Social Commerce Market Size, Share, Trends and Forecast by Business Model, Device Type, Product Type, and Region, 2026-2034

Social Commerce Market Size and Share:

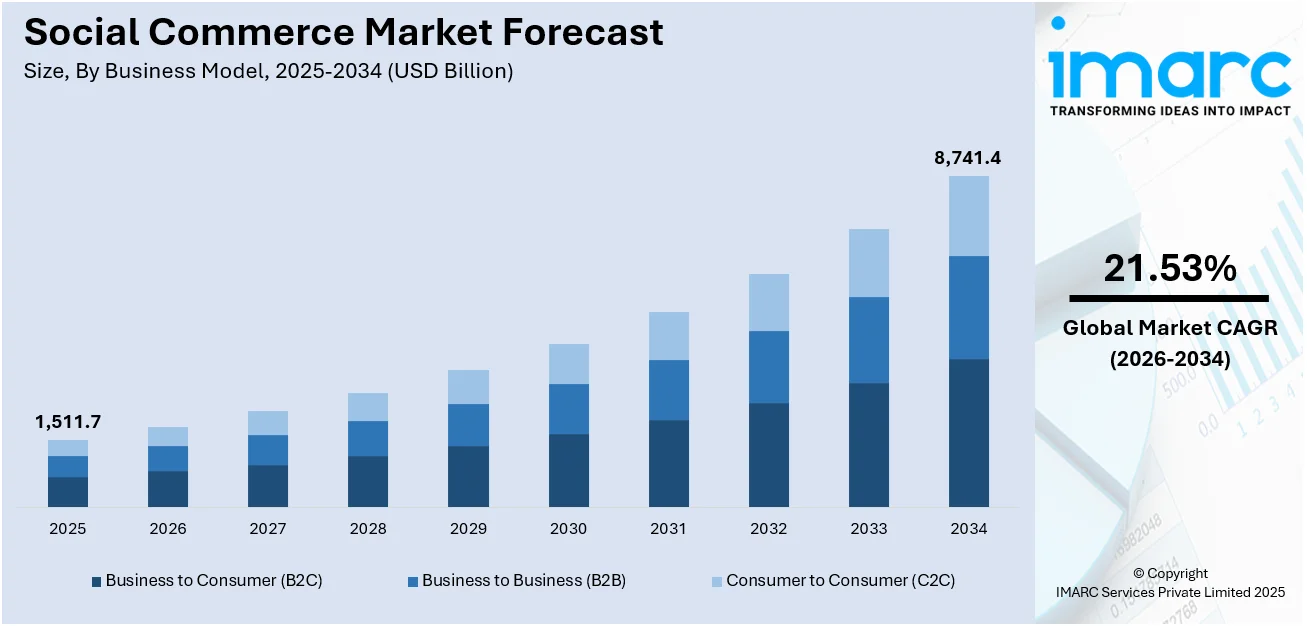

The global social commerce market size was valued at USD 1,511.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8,741.4 Billion by 2034, exhibiting a CAGR of 21.53% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of 70.0% in 2025. The growth of the Asia Pacific region is driven by high mobile internet penetration, widespread social media usage, digital influencers, and localized, seamless shopping experiences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,511.7 Billion |

|

Market Forecast in 2034

|

USD 8,741.4 Billion |

| Market Growth Rate 2026-2034 | 21.53% |

At present, the widespread use of social media platforms provides a large user base for social commerce to thrive, offering direct interaction between brands and buyers. Additionally, the ubiquity of smartphones and the increasing sophistication of mobile applications are revolutionizing how people shop online. With people spending more time on mobile devices, social commerce leverages the mobile-first nature of social media platforms to enable a seamless shopping experience. Mobile technologies, such as faster internet speeds, better mobile payment solutions, and improved app interfaces, are significantly enhancing the accessibility and convenience of shopping through social media. Furthermore, the integration of secure, user-friendly payment options like digital wallets, mobile payment solutions, and one-click payment functionalities, are making the purchasing process faster and more efficient. These innovations make it easier for buyers to complete transactions directly within social media platforms, increasing conversion rates and reducing friction for users.

