Smoke Grenade Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Smoke Grenade Market Size and Share:

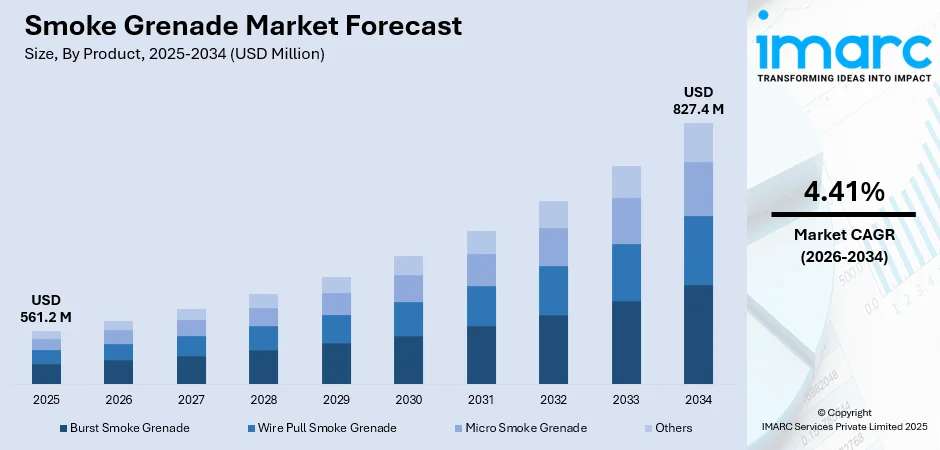

The global smoke grenade market size was valued at USD 561.2 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 827.4 Million by 2034, exhibiting a CAGR of 4.41% during 2026-2034. North America currently dominates the market, holding a significant market share of over 48.9% in 2025. A considerable rise in geopolitical tensions across the globe, increasing incidences of war and internal conflicts, and the rising demand for harmless smoke grenades in the entertainment industry represent some of the key factors driving the smoke grenade market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 561.2 Million |

|

Market Forecast in 2034

|

USD 827.4 Million |

| Market Growth Rate (2026-2034) | 4.41% |

The military and defense industry stands as a significant user of smoke grenades. These devices are widely used for obscuring movements, signaling, or creating diversions in combat scenarios. As modern warfare evolves with a focus on urban and asymmetric warfare, the need for smoke grenades has significantly increased. Smoke grenades are also essential tools in law enforcement and managing crowd control scenarios. Police forces and other security agencies use them to manage protests, riots, or other large gatherings that pose a threat to public safety. A total of 1,803 protests were filed in the United States during 2025 and this increasing number has led to the adoption of smoke grenades. These devices help disperse huge crowds without causing permanent harm, making them a preferred non-lethal option. Tear gas grenades, which are a variation of smoke grenades, are especially useful for controlling aggressive crowds while minimizing direct physical confrontations.

To get more information on this market Request Sample

The United States stands as a major market disruptor with 76.70% market share in North America, as its government is increasing the defense budgets due to heightened security concerns and geopolitical tensions. As such, the United States Department of Defense's (DOD) budget request for FY2025 is $849.8 billion, which reflects the country’s commitment to enhancing military capabilities. This increase in budget will help modernizing their armed forces, which includes equipping them with advanced smoke grenades. Moreover, smoke grenades have gained immense popularity in sports, outdoor activities, and entertainment in the United States. Paintball and airsoft enthusiasts often use smoke grenades to simulate battlefield environments, adding an extra layer of excitement to the game. Event organizers use colored smoke grenades to enhance the visual appeal of concerts, festivals, and photoshoots.

