Software Defined Networking Market Report by Component (Solution, Services), Organization Size (Small and Medium Enterprises, Large Enterprises), Application (Enterprises, Telecommunication Service Providers, Cloud Service Providers), End Use Industry (BFSI, IT and Telecom, Consumer Goods, Government and Defense, Healthcare, and Others), and Region 2025-2033

Global Software Defined Networking Market:

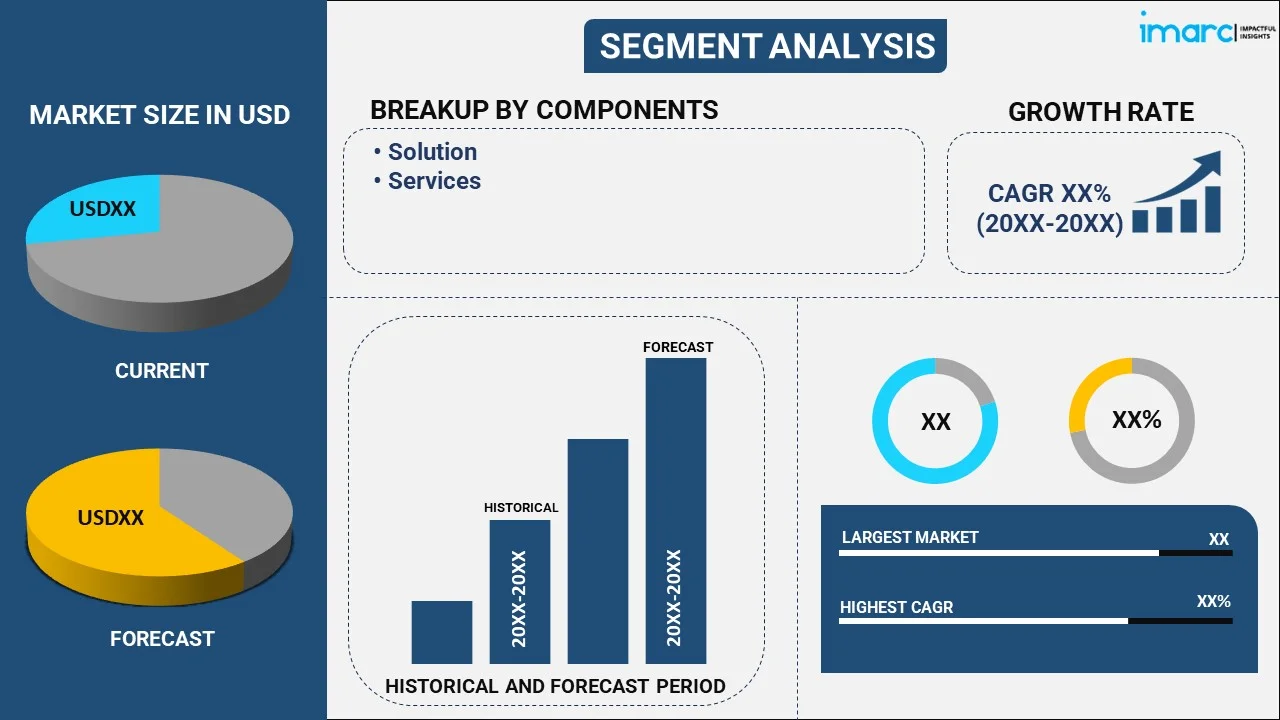

The global software defined networking market size reached USD 28.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 125.1 Billion by 2033, exhibiting a growth rate (CAGR) of 17.08% during 2025-2033. The increasing demand for network automation and programmability, rapid adoption of cloud services, and accelerating digital transformation are primarily driving the market growth. Further, the increasing advancement in the 5G network is opportunistic for the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 28.3 Billion |

|

Market Forecast in 2033

|

USD 125.1 Billion |

| Market Growth Rate (2025-2033) | 17.08% |

Software Defined Networking Market Analysis:

- Major Market Drivers: The rising trend of network infrastructure automation and the widespread adoption of cloud-computing services and big data analytics across various industries, are some of the key factors driving the software defined networking market growth. Furthermore, various technological advancements, such as the integration of the Internet of Things (IoT) with connected devices, are acting as other growth-inducing factors.

- Key Market Trends: SDN service providers are also developing architectures to support the 5G infrastructure, thereby creating a positive outlook for the market. Moreover, the increasing investments in the development of open-source SDNs, along with digitization of the existing 3G and 4G networks, are anticipated to drive the market further.

