Sneaker Market Size, Share, Trends and Forecast by Product Type, Category, Price Point, Distribution Channel, End User, and Region, 2025-2033

Sneaker Market Size and Share:

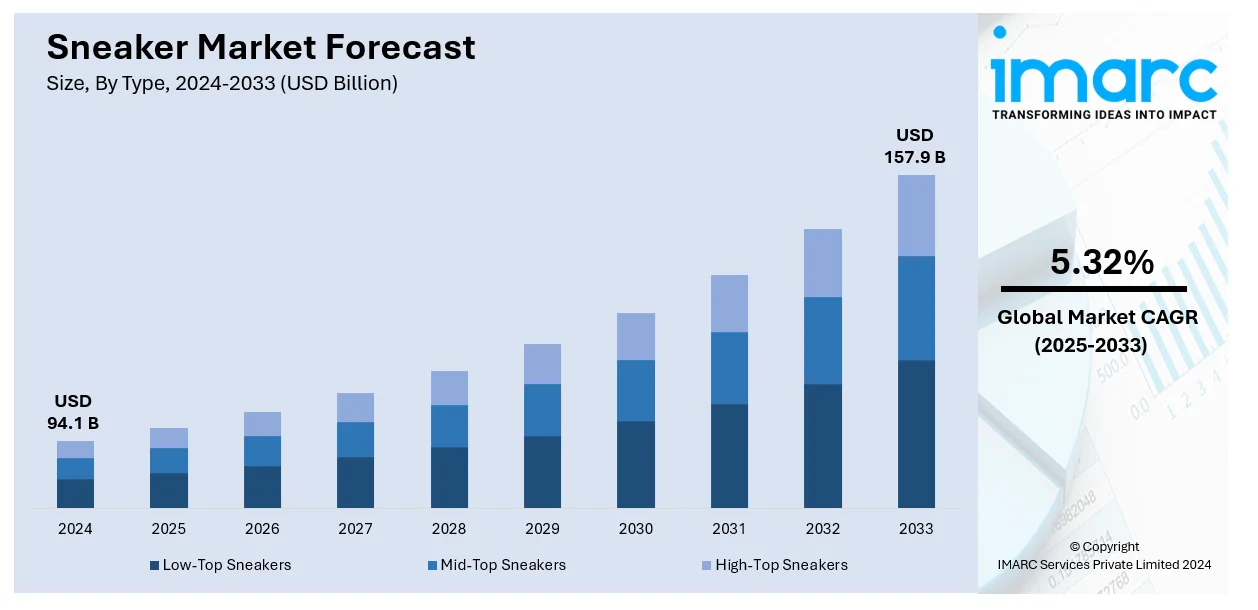

The global sneaker market size reached USD 94.1 Billion in 2024. The market is projected to reach USD 157.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The market is thriving, driven by the rising prevalence of various cultural influences and brand collaborations, rapid technological innovations, growing emphasis on health and fitness among consumers, the heightened focus on sustainability, and the expansion of brands across the globe. As of 2025, Nike tops the global market, with footwear sales reaching USD 33 Billion, while Adidas ranks second with USD 13 Billion. Together, the two companies account for roughly 57% of the global sneaker market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 94.1 Billion |

| Market Forecast in 2033 | USD 157.9 Billion |

| Market Growth Rate 2025-2033 | 5.32% |

The rising globalization across the globe, encouraging brands to expand their reach and consumer base, is acting as a growth-inducing factor. Moreover, the emergence of e-commerce platforms and digital marketing strategies that enable sneaker brands to transcend geographical boundaries and reach a wider audience is boosting the sneaker industry size. Globally, 2.71 billion individuals shop online, according to industry figures. In 2024, it is anticipated that 20.1% of retail transactions will take place on online channels. In 2024, the revenue of the e-commerce industry reached USD 26.8 trillion. Along with this, the increasing urbanization and the growing middle class across the globe fueling the demand for premium products is anticipated to drive the market growth. Furthermore, the burgeoning organization of international sporting events and global pop culture for promoting sneakers and bridging the gap between diverse cultures and demographics is enhancing the market growth. Apart from this, the heightened influence of regional trends and consumer preferences, prompting brands to adopt localized strategies, is catalyzing the sneaker market share.

