Software Defined Anything Market Size, Share, Trends and Forecast by Type, End-Use Industry, and Region, 2025-2033

Software Defined Anything Market Size and Share:

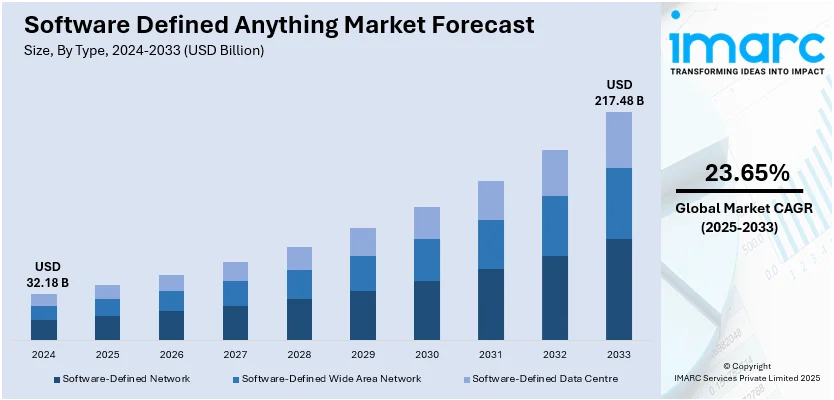

The global software defined anything market size was valued at USD 32.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 217.48 Billion by 2033, exhibiting a CAGR of 23.65% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36% in 2024. The market is growing rapidly driven by increasing demand for virtualization, cloud computing and automation across industries. Key trends include the adoption of software-defined networking (SDN) and software-defined storage (SDS) to enhance scalability and efficiency. Rising digital transformation initiatives further boost growth strengthening software-defined anything market share globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 32.18 Billion |

| Market Forecast in 2033 | USD 217.48 Billion |

| Market Growth Rate (2025-2033) | 23.65% |

The Software-Defined Anything (SDx) market is driven by the increasing demand for automation, flexibility and scalability in IT infrastructure. Enterprises seek cost-effective, software-driven approaches to manage networks, storage and data centers efficiently. Rising cybersecurity concerns are fueling investments in software-defined security solutions. The Microsoft's Digital Defense Report 2024 reveals significant shifts in cyber threats, highlighting a 2.75x increase in human-operated ransomware incidents and a 58% rise in phishing attacks resulting in an estimated $3.5 billion in financial damages. Daily, over 600 million identity attacks are reported primarily targeting user passwords. The expansion of 5G networks and IoT integration further boosts software-defined anything market growth by enabling agile and programmable infrastructure solutions.

The U.S. Software-Defined Anything (SDx) market is driven by the rapid adoption of cloud computing, AI and edge computing technologies. Rising cybersecurity threats are accelerating demand for software-defined security frameworks. Additionally, the expansion of 5G networks and IoT integration is fueling the need for programmable infrastructure. According to the report published by CTIA, 5G is revolutionizing America enhancing economic competitiveness and cutting transportation costs by $450B annually while reducing emissions by 90%. The technology has rolled out 42% faster than 4G and now covers 330 million Americans. With $705 billion invested 5G is expected to create 4.5 million new jobs and $1.5 trillion in economic growth. Government initiatives supporting digital transformation and increased investments in data centers further propel market growth.

Software Defined Anything Market Trends:

Increasing adoption of digital transformation and business agility

The increasing adoption of software-defined anything (SDx) is prominently driven by the ongoing digital transformation across various industries and the growing need for business agility. For instance, digital transformation spending reached USD 2.5 Trillion in 2024 and is set to reach USD 3.9 Trillion by 2027. As organizations continue to embrace digital technologies the demand for flexible, scalable and manageable IT infrastructure intensifies. SDx technologies offer a strategic advantage by abstracting hardware complexities and providing software-centric management solutions which enhance operational flexibility and efficiency. Moreover, SDx technologies play a pivotal role in optimizing resource utilization and reducing operational costs. By centralizing management and automating numerous tasks organizations can achieve more with less reallocating saved resources towards innovation and growth. This shift boosts efficiency and fosters a more resilient IT infrastructure capable of supporting dynamic business environments.

Rising need for defense modernization

The increasing necessity for defense modernization is a key factor driving growth in the global market largely due to the rising complexity of defense technologies and the shifting geopolitical landscape. For example, global military spending on modernization saw an uptick for the ninth straight year in 2023 totaling USD 2,443 billion. This 6.8% increase marks the fastest year-on-year growth since 2009. As nations advance their defense systems there is an escalating dependence on sophisticated IT solutions to improve operational efficacy and ensure national security. Software-defined technologies (SDxs) along with other advanced communication systems are being utilized in military units to enhance defense communication frameworks without hardware limitations. The broad adoption of SDx in telecommunications is also driving market expansion with network operators integrating SDx and Network Functions Virtualization (NFV) to improve connectivity solutions that cater to demands for stable connections and higher data transfer speeds.

