Smart Waste Management Market Size, Share, Trends and Forecast by Component, Waste Type, Method, Source, and Region, 2025-2033

Smart Waste Management Market Size and Share:

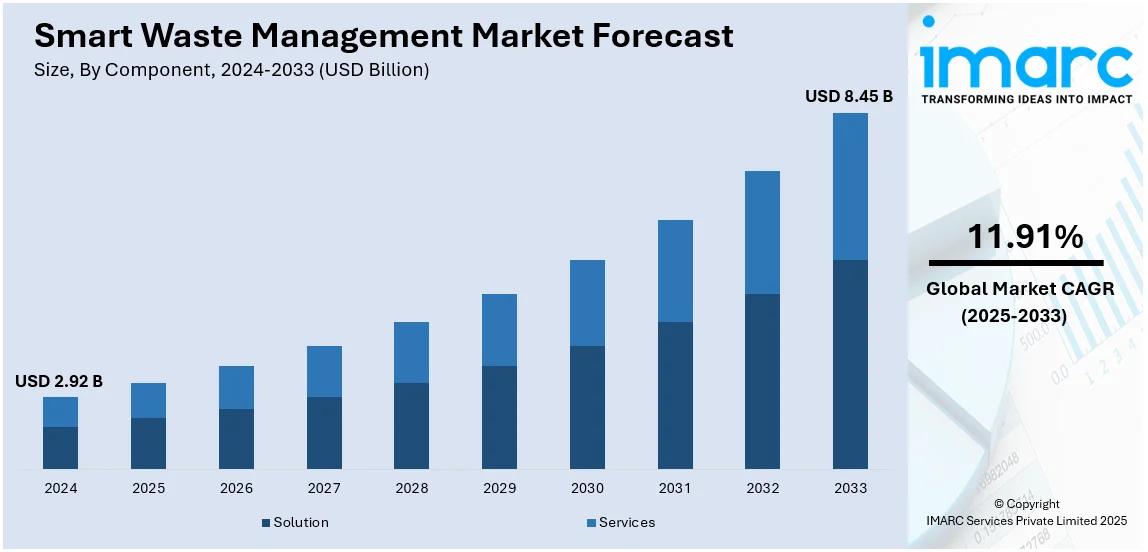

The global smart waste management market size was valued at USD 2.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.45 Billion by 2033, exhibiting a CAGR of 11.91% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.0% in 2024. The growing urban population is raising the demand for more efficient waste collection and disposal systems, which is expanding the smart waste management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.92 Billion |

|

Market Forecast in 2033

|

USD 8.45 Billion |

| Market Growth Rate 2025-2033 | 11.91% |

The global smart waste management market is driven by rapid urbanization, which amplifies waste generation and necessitates efficient disposal solutions. More than 2 billion tons of municipal waste are generated globally every year, and projections indicate a 70% increase by the year 2050, predominantly in developing countries. With waste management methods such as recycling and energy recovery, while helping to control pollution, methane emissions, and climate change, the smart waste management industry is well-positioned to solve some of the biggest problems facing the planet. Implementing circular economy frameworks, such as extended producer responsibility, is essential for minimizing waste, fostering economic development, and confronting global environmental issues. Growing environmental concerns and stringent government regulations promoting sustainable waste practices further propel the market growth. Technological advancements, such as IoT and AI, enable real-time monitoring and optimization of waste collection, reducing operational costs. Rising awareness about resource recovery and circular economy principles also enhances adoption. Additionally, public-private partnerships and investments in smart city initiatives enhance infrastructure development. The need for cost-effective and scalable waste management systems, coupled with the demand for data-driven decision-making, significantly contributes to the market's expansion.

The United States stands out as a key regional market, primarily driven by the growing need for cost-effective and sustainable waste solutions amid rising environmental concerns. Increasing adoption of IoT, AI, and cloud-based platforms enhances waste collection efficiency and operational transparency. On 24th January 2025, Recycle Track Systems secured over USD 40 Million in new capital for its AI-powered waste management solutions throughout North America. Total contracts include a landmark ten-year deal, for full waste services to New York City. Deploying Pello sensors streamlines waste collection, reduces contamination, and enhances sustainability initiatives. Innovative technology with RTS is positioning RTS at the forefront of the growing smart waste management industry throughout the USA and Canada. In addition, government incentives and funding for smart city projects encourage the integration of advanced waste management systems. Growing public awareness about reducing landfill waste and promoting recycling also enhances demand. Additionally, the rise in commercial and industrial waste, coupled with the need for real-time monitoring and analytics, accelerates market growth. These factors collectively drive innovation and investment in smart waste management technologies across the U.S.

