Smart Transportation Market Size, Share, Trends and Forecast by Solution, Services, Transportation Mode, Application, and Region, 2025-2033

Smart Transportation Market Size and Share:

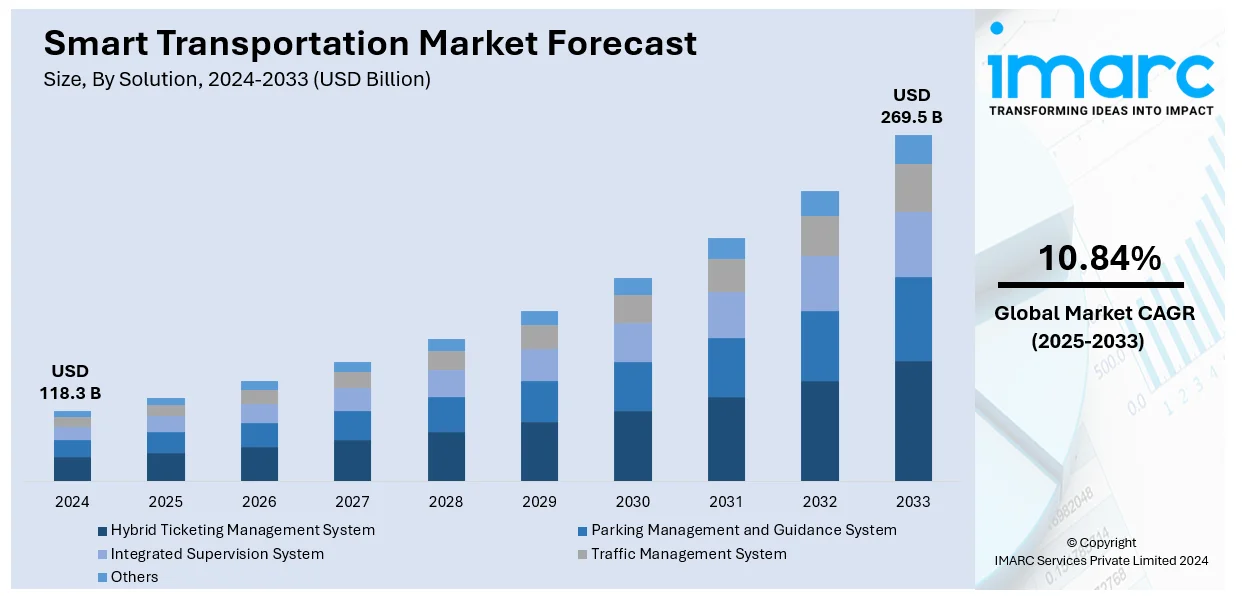

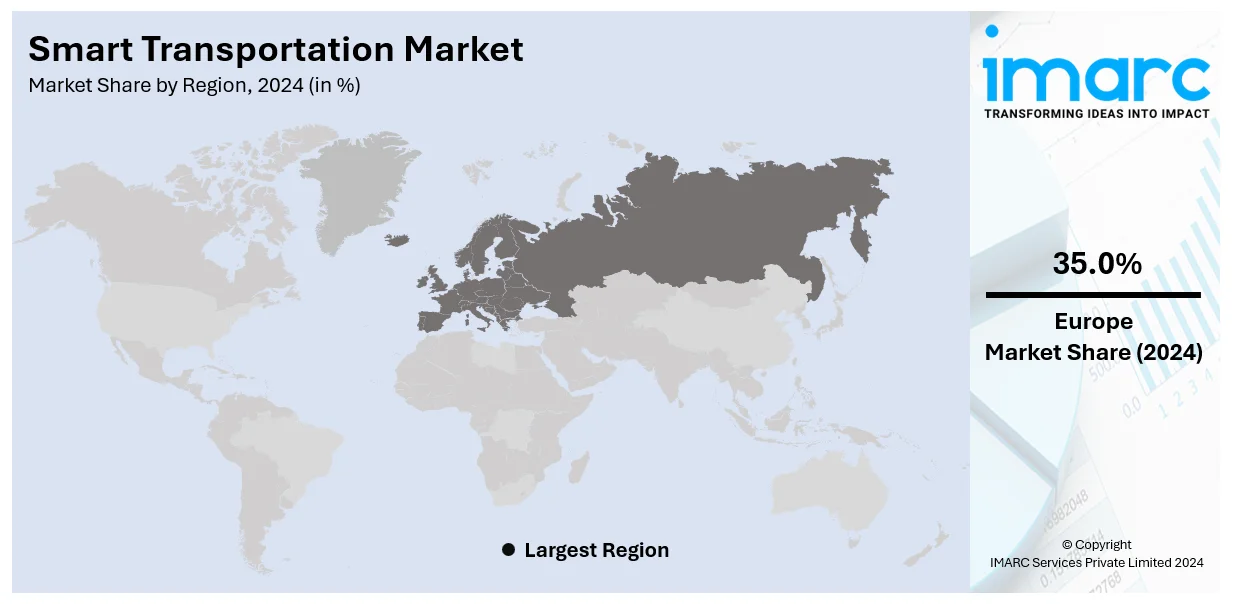

The global smart transportation market size was valued at USD 118.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 269.5 Billion by 2033, exhibiting a CAGR of 10.84% from 2025-2033. Europe currently dominates the market, holding a market share of over 35.0% in 2024. Increasing urbanization, the need for efficient transportation systems, government initiatives prioritize modernization and sustainability, smart city initiatives, the advent of fifth generation (5G) technology are some of the factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 118.3 Billion |

|

Market Forecast in 2033

|

USD 269.5 Billion |

| Market Growth Rate 2025-2033 | 10.84% |

The rising demand for electric vehicles (EVs) and autonomous driving systems is another factor contributing to the growth of this market as the same is driven by sustainable goals and carbon footprint reduction. Government initiatives such as smart city projects and further investment for the development of existing infrastructure have strengthened their advocates. Safety and convenience provided by improved passenger services like automated fare collection, smart parking, and connected vehicle systems enhanced safety will act as strong driving forces. Besides, technological advancements are converging, with urbanization becoming the next step in ensuring efficient mobility solutions within smart systems. Due to the intense increase in urban population density, traffic congestion has increased, and environmental impacts intensified, thus forcing needs for adoption of intelligent transportation systems (ITS) by governments alongside the private sector.

The smart transportation market in the United States has been driven by several key factors. The need to ameliorate urban congestion along with rapid urbanization is leading to the advancement of transportation solutions. Governments try to subsidize sustainable and efficient mobility through foundation programs such as smart city projects, intelligent transportation systems (ITS), etc., thus enhancing impetus for smart transportation market growth. Additionally, the inclusion of artificial intelligence (AI), Internet of Things (IoT), big data analytics, and other technical advancements in transportation infrastructure enhances efficiency and safety in operation, thus boosting requirements further. The electric vehicle (EV) and autonomous transportation system push are propelling this market.

Smart Transportation Market Trends:

Surging demand for transportation systems

