Solar Shading Systems Market Report by Product Type (Blinds, Shades, Louvers, Textiles), Geometry (Horizontal, Vertical, Egg-Crate), Mechanism (Fixed, Manual, Motorized), Material (Metal, Glass, Wood, and Others), and Region 2025-2033

Solar Shading Systems Market Size:

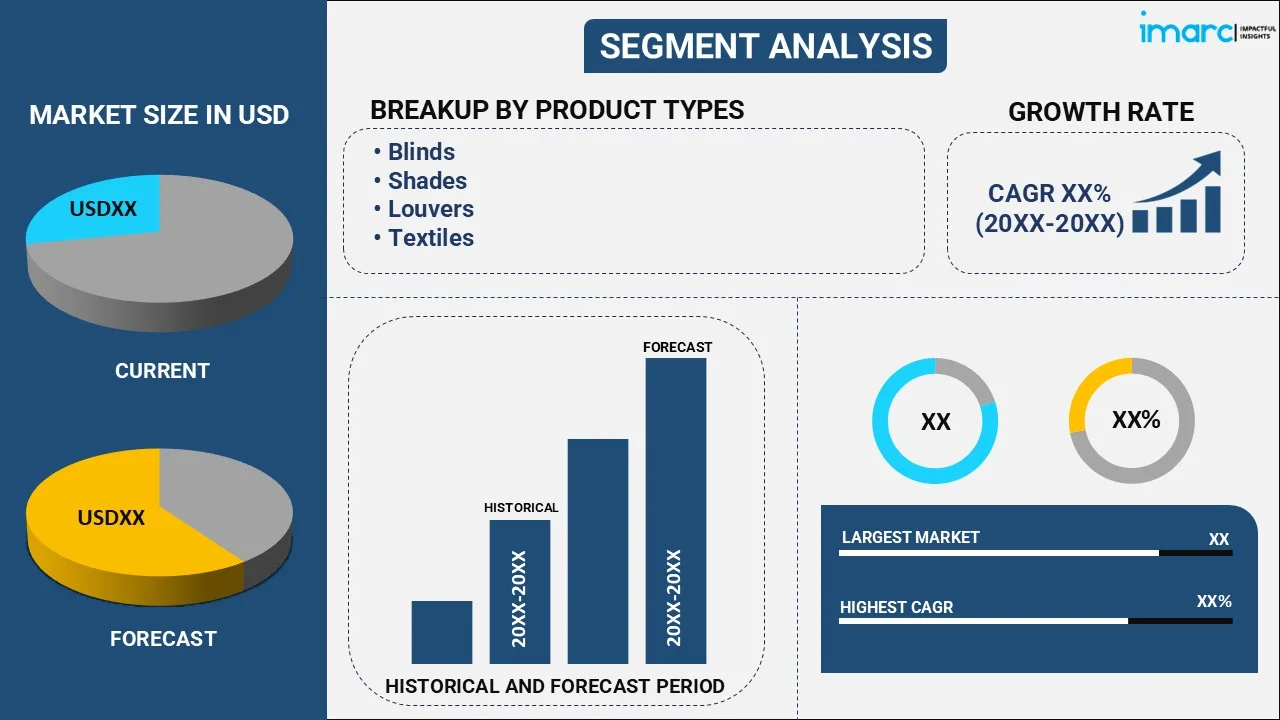

The global solar shading systems market size reached USD 12.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3% during 2025-2033. The market is propelled by the growing demand for energy-efficient solutions in buildings, the implementation of stringent building regulations and standards, various technological advancements, and rise of green building practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.1 Billion |

| Market Forecast in 2033 | USD 15.7 Billion |

| Market Growth Rate (2025-2033) | 3% |

Solar Shading Systems Market Analysis:

- Major Market Drivers: Rising energy costs and heightened awareness about sustainability are driving demand for energy-efficient solutions. Besides, the increasing popularity of green building practices and certifications like LEED is boosting the solar shading systems market growth.

- Key Market Trends: Innovations in solar shading technology, such as smart and automated shading systems, are enhancing the efficiency and convenience of these solutions which also represents the key market trend.

- Geographical Trends: The North America market is witnessing significant growth due to stringent energy regulations, widespread adoption of green building standards, and high awareness about energy efficiency. Besides, Europe also remains a key market driven by strong regulatory support for energy-efficient buildings and a mature green building industry.

