Soft Magnetic Materials Market Size, Share, and Trends by Material, Application, End Use, Region, and Forecast 2025-2033

Soft Magnetic Materials Market Size and Analysis:

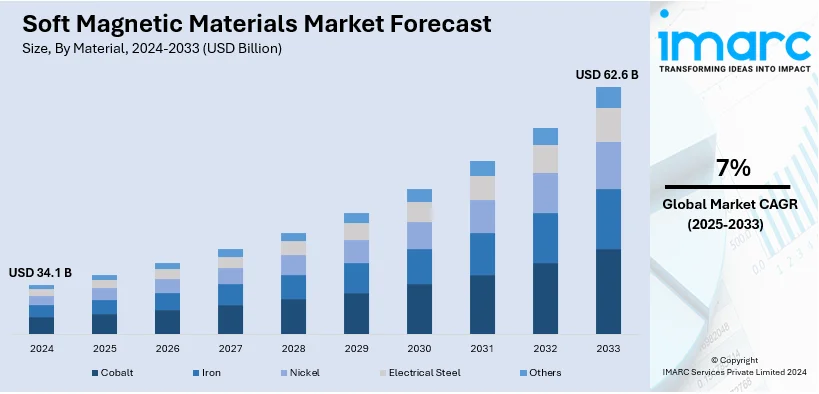

The global soft magnetic materials market size was valued at USD 34.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.6 Billion by 2033, exhibiting a CAGR of 7% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 52% in 2024. The market is encouraged by increased demand for electric and hybrid vehicles, developing renewable energy infrastructure, and recent technological developments, with considerable expansion in Asia-Pacific, bringing both challenges and possibilities for innovation and sustainability. Moreover, the US soft magnetic materials market is also growing steadily with the share of 91.3%, driven by electric vehicle (EV) adoption and renewable energy advancements, with government initiatives and technological innovation fostering energy-efficient solutions and supporting market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.1 Billion |

| Market Forecast in 2033 | USD 62.6 Billion |

| Market Growth Rate (2025-2033) | 7% |

Some of the key growth factors for soft magnetic materials market growth include rising adoption of electric vehicles and its subsequent demand for electric motors. Soft magnetic materials such as silicon iron, sintered iron, and phosphorus iron have been widely applied in electric motors to reduce the energy loss rate and enhance their efficiency. As per the reports provided by IMARC Group, electric motor market globally would grow at an estimated 3.4% CAGR over the period from 2025-2033. Moreover, advancements in the development of high-performance materials are also driving the soft magnetic materials market growth. The accelerating number of renewable energy sources including wind and solar is escalating the demand for magnetic materials in generators and transformers. Integration of new technologies in consumer electronics and a shift toward more sustainable manufacturing processes are also contributing to the market growth.

The United States is becoming a significant regional market for soft magnetic materials. The country's market is propelled by the rising demand for renewable energy systems, EVs, and advanced electronics. Additionally, research and development in material technology and investments in magnet manufacturing are further boosting growth. For example, in September 2024, Ara Partners, a private equity firm, secured USD 335 million in non-recourse financing for a permanent magnet manufacturing plant to improve the supply chain for EVs, aerospace and defense, and renewable energy in the country. The facility is owned by e-VAC Magnetics LLC, a newly formed U.S. entity wholly owned by Ara Partners.

Soft Magnetic Materials Market Trends:

Increasing Demand in Automotive Industry

The International Energy Agency states the fact that it's undergoing change; electric and hybrid automobiles are spreading worldwide. According to the sources, in 2023, new vehicles included around 14 million electric, reaching a population size of up to 40 million automobiles that existed on streets at that year-end. Soft magnetic materials are crucial to the efficient functioning of electric motors, transformers, and other such components used in electric and hybrid cars. In addition, stringent emission regulations and consumer demand for more environmentally friendly options have forced automobile manufacturers to incline toward increased use of soft magnetic materials in the enhancement of electric drivetrain performance and efficiency. Apart from the above, advanced magnetic materials can also make smaller and stronger motors; these are much needed for future generations of EVs.

Expansion of Renewable Energy

The renewable energy sector is booming nowadays, mainly with the help of a global interest in sustainable and ecological sources of energy. As per the reports Eurostat data show, renewables' share of the final consumption of energy within the European Union increased by more than one percentage point between 2021 and 23% in 2022. The 42.5% figure is the block's objective for renewable energy in 2030. Furthermore, the applications of soft magnetic materials are so extensive that the most important renewable energy systems for both solar inverters and wind turbine generators include soft magnetic materials. These are integral to renewable energy infrastructure as they are the most important to enable effective conversion and storage of energy. Because the technological improvements in renewable energy technologies are also ongoing and result in continuous advancements in the efficiency and cost-effectiveness of such systems, market share for soft magnetic materials is increasing.