Growing adoption of cloud computing

The rising adoption of cloud computing is significantly influencing the market by enhancing flexibility, scalability and efficiency in IT infrastructure management. In 2023, 59% of medium-sized businesses opted for cloud computing services an increase from 53% in 2021 according to reports. Through cloud computing businesses are transitioning from traditional hardware-dependent systems to virtualized software-defined environments. This shift not only reduces costs but also increases organizational agility. By leveraging cloud-based solutions companies can deploy and manage IT resources more dynamically adjusting to market demands with greater speed and less overhead. With companies moving more towards cloud computing the penetration of SDN, SDDC and NFV would be more necessary for smooth integration and resource management. Hybrid models of cloud computing would also give opportunities for effective management of systems in on-premises along with that in cloud deployment. This trend is resulting in a higher requirement for SDx technologies that would further drive market growth across industries. These factors are collectively creating a positive software-defined anything market outlook for the market further across the world.

Software Defined Anything Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global software defined anything market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end-use industry.

Analysis by Type:

- Software-Defined Network

- Software-Defined Wide Area Network

- Software-Defined Data Centre

- Software-Defined Computing

- Software-Defined Storage

- Software-Defined Data Centre Networking

The software-defined data center (SDDC) segment holds the largest market share because of its comprehensive unification of networking, storage and computing resources governed through software. This is because SDDC can centralize management to significantly improve operational efficiency and lower costs. This enables the SDDC to reduce operational expenses while improving resource allocation through the virtualization of key elements like storage, networking and computing. Due to this, SDDCs are of utmost significance for business digitization via cloud technologies. With enhanced security, automation, and disaster recovery features SDDCs contribute to their appeal and drive the widescale adoption of SDx solutions in various industries.

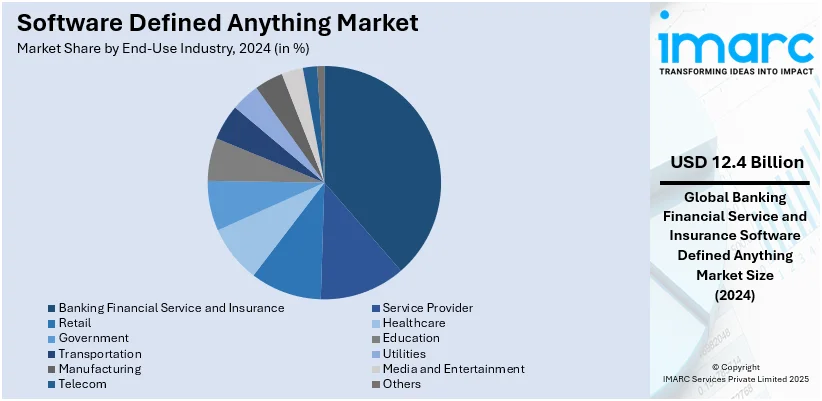

Analysis by End-Use Industry:

- Service Provider

- Banking Financial Service and Insurance

- Retail

- Healthcare

- Government

- Education

- Transportation

- Utilities

- Manufacturing

- Media and Entertainment

- Telecom

- Others

Banking, Financial Services, and Insurance leads the market with around 38.5% of market share in 2024. The Banking, Financial Services and Insurance (BFSI) industry maintains the highest share of the market in the Software-Defined Anything (SDx) report because it requires strong, scaleable and secure IT infrastructure in large quantities. When financial companies begin embracing digital transformation, management of any complicated data-intensive process demands software-defined networking (SDN) and software-defined data centers (SDDC) technologies. SDx technologies therefore advantage BFSI firms with greater control of network management, reduced infrastructure costs and simplified rollout of new services. Furthermore, SDx is more secure and is one of the industry's key concerns based on its potential to deploy extremely responsive and adaptive security controls. The BFSI sector’s need for scalable, resilient, and compliant infrastructure is fueling the software-defined anything market demand contributing to the market's growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.0%. North America being driven mainly by the developed technological base and early adoption of cutting-edge IT solutions in a host of industries in the region. The high concentration of top tech players and cloud service providers in the region is driving innovation in software-defined networking (SDN), network function virtualization (NFV), and data center offerings. North American enterprises are increasingly embracing hybrid cloud environments and 5G technology, which is supporting demand for software-defined solutions. Moreover, automation, cybersecurity, and virtualization of IT infrastructure are driving the market growth in North America to become a vital contributor to global SDx transformation. The aggressive investment in North America's data centers and cloud services also further drives the take-up of software-defined technologies for organizations to grow efficiently and preserve flexibility in business operations.

