing supply chain gaps, dual-use PV technologies, and thin-film advancements, while supporting clean energy deployment and Justice40 goals for disadvantaged communities. Furthermore, rise in advanced technologies, such as AI-powered solar trackers, are improving energy output and operational efficiency, further accelerating market expansion. Apart from this, stringent federal policies provide tax incentives and grants, encouraging product adoption. Additionally, the growing focus on grid stability and energy storage integration, along with innovations in dual-axis systems, is strengthening solar tracker market demand.

Solar Tracker Market Trends:

Increasing Adoption of Renewable Energy

The increasing deployment of renewable energy across the globe is supporting the growth of the market. Solar power becomes a prominent solution when governments and organizations acknowledge the necessity for sustainable energy solutions. Power optimization devices such as the solar trackers that enable the tracking of the sun to optimize the panels efficiency have become crucial. National targets for renewable energy are being established and measures, including tax credit and subsidies are being provided for expansion of solar power systems. This governmental support is further augmenting the growth of the solar tracker industry. The growing interest towards adoption of sustainable energy, especially solar energy due to the drive for low carbon footprint and energy security is also fostering the sales of solar trackers. Moreover, improvements in tracking technologies which render them more dependable and productive are resulting in their increasing appeal to investors and energy companies. According to a report, with current policies and market conditions, global renewable power capacity is projected to increase to 7,300 GW during the 2023-2028 forecast period.

Cost Reduction in Solar Technology

Over the past decade, the cost of solar panels has significantly decreased, making solar energy more economical compared to traditional energy sources. Technological drivers, manufacturing innovation, and increasing demand have reduced the costs of solar trackers that improve the efficiency of solar installation. Global renewable electricity generation is expected to rise to more than 17,000 TWh by 2030, almost 90% higher than in 2023. That amount would be sufficient to cover the total power demand of China, and the United States combined, in 2030, says the IEA. The reduced costs have made solar energy solutions more popular among residential, commercial, and industrial consumers. Additionally, with ongoing advancements, the effectiveness of solar trackers continues to improve. Given their potential for high returns on investment, they are widely utilized in energy projects. This trend is expected to continue as innovation drives further cost reductions and performance improvements in solar tracking technologies.

Rising Demand for Utility-Scale Projects

The escalating demand for utility-scale solar projects is driving market growth. These projects necessitate the deployment of efficient tracking systems to maximize production levels, thereby necessitating large-scale installations. Such projects are advantageous as they employ solar trackers to enhance electricity production by ensuring solar panels maintain direct contact with the sun throughout the day. By September 2024, utility-scale power generation totaled around 3,287 billion kWh, reflecting a 3% year-over-year increase. Consequently, the expansion of large-scale utility projects has exerted pressure on the global solar tracker market. Public and private entities are investing significant capital to construct mega-scale solar power plants with special emphasis on areas that receive high levels of solar insulation. The market has also been experiencing this trend due to the increased requirement for tracking systems in utility-scale project development to achieve the required energy output.

Solar Tracker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solar tracker market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, tracking type, technology, and application.

Analysis by Type:

- Active Solar Tracker

- Passive Solar Tracker

Active solar tracker leads the market share in 2024 due to advancements in technology and enhancements in the sensors as well as motor used in the system. Active solar tracker has a tracking mechanism which follows the movement of the sun to avail more of the sun’s energy and in turn produce more power than a fixed solar power system. These systems incorporate motors and sensors in such a way that allows them to track the position of the sun, as a means of achieving maximum correct positioning of the solar panels at any one time. This makes them more efficient in energy harnessing as opposed to passive trackers, which enhances their application in assorted big solar plants. The need to improve and optimize solar energy is putting pressure on economies and this is pushing the uptake of active solar trackers hence leading to the dominance in the solar tracker market share.