The rapidly increasing popularity of the transportation systems is driven by the growing demand for efficient solutions meant to solve the problems of urban congestion, as well as reduce the carbon footprint. Under the impact of urbanization, the size of cities is becoming increasingly large, whereas existing transportation systems, which are based on the application of cars, buses, and other means of transportation, often fail to support the increasing flow of traffic, which consequently leads to congestion, pollution, and numerous other negative consequences. Smart transportation solutions offer an effective alternative, as they integrate advanced technologies that allow optimizing traffic flow, improving traffic safety, and minimizing the environmental impact of transportation. The United Nations has forecasted that the world's population residing in urban areas will be 68% by 2050. Moreover, according to industry reports, there will be more than 26 smart cities by 2025, with 16 being located in North America and Europe, which further accelerates the need for smart transportation solutions to address the growing challenges of urban populations.

Advancements in technology

Several smart transportation companies are benefiting from technological advancements, particularly in the fields of the Internet of Things (IoT), artificial intelligence (AI), and blockchain. This technology enables the development of advanced transportation solutions equipped to gather, analyze, and act on huge chunks of data in real-time. For example, IoT sensors mounted in vehicles and infrastructure provide information on road conditions and traffic, and vehicle performance. This provides information that could help plan for more efficient transportation. Similarly, artificial intelligence could be used to determine route planning, traffic light durations, and fleet management to enhance traffic flow and ultimately reduce travel time. The United Nations estimated that the world's population in urban areas will reach 68% by 2050. Industry reports also indicate that by 2025, there will be more than 26 smart cities, 16 of which lie in North America and Europe, accelerating the urgency of smart transportation for growing urban populations.

Government initiatives for modernization

Government initiatives to modernize transportation infrastructure and promote sustainable mobility are among the most crucial drivers which provide incentives and fuel the growth for the smart transportation market. Governments worldwide recognize the need for modern and efficient transportation systems and invest in the development and improvement of new roads, bridges, and public transport networks. These investments are often accompanied by the introduction of policies and regulations promoting clean energy vehicles, electric cars and electric buses, as well as the implementation of smart technologies and equipment into transportation networks. For example, in April 2022, the Ministry of Electronics and Information Technology (MeitY) in India introduced multiple applications as a part of the Intelligent Transportation System (ITS) under the InTranSE-II program to enhance the country’s traffic management. Indigenous solutions like the Onboard Driver Assistance and Warning System (ODAWS), Bus Signal Priority System, and Common Smart IoT Connectivity (CoSMiC) were developed through collaboration between the Centre for Development of Advanced Computing (CDAC) and the Indian Institute of Technology Madras (IIT-M), supporting India's efforts to upgrade its transportation infrastructure with advanced, smart solutions.

