Sodium Lactate Market Size, Share, Trends and Forecast by Form, Application, End User, and Region, 2025-2033

Sodium Lactate Market Size and Share:

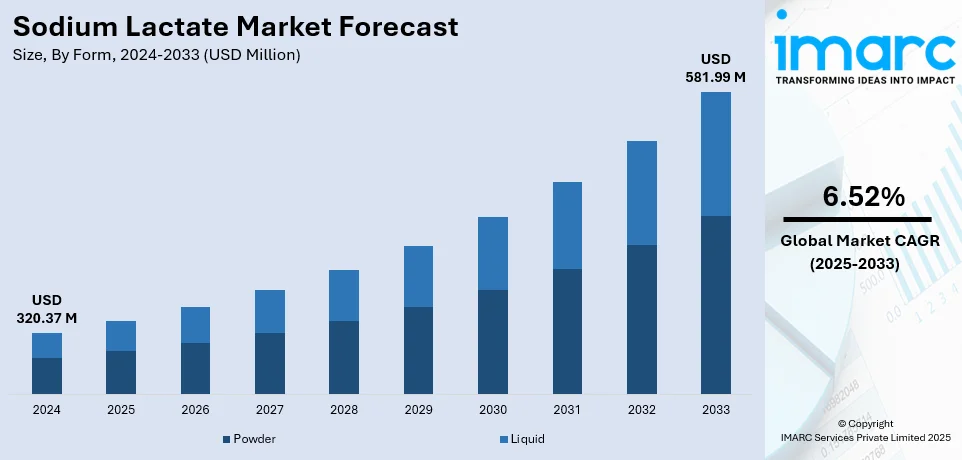

The global sodium lactate market size was valued at USD 320.37 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 581.99 Million by 2033, exhibiting a CAGR of 6.52% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.8% in 2024. The growing use in intravenous (IV) solutions for the treatment of dehydration, rising demand for food products that are devoid of synthetic preservatives and additives, and the increasing awareness about electrolyte balance are some of the drivers impelling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 320.37 Million |

| Market Forecast in 2033 | USD 581.99 Million |

| Market Growth Rate (2025-2033) | 6.52% |

The global sodium lactate industry is principally being impacted by heightening requirement for natural preservatives in the food segment, magnifying uses in pharmaceutical operations for effectively balancing electrolytes, and augmenting utilization in cosmetics as a humectant. Regulatory aid for clean-labeled as well as bio-based ingredients further fuels the market expansion. The growing preference for processed and convenience foods boosts sodium lactate adoption in meat preservation and dairy applications. Additionally, its antimicrobial and antioxidant properties enhance its role in food safety. Increasing utilization in biodegradable formulations and industrial applications further supports market expansion, positioning sodium lactate as a versatile and high-demand ingredient across multiple industries.

The United States is emerging as a crucial nation, imparting significant impacts in the sodium lactate market globally. This nation is chiefly being steered by a robust product requirement across key segments, mainly encompassing personal care, food, and pharmaceuticals. The nation’s well-structured and resilient food processing segment heavily depends on sodium lactate for its exceptional antimicrobial as well as preservative attributes, especially in dairy and meat products. For instance, as per the U.S. Department of Agriculture, per capita meat consumption in the U.S. is projected to exceed 2024 levels by 2033, with pork consumption reaching a peak of 53.6 lbs in 2030. This elevation will significantly impact the product demand. Moreover, in pharmaceuticals, it is widely used in intravenous solutions for electrolyte balance and hydration therapy. The rising preference for clean-label and bio-based ingredients further supports market growth. Regulatory approvals, advanced manufacturing capabilities, and increasing adoption in cosmetics and biodegradable formulations reinforce the United States' leading position in the global sodium lactate market.

Sodium Lactate Market Trends:

Growing Demand for Natural Food Preservatives

People are rapidly gaining more knowledge about healthy lifestyle and actively navigating for food products that are free from anthropogenic additives as well as preservatives. Sodium lactate, typically derived from the fermentation of natural ingredient, exhibits the role of a beneficial pH controller as well as preservative in dairy products, processed meats, and poultry. For instance, the consumption of ultra-processed foods globally has been escalating at a significant pace in certain high- as well as middle-income nations, accounting for approximately 25% to 60% of energy intake on a daily basis. Its exceptional capability to terminate growth of harmful microorganisms results in shelf life extension for food products, positioning it a as a preferable substance in the food and beverage sector. In addition, several populations are currently focusing on natural compounds and transparency in ingredient leveraged, which is significantly bolstering the requirement for sodium lactate in food preservation applications. Furthermore, during 2023, Florida Food Products unveiled VegStable Secure, a natural ingredient with antimicrobial activity formulated to safeguard food products against pathogens like Listeria monocytogenes, or spoilage. This clear labeling solution encompassed sodium lactate and certain other antimicrobial agents to expand the shelf life of hot dogs, meats, and hams.