Analysis by Tracking Type:

- Single Axis Tracking

- HSAT (Horizontal Single Axis Trackers)

- VSAT (Vertical Single Axis Trackers)

- TSAT (Titled Single Axis Trackers)

- PSAT (Polar Aligned Single Axis Trackers)

- Dual Axis Tracking

- TTDAT (Tip-Tilt Dual Axis Trackers)

- AADAT (Azimuth-Altitude Dual Axis Trackers)

Based on the solar tracker market forecast, single axis tracking leads the market with around 90.0% of market share in 2024. This can be attributed to the low installation costs as well as the simplicity involved in tracking a single direction. These trackers revolve on a single bearing plane, the most common of which is the North-South or East-West direction, to track movements of the sun across the surface of the earth. This basic system increases the power production of solar panels more than the simple fixed mount systems yet is simpler than the point focused trackers which increase the cost of the equipment. The solar tracker market report points out that single axis trackers are used especially in utility-scale solar power plant where a balance between price and performance is key. Single axis systems are currently being widely used as they provide excellent performance, and which are cost effective and therefore very important in the tracking systems.

Analysis by Technology:

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

- Concentrated Photovoltaic (CPV)

Solar photovoltaic (PV) holds the around 92.5% of market share in 2024, as it is the most used technology that has immense potential of generating electricity from sunlight. PV systems are very compatible with solar trackers, as these increases the production of electricity by adjusting the position of the arrays to get the best angle of the sun. Solar tracker market development is stimulated by the rising trends of residential, commercial, and utility-scale projects installed with PV systems. The market also noted that increased PV technology performance, including higher efficient panels and improved compatibility with tracking systems, is also helping to augment the solar tracker market outlook. The continued market dominance by solar PV is a clear indication of the central place that solar energy will take in the ongoing transition from conventional energy sources to renewable energy.

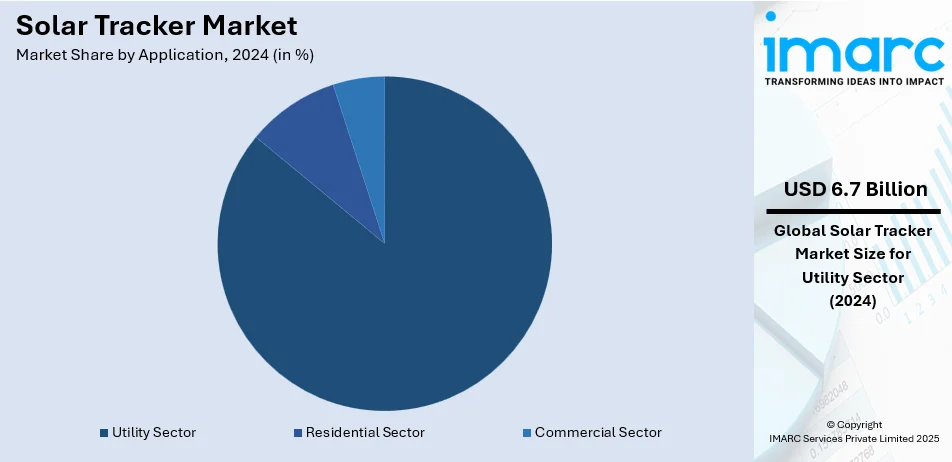

Analysis by Application:

- Utility Sector

- Residential Sector

- Commercial Sector

Utility sector dominates the market with around 86.6% of market share in 2024. Utility operations such as large-scale solar farms which are intended for the generation of power for the electrical grid benefit significantly from tracking technologies that further helps in positioning the panels for power harvesting. The solar tracker market overview reveals that utility applications remain the most popular type of tracker among the market participants as they aim to increase power production to the maximum extent possible. The continuous construction of solar farms for utility-scale solar farms, incentives from the government, and growing energy needs contribute to the perpetuity of the utility segment in the solar tracker market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.0% driven by the development of reliable and effective government policies. In addition to this, sizeable investments in renewable energy structures and supportive environment conditions are also impelling the solar tracker market growth. Ongoing efforts to decrease carbon emission and move towards energy self-sufficiency have seen the incorporation of solar tracker in the region due to their enhanced effectiveness in solar power systems. The United States stands as one of the key participants in this leadership due to significant growth in the application of solar trackers. This growth is supported by federal tax credit initiatives and state-level incentives and regulations promoting clean energy production. Besides, the presence of key market players in North America is expanding strategies towards technological growth and penetration in the market. Such organizations are already operating in the region and, due to the favorable investment environment, are constantly developing and diversifying their production.