- Competitive Landscape: Some of the major solar shading systems companies include Duco Ventilation & Sun Control, Glasscon GmbH, Hunter Douglas Inc., Insolroll Corporate, Kawneer (Arconic Corporation), Lutron Electronics Co. Inc, Skyco Shading Systems Inc., Springs Window Fashions, Unicel Architectural Corp., WAREMA Renkhoff SE., among many others.

- Challenges and Opportunities: As per solar shading systems market forecast, high initial installation costs and the complexity of integrating solar shading systems with existing building infrastructure pose significant challenges. Advancements in smart shading technologies and increased adoption of IoT in building management present significant opportunities for market growth.

Solar Shading Systems Market Trends:

Rising awareness about energy efficiency

Energy efficiency is an important consideration for both residential and commercial property owners. Solar shading solutions contribute greatly to energy savings by lowering the demand for artificial cooling. These systems help maintain ideal indoor temperatures by absorbing or reflecting solar radiation, decreasing the need for air conditioning. This reduces energy bills and the environmental impact of buildings. The increased awareness and acceptance of green construction practices, fueled by severe government laws and environmental programs, has also boosted demand for solar shading systems. As more building owners and developers see the long-term cost savings and environmental benefits, the market for solar shading systems is likely to grow substantially. As per the US News, in the U.S., energy efficiency is beating the global average efficiency improvement rate at 4%, with $86 Billion allocated for the goal under the Inflation Reduction Act.

Increasing construction activities

The global growth in construction activity, particularly in metropolitan areas, is a major driver of the solar shading systems market. As cities grow and new buildings are constructed, the demand for modern, energy-efficient infrastructure increases. Solar shading systems are increasingly being used into new building designs to meet energy efficiency goals while also improving occupant comfort. The move toward high-rise buildings and smart cities, particularly in emerging nations, is also driving up demand. For instance, Singapore's Smart Nation initiative has transformed the city-state into one of the most technologically advanced nations in the world and is unique in its holistic approach to smart city development. Similarly, Amsterdam's Smart City program is a comprehensive approach to sustainability, innovation, and quality of life. It focuses on areas such as mobility, energy, and circular economy, and has resulted in notable achievements such as the reduction of CO2 emissions and the development of new smart mobility solutions. Furthermore, retrofitting existing buildings with innovative shading technologies is becoming a popular technique for increasing energy efficiency and lowering operating costs. The construction industry's emphasis on sustainability and green building certifications is accelerating the implementation of solar shading solutions.

Rising climate changes

Climate change and increased environmental concerns are important drivers in the solar shading systems industry. As global temperatures rise and weather patterns become more variable, the demand for effective climate management within buildings grows. As per CBC Radio Canada, parts of eastern Canada, including Ontario and Quebec, are seeing more frequent heat waves and tropical nights, defined as nighttime temperatures 20 C or higher. For example, according to theClimate Atlas of Canada, the number of tropical nights in Toronto averaged roughly 6.9 annually from 1976 to 2005. With climate change, under a scenario where carbon emissions decline substantially, that is expected to climb to 17.6 annually from 2021 to 2050. From 2051 to 2080, under the two different scenarios for emissions, the average number would rise to 26.4 and 42.8 respectively. Solar shading systems play an important role in mitigating the consequences of climate change by lowering the heat load on buildings, reducing the need for energy-intensive cooling systems. This helps to reduce greenhouse gas emissions and corresponds with global environmental goals. Furthermore, governments and environmental organizations encourage the use of eco-friendly building measures, such as solar shading systems. Tax breaks, incentives, and certification schemes for green buildings encourage property owners and developers to invest in these systems, thus escalating the solar shading systems demand.

Solar Shading Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, geometry, mechanism and material.

Breakup by Product Type:

- Blinds

- Shades

- Louvers

- Textiles

Blinds accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes blinds, shades, louvers, and textiles. According to the report, blinds represented the largest segment.

