Solar Photovoltaic Glass Market Size, Share, Trends and Forecast by Type, Module, End Use Industry, and Region, 2025-2033

Solar Photovoltaic Glass Market Size and Share:

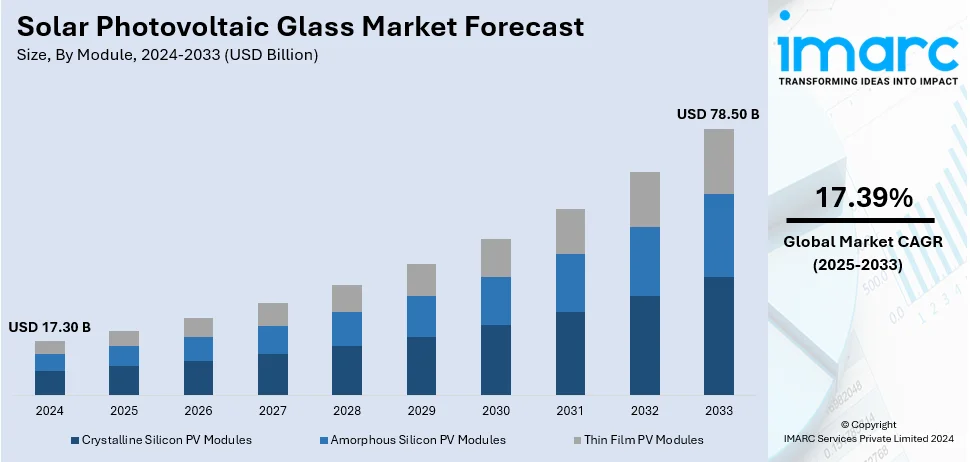

The global solar photovoltaic glass market size was valued at USD 17.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 78.50 Billion by 2033, exhibiting a CAGR of 17.39% from 2025-2033. Asia Pacific currently dominates the solar photovoltaic glass market share of over 59.4% in 2024. The market in this region is driven by the rapid growth of renewable energy adoption, increasing government incentives, declining solar panel costs, and heightened energy demand in countries like China, India, and Japan.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.30 Billion |

|

Market Forecast in 2033

|

USD 78.50 Billion |

| Market Growth Rate (2025-2033) | 17.39% |

The global solar photovoltaic glass market outlook is propelled by the increasing demand for renewable energy (RE) solutions, leading to a rise in the adoption of solar power. Government incentives and subsidies for clean energy, are fueling the market demand. For instance, the Ministry of New & Renewable Energy (MNRE) has carried forward the National Bioenergy Programme for the period of 2021-22 to 2025-26. This programme is recommended for implementation in two Phases. Phase-I of the programme has been sanctioned with a budgetary provision of Rs. 858. Additionally, rising concerns about climate change and the growing need for sustainable energy sources are further driving the market's growth. Furthermore, ongoing technological advancements in PV glass enhance efficiency and durability, impelling the market growth.

To get more information on this market, Request Sample

The United States is becoming a dominant player, holding 85.00% of the market share. The solar photovoltaic glass market demand in this country is driven by the growing shift towards decarbonization, and net-zero emissions targets, leading to increased investment in solar energy. Moreover, the expansion of utility-scale solar power projects fosters the demand for high-quality PV glass. Concurrently, continuous advancements in energy storage technologies complement solar energy growth, enhancing its appeal and strengthening the market share. Also, the increasing adoption of building-integrated photovoltaics (BIPV) boosts glass demand for architectural applications, aiding the market growth. In addition, favorable policies, such as the Inflation Reduction Act, incentivize clean energy investments, fueling the market demand. Apart from this, the rise in residential solar adoption is significantly contributing g to the market expansion.

Solar Photovoltaic Glass Market Trends:

Rising Demand for Building-Integrated Photovoltaics (BIPV)

The solar photovoltaic glass market trend is steadily rising with the rising demand for PV technology integration in buildings. Building practitioners are increasingly using solar PV glass in the design of building facades, windows, and roofs to optimize efficiency and sustainability. The construction industry is now being forced to use RE due to the changes in energy codes and the growing awareness of the effects of the environment on global climate. For instance, in January 2024, Arctech signed an entry into Turkey for BIPV solutions through a strategic partnership with Alpon Energy. Similarly, in March 2024, Fraunhofer ISE, along with its partners, introduced an off-the-shelf BIPV facade concept that enables PV integration into facades. In sum, these latest developments reflect advancements made in the field of BIPV and demonstrate how the solution is becoming accessible and practical enough for wide applicability. Anticipated growth in BIPV demand correlates with increasing government support for sustainable construction and developer efforts to lower building energy use.