Rising Use in Pharmaceutical Applications

Sodium lactate is prevalently being leveraged across the pharmaceutical sector, especially in intravenous (IV) solutions that are mainly used for mitigating health issues like imbalance of electrolytes or dehydration. Its usefulness as an electrolyte rejuvenator positions it as a requisite compound in healthcare landscape, particularly for individuals undergoing surgery or witnessing intense loss of fluids. The growing need for enhanced and safer drug compositions is encouraging higher usage of sodium lactate within the pharmaceutical sector. Moreover, the rising prevalence of long-term illnesses, coupled with the growing geriatric population is driving the need for these IV solutions. In 2023, the worldwide market for IV solutions was valued at USD 14.8 Billion . In the future, IMARC Group anticipates the market will achieve USD 23.2 Billion by 2032, showing a growth rate of 4.9% from 2024 to 2032.

Increasing Popularity of Electrolyte-Rich Beverages

The increasing knowledge about balance of electrolytes and hydration, especially among the fitness-conscious and health-aware consumers, is pushing the requirement for sodium lactate in beverages that are specifically branded as electrolyte-rich. According to a survey, around 50% of consumers, cutting across age groups, consider healthy eating as one of their top priorities. Sodium lactate is important for upgrading hydration by enhancing the absorption of electrolyte and sustaining a fluid balance inside the body. Consumers are looking for functional beverages for post-exercise recovery, post-heat stress, or after being ill. The manufacturers of these products are adding sodium lactate to their hydration offerings or sports drinks. In 2024, Electrolit rolled out a new flavor of Watermelon Lime in its line of hydration drinks at 7-Eleven stores across the country. The 21 fl. The oz bottles contain numerous beneficial compounds, including sodium lactate, to enhance the absorption of electrolytes and help boosting rehydration post dehydration situation. This newest flavor fulfills the summer hydration needs and is a new addition to Electrolit's proliferating product line of scientifically formulated beverages, prominent for gaining electrolyte levels post heavy workouts, physical activities, or heat exposure.

Sodium Lactate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sodium lactate market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on form, application, and end user.

Analysis by Form:

- Powder

- Liquid

Liquid stand as the largest form in 2024, holding around 77.6% of the market. Liquid leads the market because it is widely utilized across different industries, notably in food and pharmaceuticals. Liquid sodium lactate is frequently utilized in processed foods, meat products, and dairy items as a preservative and pH regulator because of its convenient application and improved solubility in comparison to the powdered form. In the pharmaceutical industry, it is preferred for intravenous solutions for hydration and balancing electrolytes. The high demand for liquid form in various sectors is supporting the sodium lactate market growth. Liquid sodium lactate's role extends beyond food and pharmaceuticals, finding applications in cosmetics and personal care as a humectant and buffering agent. Its ease of handling in industrial processes further supports its widespread use across multiple sectors. Rising adoption in biodegradable formulations enhances its market potential, reinforcing its dominance.

Analysis by Application:

- Bulking Agent

- Anti-oxidant

- Emulsifier

- Flavor Enhancer

- Others

Antioxidant leads the market in 2024. Sodium lactate is widely used as an antioxidant in processed meats, poultry, and other perishable food products to prevent oxidation, spoilage, and discoloration, which helps maintain product quality and freshness. Its ability to inhibit microbial growth further enhances its importance in food safety, making it highly desirable in the food processing industry. The growing user demand for longer-lasting, safe, and natural food products is offering a favorable sodium lactate market outlook. Moreover, as an antioxidant, sodium lactate is also gaining traction in pet food and animal nutrition, improving shelf life and safety. Its multifunctional benefits drive increasing adoption in ready-to-eat and convenience foods, aligning with evolving consumer preferences. Regulatory approvals for clean-label preservatives further boost its demand, solidifying its position in the global sodium lactate market.