Key Regional Takeaways:

United States Solar Tracker Market Analysis

Expansion of renewable energy in the United States is expected to witness a major rise, as the renewable capacity is likely to increase by almost 500 GW between 2024 and 2030, largely due to the incentives available under the Inflation Reduction Act. The International Energy Agency claims that the tax incentives under the IRA are critical for speeding up this expansion. The growing renewable energy demand, mainly in the utility-scale solar projects will be highly instrumental in pushing this market upward. Since solar trackers would be critical in maximizing the performance of the installation by ensuring maximum alignment with the sun for solar panels during all hours of operation. As the U.S. moves forward with more adoption of renewable energy, large-scale projects are likely to see a high deployment of solar trackers in helping meet ambitious energy goals. A combination of government incentives and growing demand for efficient solar solutions presents a strong growth driver for the U.S. solar tracker market.

Europe Solar Tracker Market Analysis

The European solar tracker market is growing at a robust rate due to the high expansion of solar PV capacity across the region. According to SolarPower Europe, in 2023, nearly 55.9 GW of new solar PV capacity was installed across the 27 Member States, a 40% increase from 2022. The cumulative EU solar PV fleet has reached 263 GW, which is up 27% from the previous year, with Germany still the largest contributor at 82 GW. This increase in solar capacity will drive higher demand for solar trackers, essential components that maximize the efficiency of solar energy installations by ensuring optimal sun tracking. European countries want to enhance the renewable share, and high-carbon reductions push the growth for large-capacity, highly efficient solar projects. This would, however, lead to an increased capacity growth in the EU and adoption of tracking systems, placing the solar tracker market in Europe at the position for sustainable growth.

Asia Pacific Solar Tracker Market Analysis

The Asia Pacific market is going to be propelled to immense growth with the rapid expansion in India's renewable energy capacity. India's annual renewable capacity additions are poised to increase much faster than that of any other major economy, including China, as projected by the International Energy Agency. In the main-case forecast, India's capacity additions are expected to more than quadruple, from 15 GW in 2023 to 62 GW by 2030. This rise in renewable energy capacity, particularly in utility-scale solar projects, will increase the demand for solar trackers. Solar trackers are essential for maximizing energy production by ensuring that solar panels remain optimally aligned with the sun throughout the day, particularly in large-scale projects. As India takes its renewable growth to the high gear and the country meets its bold targets, installation of solar trackers shall increase. Furthermore, the growing capacities of renewable capacities along with transition towards more efficient solutions in solar can be a boom for the Asian Pacific solar trackers market in years to come.

Latin America Solar Tracker Market Analysis

Latin America solar tracker market is growing due to the favorable tax incentives and government policies that support the adoption of renewable energy. For example, in Brazil, the new legal framework for solar energy provides tremendous tax benefits for solar projects. As industry reports indicate, anyone or business that starts photovoltaic generation in 2022 will not be charged taxes until 2045. Tax credits and incentives have therefore led to the increase of solar PV installations within the region; hence, large-scale solar projects can only render the most energy with the inclusion of solar trackers. Solar trackers help ensure panels remain aligned optimally with the sun, maximizing efficiency and output of energy. The aggressive renewable energy goals by Brazil and other Latin American countries will continue to increase the demand for solar trackers. Tax benefits, government support, and an increasing focus on efficient energy solutions will propel the growth of the market in Latin America.

Middle East and Africa Solar Tracker Market Analysis

The Middle East and Africa market is expected to grow at a significant rate with several large-scale projects across the region and ambitious renewable energy goals. Dubai is on its way to achieving the Dubai Clean Energy Strategy 2050 and the Dubai Net Zero Carbon Emissions Strategy 2050. The city plans to have 100% clean energy production by 2050. It has already achieved the short-term target of 25% clean energy by 2030, a target which it has upgraded to 27%, according to reports from the World Government Summit. Another is the USD 500 Billion megacity, Neom, planned by Saudi Arabia, which will be launched with a 50% renewable energy mix and eventually 100% renewable energy by 2030, according to the World Economic Forum. These ambitious projects, along with the growing demand for efficient solar solutions, are driving the adoption of solar trackers, which maximize solar panel efficiency and energy production. With the Middle East and Africa shifting toward significant deployments of renewable energy, the solar tracker market is set to boom in these regions.