To get more information on this market Request Sample

The United States is a crucial segment in the market, driven by the high mobile device penetration and a mobile-first culture. Social media platforms are optimizing their interfaces for seamless, mobile-first shopping experiences, enabling users to discover products, engage with brands, and complete purchases directly within apps, enhancing convenience and accessibility. Moreover, live-streamed shopping events, often hosted by brands or influencers, are becoming a popular way to drive sales. Via social media portals, brands can interact with their audience in real time, demonstrate products, and offer exclusive promotions. For instance, in 2024, TikTok launched "Deals For You Days" in the US, offering exclusive discounts from major brands like L’Oréal and Maybelline through in-app shopping. The initiative features live shopping events and content challenges to encourage user engagement and drive in-stream purchases.

Social Commerce Market Trends:

Rise of Social Media Usage

The increasing penetration of social media is significantly impacting the social commerce market. Through social media platforms, brands have become the new channels for communication with individuals and the promotion of products, followed by sales. In addition, the direct shopping features integrated directly into Instagram and Facebook are facilitating the discovery and purchase of products without leaving the app. The increasing number of users on social media is also creating lucrative growth opportunities for the overall market. Since its launch in 1996, social media has somehow or other penetrated the space of over half of the 8.06 Billion people in the world. Social networking platforms nearly tripled their total number of users over the last ten years, growing from 970 million in 2010 to more than 4.95 billion users by October 2023. What is more is that 72.5% of the total US population actively uses social media, which sums up to a staggering 246 Million people. Such a huge increase in the usage of social media is driving the market share of social commerce.

Advancements in Mobile Technology

The past decade has witnessed a tremendous rise in mobile technology, and smartphones have become an integral part of daily life. The improved smartphone capabilities and internet connectivity have led to increased mobile commerce, where users prefer to shop directly from their devices. Furthermore, the inflating disposable incomes of the individuals are increasing the number of smart phone users, which eventually contributes to the social commerce market value environment. For example, the Consumer Technology Sales and Forecast study by the Consumer Technology Association (CTA) also examined new technology trends, which indicated that 5G cellphones accounted for USD 61.37 Billion in revenue, up by 15% from USD 53.38 Billion in revenue, an increase of 15% from USD 53.38 Billion in 2021. In addition, 5G smartphones accounted for 62% of all smartphone units in 2021, which resulted in a surge of 72% in 2022. Furthermore, different network-providing companies are heavily investing in the installation of 5G networks to facilitate fast internet services. For example, in October 2022, Samsung Electronics said that it had been able to help NTT East expand its private 5G network through its network solutions, including the cloud-native 5G macro core and radio access network (RAN), which helped businesses in several sectors in Japan with innovative and varied applications.

Expanding Influencer Marketing

Recently, influencers have emerged as a crucial force in shaping user behavior. These individuals are able to influence the purchasing decisions of their followers through their content, recommendations, and product endorsements. The worldwide influencer marketing industry has grown by over three times since 2019. The influencer marketing platforms gained immense popularity during the COVID-19 pandemic. Additionally, the increased social media usage during the lockdown also encouraged the adoption of influencer marketing. In response to this, various influencer management startups gained traction as they struck a perfect harmony between the creative freedom of content creators and the core values and principles of brands within the financial ecosystem. For instance, in May 2023, FINTroop, the leading influencer management platform by Dot Media, a creative martech startup, was launched. FINTroop's main objective is to communicate brand messages in the most creative and original manner available. Consequently, the increasing number of influencers is creating a favorable social commerce market outlook.

Social Commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global social commerce market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on business model, device type, and product type.

Analysis by Business Model:

- Business to Consumer (B2C)

- Business to Business (B2B)

- Consumer to Consumer (C2C)

Business to consumer (B2C) represents the biggest sector in the market, accounting for a share of 55.9%, as it directly links brands with individual clients, enabling smooth online shopping experiences. This framework allows companies to connect with a broad audience on social media channels by utilizing focused advertising, partnerships with influencers, and engaging content to enhance interaction and conversions. B2C companies can foster brand loyalty by offering personalized and engaging shopping experiences, including live-streamed product unveilings, special promotions, and direct sales to users. Social commerce platforms that include shopping features enable brands to display products, gather client feedback, and provide personalized recommendations, thereby increasing individual satisfaction. The capability to engage with brands directly via comments, likes, and shares promotes stronger connections and trust among the user community. As social media progresses, the B2C model stays a crucial catalyst for growth in social commerce, prompting companies to consistently modify their strategies to improve user interaction and increase sales via these channels.

