Solar Microinverter Market Size, Share, Trends and Forecast by Connectivity, Component, Communication Channel, Type, Application, and Region, 2025-2033

Solar Microinverter Market Size and Share:

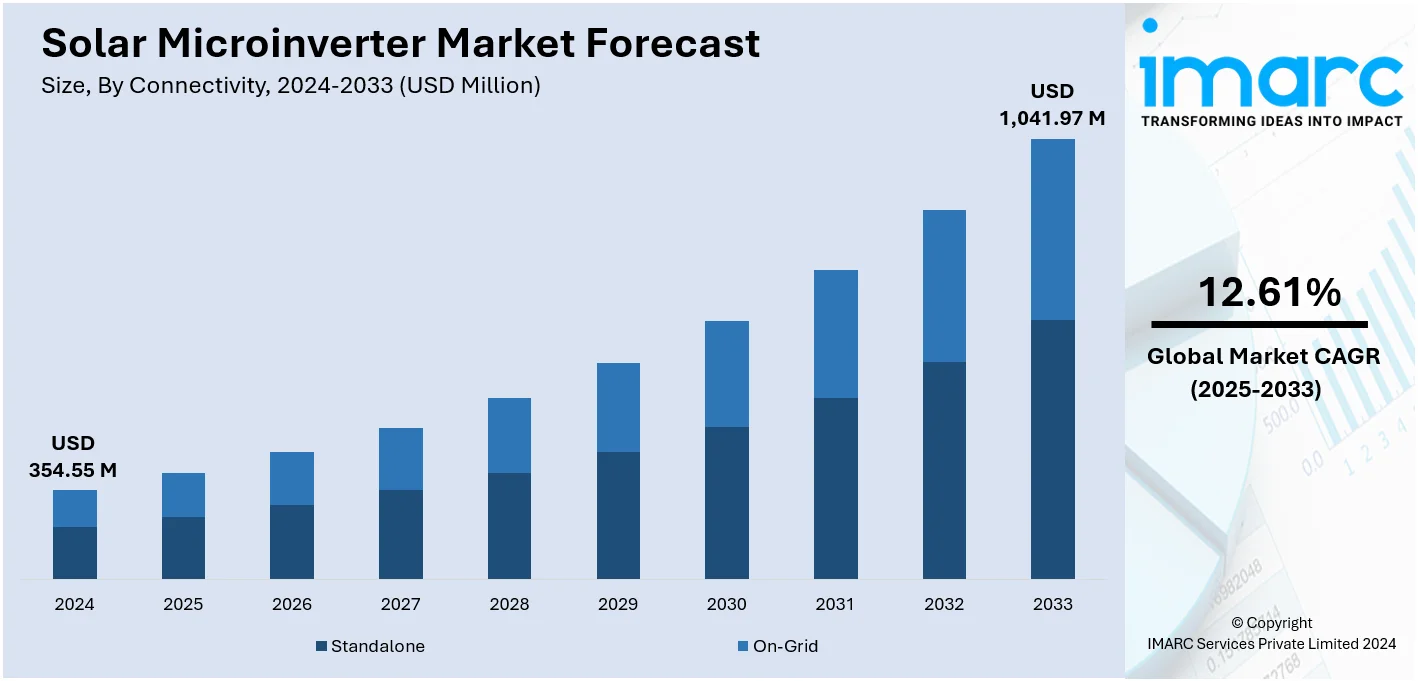

The global solar microinverter market size was valued at USD 354.55 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,041.97 Million by 2033, exhibiting a CAGR of 12.61% from 2025-2033. Asia-Pacific currently dominates the market in 2024, holding a market share of 33.9% in 2024. The demand is prompted by growing usage of solar energy as residential and commercial sectors move toward clean and decentralized sources of power generation, making more efficient solar technologies in demand. Solar microinverters increase energy output by maximizing the performance of each panel, which solves the problems of shading and mismatch, thereby raising the overall system ROI. Continued innovation from market leaders, and increasing demand for panel-level monitoring and robustness in fluctuating conditions, will be driving forces that will continue to build product adoption, further boosting solar microinverter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 354.55 Million |