Smart Transportation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart transportation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution, services, transportation mode, and application.

Analysis by Solution:

- Hybrid Ticketing Management System

- Parking Management and Guidance System

- Integrated Supervision System

- Traffic Management System

- Others

Traffic management system dominates the market with 33.7% of market share in 2024. The segment is driven by the increasing urbanization and population growth, which result in rising vehicular congestion and the need for efficient traffic management solutions. As cities expand, the volume of vehicles on the roads intensifies, leading to traffic jams, longer commute times, and increased air pollution. To address these challenges, governments and transportation authorities are investing in advanced traffic management systems that utilize technologies such as real-time traffic monitoring, adaptive signal control, and dynamic route guidance. These systems aim to optimize traffic flow, reduce bottlenecks, and improve overall transportation efficiency, ultimately enhancing the quality of life for urban residents and commuters. Furthermore, the segment is also driven by the growing adoption of smart city initiatives and the integration of transportation systems with other urban infrastructure.

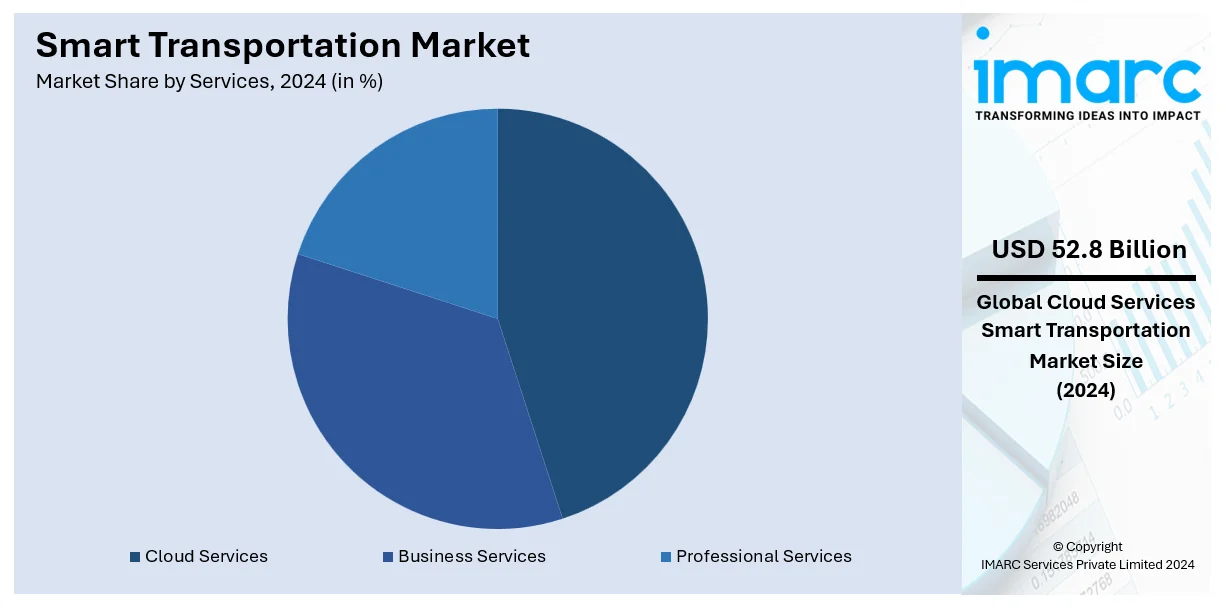

Analysis by Services:

- Business Services

- Professional Services

- Cloud Services

Cloud services lead the market with around 44.6% of smart transportation market share in 2024 due to the increasing demand for scalable and flexible computing resources, enabling businesses to adapt to changing workloads and requirements without significant upfront investments in infrastructure. With the rapid digital transformation across industries, organizations are increasingly leveraging cloud computing to streamline operations, enhance collaboration, and improve efficiency. Cloud services offer businesses the agility to quickly deploy and scale applications, allowing them to respond to market dynamics and customer demands more effectively. Moreover, the rising shift toward remote work and distributed teams have further accelerated the adoption of cloud-based solutions, enabling seamless access to data and applications from anywhere, at any time. Additionally, the growing emphasis on data-driven decision-making and the need for advanced analytics capabilities are driving organizations to migrate their data and workloads to the cloud, where they can leverage powerful processing capabilities and sophisticated machine learning algorithms to gain actionable insights.