Advancements in Electronics and Telecommunication

Highly efficient magnetic components are required for compact and power-efficient designs of consumer electronics, which include smartphones, tablets, laptops, and wearable devices. As per the reports, by the end of 2021, 5.3 billion people subscribed to mobile services, marking 67% of the world's population. The current outlook of soft magnetic materials is applied through inductors, transformers, and other respective parts that ensure good power management and signal processing. Additionally, market demand for soft magnetic materials is also increasingly influenced by developing telecommunications infrastructure and the deployment of fifth generation (5G), which requires these materials to utilize complex magnetic elements in base stations, antennas, and other wireless communication equipment with a high quality and reliability profile. Increased demands for more efficient use of energy as well as increased demand for reducing the size of electronic components make research into soft magnetic materials for creating devices which are lighter in weight, less bulky, and more effective highly sought after.

Soft Magnetic Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global soft magnetic materials market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, application, end-use, and region.

Analysis by Material:

- Cobalt

- Iron

- Nickel

- Electrical Steel

- Others

Electric steel material accounts for the largest size in 2024, having about 61.7% of the market. Electric steel is also called as silicon steel or transformer steel. The soft magnetic materials market shares have mainly captured because of better magnetic properties, with high utilization in electrical equipment. This type of steel is specifically designed to have high permeability and low coercivity, which makes it ideal for use in transformers, inductors, and motors, which are critical components in many electrical and electronic devices. In addition, the efficiency of electric steel in conducting magnetic fields and reducing energy losses makes it a preferred choice for manufacturers looking to improve the performance and efficiency of their products.

Analysis by Application:

- Motors

- Transformers

- Alternators

- Others

Motors are the leading market with a share of around 51% in 2024. Motors are dominating this segment, as the latest soft magnetic materials market report shows, because of their wide use in different sectors, such as automotive, industrial machinery, and consumer electronics. Soft magnetic materials play a crucial role in motor applications as they improve magnetic flux, reduce energy losses, and efficiency. The shift towards electric and hybrid vehicles has also driven up the demand for electric motors, which are very sensitive to soft magnetic materials to ensure maximum performance. Industrial applications, including robotics, automation, and HVAC systems, also require reliable and efficient motors to ensure good performance.

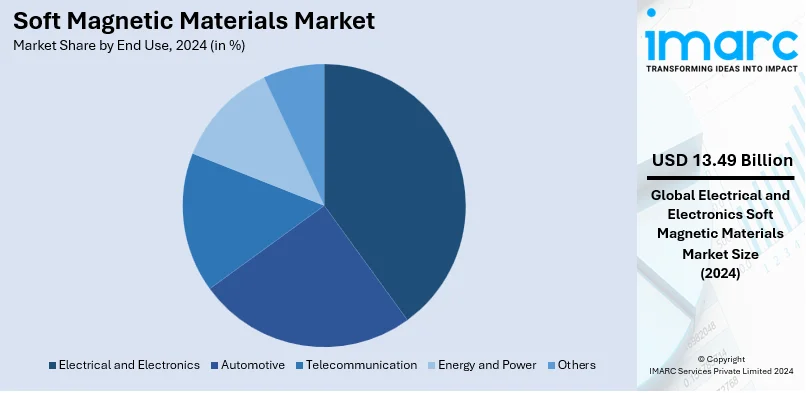

Analysis by End Use:

- Automotive

- Electrical and Electronics

- Telecommunication

- Energy and Power

- Others

Electrical and electronics leads the market with 39.5% of market share in 2024. The electrical and electronics sector represents the largest market share, reflecting the widespread adoption of soft magnetic materials in a wide array of electronic devices and electrical systems. Moreover, soft magnetic materials are integral to the functionality of transformers, inductors, sensors, and various other components that form the backbone of modern electronics. These materials enable the miniaturization and enhancement of devices such as smartphones, tablets, laptops, and wearable technology. Furthermore, the efficiency of power generation, transmission, and distribution systems is heavily reliant on the quality of soft magnetic materials used. Additionally, the growing demand for smart home devices, renewable energy solutions, and advanced telecommunication infrastructure further underscores the importance of these materials.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 52%. Based on the recent soft magnetic materials market forecast, Asia-Pacific is the dominant region due to its robust industrial base, rapid economic growth, and substantial investments in infrastructure development. Additionally, countries like China, Japan, South Korea, and India are at the forefront of technological advancements and industrial production, making them significant consumers of soft magnetic materials. Besides this, the burgeoning automotive industry in Asia-Pacific, particularly the surge in electric vehicle (EV) manufacturing, has increased the demand for these materials. Additionally, the region's strong presence in the electronics manufacturing sector, producing a vast array of consumer electronics, industrial machinery, and telecommunication equipment, is further driving the market growth.

