Smoking Accessories Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2026-2034

Smoking Accessories Market Size and Share:

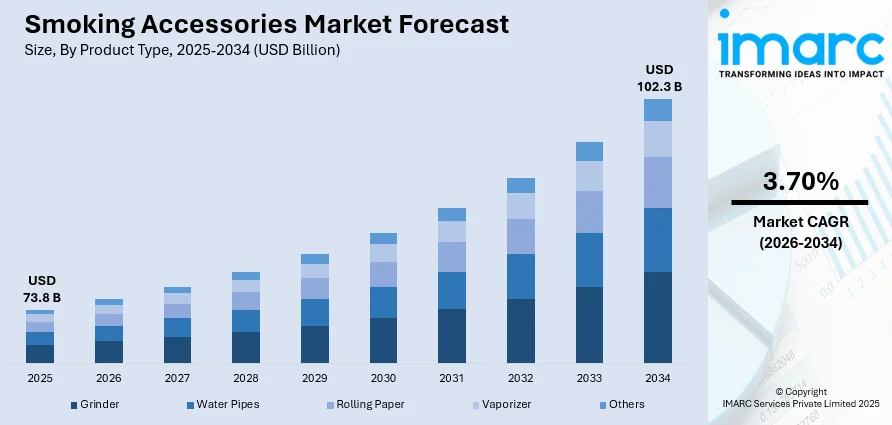

The global smoking accessories market size was valued at USD 73.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 102.3 Billion by 2034, exhibiting a CAGR of 3.70% from 2026-2034. The Asia-Pacific market currently leads the market with growing preference for high-end luxury items that enhance the smoking experience, a growing number of sustainable alternatives including biodegradable rolling papers, reusable lighters, and accessories made from ecological materials like bamboo, and an increasing interest in personalized accessories. The market is driven by a focus on sustainability, with eco-friendly materials gaining popularity. The integration of fashion and luxury into smoking accessories attracts affluent individuals, blending aesthetics with functionality. Additionally, celebrity endorsements and brand collaborations enhance product appeal and market visibility, thus influencing the smoking accessories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 73.8 Billion |

|

Market Forecast in 2034

|

USD 102.3 Billion |

| Market Growth Rate 2026-2034 | 3.70% |

One major driver in the smoking accessories market is the growing demand for premium and personalized smoking products. Consumers are increasingly seeking high-quality, customized smoking accessories, such as handcrafted pipes, designer lighters, and unique rolling papers. This trend is driven by rising disposable incomes and a shift towards luxury products. Personalized accessories, often made from premium materials like glass, wood, or metal, cater to the desire for exclusivity and individuality. As a result, manufacturers are focusing on innovation and product differentiation, contributing to the market's growth, especially in developed regions.

To get more information on this market, Request Sample

The U.S. smoking accessories market is growing rapidly because of the increasing demand from consumers for premium and innovative products. A shift towards high-end smoking items, such as luxury pipes, custom lighters, and unique rolling papers, is driving the market. The rise in disposable income, coupled with a growing trend of personalization, has fueled this demand. In November 2024, the U.S. smoking supplies e-commerce market generated USD 182 million in revenue, reflecting a 1.3% increase from October 2024. Additionally, legalization of recreational cannabis in several states has led to a surge in sales of smoking accessories, particularly in states where cannabis is legal. E-commerce platforms are also playing a pivotal role, providing easy access to a wide range of smoking products.

Smoking Accessories Market Trends:

Focus on Sustainability and Eco-Friendly Materials

With the growing environmental awareness, people are looking for smoking accessories crafted from responsibly sourced materials that reduce ecological effects. This movement is resulting in the creation of new items like rolling papers, cones, and various accessories made from bamboo, rice, hemp, and other biodegradable or renewable materials. Brands are addressing this by emphasizing sustainability in their manufacturing practices, which attracts eco-aware individuals and enables firms to align with worldwide environmental objectives. With the market moving towards eco-friendly options, the increasing emphasis on sustainability is emerging as a key element driving the interest in high-quality smoking accessories, making green products a lifestyle choice and a mark of accountability. In 2024, Houseplant, the cannabis lifestyle brand founded by Seth Rogen, partnered with French rolling paper giant OCB to launch a premium line of rolling papers and cones. The collection featured sustainable options in bamboo, brown rice, and classic varieties. This collaboration aimed to elevate the smoking experience with high-quality, responsibly sourced materials.