- Competitive Landscape: Some of the prominent software defined networking market companies include Arista Networks Inc., Cisco Systems Inc., Citrix Systems Inc., Cloudgenix Inc. (Palo Alto Networks Inc.), Cumulus Networks Inc. (Nvidia Corporation), Dell Technologies Inc., Extreme Networks Inc., Hewlett-Packard Enterprise Company, International Business Machines Corporation, Juniper Networks Inc., NEC Corporation, and Oracle Corporation, among many others.

- Geographical Trends: According to the software defined networking market dynamics, North America holds a prominent software defined networking market share, primarily driven by the presence of major technology companies and cloud service providers. Moreover, Europe is a significant player in the SDN market, with strong demand from telecom operators, enterprise data centers, and government organizations looking to modernize their network infrastructure.

- Challenges and Opportunities: The growing security concerns and the high cost associated with the deployment of SDN are hampering the market’s growth. However, the rise of cloud computing and the rapid expansion of data centers are key growth drivers for SDN. As organizations increasingly move to hybrid and multi-cloud environments, SDN offers an efficient way to manage dynamic workloads and optimize network resources.

Software Defined Networking Market Trends:

Digital Transformation

The growing digital transformation industry is driving businesses to modernize their networks to stay competitive. For instance, according to IMARC, the global digital transformation market size reached USD 692 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 2,845 Billion by 2032, exhibiting a growth rate (CAGR) of 16.9% during 2024-2032. SDN enables business agility by providing the ability to adapt, automate, and scale networks to support new services, applications, and business models, thereby boosting the software defined networking market revenue.

Adoption of Cloud Computing

The increased adoption of cloud computing is a major driver for the growth of the software defined networking (SDN) market. For instance, according to an article published by Edge Delta, 94% of major businesses globally use cloud computing in their operations. According to 2022 research of 753 technical and business professionals, 63% used the cloud heavily. In 2021, 59% of people used cloud services, compared to 53% in 2020. SDN allows businesses to scale their network resources on-demand, providing the agility to accommodate cloud-native applications and dynamic cloud workloads. With SDN, network administrators can easily adjust network configurations to align with cloud-based applications and services. These factors are expected to propel the software defined networking market in the coming years.

Increased Penetration of 5G Network

The surging adoption of 5G networks is a significant driver for the growth of the software defined networking (SDN) market. For instance, according to Statista, there were an expected 2.17 Billion 5G mobile subscriptions worldwide in 2024, up from 1.58 Billion the previous year. This number is predicted to exceed 5.56 Billion by the end of the decade. 5G networks require a highly flexible and programmable infrastructure to manage the diverse range of applications, devices, and services they support. SDN provides the centralized control and automation necessary to dynamically manage network traffic, optimize bandwidth usage, and adjust configurations in real time. These factors further positively influence the software defined networking market forecast.

Global Software Defined Networking Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global software defined networking market research report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, organization size, application, and end use industry.

Breakup by Component:

- Solution

- Physical Network Infrastructure

- SDN Controller

- SDN Application

- Others

- Services

- Integration and Deployment

- Training and Consulting

- Support and Maintenance

The report has provided a detailed breakup and analysis of the software defined networking market based on the component. This includes solution (physical network infrastructure, SDN controller, SDN application, and others), services (integration and deployment, training and consulting, and support and maintenance), and others.

According to the software defined networking market outlook, SDN solutions focus on providing a flexible, centralized, and programmable approach to managing and controlling network infrastructure. These solutions leverage SDN components to decouple the control plane from the data plane, enabling greater agility, automation, and scalability. Moreover, SDN services complement SDN solutions by offering the necessary expertise, tools, and support to implement, manage, and optimize SDN infrastructure. These services are designed to help organizations fully realize the benefits of SDN, including automation, scalability, and security.

Breakup by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the software defined networking market based on the organization size. This includes small and medium enterprises and large enterprises.

According to the software defined networking market overview, small and medium-sized enterprises (SMEs) are progressively adopting SDN technologies, but their demand is typically more conservative than that of large enterprises. SMEs often operate with limited IT budgets, and SDN can help reduce costs by centralizing network management and reducing the need for expensive proprietary hardware. Moreover, large enterprises are leading the adoption of SDN due to their complex networking needs, massive infrastructures, and demands for higher network performance, agility, and security. SDN adoption is rapidly growing in industries, such as finance, healthcare, manufacturing, and telecommunications, where dynamic, secure, and scalable networks are essential.