Smart Waste Management Market Trends:

AI-Powered Waste Sorting Systems Adoption

The adoption of AI-powered waste sorting systems is transforming how waste is processed. Moreover, these systems enhance efficiency by automatically identifying and categorizing waste, reducing manual labor, and improving recycling rates. In addition, this technological advancement contributes to more effective waste management and resource recovery processes. For instance, in September 2024, Prairie Robotics introduced AI technology to Bay City, Michigan's recycling trucks through a six-month pilot project. This initiative aims to enhance recycling efficiency in the city, using AI to improve waste sorting and management, marking a significant advancement in smart waste management market share. According to UNEP, Municipal solid waste generation is predicted to grow from 2.1 Billion Tons in 2023 to 3.8 Billion tons by 2050.

Increased Focus on Carbon Reduction

Smart waste management solutions are increasingly focused on minimizing carbon emissions by optimizing waste collection routes, reducing landfill waste, and promoting recycling. According to estimates, in 2020, solid waste emissions made up 11% of all global emissions. Furthermore, these efforts contribute to a more sustainable infrastructure that aims to significantly lower greenhouse gas emissions and address environmental concerns linked to waste disposal. For instance, in September 2024, Sharrp Ventures launched a major plastic recycling project in Hyderabad and Raipur, aiming to process 32,000 tonnes of waste annually. This initiative will reduce 15,000 tonnes of CO2 emissions, create 370 direct jobs, and promote AI-driven waste sorting, thereby creating a positive smart waste management market outlook.

Global Expansion of Smart Waste Programs

Smart waste management programs are being adopted across various regions, thereby enhancing waste-handling practices through technology-driven approaches. In contrast, these programs optimize waste collection, promote sustainability, and offer scalable solutions tailored to different waste management challenges, enabling communities and cities to improve efficiency and reduce environmental impacts globally. For instance, in May 2024, Bigbelly launched its Smart Compost Program, expanding globally after a successful U.S. debut. The program uses secure, smart bins and a mobile app, reducing operational costs by 50%, improving community waste collection, and supporting sustainability efforts by addressing food waste management.

Smart Waste Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart waste management market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, waste type, method, and source.

Analysis by Component:

- Solution

- Fleet Management

- Remote Monitoring

- Data Analytics and Advanced Reporting

- Network Management

- Asset Management

- Services

- Professional Services

- Managed Services

Solution stands as the largest component in 2024, holding around 76.4% of the market as it encompasses a wide range of technologies and systems designed to optimize waste collection, processing, and disposal. These solutions include IoT-enabled sensors, smart bins, route optimization software, and data analytics platforms that enhance operational efficiency and reduce costs. By providing real-time monitoring and predictive analytics, they enable municipalities and businesses to manage waste more effectively. The growing adoption of smart city initiatives and the need for sustainable waste management practices further drive the smart waste management market demand. Additionally, advancements in AI and cloud-based technologies are expanding the capabilities of smart waste solutions, making them indispensable for modern waste management systems.

Analysis by Waste Type:

- Solid

- Special

- E-Waste

Solid leads the market with around 55.3% of market share in 2024 due to the significant volume of solid waste generated globally, particularly in urban areas. This category includes household, commercial, and industrial waste, which necessitates efficient collection, sorting, and disposal systems. The increasing urbanization and population growth have amplified solid waste generation, driving the demand for smart solutions to manage it effectively. Technologies such as IoT-enabled bins, route optimization, and waste sorting systems are widely adopted to streamline operations and reduce environmental impact. Governments and organizations are also prioritizing sustainable practices, such as recycling and waste-to-energy conversion, further improving the segment's growth in the smart waste management market.

Analysis by Method:

- Smart Collection

- Smart Processing

- Smart Disposal

- Smart Energy Recovery

Smart collection leads the market with around 47.5% of the market share in 2024, driven by its ability to enhance efficiency and reduce operational costs. This method leverages IoT-enabled sensors, GPS tracking, and data analytics to optimize waste collection routes and schedules. Providing real-time data on bin fill levels, ensures timely pickups, minimizing overflow and unnecessary trips. Municipalities and waste management companies benefit from reduced fuel consumption, lower labor costs, and improved service quality. The growing adoption of smart city initiatives and the need for sustainable waste management practices further propel the demand for smart collection solutions. Its scalability and effectiveness in urban and industrial settings make it a preferred choice globally.