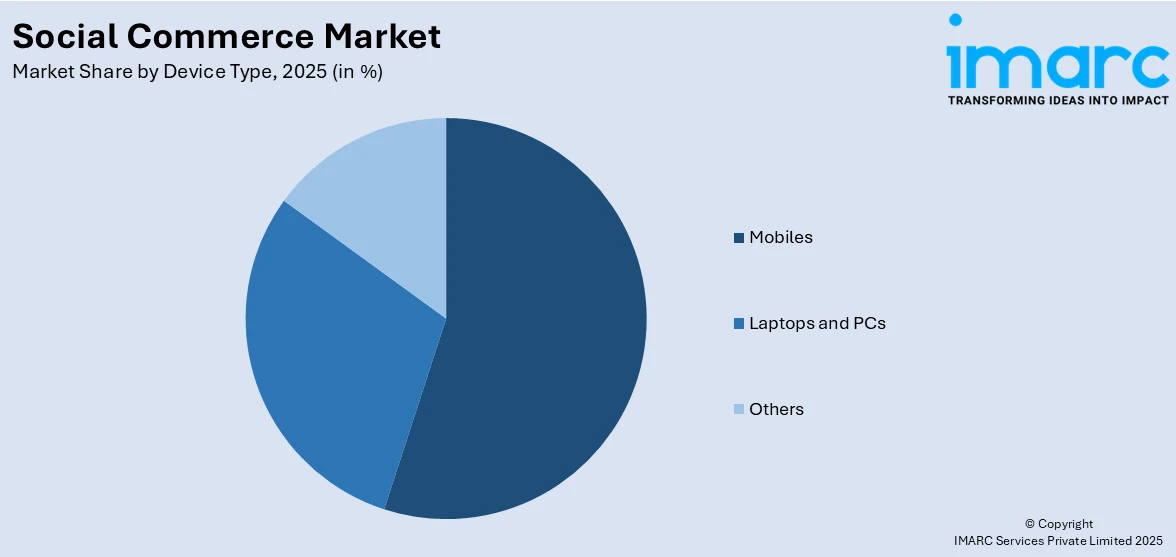

Analysis by Device Type:

Access the comprehensive market breakdown Request Sample

- Laptops and PCs

- Mobiles

- Others

Mobiles represent the largest segment as they are the main tool for online shopping. Smartphones provide shoppers with the convenience of browsing, discovering, and purchasing products seamlessly through social media platforms, which are optimized for mobile use. The portability and accessibility of mobile devices enable people to shop anywhere and anytime, enhancing the overall shopping experience. Social commerce apps on mobile devices are designed with user-friendly interfaces that integrate shopping features directly into social feeds, making the process quick and intuitive. Push notifications, real-time updates, and instant purchase options further increase user engagement, prompting more frequent purchases. The mobile-first approach of major social platforms encourages brands to optimize their marketing strategies specifically for mobile users, ensuring a smooth and effective shopping journey. As mobile technology continues to evolve, its dominance in the social commerce space is expected to expand.

Analysis by Product Type:

- Personal and Beauty Care

- Apparel

- Accessories

- Home Products

- Health Supplements

- Food and Beverages

- Others

The apparel segment holds the biggest market share, holding a share of 23.4%, due to its widespread appeal and significant user demand. Apparel brands leverage social media platforms to showcase new collections, promote limited-edition releases, and interact with audiences via influencer partnerships and user-generated content. The visual nature of social media, combined with interactive shopping features, allows buyers to experience fashion trends in real-time, enhancing impulse buying. Social commerce also enables fashion retailers to reach niche markets and tailor offerings to specific demographics, further driving growth. In addition, the ease of integrating social commerce with user-generated content, such as try-ons, styling tips, and client reviews, increases buyer confidence and encourages purchasing. This dynamic combination of social engagement, influencer marketing, and seamless shopping experiences is making apparel the dominant segment, with ongoing innovations in product offerings and customer engagement tactics assisting brands in sustaining a robust presence in the competitive market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia-Pacific leads the market and accounts for a share of 70.0% because of its extensive internet accessibility and the widespread use of mobile devices. As a large segment of the population participates in social media platforms, the area is turning into a center for online shopping via these channels. In the Asia-Pacific region, social commerce is propelled by the increasing popularity of interactive and customized shopping experiences, as platforms consistently adapt to incorporate live-streaming, influencer-driven advertising, and convenient payment methods. Moreover, the increasing presence of regional social media platforms and partnerships with international brands further enhance the market's growth, fostering a vibrant environment that promotes user interaction and e-commerce. In 2024, ByteDance launched Douyin Mall, a standalone e-commerce app in China, expanding its efforts to penetrate the e-commerce market. The app directly competes with major rivals like Alibaba, JD.com, and Pinduoduo by adding live-streaming and short video elements to enhance the shopping experience. This move strengthens ByteDance's initiative to expand its income streams through social commerce.