The United States stands out as a key market disruptor. The increasing awareness about environmental issues and ethical consumerism among American masses is positively impacting the market growth. A significant 60% of American consumers are willing to pay more for sustainable and environmentally friendly items, per an industry survey. In line with this, the growing demand for sneakers that are made from eco-friendly materials and produced through sustainable methods, is creating a positive outlook for the market in the country. Along with this, the heightened product adoption from brands that prioritize sustainability, offer transparency regarding their supply chains, and actively reduce their carbon footprint is fostering the market growth. Moreover, the adoption of circular economy principles, leading to the production of sneakers that are designed to be recycled or remade at the end of their lifecycle are contributing to the sneaker market growth in the United States.

Sneaker Market Trends:

Rising Prevalence of Cultural Influence and Brand Collaborations

The rising intersection of sneakers with popular culture through collaborations with celebrities, artists, and designers, is one of the major factors boosting the sneaker industry size. Moreover, the growing adoption of sneakers as they transcended their original athletic purposes to become symbols of fashion, identity, and status, is fueling the market growth. Besides this, the increasing popularity of limited-edition releases and exclusive designs that blend high fashion with streetwear, elevating sneakers to luxury items is providing a thrust to the market growth. For example, the world-renowned sportswear company Adidas planned to debut a new pair of trainers in February 2024 in partnership with the estate of renowned artist Bob Marley. In addition to this, the increasing influence of culture in sneakers that merges style, comfort, and personal expression is bolstering the market growth. Moreover, the heightened focus on social media and influencer marketing to improve brand visibility and create a sense of urgency among consumers is fueling the sneaker market share.

Rapid Technological Advancements and Innovation

The rapid advancements in materials science, leading to the development of lighter, more durable, and sustainable materials that enhance the performance and comfort of sneakers, are providing a thrust to the market growth. In line with this, rapid innovations such as fly knit technology or boost cushioning features that combine advanced technology with comfort and style are catalyzing the sneaker industry growth. Furthermore, the integration of digital technology into sneakers, including smart features like tracking fitness data to provide personalized coaching, is bolstering the market growth. Apart from this, the increasing utilization of three-dimensional (3D) printing technology that allows for rapid prototyping, customization, and on-demand production is one of the emerging sneaker market trends. As per an industry report, the worldwide market for 3D printing services and products was estimated at approximately USD 12.6 billion in 2020. Innovation is propelling improved performance in a variety of sports shoes, from smart shoes with inbuilt sensors to 3D printing, which allows for quick prototyping and customization.

Growing Focus on Health and Wellness Trends

The growing health consciousness among consumers and an increased focus on fitness and wellness are major factors propelling the sneaker industry share. According to a 2018 International Food Information Council study, millennials are more inclined than older generations to place a higher priority on health and wellness when choosing foods. According to the report, 64% of baby boomers (those born between 1946 and 1964) take health benefits into account when choosing foods, whereas 80% of millennials do the same. This demonstrates the growing health consciousness among the new generation, which applies to sneakers and other similar consumer goods. In line with this, the rising participation in sports and fitness activities as people invest in maintaining a healthy lifestyle, boosting the demand for athletic footwear, is fueling the market growth. Along with this, sneakers are perceived as essential gear for enhancing athletic performance, providing support, and preventing injuries, aligning with the consumer's commitment to health and fitness goals. Moreover, the imposition of various governmental initiatives that promote physical health, as well as the proliferation of fitness apps and platforms that encourage an active lifestyle, are creating a positive outlook for the market growth. Additionally, the ongoing casualization of workplace dress codes and the integration of sportswear into daily fashion are enhancing the sneaker market size.

Sneaker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sneaker market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, category, price point, distribution channel, and end user.