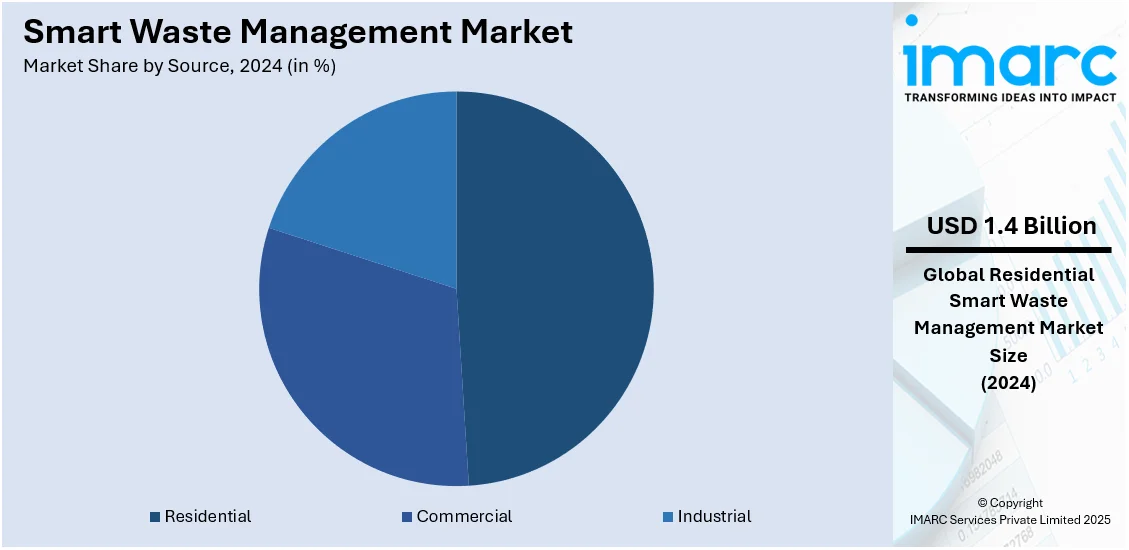

Analysis by Source:

- Residential

- Commercial

- Industrial

Residential leads the market with around 48.6% of the market share in 2024, primarily due to the high volume of waste generated by households. Rapid urbanization and population growth have intensified waste production in residential areas, necessitating efficient management solutions. Smart waste technologies, such as IoT-enabled bins and automated collection systems, are increasingly adopted to streamline waste disposal processes and improve recycling rates. These solutions help municipalities reduce operational costs and enhance service efficiency. Additionally, growing awareness about environmental sustainability and government initiatives promoting waste segregation and recycling further drive the adoption of smart waste management systems in residential areas, making it a dominant segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0% due to its advanced technological infrastructure and strong emphasis on sustainability. The region's high urbanization rate and significant waste generation drive the demand for efficient waste management solutions. Governments and municipalities are increasingly adopting IoT-enabled systems, smart bins, and data analytics to optimize waste collection and processing. Stringent environmental regulations and policies promoting recycling and waste reduction further enhance the smart waste management market growth. Additionally, the presence of leading technology providers and substantial investments in smart city initiatives accelerate the adoption of innovative waste management practices. These factors collectively position North America as the largest and most progressive regional segment in the global smart waste management market.

Key Regional Takeaways:

United States Smart Waste Management Market Analysis

The US accounted for around 88.90% of the total North America smart waste management market in 2024. The U.S. smart waste management market is expanding due to rising urbanization, government policies, and advancements in IoT-driven waste monitoring systems. The UN Division for Inclusive Social Development 2024 report states that in 2022, 80% of the 334 Million U.S. population lived in urban areas, with California having the highest urbanization rate at 94.2%. Similarly, cities are adopting AI-powered waste sorting, real-time tracking, and automated collection to optimize resource use. For instance, in November 2024, AMP and Waste Connections announced a partnership to equip a Commerce City, Colorado facility with AMP ONE and Smart Sortation. Launching in 2026, it will process 62,000 tons of single-stream recycling annually. Waste Connections previously deployed 24 AI robots (2020) and expanded to 50+ systems (2022) across multiple MRFs. Furthermore, waste-to-energy (WTE) projects are expanding as municipalities adopt sustainable disposal methods. The Resource Conservation and Recovery Act (RCRA) promotes smart waste technology, especially for hazardous and electronic waste. Besides this, private sector investments in AI-driven bins, route optimization, and data analytics improve market demand. Corporate sustainability initiatives and EPR programs are also accelerating digital transformation, while municipalities, tech firms, and waste haulers collaborate to improve waste processing and recycling efficiency.