Key Regional Takeaways:

United States Soft Magnet Materials Market Analysis

In 2024, the United States accounts for over 91.3% of the soft magnetic materials in North America. In North America, the increasing demand for energy efficient power generation and transmission systems is propelling the adoption of soft magnetic materials in electrical equipment, such as transformers and inductors. The United States soft magnetic material market faces distinct dynamics. Moreover, with limited rare earth resources, higher labor costs, and stringent environmental policies, the United States has seen a comparatively slower industry growth rate. The reliance on imports for rare earth ores and competitive pressures has shaped the trajectory of the soft magnetic material sector. The expansion of the renewable energy sector, including wind and solar power, is driving the need for soft magnetic materials in generators and converters.

Apart from this, the rise in consumer electronics and telecommunications applications is escalating the demand for soft magnetic materials in devices like smartphones and high-frequency transformers, which is augmenting the market growth. Moreover, the expanding EV sector, with over 7% of new cars sold in the US becoming electric in 2023 is escalating the demand for soft magnetic materials. Electric motors and charging infrastructure require soft magnetic materials to ensure performance and energy efficiency. Moreover, the rising demand is further increased by the telecommunications sector's need for sophisticated materials for better signal processing, which is fueled by the growth of 5G networks. In order to create cutting-edge alloys and secure market expansion, major American corporations such as Carpenter Technology and Arnold Magnetic Technologies are making significant investments in research and development (R&D).

Europe Soft Magnet Materials Market Analysis

The market for soft magnetic materials in Europe is supported by the region's focus on industrial automation, electric car adoption, and renewable energy. Moreover, soft magnetic materials are essential for energy conversion and storage in wind and solar power, which has seen large expenditures as a result of the European Union (EU)’s strict carbon neutrality requirements. For example, these materials are essential to the wind power industry in Europe, which installed 17 GW of new capacity in 2023.

Furthermore, the market is expanding as a result of continuous research and development initiatives meant to improve the qualities and performance of these materials. A European soft magnetics collaborative project was launched in 2019 with the goal of creating and refining soft magnetic materials for a variety of industrial uses, including sensors, electric motors, and transformers.

Asia Pacific Soft Magnet Materials Market Analysis

The Asia Pacific soft magnetic material market is widely influenced by China's rare earth resources, low labor costs, and rapid industry growth. Additionally, with over 55% of global rare earth mining, China's magnet sector sets a competitive pace. The expanding automotive sector, characterized by the electrification trend and the development of electric vehicles, is another significant factor propelling the market growth. Furthermore, the robust presence of electronics manufacturing in countries like China, Japan, and South Korea has amplified the consumption of soft magnetic materials in consumer electronics and telecommunications industries.

Besides, companies, such as Toshiba Materials, are focusing on the development of advanced soft magnetic alloys, tailored for high-performance applications in motors and transformers. For instance, in 2023, Toshiba Materials Co., Ltd. announced a major investment in a new production facility that will significantly boost its production capacity. On account of this, the demand for soft magnetic materials is escalating across the region.

Latin America Soft Magnet Materials Market Analysis

Power grid upgrading and rising investments in renewable energy are driving the soft magnetic materials market in Latin America. The focus on wind and solar energy projects in nations like Brazil and Mexico is escalating the demand for effective energy conversion and storage systems that use soft magnetic materials. Besides, the region's expanding automotive industry, especially in the areas of electric and hybrid vehicles, is also helping the market flourish. Furthermore, government programs to improve energy efficiency and partnerships with multinational manufacturers also contribute to market expansion.

Middle East and Africa Soft Magnet Materials Market Analysis

The rapid growth of the energy and power sectors in the Middle East and Africa region is primarily due to urbanization and infrastructural development, which is escalating the demand for soft magnetic materials in transformers, generators, and energy-efficient devices. Moreover, the expansion of the automotive industry, particularly in the Middle East, underscores the need for these materials in electric vehicle components and powertrain systems. In 2022, the United Arab Emirates (UAE) announced plans to develop an automotive manufacturing hub in Dubai to attract international automakers and suppliers to set up operations in the region.