Analysis by Product Type:

- Low-Top Sneakers

- Mid-Top Sneakers

- High-Top Sneakers

In 2024, mid-top sneakers held the largest market share. These sneakers combine the agility of low-top sneakers with the ankle stability of high-top sneakers. Additionally, their increasing popularity due to their adaptable design that fits a variety of activities and provides a reasonable amount of support and protection is contributing to their market dominance. In addition, the market is expanding because of the growing demand for balance, support, and flexibility in the basketball footwear industry, which is driving the use of mid-top shoes. Aside from that, extensive product demand from sports, fashion aficionados, and casual wearers, who value a balanced combination of practicality and fashion, is driving market expansion.

Analysis by Category:

- Branded

- Private Label

Branded sneakers lead the market share in 2024. These sneakers are dominating the market, driven by enhanced consumer loyalty, global recognition, and significant investments in marketing and innovation. Furthermore, strong brand loyalty and premium positioning increase the sneaker market share by brand, as consumers are more likely to choose established names known for quality, style, and cultural influence. Along with this, the rising adoption of branded sneakers as they benefit from strong brand heritage, extensive research and development (R&B), and high-profile endorsements and collaborations, is positively impacting the sneaker industry size. Besides this, the introduction of comprehensive marketing strategies, including celebrity partnerships, influencer marketing, and engaging social media campaigns, which enhance brand visibility and appeal, is enhancing the market growth.

Analysis by Price Point:

- Luxury

- Economic

Luxury sneakers lead the market share in 2024. Due to the increased desire from customers for upscale, designer footwear that blends exclusivity with cutting-edge design, this sector maintains the largest market share. As per the sneaker market statistics, the market is expanding due to the growing popularity of prestige companies that collaborate with well-known designers, offer limited edition releases, and have excellent workmanship. In addition, the expansion of the sneaker industry is being fueled by consumers' growing willingness to pay higher prices for luxury goods that are seen as status and fashion markers. Furthermore, ongoing innovation in sneakers, broad use of artisanal processes, and bespoke services catering to an upscale customer seeking distinction and individuality are driving the growth in the market.