Smoke Grenade Market Trends:

Increasing Adoption in Military and Law Enforcement

The growing demand for these grenades in military and law enforcement sectors is one of the most important smoke grenade market trends. These devices are highly crucial in tactical operations, including visual concealment during maneuvers, signaling, marking locations, and crowd control. Smoke grenades are used extensively in training exercises to simulate real combat conditions, enhancing readiness and operational efficiency. With a rapidly changing security environment, including rising fears of terrorism, civil war, and urban warfare, the demand for adaptable, rapidly deployed devices like smoke grenades has also increased. Smoke grenades are essential tools for de-escalating violent situations and, therefore, an indispensable device in non-lethal crowd management by law enforcement agencies. An increasing defense budget, especially among those nations that focus on strengthening their militaries, has also stimulated this market. Data from the Stockholm International Peace Research Institute (SIPRI) indicates that global military spending reached around USD 2.1 trillion in 2023. Moreover, joint ventures between defense contractors and smoke grenade manufacturers are encouraging the development of niche products that address the specific needs of security forces across the globe.

Technological Advancements

Technological developments in the smoke grenade design and formulation are driving huge innovation into the market. There is high emphasis on producing eco-friendly, non-toxic, and biodegradable smoke grenades to comply with the increasing environmental regulations and public health concerns. The advancements involved in the use of safer chemicals and sustainable materials reduce the environmental impact of the smoke grenade deployment. For instance, the latest smoke grenades now offer up to 15 minutes of continuous smoke release, a 20% improvement over previous models. In addition, longevity and effectiveness in smoke generated have improved, offering new formulations in dense, long-lasting smoke, which can now be used in extended coverage situations in different types of operational situations. Furthermore, compact, lightweight, and multifunctional smoke grenades that are capable of various functions, such as signaling and marking, have enabled their use across a wide range of applications. Product innovation through better ignition systems combined with increased security features like tamper proof, precise burn periods, among other innovations is on the leading front to make a contribution in taking the market for further growth for professional as well as recreational end-use applications.

Growth in Outdoor and Recreational Use

Smoke grenade use is rising in the recreational sector as its application increases in the conduct of outdoor activities. Examples include airsoft, paintball, photography, and other similar practices. The logic behind their preference is that smoke grenades can create dramatic scenes in simulated combat games or competitive sporting events. In paintball and airsoft scenarios, smoke grenades are used to obscure one's vision and provide a highly immersive experience by replicating real conditions for those participating. Another demand is from the emergence of social media and influencer culture, especially for photography and videography requirements, particularly in gender reveal parties, wedding shoots, and other special events. The bright and colorful smoke effect is quite eye-catching and visually appealing, thus making the products popular for personal as well as professional creative works. As per an industry report, there were 5.22 billion social media users globally at the beginning of October 2025, representing 63.8 percent of the worldwide population. Moreover, film producers and organizers of events now include smoke grenades in their films for visual effect purposes, therefore increasing the range of the market and contributing to product diversification.

Smoke Grenade Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smoke grenade market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Burst Smoke Grenade

- Wire Pull Smoke Grenade

- Micro Smoke Grenade

- Others

As per the smoke grenade market forecast, burst smoke grenade leads the market share in 2025. This increase is attributed to their extensive use across military operations, law enforcement activities, and recreational purposes. These grenades are designed to release a rapid and dense plume of smoke upon activation, making them highly effective for creating immediate visual obstructions, signaling, and tactical diversions. The efficiency and reliability of burst smoke grenades make them indispensable in combat scenarios where quick deployment of smoke is crucial for troop movement and cover. In law enforcement, these devices are commonly used for crowd control and emergency situations requiring instant smoke barriers. Their popularity has also grown in recreational activities like airsoft and paintball, as well as in the entertainment industry for special effects. The high demand for these versatile devices has solidified burst smoke grenades as the largest segment in the market, driven by their adaptability across diverse applications and the continuous advancements in smoke dispersion technology.