Competitive Landscape:

The key players in the soft magnetic materials market are increasing their research and development efforts to improve the efficiency and performance of their products. These companies are focusing on developing materials with higher saturation magnetization and lower core losses to meet the growing demands of advanced electronics and electric vehicle markets. In addition to this, they are investing in their manufacturing capabilities and strategic alliances to further strengthen their global supply chains and market presence. Additionally, the environmental aspect of sustainability is being pursued with investment in the carbon footprint of the production process. This approach will help them to be more aggressive in a competitive landscape of changing industry dynamics. For example, US tech startup Niron Magnetics has started full-scale commercial production of its rare earth-free permanent magnets in October 2024. This helps to reduce US dependence on raw materials from China for wind turbines and renewing energy manufacturing sector grow in the United States.

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the soft magnetic materials industry include:

- Arnold Magnetic Technologies

- Daido Steel Co. Ltd

- GKN Sinter Metals Engineering GmbH

- Hitachi Ltd

- Mate Co. ltd

- Meyer Sintermetall AG

- SG Technologies

- Steward Advanced Materials

- Sumitomo Metal Mining Co. Ltd

- Toshiba Materials Co Ltd (Toshiba Corporation)

- Vacuumschmelze GmbH & Co KG

Latest News and Developments:

- In 2023: Daido Steel, a Japan-based steel producer, has announced that it will invest JPY 5.2 billion ($ 39.58 million) to construct two new special melting facilities at its Chita No.2 plant. This will increase the company’s production capacity for high-grade steel to meet the increasing demand for these steel in semiconductor manufacturing equipment.

- In 2023: GKN Powder Metallurgy and Schaeffler AG announced a joint commitment to further the development of permanent magnet industry in Europe and North America.

- In 2023: Toshiba Materials Co., Ltd. announced a major investment in a new production facility that will significantly boost its production capacity.

- In 2022: The United Arab Emirates (UAE) announced plans to develop an automotive manufacturing hub in Dubai to attract international automakers and suppliers to set up operations in the region.

- In 2019: A European Soft Magnetics collaborative project was introduced that aimed to develop and optimize soft magnetic materials for numerous industrial applications, such as electric motors, transformers, and sensors.

Soft Magnetic Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Cobalt, Iron, Nickel, Electrical Steel, Others |

| Applications Covered | Motors, Transformers, Alternators, Others |

| End uses Covered | Automotive, Electrical and Electronics, Telecommunication, Energy and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arnold Magnetic Technologies, Daido Steel Co. Ltd., GKN Sinter Metals Engineering GmbH, Hitachi Ltd., Mate Co. ltd., Meyer Sintermetall AG, SG Technologies, Steward Advanced Materials, Sumitomo Metal Mining Co. Ltd., Toshiba Materials Co Ltd (Toshiba Corporation), Vacuumschmelze GmbH & Co KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the soft magnetic materials market from 2019-2033.

- The soft magnetic materials market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the soft magnetic materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Soft magnetic materials are those that can be easily magnetized and demagnetized. They are characterized by low coercivity and are primarily used to enhance and channel the flux produced by an electric current. These materials are essential in the manufacture of transformers, inductors, and various types of electromagnetic devices.

The soft magnetic materials market was valued at USD 34.1 Billion in 2024.

IMARC estimates the global soft magnetic materials market to exhibit a CAGR of 7% during 2025-2033.

The market is driven by the increasing demand for energy-efficient electrical devices, expansion in the automotive industry, especially in electric vehicle production, and advancements in electronics and telecommunications. Additionally, the push for renewable energy sources requires efficient energy storage and conversion systems, further fueling the demand for these materials.

According to the report, electric steel represented the largest segment by material due to its crucial role in enhancing the efficiency and performance of electrical transformers and motors due to its high magnetic permeability and low energy loss.

Motors leads the market by application owing to their widespread use in the automotive and industrial sectors, where soft magnetic materials are essential for optimizing energy efficiency and performance.

The electrical and electronics industry is the leading segment by end-use, as soft magnetic materials are integral to the functionality and miniaturization of devices, improving energy management and signal integrity in a myriad of electronic applications.

Based on the regional level, the market has been divided into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Soft Magnetic Materials market include Absolutdata Technologies Inc. (Infogain Corporation), Adobe Inc., Altair Engineering Inc., Alteryx Inc., Amazon Web Services Inc. (Amazon.com Inc.), Fair Isaac Corporation (FICO), Hewlett Packard Enterprise Company, International Business Machines Corporation, Microsoft Corporation, Moody's Analytics Inc. (Moody's Corporation), SAS Institute Inc., TIBCO Software Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)