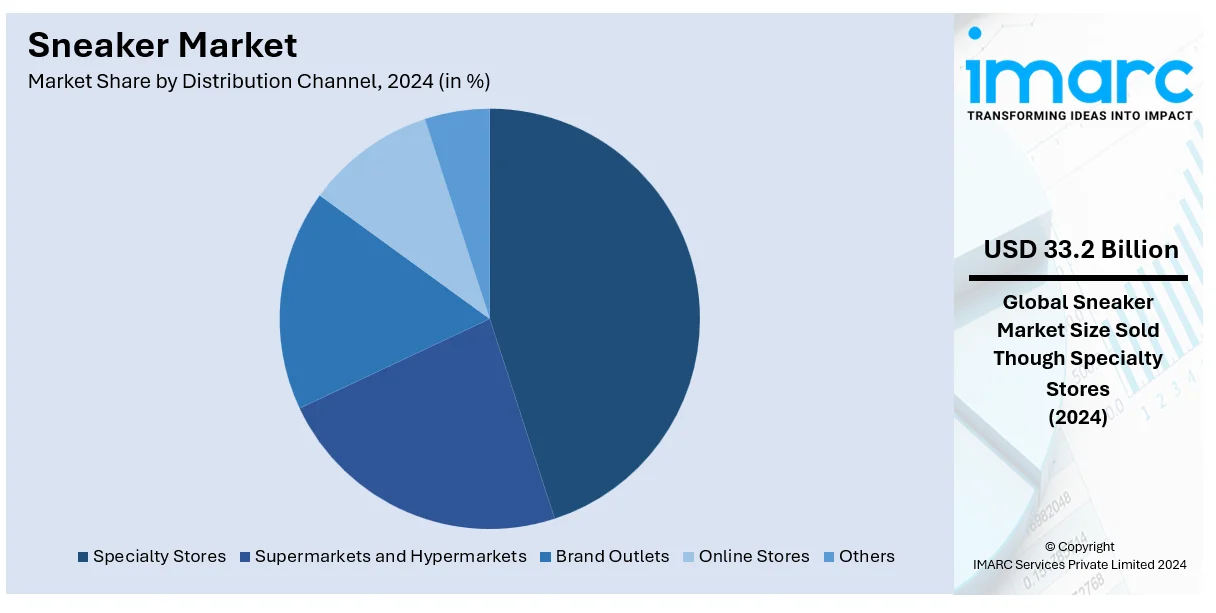

Analysis by Distribution Channel:

- Specialty Stores

- Supermarkets and Hypermarkets

- Brand Outlets

- Online Stores

- Others

Specialty stores leads the market share in 2024. These stores represent the largest segment as they offer a curated selection of footwear that caters to specific consumer interests and preferences. They are characterized by a deep focus on particular sports, styles, or sneaker cultures, providing a comprehensive retail experience and combining product variety with expert knowledge and personalized customer service. Moreover, the high level of customer engagement and the tailored shopping environment that resonates with enthusiasts looking for particular styles, brands, or the latest trends are enhancing the sneaker’s industry growth. Besides this, specialty stores host exclusive releases and limited-edition models, attracting sneaker fans and collectors who seek unique products.

Analysis by End User:

- Men

- Women

- Kids

Men leads the market with around 32% of market share in 2024. The men's segment holds the largest market share, driven by the increasing demand for a diverse range of styles, such as athletic, casual, and luxury sneakers. Moreover, the rising interest in fashion and personal style, coupled with a longstanding tradition of sneaker culture that resonates strongly with male consumers, is providing a thrust to the sneaker industry growth. Besides this, the growing popularity of sports and athletic activities among men, as well as the growing trend of incorporating sneakers into everyday and business casual attire, is enhancing the market growth.

Analysis by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share. According to the sneaker industry overview, this domination is fueled by a strong athletic culture, a significant inclination towards fitness and sports, and a deep-rooted sneaker culture. Moreover, the presence of major sneaker brands and a vast consumer base that consistently seeks the latest in sneaker innovations, limited editions, and designer collaborations is providing a thrust to the sneaker industry size. Besides this, the increasing consumer spending power, advanced retail infrastructure, and a keen interest in adopting the latest fashion trends are catalyzing the market growth. Additionally, the growing trend of casual wear in the workplace and the integration of sneakers into everyday fashion, is also fueling the sneaker market growth.

Key Regional Takeaways:

United States Sneaker Market Analysis

Fashion trends, a robust sports culture, and the rising demand for athleisure clothing are driving the sneaker business in the US. The need for performance-oriented trainers from companies like Nike, Adidas, and Under Armour is driven by the fact that about almost 60 million people in the United States alone will have a gym membership in 2024, according to industry forecasts. This accounts for over 20% half of the population. A large portion of American consumers who say they wear sneakers daily for non-athletic purposes, the athleisure trend that combines athletic and casual apparel has grown rapidly. Sneaker brands partner with athletes such as LeBron James and celebrities such as Travis Scott and Kanye West (Yeezy) to create limited-edition drops that often sell out within hours. Platforms such as StockX and GOAT state that they are experiencing double-digit growth every year. So, the shoe resale business is also thriving. Research by Digital Commerce 360 showed that U.S. Department of Commerce data found e-commerce in the United States was 22.0% of all retail sales in 2023, which led to a rise in online sneaker sales. The second and upcoming trend is sustainability. There is over half of the American consumer willing to pay extra for a more environment-friendly product. Consequently, a bigger market exists for sustainable trainers made of recycled materials.