Key Regional Takeaways:

United States Social Commerce Market Analysis

In North America, the market share for the United States was 80.00%. In the United States, the increasing number of social media users has been instrumental in boosting the adoption of online purchasing via social platforms. For instance, the count of social media users in the US is predicted to reach 307.06 Million in 2025. This number is expected to increase to 326.74 Million by 2029. Social media, which has become a staple in daily life, offers a seamless integration of e-commerce, allowing businesses to reach buyers directly within the apps. As more users engage with social media content, they are exposed to targeted advertisements and product recommendations, which often prompt purchases. Moreover, social platforms now provide features that enable users to shop directly from their feeds, facilitating smoother transactions. The growing trend of user-generated content and influencer marketing has also helped to foster trust in these platforms, further accelerating the growth of this shopping method. As more individuals turn to social media for entertainment, information, and shopping, the growing user base is supporting the social commerce market growth in the region.

Europe Social Commerce Market Analysis

In Europe, the growing presence of food and beverage businesses in the social commerce landscape has contributed to the sector's rapid adoption. According to reports, there are approximately 445k businesses in the food & drink wholesaling industry in Europe. Social media platforms have become an effective way for food and beverage brands to directly interact with individuals, showcasing their products through engaging content like recipes, live demonstrations, and influencer endorsements. With more people turning to social media for product recommendations and trends, food and beverage businesses have realized the potential of leveraging these platforms for both marketing and sales. The integration of seamless checkout options allows businesses to offer instant purchasing, making it more convenient for users to buy their favorite food and beverage items. In addition, as people increasingly seek convenience and unique dining experiences, food and beverage businesses have turned to social commerce as a powerful tool to meet user demands. This dynamic shift towards social commerce has reshaped how food and beverage brands promote themselves and interact with customers, establishing social media as a key sales channel.

Asia Pacific Social Commerce Market Analysis

In Asia-Pacific, the surge in the number of businesses engaging in direct-to-consumer sales has been a key driver for the rise of online shopping on social media. With more businesses embracing online platforms for their marketing strategies, they have adopted social commerce as an innovative way to connect directly with individuals. By integrating e-commerce functionality into their social media channels, these businesses can engage with customers in real-time, offering personalized promotions and facilitating instant purchases. For instance, India's e-commerce to soar to USD 325 Billion by 2030, fuelled by 500 Million shoppers and a robust, low-cost internet availability. Social commerce enables businesses to create immersive brand experiences, particularly in highly digital markets, where people are already accustomed to shopping online. The proliferation of mobile commerce also contributes to the rapid social commerce demand, as many people in the region prefer making purchases through their smartphones. As the demand for direct and frictionless shopping experiences continues to grow, businesses increasingly recognize social commerce as a vital part of their e-commerce strategy in this rapidly evolving market.

Latin America Social Commerce Market Analysis

In Latin America, the growing number of smartphone users and the increased penetration of internet services have contributed significantly to the expansion of social commerce. According to GSMA, 418 Million people in Latin America (65% of the population) used mobile internet, a increase of 75 Million over the past 5 years. With smartphones becoming the primary device for online browsing, shopping, and communication, more individuals are turning to social media platforms for product recommendations and purchases. The ability to shop on mobile devices has made it easier for users to access social commerce opportunities, particularly as internet connectivity improves across the region. As the internet penetration rate rises, a greater proportion of the population gains access to social media and e-commerce platforms, leading to a greater adoption of social commerce.

Middle East and Africa Social Commerce Market Analysis

In the Middle East and Africa, the growth of influencer marketing has greatly enhanced the uptake of social commerce. A survey indicates that the influencer marketing sector in the Middle East is projected to reach USD 1.3 Billion in 2023. As influencers increasingly impact user habits and buying choices, companies have progressively sought out social media influencers to endorse their products. By utilizing the trust and influence that influencers possess over their audiences, companies can increase interaction and sales directly via social media. The rise of influencer marketing has resulted in a more tailored shopping experience for buyers, who are increasingly inclined to buy products following an influencer's suggestion. As influencer partnerships increasingly merge with social commerce, it offers brands a distinctive chance to engage with people on a more profound, genuine level, fostering enduring client loyalty.