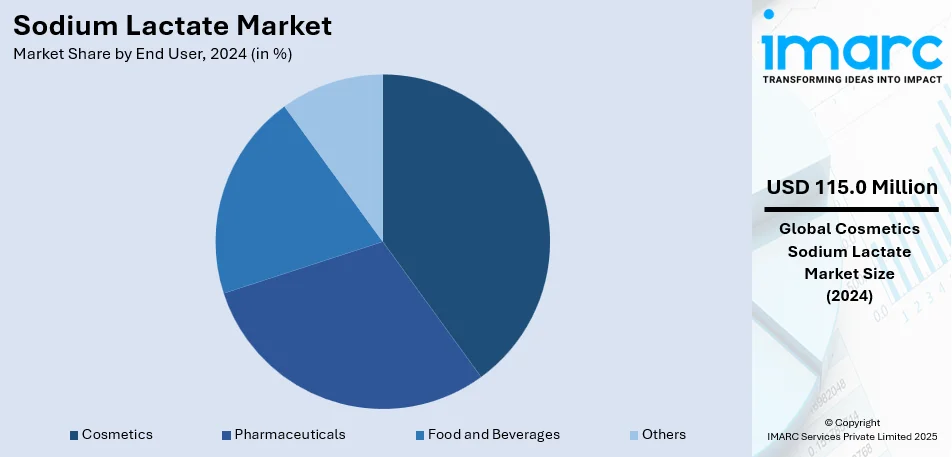

Analysis by End User:

- Cosmetics

- Pharmaceuticals

- Food and Beverages

- Others

Cosmetics lead the market with around 35.9% of market share in 2024. Cosmetics comprises the largest market share since it is broadly used in personal care or skincare products. Sodium lactate functions as a humectant, hence aiding in the skin's retention of moisture; hence, it is an essential ingredient in moisturizers, lotions, as well as creams. Its natural origin and compatibility with various formulations are also the reasons for its intense requirement as an ideal ingredient in organically sourced or clean-label cosmetic products. In addition to this, the growing demand for moisturizing skincare products, along with the rising requirement for highly effective and safe components, is also positively impacting the market. According to the data provide by the IMARC Group, the global cosmetics market was at USD 400.6 Billion in 2023.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.8%. North America dominates the market because of the growing need for natural food preservatives and additives in the F&B sector. Strict food safety rules in the area and the increasing demand for natural products are leading to the utilization of sodium lactate in processed food items, especially in meat and dairy products. In 2023, Electrolit added a new Pineapple flavor to its high-end hydration drink range as a limited-edition option. Available exclusively at 1,900 Circle K stores in eight US states, the flavor was crafted to enhance hydration during summer activities. Each Electrolit Pineapple's 21 fl. oz bottle had 326 mg of electrolytes like sodium lactate, magnesium, potassium, and calcium to help replenish electrolytes and promote recovery from dehydration. The drink was included in Electrolit's attempt to meet a variety of taste preferences and provide scientifically designed hydration options.

Key Regional Takeaways:

United States Sodium Lactate Market Analysis

In 2024, United States accounted for 97.60% of the market share in North America. The growing adoption of sodium lactate in the United States can be pertained to significant investments in the cosmetics sector, where it is increasingly utilized for its moisturizing and anti-aging properties. For instance, in 2021, the beauty industry saw record-breaking investments with 388 deals and USD 3.3 Billion in venture capital raised. With a shift toward more natural and sustainable products, sodium lactate, derived from plant-based sources, fits well within the industry’s trend towards clean beauty and eco-friendly formulations. This growing demand for safer, skin-friendly ingredients has led cosmetic companies to include sodium lactate in their formulations, particularly in lotions, creams, and serums. The widespread preference for non-toxic, effective alternatives has driven investments and innovation in the sector. As consumers demand more transparency and better-performing products, sodium lactate's ability to maintain skin hydration and improve texture is becoming a sought-after ingredient. Its growing role in cosmetics products is further catalyzed by the increased research and development efforts, all of which are positioning sodium lactate as a key player in the market.