Europe Sneaker Market Analysis

Urbanization, evolving fashion, and a culture that deeply embraces sports are the drivers for the European sneaker market. According to the statistics of European Urban Initiative, 75% of people live in cities, where sneakers and other casual, comfortable footwear are very common. Due to their European roots, sports companies like Adidas and Puma are able to retain a high level of consumer loyalty in the area. As many as over 50% of Europeans follow major football (soccer) tournaments like the UEFA Champions League, which makes football highly influential in lifestyle and performance trainers. According to industry statistics, men aged between 16 and 24 years are considered the most significant customers for footwear in the UK. These demographics are particularly keen on fashion-forward collaborations like Adidas x Gucci or Nike x Sacai. The market is also informed by Europe's focus on sustainability as companies like Veja benchmark the standard for eco-friendly trainers made from recycled materials and organic cotton. The European Union reports that 75% of internet users and 70% of EU nationals aged between 16 and 74 made purchases or placed orders for goods or services online in 2023, thus further boosting the sales of sneakers online in the region.

Asia Pacific Sneaker Market Analysis

Increased disposable incomes, urbanization, and the influence of Western culture are all contributing factors to the growth of the sneaker business in Asia-Pacific. High sneaker consumption is influenced by the region's youthful population, particularly in nations like China, Japan and India. Since its growing middle class with a taste for expensive, one-off sneakers. Industry reports claimed that China remains to be the world's largest footwear consumer in 2022. At the period, this nation occupied 17.9 percent of the consumption in shoes all over the globe. India is also an important market for sneakers since it is the third-largest consumer of footwear in the world. Footwear is part of 1.2% of the total retail basket of an average Indian, as reported by Campus Activewear. Streetwear and hip-hop culture are big influencers; often, companies like Nike and Adidas start working with local designers and artists. One of the emerging sneaker market trends is the growing demand for performance and lifestyle trainers in India, as the country is quickly urbanizing and health and wellness awareness is rising among the middle class. Sneaker sales are commonly found on online retailers, such as Tmall, Flipkart, and Rakuten, which have contributed to double-digit growth in the region's online sales.

Latin America Sneaker Market Analysis

Young population, fitness trends and Western sports culture have a footprint in the footwear market of Latin America. The fact that more than half of the population in this area is under 30 years old fuels the want for fashionable and functional sneakers. With players like Lionel Messi and Neymar promoting sneakers and football shoes that motivate customers, football is a deeply rooted part of Latin American society. Sneaker sales are further driven by urbanization, which affects over 80% of the population in countries such as Brazil and Mexico, according to data from UN-Habitat. Furthermore, access has increased because of the expansion of e-commerce platforms like MercadoLibre, which allows companies to expand their reach across the region.

Middle East and Africa Sneaker Market Analysis

Urbanization, youth culture, and the increasing impact of global fashion trends define the growing sneaker business in the Middle East and Africa. While South Africa's young city-goers have welcomed sneakers as a basic part of street fashion, high-end per capita income in the United Arab Emirates finds a preference in more exclusive sneakers. Global sporting events, like the 2022 FIFA World Cup in Qatar, has raised the demand for sport-themed sneakers. International shoe brands have become more accessible through the rapid growth of e-commerce sites like Jumia and Noon. High-income consumers are also growing their interest in sustainability.

Competitive Landscape:

To maintain and expand their competitive edge, major businesses are strategically utilizing a combination of innovation, collaboration, and sustainability. They are spending money on research and development (R&D) to improve the functionality, comfort, and environmental friendliness of their products while introducing cutting-edge innovations. In order to generate anticipation and stimulate demand through limited-edition releases and exclusive collections, leading companies are also taking part in highly publicized partnerships with prominent brands, designers, and celebrities. According to sneaker market analysis, major companies are adopting environmentally friendly production techniques and sustainable materials to lessen their environmental impact and meet the growing consumer demand for ethically responsible brands.

The report provides a comprehensive analysis of the competitive landscape in the sneaker market with detailed profiles of all major companies, including:

- Adidas AG

- ASICS Corporation

- Benetton Group S.r.l.

- Columbia Sportswear Company

- ECCO Sko A/S

- Hanesbrands Inc.

