Solar Encapsulation Market Size, Share, Trends and Forecast by Material, Technology, Application, and Region, 2025-2033

Solar Encapsulation Market Size and Share:

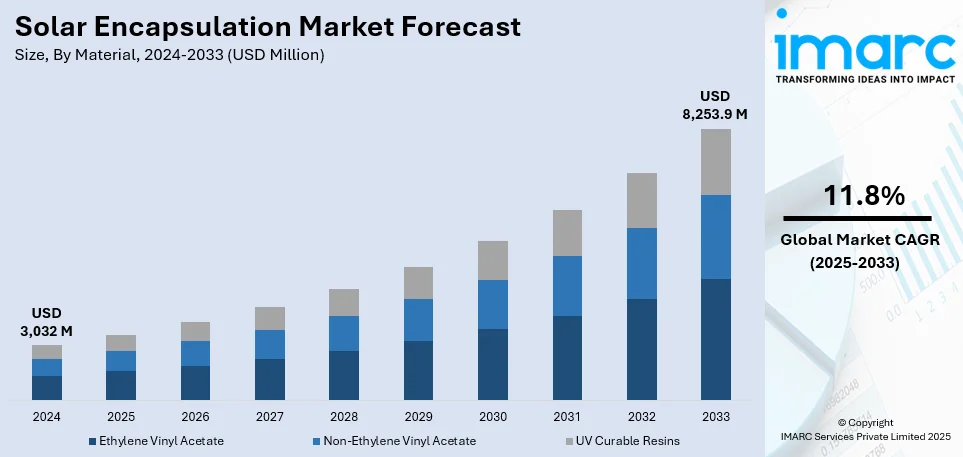

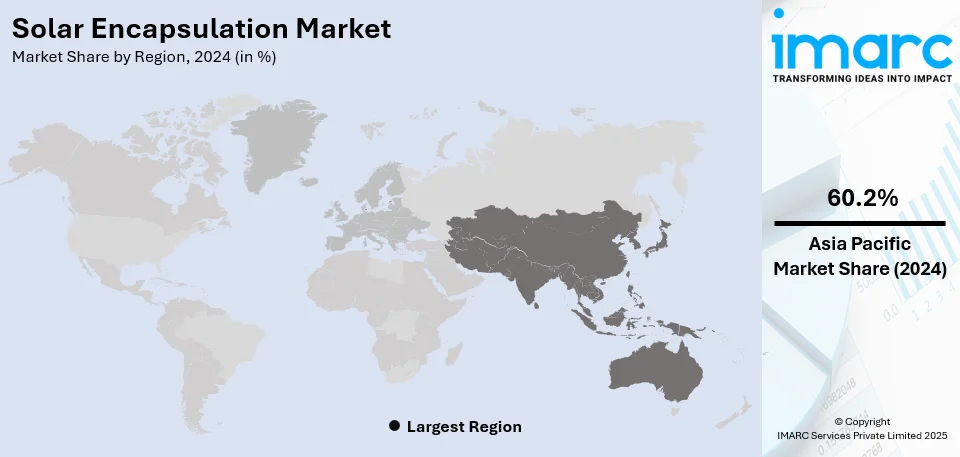

The global solar encapsulation market size was valued at USD 3,032 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,253.9 Million by 2033, exhibiting a CAGR of 11.8% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 60.2% in 2024. The market is primarily driven by heightened solar energy adoption, significant technological advancements in solar module manufacturing for higher efficiency and durability, and stringent government regulations promoting clean energy, driving demand for advanced encapsulants that enhance solar panel performance, longevity, and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,032 Million |

| Market Forecast in 2033 | USD 8,253.9 Million |

| Market Growth Rate (2025-2033) | 11.8% |

The global market is mainly impacted by rising demand for superior materials that improve the longevity and efficiency of solar cells. In line with this, ongoing innovations in solar technology, including bifacial panels and advanced photovoltaic cells, require encapsulants capable of withstanding elevated temperatures and environmental stress without compromising performance. Vikram Solar’s launch of the high-efficiency SURYAVA bifacial module with Heterojunction Technology (HJT) on August 13, 2024, exemplifies this trend, offering over 23% efficiency with G12 cells and improved durability. Furthermore, the push for decarbonization and clean energy solutions further accelerates the need for advanced encapsulants. Additionally, increasing investments in large-scale solar projects, energy-efficient construction, and ongoing research into eco-friendly encapsulants are broadening the solar encapsulation market share.