Competitive Landscape:

Key players in the market are collaborating with influencers, brands, and content creators to drive engagement and boost sales. Additionally, social platforms are expanding their e-commerce tools, allowing users to browse and buy products seamlessly within the app. Data privacy and secure payment systems are being prioritized to build trust and ensure smooth transactions. Moreover, these players are focusing on enhancing user experiences by integrating advanced features such as in-app purchasing, live-stream shopping, and personalized recommendations. They are leveraging AI and ML to offer tailored content and targeted ads, improving conversion rates. In 2024, Starbox Group Holdings Ltd. announced the launch of its AI-powered "StarboxAI VI-Pro - Live Streaming System" through its subsidiary, Starbox Technologies. The system is designed to support over 800 merchants in live streaming social commerce, integrating with Starbox's cash rebate ecosystem. This innovation aims to enhance user engagement, automate content creation, and boost sales performance.

The report provides a comprehensive analysis of the competitive landscape in the social commerce market with detailed profiles of all major companies, including:

- eBay

- Etsy Inc.

- Meesho Inc.

- PayPal Payments Private Limited

- Pinterest Inc.

- Poshmark Inc.

- Reddit Inc.

- Taobao (Alibaba Group Holding Limited)

- Twitter Inc.

- Verizon Communications Inc.

Latest News and Developments:

- January 2025: StoryStream has launched a new AI-powered video commerce platform to transform online shopping experiences. The platform integrates immersive storytelling, shoppable videos, and live commerce, enhancing customer engagement. Brands can now create dynamic, story-based content that resonates with digital-savvy shoppers. The solution aims to revolutionize eCommerce, offering features like Stories and live commerce, to drive conversion, even for niche products like reclaimed lumber.

- January 2025: TalkShopLive unveiled TSL Shoppettes™ at CES®, a new social commerce tool for Instagram, Facebook, and more. This innovative platform enables short-form, shoppable videos featuring up to five products, allowing easy purchases through simple comments. With TSL Shoppettes™, businesses and creators can engage customers via video shopping events across various digital platforms. The system streamlines the buying process, offering a seamless user experience.

- April 2024: Paramount partnered with Shopsense AI to introduce mobile shopping options within its entertainment content, available on both televised and streaming platforms. This collaboration integrates AI-driven retail media to enhance viewers' shopping experiences directly during programming. By embedding shopping links and features, Paramount aims to create seamless engagement opportunities, tapping into the growing trend of shoppable content across diverse media formats.

- April 2024: YouTube rolled out new shopping tools that enable creators to curate product collections based on specific themes and showcase them in personalized virtual stores. These collections are displayed in the creators' Store tab, product lists, and video descriptions, making shopping more accessible for their audience. This move aligns with YouTube's broader efforts to strengthen its e-commerce capabilities and empower creators to monetize their content effectively.

- April 2024: Social commerce platform Flip secured USD 144 Million in a Series C funding round, accelerating its expansion efforts. With this investment, Flip launched MagicOS, an AI-powered ad manager, to provide brands with advanced advertising capabilities. Additionally, the company revamped its marketing platform to incorporate AXON AI technology from AppLovin, enabling businesses to create highly targeted and efficient advertising campaigns.

Social Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Business to Consumer (B2C), Business to Business (B2B), Consumer to Consumer (C2C) |

| Device Types Covered | Laptops and PCs, Mobiles, Others |

| Product Types Covered | Personal and Beauty Care, Apparel, Accessories, Home Products, Health Supplements, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | eBay, Etsy Inc., Facebook, Meesho Inc., PayPal Payments Private Limited, Pinterest Inc., Poshmark Inc., Reddit Inc., Taobao (Alibaba Group Holding Limited), Twitter Inc., Verizon Communications Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the social commerce market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global social commerce market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the social commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The social commerce market was valued at USD 1,511.7 Billion in 2025.

IMARC estimates the social commerce market to exhibit a CAGR of 21.53% during 2026-2034.

The social commerce market is driven by the growing use of social media platforms, the rise of influencer marketing, and seamless integration of shopping features on these platforms. User trust in social recommendations, personalized shopping experiences, and mobile-first usage also play pivotal roles. Furthermore, enhancements in AI and AR enhance user engagement and help in streamlining decisions related to purchases.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the social commerce market include eBay, Etsy Inc., Facebook, Meesho Inc., PayPal Payments Private Limited, Pinterest Inc., Poshmark Inc., Reddit Inc., Taobao (Alibaba Group Holding Limited), Twitter Inc., Verizon Communications Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)