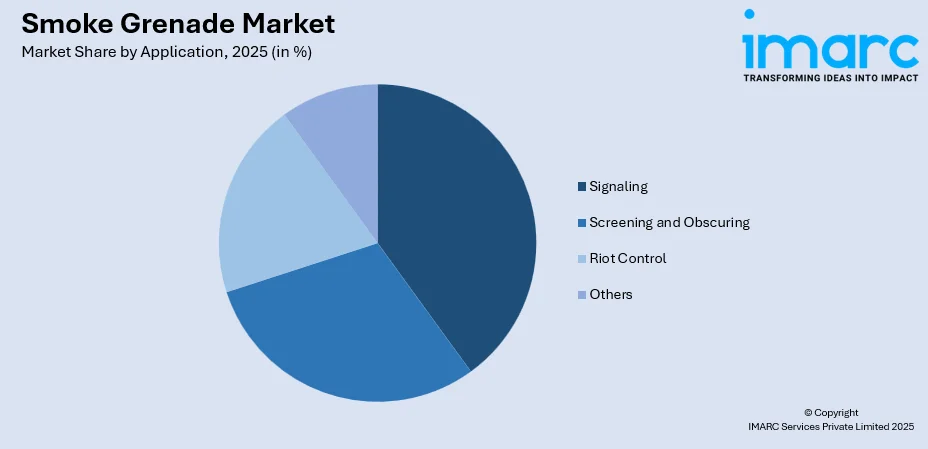

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Signaling

- Screening and Obscuring

- Riot Control

- Others

As per the smoke grenade market outlook, signaling leads the industry in 2025, driven by its critical role in military, maritime, and emergency operations. Smoke grenades are widely used for visual signaling in combat zones, enabling troops to mark locations, communicate with allies, and signal for air support or extraction. In maritime operations, they are essential for rescue missions, allowing vessels and individuals in distress to attract attention quickly. Law enforcement agencies also use smoke grenades for signaling during crowd management, hostage situations, and tactical operations. Additionally, signaling smoke grenades are frequently employed in training exercises, enabling clear visual indicators for movement or actions during drills. The growing demand for efficient and reliable communication tools in high-pressure environments, coupled with advancements in smoke grenade technology, such as increased visibility and color variety, continues to drive the dominance of the signaling segment in the market.

Analysis by End User:

- Military and Defense

- Law Enforcement

- Others

Military and defense lead the market share in 2025, owing to its extensive reliance on smoke grenades for tactical operations, training, and combat scenarios. They are vital for creating smokescreens to obscure troop movements, providing cover, and disorienting adversaries in both offensive and defensive strategies. They are also used for signaling and marking locations during joint operations or battlefield maneuvers. Modern militaries prioritize tools that enhance battlefield efficiency, and smoke grenades fit seamlessly into this need due to their portability, ease of use, and effectiveness. Rising defense budgets globally, especially in areas such as North America, Asia-Pacific, and Europe, are driving the growing demand for modern smoke grenades. For example, the U.S. Department of Defense and several NATO allies continue to invest heavily in tactical equipment, including multi-purpose and environmentally friendly smoke grenades. This consistent and significant usage cements military and defense as the leading end-user segment in the global smoke grenade market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 48.9%. This growth is driven by robust defense spending, advancements in military technology, and the high adoption of smoke grenades across diverse applications. The United States, in particular, is the largest contributor, with its defense budget exceeding $850 billion in 2025, reflecting a strong focus on modernizing tactical equipment, including smoke grenades. The presence of key manufacturers and defense contractors, coupled with the region’s active involvement in global military operations and joint training exercises, bolsters the demand. Smoke grenades are also widely used by law enforcement agencies in North America for riot control, signaling, and training. Additionally, the growing recreational use of smoke grenades in activities like airsoft and paintball, along with their popularity in entertainment and photography, adds to market growth. The combination of strong government procurement programs, high military activity, and civilian applications has positioned North America as the largest regional segment in the global smoke grenade market.