| Market Forecast in 2033 | USD 1,041.97 Million |

| Market Growth Rate 2025-2033 | 12.61% |

Currently, growing awareness among the masses regarding renewable energy and environment sustainability is promoting the use of solar energy solutions with microinverters proving to be much superior to traditional string inverters. Microinverters maximize energy efficiency by optimally extracting the output of each individual solar panel, which makes them suitable for residential and small commercial-scale applications. Besides this, their ability to improve system reliability, reduce maintenance costs, and provide better performance in partially shaded environments makes them highly attractive to users. Additionally, technological advancements, such as improved power conversion efficiency and reduced system costs, promote their usage. Apart from this, government incentives and policies supporting clean energy adoption like tax credits and rebates, contribute to the growth of the market.

The United States has emerged as a major region in the solar microinverter market owing to many factors. The increasing demand for renewable energy solutions, particularly solar power, has enabled the adoption of microinverters due to their efficiency and ability to enhance the overall performance of solar panels. Microinverters facilitate each panel to function independently for expanding energy production, especially in partially shaded areas. Additionally, technological advancements have made microinverters more affordable, with improved reliability and performance. Government incentives, along with tax credits focus on encouraging the adoption of clean energy solutions further fuel the market growth. Apart from this, the rising focus on energy independence and sustainability also plays a significant role, as users and businesses seek to reduce reliance on traditional energy sources. Moreover, companies work on creating effective social microinverters. In September 2024, HYXiPOWER, a leading high-tech renewable energy company, introduced its range of solar microinverters in North America at RE+ Anaheim 2024. The company promises to deliver smooth solutions by combining intelligent monitoring systems with sturdy and dependable microinverters and batteries, ensuring a more convenient and energy-efficient solar experience for users in the United States.

Solar Microinverter Market Trends:

Increasing solar energy usage

The growing employment of solar energy because of the surging requirement of energy is impelling the market growth. In line with this, there is an increase in the traction of renewable energy options, especially solar energy. The International Energy Agency (IEA) predicts that more than 100 million households will adopt solar PV technology by 2030. Moreover, numerous sectors are pursuing cleaner and more sustainable energy options that reduce environmental effects. In addition, solar microinverters are essential for enhancing the energy production of solar panels by tackling challenges, which include shading or mismatches between panels, thereby ensuring maximum efficiency. This enhanced energy output results in greater returns on investment (ROI) for solar systems. Key players like Enphase Energy and APsystems are expanding product portfolios to meet this rising demand. Their continuous innovations and strategic partnerships are pushing the market toward faster global adoption.

Increasing demand for enhanced efficiency and reliability

The rising demand for enhanced efficiency and reliability is supporting the growth of the market. Besides this, various manufacturers are rapidly advancing in solar microinverter designs to enhance their efficiency and reliability. They create microinverters that offer higher conversion efficiencies and enhance thermal management, which ultimately improves overall system performance. The global market for thermal management technologies attained a size of USD 14.7 Billion in 2024. The consistency of microinverter systems is also enhanced, as they operate independently and reduce the impact of a single point of failure. Moreover, people employ these microinverters in residential places due to their effectiveness. In addition, the increasing demand for improved energy production and reduced maintenance costs are contributing to the growth of the market. Leading firms are focusing on next-generation microinverters with built-in monitoring features. This enables end users to detect and resolve faults early, further boosting reliability.

Growing popularity of individual panel optimization

The rising popularity of individual panel optimization is offering a favorable solar microinverter market outlook. Solar microinverters provide a unique benefit over conventional string inverters by allowing the optimization of each individual panel. In this regard, these microinverters enhance the efficiency of each panel individually, unlike string inverters that consider all panels in a string as one unit. This guarantees that even if one panel is covered, it will not impact the system's total output. Industry reports show that a microinverter system generates 5–30% more power than a string system. In addition, this assists in providing higher energy production and increased ROI. Furthermore, the high adoption of solar microinverters, particularly in scenarios where shading or panel variability is a concern, is bolstering the growth of the market. Market leaders are targeting these high-variability installations with tailored microinverter models. Their focus on performance in challenging conditions is helping them gain competitive advantage.

Solar Microinverter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solar microinverter market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on connectivity, component, communication channel, type, and application.