Asia Pacific Sodium Lactate Market Analysis

In the Asia-Pacific region, the growing utilization of sodium lactate is closely linked to the booming pharmaceutical industry, which is increasingly using sodium lactate in formulations. For instance, pharmaceutical sector in India globally secured third rank for the pharmaceutical production on the basis of the volume and 14th rank based on the value, aided by a well-structured domestic segment enveloping more than 10,000 custom manufacturing facilities and almost 3,000 drug firms. Sodium lactate’s ability to maintain stability and enhance the shelf-life of medications makes it an attractive ingredient for pharmaceutical companies. The industry’s rapid expansion, particularly in nations such as India or China, is being fueled by the accelerating requirement for leading-edge healthcare services and the heightening case registrations of chronic disorders. As the pharmaceutical sector invests heavily in research and development, sodium lactate’s applications in intravenous fluids, intravenous injections, and oral medications are gaining traction. Furthermore, its role as a stabilizer and preservative in drug formulations is invaluable in maintaining the efficacy and safety of pharmaceuticals. With the growth of healthcare infrastructure and higher access to healthcare products, sodium lactate is becoming essential in meeting the industry’s evolving needs.

Europe Sodium Lactate Market Analysis

In Europe, the growing demand for sodium lactate is largely driven by the increasing need for antioxidants, especially among the aging population. According to WHO, the individuals with 60 or more than that is significantly proliferating across the WHO European nations. There were 215 Million with this age during 2021, and projections indicate that by the year 2030, this number will elevate to 247 Million, and then to 300 Million or more by the year 2050. Sodium lactate is known for its skin-protecting and antioxidant properties, which aid the neutralization of free radicals and minimize the noticeable signs of aging. As the elderly population grows, there is a rising focus on maintaining skin health and reducing the impacts of aging, thus creating an expanding market for anti-aging products enriched with sodium lactate. The cosmetic and skincare industries, which are key players in Europe, are increasingly incorporating this ingredient into their products, ranging from serums to moisturizers. This trend is further supported by consumer preferences for products that provide natural, non-invasive alternatives to traditional anti-aging treatments. As the aging population becomes more conscientious about skin care, sodium lactate’s role in improving skin texture, reducing wrinkles, and providing hydration makes it an appealing choice for both consumers and manufacturers.

Latin America Sodium Lactate Market Analysis

The adoption of sodium lactate in Latin America is being driven by the growing demand for food and beverages, fuelled by increasing disposable incomes. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. As economic conditions improve in countries like Brazil and Mexico, there is a rise in consumer spending, particularly in the food and beverage sector. Sodium lactate is used as a flavor booster or food preservative, particularly in processed meats, dairy products, and beverages. With more consumers seeking high-quality, preserved, and flavored food products, sodium lactate is becoming a key ingredient in the food industry. Additionally, as Latin American consumers are increasingly opting for healthier, cleaner-label products, sodium lactate’s natural preservative properties make it a preferred choice. The magnified disposable income in the region is pushing the requirement for more diverse and high-quality food products, driving the adoption of sodium lactate.

Middle East and Africa Sodium Lactate Market Analysis

In the Middle East and Africa, the growing demand for sodium lactate is largely driven by the increasing preference for natural food preservatives in the food and beverage industry, particularly in countries experiencing rapid growth in tourism. For instance, Dubai hosted around 14.96 Million visitors during January-October in 2024, marking an 8% elevation in comparison to the same period in 2023, highlighting a strong growth in tourism. As tourism flourishes, both local and international food suppliers are looking for natural solutions to extend the shelf life of their products without relying on synthetic additives. Sodium lactate is gaining popularity as a natural preservative due to its ability to inhibit microbial growth and maintain the quality of food products. The demand for healthier, safer, and more sustainable food options is rising, driven by the influx of tourists seeking organic and preservative-free foods. As the tourism sector continues to expand, sodium lactate is being increasingly adopted to meet the growing needs of food safety and quality in the region.

Competitive Landscape:

The market is currently depicting a robust competition with leading firms actively emphasizing on product enhancements, capacity expansion, and strategic partnerships. Major companies, including Corbion or Jungbunzlauer dominate the industry through extensive production capabilities and strong distribution networks. For instance, as per industry reports, Corbion registered sales of USD 972.9 Million during Q1 to Q3 in 2024. Moreover, market participants emphasize sustainable manufacturing processes and compliance with stringent food, pharmaceutical, and cosmetic regulations. Rising demand for natural preservatives in food, electrolyte solutions in healthcare, and humectants in cosmetics intensifies competition. Companies invest in research and development to significantly improve product purity and application versatility. Strategic acquisitions and regional expansions further strengthen market positioning amid growing consumer preference for multifunctional and bio-based ingredients.

The report provides a comprehensive analysis of the competitive landscape in the sodium lactate market with detailed profiles of all major companies, including:

- abcr GmbH

- Cambridge Isotope Laboratories Inc. (Otsuka Pharmaceutical Co. Ltd.)