Key Regional Takeaways:

United States Software Defined Anything Market Analysis

In 2024, the United States accounted for over 82.50% of the software defined anything market in North America. The growing software-defined anything adoption in the United States is driven by the increasing reliance on cloud computing across industries. A recent survey indicates that 98% of organizations in the U.S. have integrated cloud technology into their business operations. Many are utilizing software-defined networking, storage solutions and data centers to improve agility, scalability and efficiency in their operations. As cloud computing continues to evolve businesses are shifting from traditional hardware-dependent architectures to software-defined infrastructures to optimize workloads and improve resource allocation. The growing demand for hybrid and multi-cloud environments further fuels software-defined anything adoption allowing enterprises to integrate on-premises and cloud-based resources seamlessly. Cloud service providers and technology firms are expanding their software-defined solutions to address enterprise requirements for security, automation and cost efficiency. The push for digital transformation and the rise of software-defined security solutions are influencing businesses to modernize their IT infrastructure. The need for software-defined networking in remote work data-driven decision-making and AI-powered cloud applications further accelerates software-defined anything adoption across enterprises in the United States.

Asia Pacific Software Defined Anything Market Analysis

The growing software-defined anything adoption in Asia-Pacific is largely driven by the expansion of the media and entertainment industry, which increasingly relies on flexible, software-defined solutions. The Indian Media & Entertainment (M&E) sector is poised for significant expansion, with an anticipated growth rate of 10.2%, projected to reach ₹2.55 trillion (USD 30.8 billion) by 2024. The sector is also expected to achieve a compound annual growth rate (CAGR) of 10%, potentially reaching ₹3.08 trillion (USD 37.2 billion) by 2026, as reported by the India Brand Equity Foundation. Media and entertainment companies are adopting software-defined networking and storage to manage high-bandwidth content, facilitate real-time streaming, and optimize data distribution across multiple platforms. The growing use of cloud-based media workflows, including video editing, post-production, and content distribution, is propelling demand for software-defined anything solutions. Media firms are leveraging software-defined storage to handle large-scale data requirements and improve latency performance. The surge in digital entertainment, gaming, and over-the-top (OTT) streaming services further encourages software-defined anything adoption, as these platforms require scalable and software-driven infrastructures.

Europe Software Defined Anything Market Analysis

The growing software-defined anything adoption in Europe is influenced by the expansion of BFSI services, which demand flexible, software-defined infrastructure to manage complex financial operations. In 2021, there were 784 foreign bank branches operating within the EU, with 619 of those being from other EU member countries and 165 from non-EU nations. Banks, insurance firms, and fintech companies are increasingly adopting software-defined networking and storage to streamline transaction processing, enhance cybersecurity, and optimize data management. The shift towards digital banking, mobile payments, and AI-driven financial analytics is driving the need for scalable, software-defined anything solutions. The growing emphasis on real-time fraud detection, automated risk assessment, and regulatory compliance is pushing financial institutions to deploy software-defined security frameworks. Cloud-based core banking solutions and API-driven open banking models are further accelerating software-defined anything adoption. The rise of digital wallets blockchain-based financial transactions, and AI-powered customer engagement solutions is fuelling investment in software-defined infrastructure.

Latin America Software Defined Anything Market Analysis

The growing software-defined anything adoption in Latin America is primarily influenced by the increasing privatization of healthcare, which requires efficient and flexible IT infrastructure. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), out of Brazil’s total of 7,191 hospitals, a substantial 62% are privately owned. As healthcare organizations transition to private management, the need for software-defined networking, storage, and security solutions is growing to support electronic health records, telemedicine, and cloud-based patient data management. The expansion of private hospitals and specialized clinics is driving investment in scalable and software-driven healthcare IT infrastructure. The growing focus on AI-powered diagnostics, remote patient monitoring, and digital health platforms is further encouraging software-defined anything adoption. The demand for secure, interoperable, and cost-effective IT solutions is pushing private healthcare providers to invest in software-defined security and networking to enhance data accessibility and regulatory compliance.