Celebrity Endorsements and Brand Collaborations

Celebrity endorsements and brand partnerships is a crucial factor influencing the market, as they leverage the influence of high-profile figures to attract new user segments, enhance brand credibility, and create exclusive, sought-after smoking accessories. Notable individuals, particularly those associated with cannabis culture, attract considerable user interest and enhance the credibility of the products they endorse. These collaborations significantly increase brand visibility by leveraging the influence and established status of celebrities, thereby boosting brand recognition. By aligning with prominent figures, brands gain access to new user demographics, expand their market reach, and create exclusive, limited-edition products that resonate with dedicated followers. The integration of celebrity influence with innovative product offerings elevates the appeal of smoking accessories, positioning them as lifestyle products. As a result, such partnerships are pivotal in generating consumer interest, especially within niche markets, and contribute to the overall growth of the sector. In 2024, Futurola officially announced a global partnership with Snoop Dogg to launch a new co-branded line of premium smoking accessories. The collaboration blends Futurola’s innovation with Snoop’s cannabis legacy, introducing papers and cones.

Integration of Fashion and Luxury into Smoking Accessories

People are progressively perceiving smoking products as expressions of lifestyle, encouraging brands to provide accessories that combine top-quality craftsmanship with sophisticated design aesthetics. The combination of smoking accessories with trendy and high-end branding not only enhances the product's appeal but also draws in affluent individuals who appreciate both practicality and aesthetics. This trend is especially noticeable in partnerships between luxury labels and prominent designers, which produce unique, aesthetically pleasing items that attract individuals wanting to express a fashion statement. The demand for these high-quality, stylish accessories is growing, as they offer more than just utility and embody a sense of sophistication, exclusivity, and cultural relevance, making them desirable to individuals. In 2024, luxury brand S.T. Dupont launched a stylish cigar accessory collection in collaboration with fashion house Casablanca Paris. Titled “The Art of Sport,” the line included lighters, ashtrays, humidors, and leather goods across Mosaic, Tennis, and Leather-themed designs. The collection blended S.T. Dupont’s craftsmanship with Casablanca’s vibrant, sport-inspired aesthetic.

Smoking Accessories Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smoking accessories market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, age group, and distribution channel.

Analysis by Product Type:

- Grinder

- Water Pipes

- Rolling Paper

- Vaporizer

- Others

Vaporizer stands as the largest component in 2025, driven by the growing shift towards healthier and more discreet alternatives to traditional smoking methods. Vaporizers, particularly those designed for cannabis and nicotine, offer a smoother, less harmful experience by heating substances without combustion, reducing the harmful toxins associated with smoking. This has made vaporizers increasingly popular among health-conscious users, as well as those seeking more subtle methods of consumption. The rise of e-cigarettes and vape pens has further propelled the vaporizer segment, especially among younger consumers. Additionally, innovations in vaporizer technology, including improved battery life, portability, and customizable features, continue to attract a wider audience, ensuring vaporizers remain the dominant segment in the market.

Analysis by Age Group:

- Below 18 Years

- 18 to 30 Years

- 30 to 50 Years

- Above 50 Years

18 to 30 years leads the market due to their growing interest in modern smoking alternatives, particularly vaping and cannabis consumption. This demographic is highly influenced by trends, social media, and lifestyle preferences, driving their demand for innovative, personalized, and premium smoking accessories. They seek products that reflect their individuality, such as custom pipes, designer lighters, and eco-friendly rolling papers. The growing popularity of vaping as a healthier substitute to conventional smoking also contributes to the segment's dominance. Furthermore, this age group is tech-savvy, with a strong preference for purchasing smoking accessories through e-commerce platforms. Their purchasing power and evolving preferences make them a key driver in the market’s growth.