Breakup by Application:

- Enterprises

- Telecommunication Service Providers

- Cloud Service Providers

The report has provided a detailed breakup and analysis of the software defined networking market based on the application. This includes enterprises, telecommunication service providers, and cloud service providers.

Enterprises use SDN to optimize their internal networks, improve agility, enhance security, and enable easier integration with cloud platforms. Enterprises manage large-scale data centers that host critical applications and services. SDN allows enterprises to automate network provisioning, optimize traffic flows, and enforce network policies across data centers. Moreover, telecommunication service providers (Telcos) use SDN to transform their legacy networks into more agile, scalable, and cost-effective infrastructures. SDN supports network slicing, service provisioning, and the deployment of 5G networks. Apart from this, cloud service providers (CSPs) leverage SDN to optimize their data centers, offer advanced network services to customers, and manage large-scale cloud infrastructures more efficiently. SDN is crucial for providing flexibility, scalability, and security in public, private, and hybrid cloud environments.

Breakup by End Use Industry:

- BFSI

- IT and Telecom

- Consumer Goods

- Government and Defense

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the software defined networking market based on the end use industry. This includes BFSI, IT and telecom, consumer goods, government and defense, healthcare, and others.

The BFSI sector is highly regulated and requires robust security, compliance, and network performance. SDN helps financial institutions improve agility, enhance security, and manage complex, multi-site networks efficiently. Moreover, IT and telecom companies are among the early adopters of SDN, using it to modernize their infrastructure, improve scalability, and enhance service delivery for both internal and external customers. Telecom providers use SDN in combination with NFV to virtualize network services such as firewalls, routers, and load balancers. Apart from this, SDN allows consumer goods companies to optimize their supply chain by providing real-time visibility and control over logistics, manufacturing, and distribution networks.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

According to the software defined networking market statistics, North America, especially the United States and Canada, holds the prominent market share in the SDN sector. The region is a hub in technology innovation, with strong adoption of advanced networking solutions in industries like IT, telecom, BFSI (Banking, Financial Services, and Insurance), and cloud services. Telecom companies in North America are aggressively rolling out 5G networks, where SDN is crucial for network slicing, traffic optimization, and automation. Moreover, Europe is witnessing a shift toward digital transformation across industries, with a strong focus on cloud adoption, cybersecurity, and network automation, further contributing to the market’s growth. European governments and enterprises are embracing SDN as part of broader digitalization strategies, particularly in the manufacturing, finance, and retail sectors.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Arista Networks Inc.

- Cisco Systems Inc.

- Citrix Systems Inc.

- Cloudgenix Inc. (Palo Alto Networks Inc.)

- Cumulus Networks Inc. (Nvidia Corporation)

- Dell Technologies Inc.

- Extreme Networks Inc.

- Hewlett-Packard Enterprise Company

- International Business Machines Corporation

- Juniper Networks Inc.

- NEC Corporation

- Oracle Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Software Defined Networking Market Recent Developments:

- September 2024: Airtel Business, Bharti Airtel's B2B arm, and Cisco, the world's leading networking and security company, launched the Airtel Software-Defined (SD) Branch, a simple, secure, cloud-based, end-to-end-managed network solution for organizations.

- September 2024: IBM and NTT DATA partnered to launch SimpliZCloud, a fully managed cloud service based on IBM LinuxONE and targeted for the Indian financial services sector. SimpliZCloud combines AI and hybrid cloud technologies to provide specialized computation and storage resources via Software Defined Networking (SDN).

- May 2024: Cyan unveiled Blue Planet software, a software-defined networking (SDN) system that enables all types of service providers to virtualize their networks. The new SDN software consists of third-party applications that run on the open SDN platform.

Software Defined Networking Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Applications Covered | Enterprises, Telecommunication Service Providers, Cloud Service Providers |

| End Use Industries Covered | BFSI, IT and Telecom, Consumer Goods, Government and Defense, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arista Networks Inc., Cisco Systems Inc., Citrix Systems Inc., Cloudgenix Inc. (Palo Alto Networks Inc.), Cumulus Networks Inc. (Nvidia Corporation), Dell Technologies Inc., Extreme Networks Inc., Hewlett-Packard Enterprise Company, International Business Machines Corporation, Juniper Networks Inc., NEC Corporation, Oracle Corporation., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global software defined networking market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global software defined networking market?

- What are the key regional markets?

- What is the breakup of the market based on the component?

- What is the breakup of the market based on the organization size?

- What is the breakup of the market based on the application?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global software defined networking market and who are the key players?

- What is the degree of competition in the industry?

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the software defined networking market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global software defined networking market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the software defined networking industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)