Europe Smart Waste Management Market Analysis

Europe’s smart waste management market is changing given the stringent environmental regulations, circular economy policies, and the EU’s Green Deal initiatives. According to the European Environment Agency, municipal waste recycling in the EU has risen to 49%, with each citizen generating 5 tons of waste annually, of which 40.8% is recycled. Packaging waste has a 64% recycling rate, while electronic waste stands at 39%. Additionally, countries in Europe including Germany, the Netherlands, and Sweden are adopting advanced waste segregation, automated sorting, and RFID tracking to improve efficiency. AI-powered digital platforms and blockchain technology enhance transparency in waste collection, processing, and material recovery. Extended Producer Responsibility (EPR) schemes push manufacturers to integrate smart tracking for recyclables, reducing landfill reliance. Moreover, rising sensor-based smart bins track real-time waste levels, enabling predictive collection scheduling is propelling the market expansion. Besides this, increasing government and private sector investments in robotic waste sorting and IoT-enabled recycling plants are driving higher resource recovery rates and operational efficiency across the region.

Asia Pacific Smart Waste Management Market Analysis

The market in Asia Pacific is witnessing growth and is propelled by rapid urbanization, rising waste generation, and smart city initiatives. According to the Central Pollution Control Board, India generates 62 Million Tons of waste annually, with over 75% unprocessed, primarily consisting of organic materials, plastic, paper, glass, metal, and hazardous waste. Plastic waste accounts for nearly 12% of total waste. Furthermore, China, Japan, and South Korea are integrating AI-driven waste segregation, smart landfill monitoring, and IoT-based waste collection. Public-private partnerships (PPPs) are fostering large-scale adoption of automated waste processing and blockchain-based traceability systems. Additionally, sensor-equipped smart bins and mobile-based reporting are improving waste management in urban centers. India is advancing waste-to-wealth solutions, hosting the 12th Regional 3R and Circular Economy Forum in Jaipur (March 3-5, 2025). The forum will showcase smart waste policies, solid-liquid waste management initiatives, and circular economy strategies, concluding with the Jaipur Declaration to enhance Asia-Pacific’s resource efficiency and waste reduction efforts.

Latin America Smart Waste Management Market Analysis

In Latin America, the smart waste management market is escalating as cities modernize collection, recycling, and landfill management. For example, in February 2025, ALPLA acquired a majority stake in Clean Bottle, a Brazilian HDPE recycler with a 15,000-tonne annual capacity, securing high-quality PCR supply and advancing 100% recyclable packaging by 2025. Additionally, the growing adoption of AI-based sorting, RFID tracking, and smart waste monitoring systems in Brazil, Mexico, and Chile is impelling the market. Waste-to-energy projects and digital waste platforms are gaining government support. Furthermore, IoT-equipped smart bins are improving collection efficiency and supporting market demand. Informal waste collection remains a challenge, but digital tools are integrating informal recyclers. Moreover, AI-driven waste classification is enhancing recycling efficiency, while sustainability-focused businesses invest in smart packaging and compliance tracking to strengthen environmental accountability.

Middle East and Africa Smart Waste Management Market Analysis

The Middle East and Africa’s market is advancing attributed to urbanization, sustainability targets, and rising waste generation. The UAE produces over 21 Million Tons of MSW annually, with per capita waste declining from 2.1 kg/day to 1.8 kg/day (657–767 kg/year), placing it among the highest global MSW producers, as per the Ministry of Climate Change and Environment (MOCCAE). Similarly, smart waste solutions, including AI-driven segregation, sensor-equipped bins, and automated collection, are being integrated into municipal systems, thereby impelling the market. Moreover, gulf countries are increasingly investing in waste-to-energy (WTE) projects, using real-time monitoring and digital waste tracking. Apart from this, the increasing adoption of mobile waste reporting and IoT-enabled collection systems in Africa is supporting market expansion. Furthermore, automated sorting and robotic processing are augmenting material recovery, reducing landfill dependency, and promoting a circular economy.