Blinds are highly versatile and customizable, making them ideal for a variety of uses in both residential and commercial settings. Vertical, horizontal, Venetian, and roller blinds are among the many varieties available, each with its own set of advantages. This range enables customers to select blinds that best meet their unique requirements, whether they are for light control, privacy, or aesthetic appeal. Furthermore, blinds can be made of a variety of materials, including wood, metal, and fabric, allowing additional personalization options. This adaptability to various interior styles and functional requirements contributes considerably to their popularity and market dominance. Additionally, the long-term savings on energy bills make solar blinds an attractive investment for both residential and commercial property owners who are seeking solutions to rising bills. According to the FORBES MAGAZINE, Americans pay an average of $429.33 per month for their utility bills. In 2022, consumers on average paid 14.3% more for electricity than in 2021, which is more than double the overall 6.5% rise in prices, according to Consumer Price Increase data released by the U.S. Bureau of Labor Statistics.

Breakup by Geometry:

- Horizontal

- Vertical

- Egg-Crate

A detailed breakup and analysis of the market based on the geometry have also been provided in the report. This includes horizontal, vertical, and egg-crate.

Horizontal shading systems reduce the need for artificial cooling by minimizing solar heat gain, resulting in decreased energy usage and expenses. They can be created to improve the architectural aesthetics of buildings, making them attractive in modern and contemporary designs. These systems can also be modified to limit the quantity of sunlight that enters a space, allowing for greater light management flexibility and improved interior comfort. They are widely used in office buildings, commercial complexes, and modern residential buildings. As per Centers for Sustainable Systems, by 2050, commercial building floor space is expected to reach 124.6 billion square feet, a 29% increase from 2022, which is further escalating the demand for horizontal blinds.

Vertical systems are excellent at blocking strong sunlight from lower angles, which is especially useful in the mornings and late afternoons. They give a layer of privacy without fully blocking the view, making them ideal for residential and office buildings. These technologies strike a mix between aesthetics and usefulness, adding to the building's architecture while also increasing energy efficiency.

The combination of horizontal and vertical elements makes egg-crate systems highly efficient in blocking direct sunlight from all angles. By reducing solar heat gain significantly, these systems help maintain comfortable indoor temperatures, reducing the need for air conditioning. Moreover, egg-crate systems allow for better control of natural light, optimizing daylight penetration while minimizing glare.

Breakup by Mechanism:

- Fixed

- Manual

- Motorized

Motorized represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the mechanism. This includes fixed, manual, and motorized. According to the report, motorized represented the largest segment.

Motorized systems dominate the market. The growing popularity of smart homes and intelligent building management systems (BMS) is another important aspect contributing to motorized solar shading systems' supremacy. As per IMARC Group, global smart homes market is expected to reach US$ 345.6 Billion by 2032, exhibiting a growth rate (CAGR) of 10.87% during 2024-2032. These systems can be effortlessly linked with a variety of smart devices and BMS, allowing for automated modifications based on real-time data. Motorized shades, for example, can be programmed to descend during peak sunshine hours in order to prevent heat gain or to raise in the morning to allow natural light in. This level of automation improves energy economy and meets the growing customer desire for smart, interconnected home environments, thus creating a favorable solar shading systems market outlook.

Breakup by Material:

- Metal

- Glass

- Wood

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metal, glass, wood, and others.

Metal solar shading systems are renowned for their durability and strength, making them a popular choice for both residential and commercial buildings. Metals such as aluminum and steel are commonly used due to their ability to withstand harsh weather conditions, including high winds and heavy rain. Their robustness ensures a long lifespan, reducing the need for frequent replacements and maintenance. This durability translates into cost savings over time, appealing to cost-conscious consumers and developers looking for long-term solutions, thus increasing the solar shading systems market revenue.

Glass solar shading systems provide a seamless integration with modern building facades, offering a visually appealing solution that enhances natural light while providing shading. These systems are often used in high-end commercial buildings, offices, and luxury residences where aesthetics play a crucial role. Glass shading can include features like tinted, frosted, or patterned finishes, adding to the architectural elegance and sophistication of a building.

Wood solar shading systems offer a warm, natural aesthetic that can enhance the appearance of both residential and commercial buildings. The use of wood adds a touch of elegance and organic beauty, making these systems particularly popular in settings that prioritize natural materials and sustainability. Wood can be used in various finishes and treatments, providing a range of design options to suit different architectural styles.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest solar shading systems market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest regional market for solar shading systems.