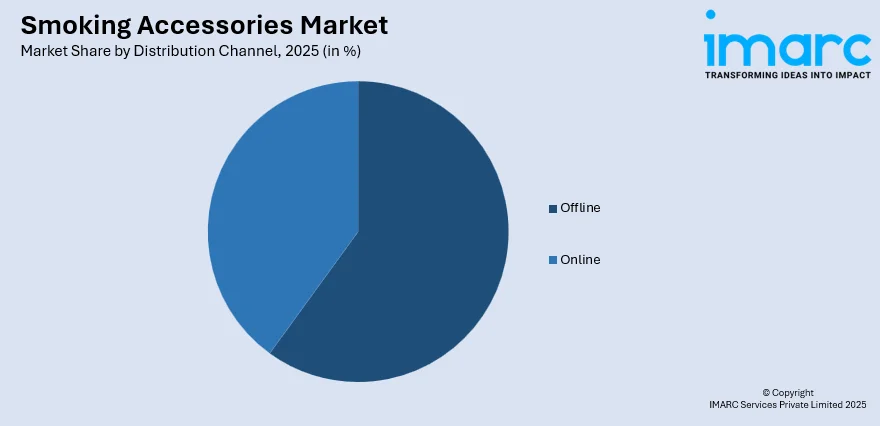

Analysis by Distribution Channel:

- Offline

- Online

In 2025, offline accounts for the majority of the market due to the strong consumer preference for in-person shopping experiences. Physical stores, such as tobacco shops, head shops, and convenience stores, offer customers the opportunity to examine products firsthand, ensuring quality and authenticity before purchase. Additionally, many consumers value the personalized experience provided by knowledgeable staff who can offer recommendations based on individual preferences. Offline retail also benefits from immediate product availability, eliminating the waiting time associated with online orders. While online shopping is growing, offline channels continue to dominate, especially in regions where traditional retail shopping remains the preferred method. The in-store experience, coupled with the social and cultural aspects of smoking, keeps offline distribution strong.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share driven by rapid urbanization, a rising middle class, and growing disposable incomes. Countries like China, India, and Japan are major contributors, with increasing consumer demand for smoking products, particularly in urban areas. The rising popularity of vaping and other alternative smoking methods is further propelling the market, especially among younger consumers. Additionally, the gradual acceptance of cannabis in some regions is fostering demand for cannabis-related accessories. The availability of a wide range of smoking accessories through both offline and online channels, along with regional cultural factors, has positioned Asia Pacific as the dominant market.

Key Regional Takeaways:

US Smoking Accessories Market Analysis

The smoking accessories market in the USA is influenced by changing user tastes and an increasing desire for high-quality, customized products. As smoking shifts from a regular habit to a personal lifestyle choice, people are more frequently looking for premium, stylish accessories that showcase their unique identities. The market is experiencing a transition towards more elegant and advanced products, such as designer lighters, handmade pipes, and personalized rolling papers, as buyers seek items that elevate their smoking experience. For example, in 2024, Hemper and iconic fashion brand Fred Segal launched a high-fashion cannabis accessory line, blending style and function. The collection includes ceramic bongs, ashtrays, and catchall trays inspired by Fred Segal’s signature aesthetic. This marks Fred Segal’s debut in the cannabis space and Hemper’s entry into premium lifestyle markets. Moreover, the rise in alternative smoking techniques, such as vaping, are driving the need for specialized accessories. The growing understanding about sustainability is also encouraging manufacturers to develop eco-friendly products, as people favor biodegradable and reusable choices. The rising number of online shopping platforms is increasing the availability of smoking accessories, allowing brands to connect with a wider audience.