Middle East and Africa Software Defined Anything Market Analysis

The growing software-defined anything adoption in the Middle East and Africa is largely attributed to the rising investment in IT and telecom sectors. In the Middle East, Türkiye, and Africa (META), total expenditures on information and communications technology (ICT) are expected to surpass USD 238 billion this year, reflecting a 4.5% increase compared to 2023.Governments and enterprises are allocating resources to modernize network infrastructure, enhance cloud computing capabilities, and expand software-defined networking adoption. The growing deployment of 5G networks and fiber-optic communication is accelerating demand for software-defined anything solutions, enabling operators to enhance network automation and optimize service delivery. Enterprises are adopting software-defined storage and security to support cloud-driven digital transformation initiatives.

Competitive Landscape:

The Software-Defined Anything (SDx) market is highly competitive driven by rapid technological advancements and increasing enterprise demand for agile, scalable and cost-efficient IT solutions. Companies are focusing on software-driven innovations across networking, storage and security to differentiate themselves. Market players compete on automation capabilities, integration with cloud and edge computing and enhanced cybersecurity features. Strategic partnerships, mergers and acquisitions are common to expand market reach and technological expertise. The rise of AI-driven software-defined solutions and the growing need for interoperability are intensifying competition compelling firms to continuously enhance performance, reliability and adaptability in their offerings.

The report provides a comprehensive analysis of the competitive landscape in the software-defined anything market with detailed profiles of all major companies, including:

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- VMware Inc.

- Juniper Networks Inc.

- Microsoft Corporation

- Aryaka Networks Inc.

- Arista Networks Inc.

- Citrix Systems Inc.

- NEC Corporation (AT&T Corporation)

- NetApp Inc.

- Bigleaf Networks Inc.

Latest News and Developments:

- April 2024: Cisco has successfully finalized its acquisition of Isovalent, a leading entity in open-source cloud-native networking and security. This acquisition marks a significant step in Cisco's strategy to influence the future of secure, multicloud networking solutions.

- April 2024: Fortinet has rolled out its latest update to FortiOS, which enhances its Security Fabric with AI-powered security, data protection, and managed services. This update integrates networking and security, strengthening Software-Defined Anything (SDx) capabilities. The new features aim to optimize cybersecurity operations while ensuring robust protection across digital landscapes.

- June 2024: Dell Technologies and Ericsson have announced a strategic partnership that leverages their extensive knowledge and telecom software to assist communications service providers (CSPs) in transitioning to cloud-based radio access network (RAN) solutions. This collaboration aims to deliver comprehensive support for successful cloud RAN implementations.

- May 2024: Hewlett Packard Enterprise has introduced new offerings within its HPE GreenLake cloud platform, aimed at streamlining the management and optimization of storage, data, and workloads across various environments, including on-premises and public clouds. These updates are designed to give enterprises more flexibility and control in hybrid cloud operations.

- February 2024: IBM has rolled out new professional services specifically tailored for users of Cisco's SDN and SD-WAN solutions, enhancing its Technology Lifecycle Services (TLS). The company has launched IBM Network Health Check, which optimizes Cisco infrastructure via Software-Defined Anything (SDx) solutions. These services aim to improve network performance, security, and remote management for businesses.

Software Defined Anything Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End-Use Industries Covered | Service Provider, Banking Financial Service and Insurance, Retail, Healthcare, Government, Education, Transportation, Utilities, Manufacturing, Media and Entertainment, Telecom, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cisco Systems Inc., Dell Technologies Inc., Hewlett Packard Enterprise Development LP, International Business Machines Corporation, VMware Inc., Juniper Networks Inc., Microsoft Corporation, Aryaka Networks Inc., Arista Networks Inc., Citrix Systems Inc., NEC Corporation (AT&T Corporation), NetApp Inc., Bigleaf Networks Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the software-defined anything market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global software-defined anything market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the software-defined anything industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The software defined anything market was valued at USD 32.18 Billion in 2024.

IMARC estimates the software defined anything market to reach USD 217.48 Billion by 2033, exhibiting a CAGR of 23.65% during 2025-2033.

The software defined anything market is driven by increasing digital transformation, demand for business agility, and the need for scalable IT infrastructure. Growing cloud adoption, edge computing, and network security concerns further accelerate adoption. Additionally, SDx enhances automation, optimizes resource utilization, and reduces operational costs, fueling market growth.

North America leads the software-defined anything market, driven by rapid digital transformation, strong cloud adoption, and significant investments in advanced IT infrastructure and cybersecurity solutions.

Some of the major players in the software defined anything market include Cisco Systems Inc., Dell Technologies Inc., Hewlett Packard Enterprise Development LP, International Business Machines Corporation, VMware Inc., Juniper Networks Inc., Microsoft Corporation, Aryaka Networks Inc., Arista Networks Inc., Citrix Systems Inc., NEC Corporation (AT&T Corporation), NetApp Inc., Bigleaf Networks Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)