Analysis by Connectivity:

- Standalone

- On-Grid

Standalone stands as the largest connectivity in 2024, holding 85.0% of the market share. Standalone does not depend on a central inverter, which makes it ideal for small-scale residential and commercial solar installations. This independence offers greater flexibility and simplifies system design, making it easier for users to install and manage their solar systems. Since each panel operates individually, standalone systems provide enhanced performance, especially in areas with partial shading or varying sunlight conditions. This increased efficiency is a major selling point. Furthermore, independent microinverters are simpler to oversee and troubleshoot, enabling users to monitor the performance of every single panel. As energy independence increases and the need for decentralized energy solutions grows, standalone systems provide users with greater control, leading to their popularity. Their ability as well as reliability to enhance energy production in diverse environments encourage their usage.

Analysis by Component:

- Hardware

- Software

Hardware leads the market with 73.2% of market share in 2024. It is important, as it forms the essential backbone of the entire system. Microinverters are mainly hardware components that change the direct current (DC) generated by solar panels into alternating current (AC), which can be employed in residential and commercial settings. The need for hardware is elevated as microinverters are utilized to enhance energy production and maintain the effectiveness of solar energy systems. As each microinverter functions separately, it enhances the efficiency of individual panels, particularly in situations with partial shade or inconsistent sunlight. This makes them a preferred choice for users seeking efficient and reliable solar solutions. Additionally, the increasing affordability and durability of microinverter hardware encourage its utilization in residential and commercial applications. As solar energy adoption increases and the need for energy efficiency becomes high, hardware continues to provide the necessary technology for better energy management and output.

Analysis by Communication Channel:

- Wired

- Wireless

Wired holds 80.0% of the market share as it offers reliable and stable data transfer. Wired connections, like those utilizing Ethernet or powerline communication, guarantee that the microinverters can send performance data effectively and without disruption. This is particularly crucial in solar setups where real-time oversight and system analysis are vital for maximum efficiency. Wired communication is more resistant to interruptions than wireless systems, which may suffer from signal interference or range problems. Furthermore, the exceptional reliability provided by wired systems makes them a better suited choice for people who value dependable performance. Moreover, wired connections tend to be more secure, reducing the possibilities of unauthorized access or data loss. With the rising need for effective energy management and precise monitoring, wired communication continues to be a preferred option, offering a robust and stable connection for improved oversight and regulation of solar energy systems.

Analysis by Type:

- Single Phase

- Three Phase

Single phase microinverters dominate the industry, accounting for 68.2% of market share as they are ideal for residential solar installations. They are made to work with standard residential electrical systems that use single-phase power. They are simpler, more affordable, and easier to install compared to their three-phase counterparts, making them the preferred choice for homeowners. Single-phase systems are also more compact, which is convenient for residential users who have limited space for their solar equipment. Additionally, these microinverters offer improved energy efficiency by optimizing each individual panel’s output, which is particularly useful in homes with varying roof layouts or shading. Their lower cost and ease of use contribute to their popularity since they provide a cost-effective solution for people seeking to adopt solar power. As residential solar energy continues to rise in demand, single-phase microinverters remain a top choice due to their simplicity and effectiveness.