Competitive Landscape:

The competitive landscape of the global smart waste management market is characterized by intense innovation and strategic initiatives. Key players are focusing on developing advanced technologies such as IoT-enabled sensors, AI-driven analytics, and cloud-based platforms to optimize waste collection and processing. Many are investing in research and development to create scalable and cost-effective solutions tailored to urban and industrial needs. Strategic partnerships with governments and municipalities are also common, aiming to integrate smart waste systems into broader smart city projects. Additionally, companies are emphasizing sustainability by promoting recycling and resource recovery solutions. Expansion into emerging markets and mergers and acquisitions further highlight efforts to strengthen global presence and market share.

The report provides a comprehensive analysis of the competitive landscape in the smart waste management market with detailed profiles of all major companies, including:

- Bigbelly Inc.

- Bin-e

- Ecube Labs Co. Ltd.

- Enevo (REEN AS)

- Evreka

- GreenQ Ltd.

- Pepperl+Fuchs SE

- RecycleSmart Solutions

- Rubicon Technologies LLC

- Sensoneo

- Suez SA

- Veolia Environnement S.A.

Latest News and Developments:

- February 2025: Schaeffler's Skalica, Slovakia plant digitalized waste management with Sensoneo’s IoT-based solution. Real-time sensor data optimizes waste collection, reducing emissions and improving efficiency. The system tracks waste weight, contamination, and recycling potential. Schaeffler plans to expand this innovation across its European facilities.

- February 2025: BRE launched SmartWaste Scan, an AI-powered upgrade to its SmartWaste platform. Using OCR and machine learning, it automates waste data entry, reducing processing time by 24%, improving compliance, and enhancing carbon tracking. The platform streamlines sustainability efforts for the construction sector, increasing efficiency and reducing environmental impact.

- February 2025: Max-R and Intuitive AI partnered to launch AI-powered smart bins, integrating Oscar Sort for real-time waste sorting and data collection. This innovation improves recycling rates, reduces contamination, and enhances sustainability efforts. The partnership also expands digital advertising opportunities through OMX, enhancing engagement at high-traffic venues.

- December 2024: Blue Planet Environmental Solutions acquired Smart Environmental, a top waste management player in New Zealand. The move strengthens Blue Planet’s Asia-Pacific presence, enhancing smart waste management with landfill remediation, organics processing, and recycling. The partnership supports New Zealand’s sustainability goals through innovative circular economy solutions.

- June 2024: ANDRITZ is advancing Austria’s waste sector with the ReWaste F project, developing a Smart Waste Factory using IoT sensors, AI-driven sorting, and real-time monitoring. Trials at the ART Center optimize recycling efficiency, reduce emissions, and enhance circular economy practices through digitalized waste treatment and recovery systems.

Smart Waste Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Waste Types Covered | Solid, Special, E-Waste |

| Methods Covered | Smart Collection, Smart Processing, Smart Disposal, Smart Energy Recovery |

| Sources Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bigbelly Inc., Bin-e, Ecube Labs Co. Ltd., Enevo (REEN AS), Evreka, GreenQ Ltd., Pepperl+Fuchs SE, RecycleSmart Solutions, Rubicon Technologies LLC, Sensoneo, Suez SA, Veolia Environnement S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart waste management market from 2019-2033.

- The smart waste management market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart waste management market was valued at USD 2.92 Billion in 2024.

IMARC estimates the smart waste management market to exhibit a CAGR of 11.91% during 2025-2033, reaching a value of USD 8.45 Billion by 2033.

The key drivers of the smart waste management market include increasing urbanization, environmental concerns, and the adoption of sustainable practices. Technological advancements, such as IoT and AI, are also central to optimizing waste collection, reducing costs, and improving operational efficiency. Additionally, government regulations and public-private investments promote the adoption of smart waste solutions.

North America currently dominates the smart waste management market, accounting for a share exceeding 35.0%. This dominance is fueled by its advanced technological infrastructure, growing urbanization, stringent environmental regulations, and substantial investments in smart city projects.

Some of the major players in the smart waste management market include Bigbelly Inc., Bin-e, Ecube Labs Co. Ltd., Enevo (REEN AS), Evreka, GreenQ Ltd., Pepperl+Fuchs SE, RecycleSmart Solutions, Rubicon Technologies LLC, Sensoneo, Suez SA, and Veolia Environnement S.A., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)