- Kering SA

- New Balance

- Nike Inc.

- Puma SE

- Reebok International Limited (Authentic Brands Group LLC)

- Skechers U.S.A. Inc.

- Under Armour Inc.

- VF Corporation

Latest News and Developments:

- June 2025: Akasa Air, in partnership with Adidas, unveiled SkyEaze, a custom-designed sneaker featuring Adidas’ Cloudfoam sock liner technology and incorporating the airline’s signature “sunrise orange” branding, specifically crafted for its cabin crew and ground staff. The launch underscores Akasa’s commitment to employee well-being, performance, and comfort.

- June 2025: Hummel, in collaboration with Revenant Esports (RNTX), unveiled “The Pulse”—India’s first dedicated esports sneaker, designed to reflect the gaming mindset through dynamic linework symbolizing the mental-to-physical spark experienced before gameplay. The limited‑edition shoe will be available exclusively on Hummel’s Indian website. The collaboration represents a historic milestone in merging esports culture with sportswear, with plans for further joint ventures in team sports and retail across India and Southeast Asia.

- May 2025: PUMA hosted an immersive H‑Street launch event in Seoul from May 16–18, 2025, featuring a VIP opening attended by global ambassador and local stars. Set to debut globally on June 28, 2025, the revamped H‑Street sneaker reprises its 2003 low‑profile track silhouette with modern comfort upgrades and a bold “hero” neon green option, reinforcing PUMA’s fusion of heritage and innovation.

- December 2024: Reebok has revealed that it is returning to basketball with a new collaboration with the WNBA. This partnership demonstrates Reebok's dedication to promoting basketball culture while aiding the development of female athletes and the WNBA.

- October 2024: Adidas has announced a much-anticipated partnership between Lionel Messi and Bad Bunny that combines pop culture and sports. In addition to showcasing their distinct personalities, the collection features colorful clothing and shoes that capture their individual and professional adventures. The designs celebrate Messi and Bad Bunny's worldwide prominence in a variety of venues, appealing to both fans.

- July 2022: Adidas AG and Guccio Gucci S.p.A. planned to launch a footwear line centered on the Gazelle silhouette.

- March 2022: With the creation of Reebok Design Group (RDG) in collaboration with SPARC Group, Authentic Brands Group (ABG) declared that it has successfully acquired Reebok from Adidas in order to maintain the brand's legacy.

- March 2020: The first carbon-plate running shoes, the ASICS Metaracer, which offers improved stability, a revised mesh upper to keep the feet cool, and a redesigned toe-spring form to reduce strain, were among the three sports shoes that ASICS unveiled in a virtual reality showroom.

Sneaker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Low-Top Sneakers, Mid-Top Sneakers, High-Top Sneakers |

| Categories Covered | Branded, Private Label |

| Price Points Covered | Luxury, Economic |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Brand Outlets, Online Stores, Others |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, ASICS Corporation, Benetton Group S.r.l., Columbia Sportswear Company, ECCO Sko A/S, Hanesbrands Inc., Kering SA, New Balance, Nike Inc., Puma SE, Reebok International Limited (Authentic Brands Group LLC), Skechers U.S.A. Inc., Under Armour Inc., VF Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sneaker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sneaker market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sneaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global sneaker market was valued at USD 94.1 Billion in 2024.

IMARC Group expects the market to reach USD 157.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033.

The key factors driving the global sneaker market include rising interest in athleisure trends, increasing health awareness, and the popularity of sneakers as fashion statements. Collaborations between brands and celebrities, advancements in sustainable materials, and growing e-commerce platforms further fuel demand in diverse consumer segments worldwide.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Sneaker market include Adidas AG, ASICS Corporation, Benetton Group S.r.l., Columbia Sportswear Company, ECCO Sko A/S, Hanesbrands Inc., Kering SA, New Balance, Nike Inc., Puma SE, Reebok International Limited (Authentic Brands Group LLC), Skechers U.S.A. Inc., Under Armour Inc., VF Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)