North America Smoking Accessories Market Analysis

The North America smoking accessories market is growing because of changing user habits, product advancements, and the increasing demand for high-end lifestyle products. People are seeking smoking accessories as expressions of lifestyle instead of just functional items, which boosts the demand for products that merge design, quality, and uniqueness. The shift towards premiumization is motivating producers to incorporate luxury materials, contemporary designs, and innovative features that improve user satisfaction. Moreover, robust retail distribution channels and the extensive availability of online platforms are enhancing the accessibility of these products, enabling buyers to discover a broader array of choices. For instance, the U.S. Census Bureau indicated that retail e-commerce sales hit $300.2 Billion in Q1 2025, underscoring the growing influence of digital platforms. Furthermore, the growing interest in different smoking techniques like vaping and herbal products are broadening product demand.

Europe Smoking Accessories Market Analysis

The smoking accessories market in Europe is driven by changing consumer tastes, increased interest in high-quality products, and the rise of niche culture surrounding smoking as a lifestyle aspect. Many people desire accessories that blend practicality with visual attractiveness, such as improved materials, refined artistry, and visual appeal. The growing number of online retail channels is enhancing market access, allowing users to find a wider array of products. Environmental awareness is increasingly shaping product development, as there is a rise in the demand for organic and sustainable choices. An excellent example of the shift toward organic and sustainable choices is the 2024 launch of OCB Rice Papers by Republic Technologies UK, which are made from a blend of rice and organic hemp and are chlorine-free. Available in Slim and Slim & Tips formats, the launch targets the growing consumer demand for natural roll-your-own products.

Asia Pacific Smoking Accessories Market Analysis

The smoking accessories market in the Asia Pacific region is being driven by growing disposable incomes and changing lifestyle choices, leading to increased demand for premium and personalized products. There is rise in the demand for high-quality materials, elegant finishes, and design-oriented visuals, as people in the region are showing a growing interest in accessories that blend style and practicality. The increasing number of online shopping is improving access to various product choices, enabling local and global brands to connect with a larger audience. Quantifying the significance of digital commerce in the region, the India Brand Equity Foundation (IBEF) reported that India’s e-commerce industry, valued at Rs. 10,82,875 crore (US $125 billion) in FY24, is projected to grow to Rs. 29,88,735 crore (US $345 billion) by FY30. Besides this, sustainability factors are influencing choices, as eco-aware shoppers prefer items that are reusable and ethically produced.

Latin America Smoking Accessories Market Analysis

The market for smoking accessories in Latin America is growing because of rising consumer interest in lifestyle and self-expression, leading to higher demand for high-quality, fashionable products. With the advancement of urbanization and an increase in disposable incomes, a greater number of consumers are inclined to spend on accessories that improve functionality and aesthetic appeal. The expansion of online retail avenues is increasing availability of a wider variety of products and brands, promoting competition and innovation. Highlighting the significance of online retail in the region, the IMARC Group reported that the Mexico e-commerce market size reached USD 54.4 Billion in 2025. Besides this, the growing environmental consciousness is influencing buying choices, leading to a preference for reusable, eco-friendly materials and sustainable production methods.

Middle East and Africa Smoking Accessories Market Analysis

The smoking accessories market in the Middle East and Africa is driven by changing consumption trends and a growing demand for upscale lifestyle products, especially in urban areas where café culture and social smoking environments prevail. Shoppers are increasingly valuing accessories that showcase their personal style and social status, leading producers to provide high-quality materials, customized designs, and improved features. The expansion of digital commerce and global brand presence is increasing product accessibility and user options, resulting in intensified competition and accelerated innovation. According to the International Trade Administration (ITA), it is projected that the number of internet users participating in e-commerce in Saudi Arabia will hit 33.6 million by 2024, highlighting the increasing trend of online retail. Additionally, the rise of alternative consumption models is broadening accessory categories, facilitating diversification and enhancement of value.