Key Regional Takeaways:

United States Smoke Grenade Market Analysis

In 2025, the United States leads the market in North America with 76.70% share. Growth is currently being observed in the U.S. market for smoke grenades as driven by demand from the defense sector and by law enforcement agencies, in addition to industrial applications. According to industrial reports, in 2023, the United States military committed USD 916 billion to the budget of defense. It recorded the highest defense spending globally during that year. The Army alone plans to spend approximately USD 2.6 billion in 2023 on purchasing ammunition. The demand is further boosted by the increasing use in law enforcement and emergency response operations. Innovative products, such as multi-color smoke and high-visibility smoke grenades, lead the market. Key market players, including The Safariland Group and BAE Systems, play a significant role in the industry. Ongoing research and development initiatives focusing on environmentally friendly and non-toxic smoke formulations are driving market growth. The U.S. market's technological advancement and production capabilities continue to place the country at the top of the global smoke grenade industry.

Europe Smoke Grenade Market Analysis

The European market for smoke grenades is growing mainly due to increasing defense spending as well as by civilian recreational needs. NATO nations, especially UK and France are boosting their military expenditure with escalating security issues. During the year 2023/24 the UK allocated close to USD 66.8 billion for defence which is nominal increase of almost USD 1.4 billion from previous year (as GOV.UK data). The budget documents however do not give the smoke and obscurant supplies under any such detailed expenditures. Ministry of Defence' spending plans for 2025 reflect an increase to USD 70.6 billion in 2024/25, House of Commons Library stated. More than 1,928 de-encirclement stun hand grenades were used by the national police in France in 2022: most often during demonstrations. European manufacturers also include RUAG and Nexter Systems, targeting the development of more effective as well as non-toxic smokes. An impetus of the market development is government defense sector modernisation policies and defense R&D non-toxic solutions.

Asia Pacific Smoke Grenade Market Analysis

Asia Pacific smoke grenade market growth is highly booming due to rising defense budget and geopolitical tensions. In 2022, the military spending by China reached nearly USD 292 billion with an increase of 5.8% from last year, as per reports. The India defense budget was USD 83.6 billion in 2023 as a result of modernization in military. There is also growing demand from civilian which is picking up shooting sports, especially in countries like Australia and Japan. Major R&D in the region goes on for new generation ammunition development with smart as well as precision-guided munition, and many encouraging partnerships and cooperation between players operating in India with global participants such as technology transfers by collaborations such as with international firms collaborating Bharat Dynamics, adoption among the law enforcing agencies of the non-lethal ammunition, as part of their overall change dynamics in the marketplace. Government-sponsored infrastructural development along with increasing disposable incomes further accelerate the growth in the market and make Asia Pacific a key participant in the international smoke grenade industry.

Latin America Smoke Grenade Market Analysis

Latin America's market for smoke grenades is growing, driven by expanding defense budgets, increasing civilian ownership of firearms, and heightened security concerns. According to an industry report, Brazil's military expenditure in 2022 was estimated at USD 20.21 billion, up by 5.34% compared to the preceding year. Demand from civilians is also significant and is driven by liberalized regulations on gun ownership: more than 1.6 million firearm licenses have been granted in Brazil. Mexico and Colombia are investing in advanced ammunition to fight organized crime and secure their nations. Moreover, the rising middle class and penetration of smartphones in the region create a foundation for digital platforms in the sales of ammunition. Brazil's Companhia Brasileira de Cartuchos (CBC) dominates the industry, exporting ammunition to over 100 countries, as per reports. Medical tourism in Costa Rica increases the demand for non-lethal ammunition among security personnel indirectly. Latin America's market growth is supported by the government-led programs and partnerships with international producers for improving local manufacturing capacity.