Continual Technological Advancements in Solar Glass Efficiency

The ongoing technological improvements are continuously improving the performance and effectiveness of solar PV glass. The addition of nano-particle coatings and thin-film technologies improves the ability of the solar glass to collect and convert light and energy at various lighting conditions including low light conditions. These advancements increase the versatility of the system in different weather conditions, reduce the number of panels needed, and lower the cost of putting up the system, making it more practical. The Ministry of New and Renewable Energy (MNRE) of the Government of India is implementing the Production Linked Incentive (PLI) Scheme as part of the National Programme on High-Efficiency Solar PV Modules. This initiative, with an allocation of INR 24,000 Crore (USD 2.8 Billion), aims to promote the manufacturing of high-efficiency Solar PV Modules. This is basically to be done at an industrial scale which is the GW scale for high-efficiency solar PV modules as stated by MNRE. The efficiency of solar panels has recorded a significant improvement from 10% to over 20 % and some reaching up to 25% conversion as reported in an article by Green Lancer. This progress enables solar systems to convert more sunlight into renewable energy, driving the adoption of solar PV glass in both residential and commercial applications as technology continues to shift.

Growing Focus on Sustainable Agriculture

The solar photovoltaic glass market forecast projects a rise in the augmenting interest for use in sustainable farming, especially for solar greenhouse construction. Greenhouses can produce renewable energy with PV glass while preserving ideal light conditions for crops. This development addresses the global need for efficient methods in farming that reduce the exploitation of energy resources. Solar greenhouses are further being adopted widely because they can support both food production and RE production. This industry is anticipated to boost the market growth further as investments in sustainable agriculture are expected to rise in the future demand for solar PV glass. In this regard, the USDA is providing more than USD 3 Billion for funding agricultural producers and the forest landowners in the United States to participate in conservation programs and to implement climate-smart practices voluntarily. This in turn increases support for renewable energy technologies like the solar PV glass we are talking about today in agriculture as producers turn to sustainable, climate smart farming practices.

Solar Photovoltaic Glass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solar PV market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, module, and end use industry.

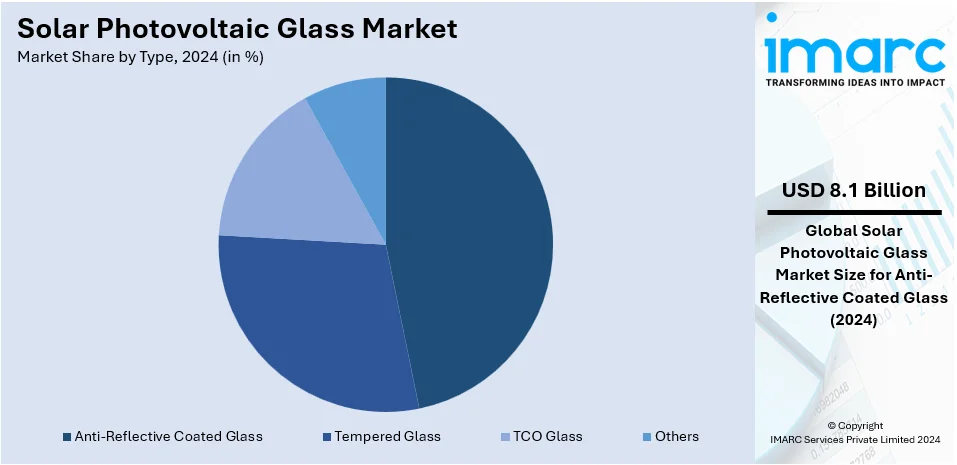

Analysis by Type:

- Anti-Reflective Coated Glass

- Tempered Glass

- TCO Glass

- Others

Anti-Reflective coated glass leads the market with around 46.6% of the solar photovoltaic glass market share in 2024. This dominance is because anti-reflective coatings offer great performance enhancement benefits to solar panels. These coatings minimize the reflectance of light to the surface of the solar cells and as a result, more sunlight is converted to heat or electricity hence enhancing the efficiency of the solar power production. The rising need to produce higher energy from solar installations is driving the use of anti-reflective coated glass. Also, since anti-reflective coatings are relatively cheaper to produce, coupled with improvements in coating technology, the prices of the coatings have come down and manufacturers can now afford to incorporate them into their products. The increasing concern with RE in the residential and commercial segments increases the need for effective solar panels. Furthermore, there are favorable government policies underway in various countries encouraging the use of RE and energy-efficient technologies, and this segment is also benefiting from the fact that anti-reflective coated glass is being considered as the best solution for the enhancement of the efficiency of solar power systems.