To get more information on this market, Request Sample

The United States is a key regional market and is witnessing growth due to strong federal incentives like the Investment Tax Credit (ITC), which augment solar installations, increasing the demand for advanced encapsulants that enhance system durability and efficiency. Similarly, the growing adoption of solar energy, particularly in residential and commercial sectors, fuels market growth, as consumers seek high-performance, long-lasting modules. Moreover, the heightened focus on energy security and grid resilience is also encouraging investments in solar technologies, including encapsulants. Notably, on September 12, 2024, the U.S. Department of Energy committed USD 40 Million to enhance the solar energy supply chain, focusing on extending PV system lifespans, promoting recycling, and supporting solar manufacturing. These efforts, alongside advances in eco-friendly encapsulants, are positive influencing the solar encapsulation market outlook.

Solar Encapsulation Market Trends:

Increasing Adoption of Solar Energy

The global shift towards renewable energy, especially solar power, is among the major solar encapsulation market trends. As governments and industries continue to focus on renewable energy investments, the solar power market is expanding rapidly. Solar encapsulants, including EVA (Ethylene Vinyl Acetate) films, are critical in protecting solar cells from moisture, UV light, and mechanical stress. This increase in installations of solar energy, coupled with the requirement to enhance the efficiency and longivity of photovoltaic (PV) modules, is also an added driving factor for the quality encapsulation material. According to the International Energy Agency (IEA), it is expected that global electricity demand will rise yearly by 2.1% by 2040, a rate greater than the increase of global primary energy demand. This trend underlines the continued growth and importance of solar energy, propelling the need for advanced encapsulation technologies to ensure the longevity and efficiency of solar installations.

Technological Advancements in Solar Module Manufacturing

Advances in solar module manufacturing, for example, bifacial and high-efficiency solar cells, driving the technologies to higher levels of sophistication is driving the solar encapsulation market growth. These improve the energy yield and lifetime of solar panels, which would call for encapsulants that can support higher-temperature exposure to UV and other environmental factors without sacrificing efficiency. Enhanced encapsulants also contribute to improving the overall aesthetics and performance of solar modules, making them more attractive for diverse applications. A prime example is the February 2021 launch of CONSERV Giga Fast Cure by RenewSys India Pvt. Ltd. This revolutionary EVA encapsulant decreases the curing time of module production by 2-3 minutes per module, enhancing production efficiency. The demand for advanced encapsulation materials will continue to increase with the development of solar technology, driven by the need for higher performance, durability, and reduced manufacturing time in solar panel production.

Government Regulations and Sustainability Initiatives

Major factors strengthening the solar encapsulation market demand are government policies to promote clean energy and carbon footprint reduction. Global incentives, tax rebates, and sustainability goals are compelling the widespread acceptance of solar energy. Many countries have set renewable energy targets with ambitious goals, and regulations for the use of energy-efficient and durable materials are being implemented for the production of solar panels. These regulations are enhancing the demand for advanced solar encapsulants, which play a critical role in improving the life and efficiency of solar panels to ensure that the solar power system meets severe sustainability standards. As per SEIA, installation in the world is up by over 33% with the majority being in ground-mounted systems. Governments' continued preference for renewable energy sources will thus see the high-performance solar encapsulation materials experience ever-increasing demand, as renewable energy forms require energy efficiency and long lifetime for solar technologies.

Solar Encapsulation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solar encapsulation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, technology, and application.

Analysis by Material:

- Ethylene Vinyl Acetate

- Non-Ethylene Vinyl Acetate

- UV Curable Resins

Ethylene vinyl acetate (EVA) leads the market with around 82.7% of market share in 2024 due to its proven reliability, superior adhesive properties, and exceptional moisture and UV resistance. EVA ensures the protection of photovoltaic cells, enhancing their durability and efficiency. Its compatibility with various solar cell technologies, including both monofacial and bifacial panels, further drives its widespread adoption. EVA's cost-effectiveness, combined with its high thermal stability and low degradation rate, makes it a preferred choice for manufacturers. Additionally, its established performance in diverse environmental conditions, alongside ongoing improvements in formulation, continues to solidify EVA’s dominance in the solar encapsulation market.