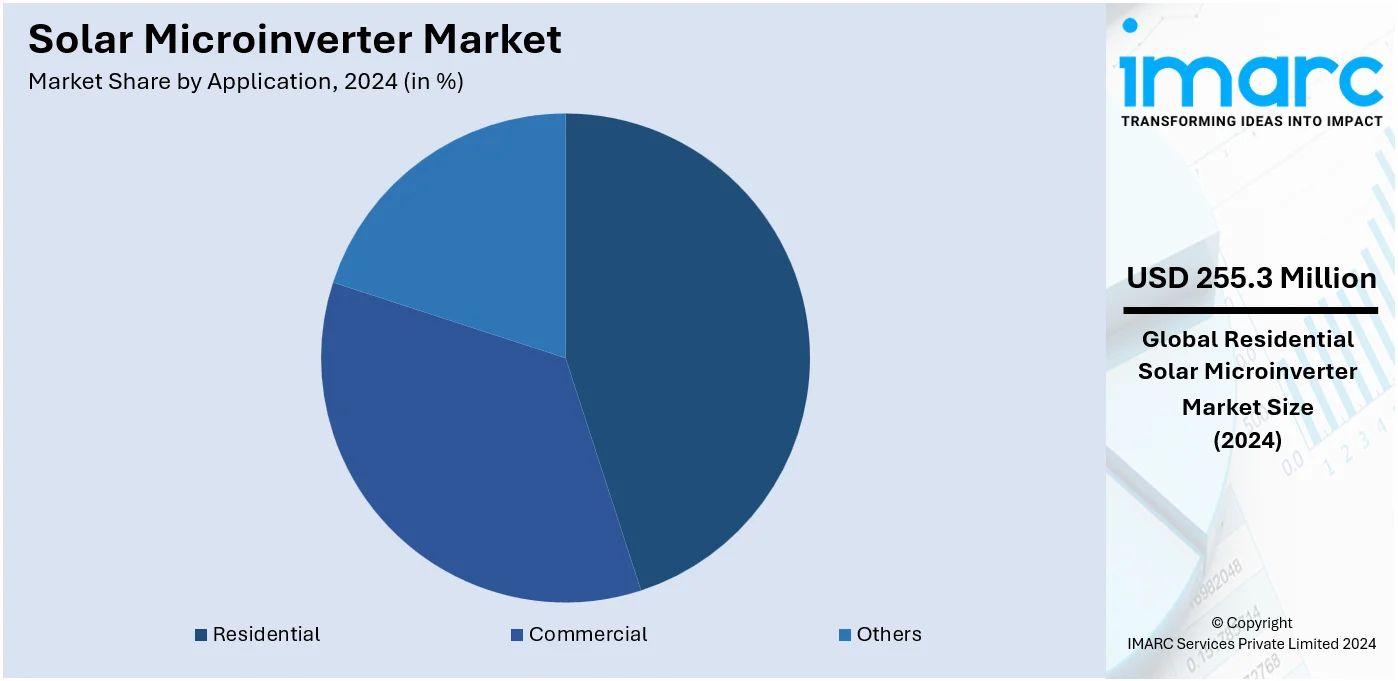

Analysis by Application:

- Residential

- Commercial

- Others

Residential applications hold a share of 72.0% as they are being widely adopted since homeowners turn to solar energy for both environmental and financial benefits. Microinverters are important for residential solar systems because they maximize the energy output of each individual solar panel, which is especially useful in homes with roofs that have partial shading or irregular shapes. By optimizing each panel’s performance, residential users get more energy from their solar systems, improving efficiency and lowering electricity costs. Additionally, microinverters make it easier to monitor and troubleshoot solar systems, providing homeowners with detailed insights into the performance of each panel. Their ease of installation and lower upfront costs also make them an attractive option for residential users. Since people seek to reduce their carbon footprint and become energy independent, microinverters have become the go-to solution for residential solar power.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

The Asia-Pacific region is enjoying the leading position in the market, holding a share of 33.9% in 2024. The region has seen a massive surge in solar energy adoption, driven by countries like China, India, and Japan where there is a strong shift toward renewable energy to combat pollution and reduce dependence on fossil fuels. Besides this, microinverters are gaining popularity in this region due to their ability to maximize solar panel efficiency, particularly in areas with uneven sunlight or partial shading. Additionally, this area benefits from lower manufacturing costs, making solar solutions, including microinverters, more affordable for residential and commercial users. Government policies and incentives in countries like China and India also encourage the employment of solar installations and microinverters. Moreover, big companies in India work on creating new solar microinverters to improve energy output and reduce maintenance costs. In October 2024, Servotech Power Systems Ltd., the prominent energy equipment and solutions provider, introduced a range of new products, such as solar on-grid inverters and solar microinverters at a recent event in India. They intend to create high-quality products at a reasonable cost, appealing to Indian users.