Analysis by Module:

- Crystalline Silicon PV Modules

- Amorphous Silicon PV Modules

- Thin Film PV Modules

Crystalline silicon PV Modules take the largest share of the market due to their reliability and popularity among other solar PV glass. These modules are the most used in solar power installations, for both commercial and residential use, and make up the largest share of solar energy globally. The increasing number of consumers seeking solar power, coupled with high conversion efficiency, makes crystalline silicon modules popular. Moreover, continuous advancements in silicon material have enhanced the chances of large-scale applications. Reduced costs of manufacturing solar panels and the ongoing development of the solar energy market also help this segment to develop. Furthermore, government policies and supportive measures promoting the implementation of RE sources worldwide contribute to the growth of crystalline silicon PV modules’ demand.

Analysis by End Use Industry:

- Residential

- Non-Residential

- Utility

The utility segment holds the largest market share in the solar PV glass market, driven by the rapid expansion of solar power projects worldwide. Large-scale PV systems are important in fulfilling the increasing energy demand with clean energy and disengaging from the continued use of conventional energies. The RE targets and subsidies have driven large-scale procurement of utility-scale solar PV plants, which have increased the demand for PV glass. The decline in the cost of solar technology and the increase in the efficiency of solar panels make large-scale farms feasible thus their development. Also, the trend of achieving energy independence and the generation of sustainable power has led to the higher utilization of solar power by utilities. As utilities strive to build the solar portfolio and balance the decarbonization objectives, the utility segment will remain the key driver of solar PV glass demand and propelling the market forward.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 59.4%. This dominance is mainly attributed to the rapid adoption of solar energy in countries such as China, India, and Japan, where the emphasis on renewable energy (RE) is growing to address rising energy demands and combat environmental challenges. China as the largest manufacturer of solar panels has a significant role to play in the growth of the region. Furthermore, the reduction of the price of solar panels and the introduction of incentives and subsidies from the government for clean energy projects also help to advance the market. The region also has a large infrastructure development and urbanization program that provides a good market for large-scale solar projects. In addition, Asia Pacific’s goal of reaching net-zero emissions and the demand for energy self-sufficiency are other factors that will catalyze the solar PV glass market in the region.

Key Regional Takeaways:

North America Solar Photovoltaic Glass Market Analysis

The North American solar photovoltaic glass market growth is driven by the increasing adoption of RE sources and strong governmental support for clean energy initiatives. The United States is a major market that actively promotes the development of sustainable solutions to reach a net-zero economy by 2050. Laws such as the Inflation Reduction Act have promoted solar energy production thus increasing the demand for PV glass. According to reports, America produced approximately 283 TWh in 2024, reflecting a substantial growth in solar capacity, which directly boosts the demand for PV glass as a critical component in solar panel production. Moreover, a rising number of installations of solar power systems in residential and commercial buildings, and the continuously reducing price of solar panels are the other significant growth-inducing factors. Besides this, technological factors such as growth in the quality of glass, energy performance, and appearance are also driving the growth of the market by developing new products like BIVPs. In addition, more investment in utility-scale solar power projects and energy storage systems also creates demand for the solar PV glass market, fostering the market growth in the region.

United States Solar Photovoltaic Glass Market Analysis

The United States targets 95% grid decarbonization by 2035, which will require significant growth in solar energy capacity, driving demand for solar technologies, including solar PV glass. The National Renewable Energy Laboratory, or NREL, states that to achieve this ambitious goal, the U.S. needs to install 30 GWAC of solar PV annually between 2021 and 2025 and ramp up to 60 GWAC per year from 2025 to 2030. A sector that stands to benefit from the fast-paced boom in the coming years is that of solar PV glass, most importantly with increased Building-Integrated Photovoltaics adoption that allows integrating PV into buildings such as windows, facades, and even roof cover. Increasing adoption is based on both governmental policies supportive of renewable energies and technology upgrades with energy saving, green-construction incentives at play. This trend will significantly speed up the growth of the U.S. solar photovoltaic glass market.