Analysis by Technology:

- Single crystal/Polycrystalline Silicon Solar Technology

- Thin-film Solar Technology

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a-Si)

Single crystal/polycrystalline silicon solar technology leads the market with around 89.7% of market share in 2024 attributed to their widespread use in photovoltaic (PV) modules. These technologies offer high efficiency, durability, and cost-effectiveness, making them dominant in both residential and commercial solar installations. Single-crystal silicon provides superior energy conversion efficiency, while polycrystalline silicon offers a more affordable option with acceptable performance. As both technologies continue to evolve with higher power output and better thermal stability, they drive demand for advanced encapsulants, ensuring long-term module reliability. The widespread adoption of these technologies fuels the need for encapsulation materials that enhance longevity and performance under diverse environmental conditions.

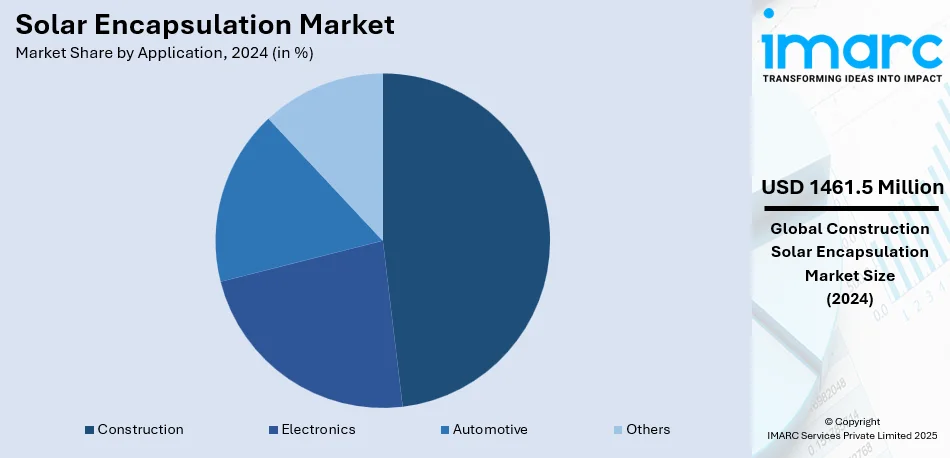

Analysis by Application:

- Construction

- Electronics

- Automotive

- Others

Construction leads the market with around 48.2% of market share in 2024, as it sees increasing adoption of solar panels in buildings. With growing interest in sustainable architecture, solar panels are increasingly integrated into residential, commercial, and industrial structures. Encapsulation materials, particularly ethylene-vinyl acetate (EVA), are critical in protecting solar cells from environmental elements such as UV radiation, moisture, and mechanical stress. The demand for energy-efficient and durable building-integrated photovoltaics (BIPVs), such as solar roof shingles or windows, further propels the need for high-quality encapsulants that ensure the longevity and efficiency of solar modules, fueling market growth in the construction sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 60.2% driven by its strong commitment to renewable energy and rapid solar installation growth. Countries like China, India, and Japan are spearheading solar power generation, bolstered by government incentives and ambitious renewable energy targets. As reported by the Press Information Bureau (PIB) on 22 January 2025, India's renewable energy sector saw significant advancements, including the addition of 24.5 GW of solar and 3.4 GW of wind capacity in 2024, surpassing 2023 numbers. The country is targeting 500 GW of non-fossil fuel-based energy by 2030. Key developments such as the growth of rooftop solar, green hydrogen initiatives, and expanded solar manufacturing further fuel demand for high-performance encapsulants. These advancements in solar technology and manufacturing increase the need for efficient, durable encapsulation materials across the region.