Middle East and Africa Smoke Grenade Market Analysis

The smoke grenade market demand in the Middle East and Africa is propelled by military demand as well as civilian usage on an increasing scale, both for recreational and industrial sectors. According to an industry report, Saudi Arabia continues to modernize its military through defense budget worth USD 75.01 Billion in 2022 and spends in technologies that have smoke grenades in their repertoire, used in tactical training and operations. Smoke grenades are also used in both defense and mining operations in South Africa, where non-toxic, environmentally friendly products are increasingly sought after. Airsoft and other outdoor activities create growing civilian demand, and interest has been on the rise in the UAE and Egypt. South African defense manufacturers Denel, and international firms extending their presence to the region are some of the key players. The factors for growth in this region include the government's investments in security and defense infrastructure, disposable incomes.

Competitive Landscape:

Leading companies in the market are prioritizing innovation, forming strategic partnerships, and expanding their presence across different regions to enhance their competitive edge and solidify their positions. Companies are investing heavily in research and development (R&D) to create advanced smoke grenades with enhanced performance, longer burn times, and environmentally friendly materials. Some are introducing multi-purpose smoke grenades that combine smoke effects with other capabilities, such as tear gas dispersion or infrared illumination, catering to evolving military and law enforcement needs. Strategic collaborations with defense agencies and international militaries are another priority, allowing these companies to secure large-scale procurement contracts. Expanding into emerging markets across Asia-Pacific, Latin America, and the Middle East has become a prevalent growth strategy, fueled by growing defense expenditures and heightened security challenges in these areas. Additionally, key players are tapping into the recreational and entertainment segments by offering safe, vibrant, and user-friendly smoke grenades for civilian use, broadening their customer base.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- 3rd Light Ltd.

- Centanex Ltd.

- Combined Systems Inc.

- Daekwang Chemical Co. Ltd.

- Defense Technology LLC (Safariland LLC)

- Nammo AS

- Nonlethal Technologies Inc.

- Rheinmetall AG

- Sport Smoke LLC.

Latest News and Developments:

- September 2025: Russian Army received the RDG-U smoke grenade, developed by TsNIITochMash. This grenade, approved for mass production, provides camouflage against guided missiles.

- May 2025: EDGE acquired 51% of CONDOR Non-Lethal Technologies on May 1, 2025. CONDOR is an industry leader in non-lethal technologies, manufacturing smoke grenades and other products such as tear gas, rubber ammunition, and pyrotechnics. This acquisition will further strengthen EDGE's position in the global defence, security, and public safety markets and target growth in markets such as the USA.

- May 2025: Bundeswehr ordered around one million DM45 smoke hand grenades, under a framework agreement signed on May 22, 2025. The potential total order is up to 1.5 million grenades, valued at EUR 67 million (USD 68.71 Million). Production will occur at Rheinmetall’s Silberhütte site, continuing until 2027.

Smoke Grenade Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Burst Smoke Grenade, Wire Pull Smoke Grenade, Micro Smoke Grenade, Others |

| Applications Covered | Signaling, Screening and Obscuring, Riot Control, Others |

| End Users Covered | Military and Defense, Law Enforcement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3rd Light Ltd., Centanex Ltd., Combined Systems Inc., Daekwang Chemical Co. Ltd., Defense Technology LLC (Safariland LLC), Nammo AS, Nonlethal Technologies Inc., Rheinmetall AG, Sport Smoke LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smoke grenade market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smoke grenade market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smoke grenade industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smoke grenade market was valued at USD 561.2 Million in 2025.

IMARC Group estimates the market to reach USD 827.4 Million by 2034, exhibiting a CAGR of 4.41% during 2026-2034.

The smoke grenade market is driven by the rising defense budgets, increasing military and law enforcement operations, rapid advancements in smoke grenade technology, growing demand for crowd control measures, and expanding recreational and entertainment applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the smoke grenade market include 3rd Light Ltd., Centanex Ltd., Combined Systems Inc., Daekwang Chemical Co. Ltd., Defense Technology LLC (Safariland LLC), Nammo AS, Nonlethal Technologies Inc., Rheinmetall AG, Sport Smoke LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)