Europe Solar Photovoltaic Glass Market Analysis

The market for European solar PV glass is growing much, which is due to a combination of technological and regulatory factors. Other key regulations include the Renewable Energy Directive 2009/28/EC, the National Renewable Energy Action Plan (NREAP), the Solar Europe Initiative, and the Energy Performance of Buildings Directive (EPBD), amongst others, which have created much ground for pushing more towards renewable energy integration and adoption, especially with BIPV. These regulations were intended to foster the integration of solar PV with building structures while encouraging energy efficiency and sustainability. Advanced solar products are also presented to the market, meeting not only aesthetic demands but also practical needs in the construction process. In 2023, the EU recorded a record 55.9 GW of solar PV capacity installed across its 27 Member States, representing a 40% growth from 2022 and doubling the market in just two years, according to SolarPower Europe. This solar adoption surge provides a strong growth driver for the solar PV glass market in Europe.

Asia Pacific Solar Photovoltaic Glass Market Analysis

The Asia-Pacific market for solar photovoltaic, or PV glass, is expanding remarkably due to stringent renewable energy ambitions and fast-paced advancements in solar technologies. China has been driving the growth story in the international renewable energy domain, contributing a range of between 34 percent and 53 percent to annual global renewable generation capacity additions between 2013 and 2021, IRENA estimates show. This supremacy makes China a leader in the growth of solar PV technologies, including solar PV glass. South Korea, on the other hand, targets 48 GW of renewable energy capacity by 2030, which is projected to cover 20% of its domestic energy demand, according to IRENA. Such ambitious targets are driving the uptake of Building-Integrated Photovoltaics (BIPV) and advanced solar solutions, such as PV glass, in the region. In this context, countries in Asia-Pacific are accelerating their renewable energy plans, and therefore, the market for solar PV glass is going to witness growth in the region.

Latin America Solar Photovoltaic Glass Market Analysis

The Latin American solar PV glass market is on the verge of massive growth, backed by strategic partnerships and a growing renewable energy capacity. In 2020, LONGi signed a deal with Solatio Energia to deliver 908 MW of its Hi-MO4 modules across its large-scale solar projects in Latin America, which include commercial rooftop installations in Brazil, according to industry reports. This is likely to drive the growth in the adoption of solar technologies, including solar PV glass, in the entire region. Brazil is a key player in the Latin American renewable energy market, where total installed solar energy capacity increased from about 14.19 GW in 2021 to 24.08 GW in 2022, according to the International Renewable Energy Agency. The country is also on track to reach 1.2 million solar power generation systems by 2024, further fueling demand for solar PV glass as the region continues its transition to cleaner energy. This surge in installations is driving market growth for solar PV glass in Latin America.

Middle East and Africa Solar Photovoltaic Glass Market Analysis

The Middle East and Africa MEA solar photovoltaic, or PV glass market is slated to witness healthy growth as tremendous investments in the solar energy sector are undertaken all over the region. The total value of the solar projects planned to be in operation from 2020-2024 amounts to between USD 15 Billion and USD 20 Billion, as per the Middle East Solar Industry Association. This is an investment boom in the region towards renewable energy development. In May 2022, Emirates Water and Electricity Co. announced the launch of the 1.5 GW Al Ajban PV project, a greenfield solar plant, highlighting the Middle East's growing reliance on solar power. The demand for solar PV glass would likely increase as large-scale solar projects grow both within the Middle East and Africa. They seek the integration of efficient, high-performance solar modules within ambitious renewable energy initiatives in both regions.

Competitive Landscape:

Market players in the solar photovoltaic glass industry are increasingly focusing on technological innovation and strategic collaborations to stay competitive. A major trend is the development of advanced, high-efficiency glass that enhances the performance of solar panels, such as anti-reflective coatings and tempered glass for better durability and energy capture. Leading companies are also expanding their production capacities to meet growing global demand, particularly in regions with aggressive renewable energy targets. Additionally, partnerships between solar panel manufacturers and glass producers are becoming more common to optimize the integration of materials. Some players are venturing into the BIPV segment, integrating solar glass directly into building materials. This shift is driven by the increasing demand for aesthetically integrated and sustainable solutions. Additionally, industry participants are focusing on sustainability efforts, minimizing carbon footprints by adopting more environmentally friendly manufacturing processes.