Key Regional Takeaways:

United States Solar Encapsulation Market Analysis

In 2024, the United States represents 91.50% of the North America solar encapsulation market. Major growth driver for the market during the forecast period is set by the Department of Energy (DOE), where the US intends to generate 100% carbon pollution-free electricity by 2035. Such a commitment for decarbonization has helped in increase investments in renewable energy, especially solar power, which reduces carbon emissions significantly. The expansion of solar energy capacity demands advanced encapsulation materials in solar encapsulations, which enhance the performance, durability, and longevity of the solar panels. As the use of solar power increases in residential, commercial, and utility-scale projects, there is a consequent increase in the demand for high-quality encapsulants such as EVA films. The Biden administration's focus on clean energy infrastructure, coupled with federal incentives and tax rebates, is accelerating the shift towards renewable energy solutions. This, in turn, is driving the solar encapsulation market as part of the broader effort to meet the nation's renewable energy targets and reduce reliance on fossil fuels.

Europe Solar Encapsulation Market Analysis

The main driver behind this market can be attributed to the strides taken by governments in Europe, especially through UK commitment to achieving a net-zero electricity grid by 2035. The UK has planned to eliminate fossil fuel use within the generation of energy and has intended to promote renewable energy. This is strongly driving demand for solar PV systems. As per industry reports, the UK reduced the VAT on solar PV panel installations and other renewable energy items by 5% in January 2022, which made solar energy more affordable for residential users. Such policies are expected to accelerate the adoption of solar technologies, thus increasing the need for high-quality solar encapsulation materials that ensure the durability and efficiency of photovoltaic (PV) modules. Additionally, Europe’s overall commitment to sustainability and renewable energy adoption is set to drive the growth of the solar encapsulation market, as countries invest in cleaner and more reliable energy solutions. These favorable policies will continue to support the expansion of the solar market and demand for encapsulation materials in the region.

Asia Pacific Solar Encapsulation Market Analysis

As per IBEF, installed renewable energy capacity in India will grow to nearly 170 GW by March 2025, while it currently stands at around 135 GW as of December 2023. The rising installed renewable energy capacity is putting up a heavy demand for solar power solutions. Along with increasing the installation capacity for solar energy, the efficiency, durability, and high-performance quality of the solar modules will become more imperative. Solar encapsulants protect the photovoltaic cells from the environment. It is going to enhance the performance and extend the life of the solar panels. The investment on solar energy project across India as well as Asia Pacific region going to increase exponentially. This going to strengthen demand for solar encapsulation materials massively. As countries like India push towards ambitious renewable energy targets, the market for advanced encapsulation solutions is poised for sustained growth, supporting the region's transition to cleaner energy sources.

Latin America Solar Encapsulation Market Analysis

Mexico set a goal to source at least 35% of its electricity from clean energy by 2024 under its newly established energy transition law, according to NREL. This move toward renewable energy is helping bolster the growth in solar energy installations, which, in turn, increases the demand for high-quality encapsulation materials for solar applications. As the importance of solar power in Mexico's energy mix increases, solar modules that are long-lived and efficient become the need of the hour. Solar encapsulants like EVA films protect photovoltaic cells against environmental stress, moisture, and UV exposure, thereby improving the performance and lifespan of solar panels. As Mexico and other Latin American countries continue to emphasize clean energy for their respective communities, the solar encapsulation market stands to gain with increasing demand for solar modules and, most importantly, the use of more developed materials for the installation to ensure long and efficient running times.

Middle East and Africa Solar Encapsulation Market Analysis

The UAE Energy Strategy 2050 seeks to treble the impact of renewable energy and expend AED 150-200 Billion (approximately USD 40.8 to USD 54.4 billion) by 2030 to meet the country’s growing energy demand driven by a rapidly expanding economy. This initiative is set to significantly augment the solar energy sector, driving the demand for advanced solar encapsulation materials. Solar encapsulants, such as EVA films, are essential for protecting photovoltaic (PV) cells from moisture, UV light, and mechanical stress, ensuring the efficiency and longevity of solar panels. As the UAE accelerates its renewable energy adoption to achieve its ambitious targets, the need for high-quality encapsulation materials will continue to rise, contributing to market growth. This investment in renewable energy infrastructure is among the elements strengthening demand for solar modules and encapsulants in the Middle East and Africa region, thus positioning the solar encapsulation market for growth in line with the UAE's clean energy goals.