- Corbion N.V.

- Dr. Paul Lohmann GmbH & Co. KGaA

- Finetech Industry Limited

- Foodchem International Corporation

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Jiaan Biotech

- Jungbunzlauer Suisse AG

- Loba Chemie Pvt. Ltd.

- Luoyang Longmen Pharmaceutical Co. Ltd.

- Merck KGaA

- Qingdao Dawei Biological Engineering Co. Ltd.

Latest News and Developments:

- November 2024: Electrolit is building a USD 400 Million state-of-the-art manufacturing facility in Waco, TX, its first U.S. production site, set to open in 2026. The plant will create over 200 jobs and meet the rising demand for its premium hydration drinks, which feature key ingredients like sodium for enhanced electrolytes. This expansion, in partnership with Keurig Dr Pepper, supports Electrolit's growing presence in North America.

- October 2024: Electrolit has launched a new Lemon Lime flavor of its electrolyte-packed hydration powders, exclusively on Amazon during October Prime Day. The new flavor joins existing options like Grape and Fruit Punch, offering a blend of sodium, potassium, calcium, and magnesium to support hydration.

- September 2024: Hikma Pharmaceuticals has launched Foscarnet Sodium Injection (6000mg/250mL) in the US for treating CMV retinitis in AIDS patients and acyclovir-resistant HSV infections in immunocompromised individuals. The sodium-based injection is also approved for combination therapy with ganciclovir in relapse cases.

- June 2024: Electrolit has launched a new Green Apple flavor exclusively in Texas, available at H-E-B, 7-Eleven, and other retailers until the end of summer. This limited-edition beverage, formulated post in-depth research with magnesium, sodium, potassium, calcium, and glucose, offers complete hydration. Each 21 fl. oz. serving contains 326 mg of electrolytes to help replenish the body.

- January 2024: Jungbunzlauer, a leader in the Sodium Lactate market, announced the opening of a new Biogums production facility in Port Colborne, Canada. This expansion aims to meet increasing demand for high-quality products and reinforces the company's commitment to excellence. The hydrocolloids, derived from renewable raw materials like corn, are essential in Food, Personal Care, Household, and Industrial applications.

Sodium Lactate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Powder, Liquid |

| Applications Covered | Bulking Agent, Anti-Oxidant, Emulsifier, Flavor Enhancer, Others |

| End Users Covered | Cosmetics, Pharmaceuticals, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | abcr GmbH, Cambridge Isotope Laboratories Inc. (Otsuka Pharmaceutical Co. Ltd.), Corbion N.V., Dr. Paul Lohmann GmbH & Co. KGaA, Finetech Industry Limited, Foodchem International Corporation, Henan Jindan Lactic Acid Technology Co. Ltd., Jiaan Biotech, Jungbunzlauer Suisse AG, Loba Chemie Pvt. Ltd., Luoyang Longmen Pharmaceutical Co. Ltd., Merck KGaA, Qingdao Dawei Biological Engineering Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sodium lactate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sodium lactate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sodium lactate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sodium lactate market was valued at USD 320.37 Million in 2024.

IMARC estimates the sodium lactate market to to reach USD 581.99 Million by 2033, exhibiting a CAGR of 6.52% during 2025-2033.

The market is impacted by magnifying need for natural preservatives in food, elevating utilization in pharmaceuticals for hydration therapy, proliferating applications in cosmetics as a humectant, and growing adoption in biodegradable formulations. Regulatory support for bio-based ingredients further accelerates market growth across multiple industries.

North America currently dominates the sodium lactate market, accounting for a share exceeding 37.8%. This dominance is fueled by robust requirement in the cosmetics, food, and pharmaceutical segments, stricter regulatory frameworks, and the presence of major manufacturers facilitating steady advancements and supply.

Some of the major players in the sodium lactate market include abcr GmbH, Cambridge Isotope Laboratories Inc. (Otsuka Pharmaceutical Co. Ltd.), Corbion N.V., Dr. Paul Lohmann GmbH & Co. KGaA, Finetech Industry Limited, Foodchem International Corporation, Henan Jindan Lactic Acid Technology Co. Ltd., Jiaan Biotech, Jungbunzlauer Suisse AG, Loba Chemie Pvt. Ltd., Luoyang Longmen Pharmaceutical Co. Ltd., Merck KGaA, Qingdao Dawei Biological Engineering Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)