Competitive Landscape:

The major market players are aiming towards strengthening technological portfolios and covering more worldwide regions to propel their solar tracker market standing. Manufacturers, including NEXTracker, Array Technologies and Solar Flex Rack are already engineering superior tracking mechanisms that will greatly enhance the output and stability of systems installed in the utility-scale solar power sector. These innovations are smart tracking technologies, the standard two-axis trackers, and others that use AI to help in energy tracking. Furthermore, the competition in these industries is increasing as these companies are focusing on forging strategic collaborations, mergers, and acquisitions to tap new segments and expand into new product categories. This way they can come up with a geographical footprint and offer the growing market of solar trackers from different regions through the help of their local and international partners.

The report provides a comprehensive analysis of the competitive landscape in the solar tracker market with detailed profiles of all major companies, including:

- Arctech Solar Holding Co. Ltd.

- Array Technologies Inc.

- Convert Italia SpA (Valmont Industries Inc.)

- DEGER energie GmbH & Co KG

- First Solar Inc.

- Nextracker Inc. (Flex Ltd.)

- Powerway Renewable Energy Co. (SinoTech Power Group)

- Soltec Energias Renovables S.L.

- Sunpower Corporation (Total S.A.)

Latest News and Developments:

- February 2024: Array technologies Inc. and aluminum products company (ALUPCO®) have formed a strategic partnership, combining Array’s industry-leading products with ALUPCO®’s leading production capabilities to expand the growth of renewable energy projects in the Middle East.

- January 2024: Arctech solar handling Co. Ltd expanded its business to Turkey by forming a partnership with Alpon Energy, a solar company specializing in solar trackers, as well as engineering, procurement, and construction (EPC) work.

- January 2024: First Solar Inc. partnered with cleantech solar to procure clean energy for its Sriperumbudur plant. Under the agreement, cleantech solar would provide clean electricity to First Solar’s 3.3 gigawatt vertically integrated solar manufacturing facility in Sriperumbudur.

Solar Tracker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Active Solar Tracker, Passive Solar Tracker |

| Tracking Types Covered |

|

| Technologies Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP), Concentrated Photovoltaic (CPV) |

| Applications Covered | Utility Sector, Residential Sector, Commercial Sector |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arctech Solar Holding Co. Ltd., Array Technologies Inc., Convert Italia SpA (Valmont Industries Inc.), DEGER energie GmbH & Co KG, First Solar Inc., Nextracker Inc. (Flex Ltd.), Powerway Renewable Energy Co. (SinoTech Power Group), Soltec Energias Renovables S.L., Sunpower Corporation (Total S.A.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solar tracker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solar tracker market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solar tracker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar tracker market was valued at USD 7.75 Billion in 2024.

The solar tracker market is projected to exhibit a CAGR of 17.2% during 2025-2033, reaching a value of USD 32.4 Billion by 2033.

The market is majorly driven by rising renewable energy adoption, significant technological advancements like AI integration, cost reductions in solar technology, increasing utility-scale projects, government incentives and subsidies, and the growing need for energy efficiency, security, and sustainable solutions.

North America currently dominates the solar tracker market, accounting for a share exceeding 32.0%. This dominance is fueled by strong government incentives, robust investments in renewable energy infrastructure, advanced technologies, and supportive regulatory policies promoting solar energy adoption.

Some of the major players in the solar tracker market include Arctech Solar Holding Co. Ltd., Array Technologies Inc., Convert Italia SpA (Valmont Industries Inc.), DEGER energie GmbH & Co KG, First Solar Inc., Nextracker Inc. (Flex Ltd.), Powerway Renewable Energy Co. (SinoTech Power Group), Soltec Energias Renovables S.L., and Sunpower Corporation (Total S.A.), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)