The report provides a comprehensive analysis of the competitive landscape in the solar photovoltaic glass market with detailed profiles of all major companies, including:

- AGC Glass Europe

- Borosil Renewables

- ClearVue Technologies Limited

- Flat Glass Group Co., Ltd

- MetSolar

- Mitrex

- Onyx Solar Group LLC

- Vitro Architectural Glass

- Xinyi Solar Holdings Limited

- Zhejiang HIITIO New Energy Co., Ltd

Latest News and Developments:

- April 2024: Bluebird Solar launched an n-type TOPCon dual-glass bifacial PV module in Hyderabad at the RenewX 2024. The new product has a rated power output of 600 Wp and provides an energy conversion efficiency of up to 23.25%. It has adopted a 16-busbar design to enhance power generation due to reduced resistive losses. Moreover, the new PV module comes with 12 years warranty and 30-year performance guarantee.

- March 2024: Solar panel recycling company Solarcycle is investing USD 344 million to establish a solar glass manufacturing facility in Cedartown, Georgia. The plant plans to utilize recycled solar panels to manufacture five to six gigawatts of crystalline-silicon photovoltaics each year, generating 600 job opportunities.

- November 2023: System USA collaborated with ClearVue to place transparent solar glass on a greenhouse in California, producing about 82 kilowatts of power and 107,000 kilowatt-hours per year, decreasing expenses. ClearVue is based on the usage of nano- and micro-particles to control the light path to monocrystalline silicon PV modules.

- February 2023: Triveni Glass Ltd plans to allocate Rs 1,000 crore (USD 0.12 Billion) to establish a solar glass production facility in Andhra Pradesh, generating 2,000 job opportunities. The plant is expected to have a capacity of 840 metric tonnes per day and will be located in East Godavari district.

Solar Photovoltaic Glass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Anti-Reflective Coated Glass, Tempered Glass, TCO Glass, Others |

| Modules Covered | Crystalline Silicon PV Modules, Amorphous Silicon PV Modules, Thin Film PV Modules |

| End Use Industries Covered | Residential, Non-Residential, Utility |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGC Glass Europe, Borosil Renewables, ClearVue Technologies Limited, Flat Glass Group Co., Ltd, MetSolar, Mitrex, Onyx Solar Group LLC, Vitro Architectural Glass, Xinyi Solar Holdings Limited, Zhejiang HIITIO New Energy Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solar photovoltaic glass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solar photovoltaic glass market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solar photovoltaic glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Solar photovoltaic (PV) technology converts sunlight directly into electricity using semiconductor materials. When sunlight hits PV cells, it generates an electric current through the photovoltaic effect. Solar PV systems are widely used for residential, commercial, and utility-scale applications, providing a clean, renewable, and sustainable energy source.

The global solar photovoltaic glass market was valued at USD 17.30 Billion in 2024.

IMARC estimates the global solar photovoltaic glass market to exhibit a CAGR of 17.39% during 2025-2033.

Key factors driving the global solar photovoltaic glass market include increasing demand for renewable energy, declining solar panel costs due to technological advancements, supportive government policies and incentives, rising concerns about climate change, and growing investments in large-scale solar projects for energy security and sustainability.

In 2024, anti-reflective coated glass represented the largest segment by type, driven by its ability to enhance solar panel efficiency by reducing light reflection, allowing more sunlight to be absorbed. The growing demand for high-performance solar installations across residential, commercial, and utility-scale sectors has further fueled the adoption of this glass type.

Crystalline leads the market by module owing to their high energy conversion efficiency and long-term durability, making them ideal for residential, commercial, and utility-scale applications. Their declining production costs and proven reliability further enhance their adoption across diverse renewable energy projects worldwide.

The utility is the leading segment by end use industry, driven by due to the growing deployment of large-scale solar farms to meet rising energy demands. Government incentives, renewable energy targets, and the cost-effectiveness of utility-scale solar installations further drive the segment’s leading position in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global solar photovoltaic glass market include AGC Glass Europe, Borosil Renewables, ClearVue Technologies Limited, Flat Glass Group Co., Ltd, MetSolar, Mitrex, Onyx Solar Group LLC, Vitro Architectural Glass, Xinyi Solar Holdings Limited, Zhejiang HIITIO New Energy Co., Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)