Competitive Landscape:

The competitive landscape of the global solar encapsulation market is shaped by key players focusing on innovation, partnerships, and expanding global reach. Companies are heavily funding research and development (R&D) to develop advanced, cost-effective, and eco-friendly encapsulants that meet the rising demand for efficient solar power systems. Strategic collaborations, including joint ventures and acquisitions, are enabling market leaders to enhance technological expertise and broaden their product portfolios. For instance, on October 22, 2024, HIUV partnered with H.B. Fuller to augment solar encapsulation offerings in the U.S. market. HIUV will supply high-performance EVA and POE films, which are essential for improving the efficiency, durability, and performance of PV modules. The increasing focus on sustainability and high-performance encapsulants is further driving market growth.

The report provides a comprehensive analysis of the competitive landscape in the solar encapsulation market with detailed profiles of all major companies, including:

- 3M Company

- Borealis GmbH

- Dow Inc.

- Hangzhou First Applied Material Co., Ltd.

- Hanwha Advanced Materials

- JA SOLAR Technology Co., Ltd.

- LG Chem

- Mitsui Chemicals America, Inc.

- RenewSys

- Shin-Etsu Chemical Co., Ltd.

- Targray

Latest News and Developments:

- December 2024: Huasun secured two key contracts with PowerChina, totaling 840 MWp of HJT solar modules. This includes a 500 MWp procurement and a 339.68 MWp offshore PV project. The success reinforces Huasun’s leadership in HJT technology and offshore photovoltaics, with their V-Ocean modules ensuring reliability in challenging marine environments, supporting China's energy transition goals.

- December 2024: EnlogEU GmbH announced a strategic collaboration with Dr. Hans Werner Chemikalien, a Turkish producer of EVA, POE, and EPE encapsulation films for PV solar modules. The collaboration aims to promote these advanced encapsulant solutions globally, enhancing the durability, reliability, and efficiency of solar modules. EnlogEU's market expertise will support Dr. Hans Werner's international expansion.

- November 2024: Cybrid introduced RayBo®, a groundbreaking encapsulant for TOPCon solar modules, designed to protect against UV-induced degradation (UVID) and enhance performance. RayBo® converts harmful UV light into blue light, augmenting energy output. Tested by TUV Nord and Shanghai Jiao Tong University, RayBo® ensures long-term module reliability, extending lifespan, reducing LCOE, and increasing energy yield, making it a key solution for TOPCon technology.

- February 2024: Fraunhofer ISE unveiled the TEC module in Europe, which aims to enhance the performance of solar photovoltaic modules.

- October 2023: The Shanghai-based firm AIKO has displayed its unique solar cell products at the Melbourne All-Energy exhibition in Australia, including technology in solar encapsulation.

- August 2023: Alishan Green Energy launched a new coated backsheet in India, designed for encapsulation of solar modules.

Solar Encapsulation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Ethylene Vinyl Acetate, Non-Ethylene Vinyl Acetate, UV Curable Resins |

| Technologies Covered |

|

| Applications Covered | Construction, Electronics, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Borealis GmbH, Dow Inc., Hangzhou First Applied Material Co., Ltd., Hanwha Advanced Materials, JA SOLAR Technology Co., Ltd., LG Chem, Mitsui Chemicals America, Inc., RenewSys, Shin-Etsu Chemical Co., Ltd., Targray, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solar encapsulation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solar encapsulation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solar encapsulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar encapsulation market was valued at USD 3,032 Million in 2024.

The solar encapsulation market is projected to exhibit a CAGR of 11.8% during 2025-2033, reaching a value of USD 8,253.9 Million by 2033.

The key factors driving the global market include the increasing adoption of solar energy, significant advancements in solar technology, stringent government regulations promoting clean energy, the heightened need for higher efficiency and durability in solar modules, and the growing focus on sustainability in the energy sector.

Asia Pacific currently dominates the solar encapsulation market, accounting for a share exceeding 60.2%. This dominance is fueled by rapid solar installations, government incentives, and ambitious renewable energy targets in countries like China, India, and Japan.

Some of the major players in the solar encapsulation market include 3M Company, Borealis GmbH, Dow Inc., Hangzhou First Applied Material Co., Ltd., Hanwha Advanced Materials, JA SOLAR Technology Co., Ltd., LG Chem, Mitsui Chemicals America, Inc., RenewSys, Shin-Etsu Chemical Co., Ltd. and Targray among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)