North America, particularly the United States and Canada, boasts advanced infrastructure and a high rate of technological adoption, which significantly contribute to the region's dominance in the solar shading systems market. The region has a well-established construction industry that readily incorporates innovative building technologies, including solar shading systems. With a focus on sustainable and energy-efficient building practices, North American builders and developers are early adopters of advanced shading solutions. The integration of smart technologies, such as automated and sensor-controlled shading systems, is more prevalent in this region due to the availability of cutting-edge technology and a market that values innovation. Besides, the regulatory framework in North America is another key factor driving the market share. Governments at both federal and state levels have implemented stringent energy efficiency standards and building codes. THE INFLATION REDUCTION ACT which has spurred a clean energy boom, contributing to more than $360 billion in private sector clean energy announcements. According to the Act, Americans who installed the mentioned technologies in 2023 can claim credits on their tax returns due on April 15, 2024. For instance, families who install an efficient electric heat pump for heating and cooling can receive a tax credit of up to $2,000 and save an average of $500 per year on energy bills.

Competitive Landscape:

- The solar shading systems market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the solar shading systems industry include Duco Ventilation & Sun Control, Glasscon GmbH, Hunter Douglas Inc., Insolroll Corporate, Kawneer (Arconic Corporation), Lutron Electronics Co. Inc, Skyco Shading Systems Inc., Springs Window Fashions, Unicel Architectural Corp. and WAREMA Renkhoff SE.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- As per the solar shading systems market overview, key competitors are constantly improving their product offerings to maintain their market position. They are extensively investing in R&D to produce improved shading solutions that combine smart technologies such automated controls, sensors, and building management system integration. Companies are creating shade systems that can change in real time based on weather conditions, sunshine intensity, and internal temperatures. This not only improves energy economy, but also increases user comfort and convenience. Besides, strategic acquisitions and alliances are important strategy used by market leaders to strengthen their competitive position. Moreover, various players are spending in creative marketing strategies to highlight their products. For instance, In January 2023, the lighting control arm ofLegrand, Vantage, has announced its planned attendance of the lighting conference alongside Legrand shading systems.

Solar Shading Systems Market News:

- In March 2023, DUCO is expanding its business internationally by participating in the world's leading trade fair BAU for architecture, materials and systems (17 to 22 April 2023 in Munich), DUCO will present its latest developments in the field of natural ventilation and architectural shading.

- In March 2023, the VELUX Group launched its Nature Collection of roof window blinds with a 50% lower carbon footprint compared to standard VELUX blinds. The blind profiles are made from Hydro* CIRCAL 75R aluminium, which contains a minimum of 75% recycled post-consumer aluminium scrap. The blind textiles are made from 50% recycled textile and during 2023 this will increase to 100% recycled textile. The low-carbon aluminium accounts for the greatest carbon reduction.

Solar Shading Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blinds, Shades, Louvers, Textiles |

| Geometries Covered | Horizontal, Vertical, Egg-Crate |

| Mechanisms Covered | Fixed, Manual, Motorized |

| Materials Covered | Metal, Glass, Wood, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Duco Ventilation & Sun Control, Glasscon GmbH, Hunter Douglas Inc., Insolroll Corporate, Kawneer (Arconic Corporation), Lutron Electronics Co. Inc, Skyco Shading Systems Inc., Springs Window Fashions, Unicel Architectural Corp., WAREMA Renkhoff SE., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solar shading systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global solar shading systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solar shading systems industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global solar shading systems market was valued at USD 12.1 Billion in 2024.

We expect the global solar shading systems market to exhibit a CAGR of 3% during 2025-2033.

The introduction of solar shading systems in aesthetically appealing designs, shapes, and colors, along with the advent of various product variants integrated with the IoT and Bluetooth technologies to facilitate automatic adjustments and enhance the comfort for the user, is primarily driving the global solar shading systems market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous construction activities, thereby negatively impacting the global market for solar shading systems.

Based on the product type, the global solar shading systems market has been divided into blinds, shades, louvers, and textiles. Among these, blinds currently hold the majority of the total market share.

Based on the mechanism, the global solar shading systems market can be segmented into fixed, manual, and motorized. Currently, motorized exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global solar shading systems market include Duco Ventilation & Sun Control, Glasscon GmbH, Hunter Douglas Inc., Insolroll Corporate, Kawneer (Arconic Corporation), Lutron Electronics Co. Inc, Skyco Shading Systems Inc., Springs Window Fashions, Unicel Architectural Corp., and WAREMA Renkhoff SE.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)