Key Regional Takeaways:

United States Solar Microinverter Market Analysis

In North America, the market share for the United States was 80.00%. The solar microinverter market in the United States is experiencing robust growth, which can be accredited to favorable government policies, increasing user demand for energy efficiency and technological advancements. As reported by industry sources, by 2024, around 4.2 million homes in the United States have solar panels, with each setup generally featuring 25 to 30 panels. This brings the total number of solar panels on residential rooftops across the nation to an estimated 105 to 126 Million. Moreover, federal incentives like the Investment Tax Credit (ITC) have significantly reduced the upfront costs of solar systems, further promoting their adoption. Additionally, state-level initiatives that support clean energy propel the solar microinverter market growth. Technological improvements in microinverters, such as enhanced efficiency, lower costs, and integration with smart grid systems, make them more attractive for both residential and commercial sectors. As electricity prices continue to rise, users employ solar energy solutions for cost savings and energy independence. The shift from traditional string inverters to microinverters, which provide higher energy optimization and flexibility, is gaining traction, especially in the context of distributed energy resources (DER).

Europe Solar Microinverter Market Analysis

The solar microinverter market in Europe is experiencing substantial growth, driven by a strong commitment to reducing carbon emissions and promoting renewable energy. The European Environment Agency (EEA) states that in 2023, renewable energy sources accounted for about 24.1% of the final energy usage in the European Union, highlighting the region’s persistent dedication to diversifying energy sources and reducing reliance on fossil fuels. The Renewable Energy Directive of the European Union and initiatives at the national level have created a strong regulatory structure that encourages the adoption of solar energy. Moreover, the increasing electricity costs throughout the continent prompt both residential and commercial sectors to pursue more affordable and efficient energy options, leading to solar energy being a more viable alternative. Microinverters provide enhanced performance over conventional string inverters, especially for residential uses since they enable optimization at the module level, increased design flexibility, and better energy capture in partially shaded regions. Technological advancements like enhanced monitoring systems and smart grid integration, have also enhanced the appeal of microinverters.

Asia-Pacific Solar Microinverter Market Analysis

The solar microinverter market in the Asia-Pacific (APAC) region is growing rapidly due to increasing investments in solar infrastructure, supportive government policies, and the rising shift towards sustainable energy. Countries like China, India, and Japan wager heavily on solar power as part of their renewable energy strategies, with incentive schemes reducing cost barriers. As stated by the Press Information Bureau (PIB), India has attained a key breakthrough in its renewable energy efforts, exceeding 200 GW of overall renewable energy capacity, aiming for 500 GW from non-fossil sources by 2030. This remarkable achievement further drives the demand for solar energy solutions. Technological advancements in microinverters, offering higher efficiency and reliability, make them more appealing for both residential and commercial applications. Additionally, the shift towards decentralized energy systems is gaining traction, with microinverters playing a key role.

Latin America Solar Microinverter Market Analysis

In Latin America, the solar microinverter market is driven by the increasing demand for renewable energy and government-backed initiatives promoting solar power adoption. As reported by the World Economic Forum, Chile derives 35% of its energy from solar and wind sources, underscoring the nation’s major infrastructure advancements and the swift expansion of its renewable energy sector. This shift towards cleaner energy sources is offering lucrative growth opportunities for solar technologies, including microinverters, which optimize energy production at the panel level. As the region continues to adopt sustainability, the usage of microinverters is expected to rise.

Middle East and Africa Solar Microinverter Market Analysis

In the Middle East, the solar microinverter market is gaining traction, driven by the region's shift towards sustainable energy. Industry reports indicate that oil and gas exports currently represent approximately 30% of the UAE’s economic activity while the proportion of clean energy is growing swiftly. The nation experienced almost a 70% rise in overall renewable energy capacity from 2022 to 2023, indicating a robust dedication to diversifying energy sources. As the UAE and other Middle Eastern nations invest in their renewable energy initiatives, the demand for advanced solar technologies, such as microinverters, is becoming high.