Competitive Landscape:

The competitive landscape of the U.S. smoking accessories market is composed of both established and new players. Key players command the market with a broad portfolio and strong brand recognition. The firms focus on product innovation with premium materials, unique designs, and eco-friendly options to differentiate themselves in the market. The niche brands are becoming popular in the market, as the demand for customized and artisanal smoking accessories is high. E-commerce platforms have now become a vital distribution channel, not only for the large but also for the small players in reaching a more significant consumer base. On the other hand, increased acceptance of cannabis is influencing the competitive scenario, where companies are looking at producing cannabis-related smoking accessories.

The report provides a comprehensive analysis of the competitive landscape in the smoking accessories market with detailed profiles of all major companies, including:

- Black Leaf

- British American Tobacco P.l.c.

- Bull Brand

- Chongz Ltd.

- Curved Papers Inc.

- Empire Glassworks

- Imperial Brands Plc

- Jinlin (HK) Smoking Accessories Co. Ltd.

- Moondust Paper Pvt Ltd.

- Republic Technologies International SAS

Latest News and Developments:

- September 2025: VAPORESSO launched the XROS PRO 2 at InterTabac 2025 in Dortmund, Germany. The flagship vape features a 2000mAh battery, aerospace-grade magnesium alloy body, and super pulse tech for stable MTL flavor, along with compatible accessories like upgraded COREX 3.0 pods and precision-fit chargers. It redefines performance and durability in vaping accessories.

- In August 2024, Snoop Dogg and Futurola partnered to launch a co-branded line of smoking accessories, blending Snoop’s iconic influence with Futurola’s expertise in rolling papers, cones, and joint-making tools.

- In May 2024, HARA Brands' Hemper has partnered with Fred Segal to launch a line of smoking accessories combining Fred Segal's iconic style with Hemper's innovative designs. The collection is available online and in select Fred Segal stores.

- In January 2024, Republic Technologies launched OCB Rice Papers, an organic and chlorine-free rolling paper made from a blend of rice and organic hemp. These slow-burning papers are available in Slim and Slim & Tips packs, appealing to consumers seeking natural ingredients in rolling products.

- In October 2023, Custom Cones USA introduced three fresh pre-roll accessory brands for direct-to-consumer sales comprising DaySavers, Smoke Temple, and Fill-a-Blunts. The product range featured creative designs like pre-roll tubes, cross cones, and blunt wraps.

- In December 2023, Miami-based jewelry brand Miansai debuted its Art of Smoking Collection during the Art Basel festival. This collection featured replica smoking pipes inspired by do-it-yourself (DIY) smoking accessories from the past, blending elegant craftsmanship with nostalgia.

Smoking Accessories Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Grinder, Water Pipes, Rolling Paper, Vaporizer, Others |

| Age Groups Covered | Below 18 Years, 18 to 30 Years, 30 to 50 Years, Above 50 Years |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Black Leaf, British American Tobacco P.l.c., Bull Brand, Chongz Ltd., Curved Papers Inc., Empire Glassworks, Imperial Brands Plc, Jinlin (HK) Smoking Accessories Co. Ltd., Moondust Paper Pvt Ltd., and Republic Technologies International SAS., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smoking accessories market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smoking accessories market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smoking accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global smoking accessories market was valued at USD 73.8 Billion in 2025.

IMARC Group estimates the market to reach USD 102.3 Billion by 2034, exhibiting a CAGR of 3.70% from 2026-2034.

The smoking accessories market is driven by the growing focus on sustainability, with eco-friendly materials gaining popularity. Celebrity endorsements and brand collaborations enhance product appeal and market visibility. In addition, the integration of fashion and luxury into smoking accessories attracts affluent individuals, blending aesthetics with functionality.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global smoking accessories market include Black Leaf, British American Tobacco P.l.c., Bull Brand, Chongz Ltd., Curved Papers Inc., Empire Glassworks, Imperial Brands Plc, Jinlin (HK) Smoking Accessories Co. Ltd., Moondust Paper Pvt Ltd., and Republic Technologies International SAS., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)