Competitive Landscape:

Key players work on developing innovative and high-quality products that meet the growing solar microinverter market demand for efficient solar energy solutions. These companies focus on improving the performance, reliability, and affordability of microinverters, making them more accessible to a broader audience. They also introduce new technologies, such as improved communication systems and enhanced energy monitoring features. Additionally, they partner with solar installers and manufacturers to expand their market reach and make microinverters available to residential and commercial users alike. They are placing bets on making efforts in research and development (R&D) activities to ensure that the microinverters continue to evolve, providing better energy management and higher efficiency. Moreover, these companies often work closely with government agencies and organizations to promote solar energy adoption, offering incentives and support. For instance, in February 2024, SPARQ the prominent consulting firm, teamed up with Jio Things Limited, a subsidiary of Jio Platforms Limited, to produce, partner on, and distribute its efficient and affordable single-phase microinverters in India. These microinverters are intended for solar energy applications in both residential and commercial settings.

The report provides a comprehensive analysis of the competitive landscape in the solar microinverter market with detailed profiles of all major companies, including:

- ABB Asea Brown Boveri Ltd.

- Chilicon Power, LLC

- Enphase Energy Inc.

- Altenergy Power System Inc.

- SunPower Corporation

- Darfon Electronics Corporation

- Delta Energy Systems

- Siemens AG

- Delta Energy Systems (Germany) GmbH

- Alencon Systems LLC

- ReneSola Ltd.

- Omnik New Energy Co. Ltd.

- EnluxSolar Co. Ltd.

- Sungrow Deutschland GmbH

- Sensata Technologies, Inc.

Latest News and Developments:

- November 2024: Servotech Power Systems introduced the Microsync series microinverters (STMSI-800 and STMSI-1600). They include maximum power point tracking and reverse power flow to return excess power to the grid.

- June 2024: Hoymiles, the well-known microinverter supplier and a clean energy solution provider introduced the MIT-5000-8T microinverter at the SNEC tradeshow in Shanghai, asserting it as the largest and most efficient three-phase version thus far. The device provides a 20% lower cost compared to smaller versions, intended for spacious residences and commercial structures. It features an extensive MPPT voltage range (12V to 136V), a peak efficiency of 97.70%, and a 5 kW output. It accommodates a maximum of eight solar panels, features four MPPTs, and offers natural convection cooling along with IP67 protection.

- March 2024: Enphase Energy, the prominent energy technology company, commenced the distribution of its IQ8P Microinverters, boasting a peak output of 480 W, to Thailand and the Philippines for both residential and commercial applications. These microinverters accommodated high-capacity solar panels and included a 15-year warranty. They offer to improve energy generation and provide superior monitoring through the IQ Gateway.

Solar Microinverter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connectivities Covered | Standalone, On-Grid |

| Components Covered | Hardware, Software |

| Communication Channels Covered | Wired, Wireless |

| Types Covered | Single Phase, Three Phase |

| Applications Covered | Residential, Commercial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB Asea Brown Boveri Ltd., Chilicon Power, LLC, Enphase Energy Inc., Altenergy Power System Inc., SunPower Corporation, Darfon Electronics Corporation, Siemens AG, Delta Energy Systems (Germany) GmbH, Alencon Systems LLC, ReneSola Ltd., Omnik New Energy Co. Ltd., EnluxSolar Co. Ltd., Sungrow Deutschland GmbH, Sensata Technologies, Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solar microinverter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solar microinverter market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solar microinverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar microinverter market was valued at USD 354.55 Million in 2024.

IMARC estimates the solar microinverter market to exhibit a CAGR of 12.61% during 2025-2033.

The increasing demand for solar energy due to environmental concerns, along with the requirement for sustainable power sources, is impelling the market growth. Besides this, technological advancements in microinverter design, such as improved power conversion efficiency and reduced system costs, are making them more appealing to residential and commercial users. In addition, government incentives as well as policies are supporting renewable energy, such as tax credits and subsidies, are encouraging the adoption of microinverters.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, Latin America, wherein Asia-Pacific currently dominates the market due to the escalating need for renewable energy requirements.

Some of the major players in the solar microinverter market include ABB Asea Brown Boveri Ltd., Chilicon Power, LLC, Enphase Energy Inc., Altenergy Power System Inc., SunPower Corporation, Darfon Electronics Corporation, Siemens AG, Delta Energy Systems (Germany) GmbH, Alencon Systems LLC, ReneSola Ltd., Omnik New Energy Co. Ltd., EnluxSolar Co. Ltd., Sungrow Deutschland GmbH, Sensata Technologies, Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)