Analysis by Transportation Mode:

- Roadways

- Railways

- Airways

- Maritime

Roadways dominate the market with 55.5% of market share in 2024. The roadways segment is driven by the increasing demand for efficient and sustainable transportation solutions in urban and rural areas worldwide. With rapid urbanization and population growth, cities are facing mounting challenges related to traffic congestion, air pollution, and road safety. As a result, there is a growing emphasis on upgrading road infrastructure and implementing smart transportation technologies to improve mobility and reduce environmental impact. Additionally, government initiatives aimed at modernizing roadways, such as the development of expressways, highways, and intelligent transportation systems (ITS), are driving market growth by enhancing connectivity and facilitating smoother traffic flow. Moreover, the rise of e-commerce and the increasing demand for last-mile delivery services are fueling investments in road transportation infrastructure to support the efficient movement of goods and services. Furthermore, advancements in vehicle technologies, including electric and autonomous vehicles, are reshaping the roadways segment by promoting the adoption of cleaner, safer, and more efficient transportation options.

Analysis by Application:

- Mobility as a Service

- Public Transport

- Transit Hubs

- Connected Cars

- Video Management

- Others

The mobility as a service (MaaS) segment is driven by the increasing demand for seamless and integrated transportation solutions that offer convenience, affordability, and sustainability to urban commuters. As cities grapple with issues of congestion, pollution, and limited parking, there is a growing recognition of the need for alternative modes of transportation that can reduce reliance on private car ownership and promote the use of shared mobility services. MaaS platforms aim to address these challenges by offering a comprehensive range of transportation options, including public transit, ride-sharing, bike-sharing, scooter-sharing, and on-demand mobility services, all accessible through a single digital interface.

The public transport segment is driven by the increasing need for efficient, reliable, and sustainable transportation options to meet the growing mobility demands of urban populations. Public transit systems play a crucial role in providing affordable and accessible transportation services to residents, commuters, and visitors, serving as the backbone of urban mobility networks. With urbanization on the rise and cities becoming more densely populated, there is a growing recognition of the importance of investing in public transport infrastructure and services to reduce air pollution, alleviate congestion, and improve overall quality of life.

The transit hubs segment is driven by the increasing importance of multimodal transportation hubs as key nodes in urban mobility networks, facilitating seamless connections between different modes of transportation and enhancing the overall efficiency and accessibility of urban mobility. Transit hubs, such as airports, train stations, bus terminals, and intermodal facilities, play a critical role in accommodating the movement of people and goods within and between cities, regions, and countries. With the rise of urbanization and the growing complexity of transportation systems, there is a growing recognition of the need to invest in transit hub infrastructure and services to support the efficient and sustainable movement of passengers and freight.

The connected cars segment is driven by the increasing demand for advanced connectivity and automation features in vehicles, as well as the growing emphasis on road safety, efficiency, and convenience. Connected cars, also known as smart cars or internet-enabled vehicles, are equipped with a range of sensors, communication technologies, and onboard computing systems that enable them to communicate with other vehicles, infrastructure, and external networks in real-time. These capabilities offer numerous benefits to drivers, passengers, and society as a whole, including improved navigation and traffic management, enhanced vehicle safety and security, and greater convenience and comfort.

The video management segment is driven by the increasing demand for advanced video surveillance and management solutions to enhance security, safety, and operational efficiency in various industries and applications. Video management systems (VMS) enable organizations to capture, store, manage, and analyze video footage from surveillance cameras, drones, and other sources, providing valuable insights and situational awareness to decision-makers and stakeholders.

The others segment encompasses a diverse range of emerging trends, technologies, and applications that are driving innovation and growth in the transportation and mobility industry. These include electric vehicles (EVs), autonomous vehicles (AVs), drone delivery services, hyperloop transportation systems, urban air mobility (UAM) solutions, and smart infrastructure projects, among others.

Regional Analysis

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 35.0%. The European region is driven by the increasing focus on sustainability and environmental conservation, leading to a surge in demand for eco-friendly transportation solutions. Governments across Europe are implementing stringent regulations to reduce carbon emissions and combat climate change, thereby incentivizing the adoption of electric vehicles (EVs) and other alternative modes of transportation. Furthermore, the continent's dense urban centers are grappling with traffic congestion and air pollution, prompting the need for smarter, more efficient transportation systems. Investments in infrastructure modernization, coupled with advancements in technology such as IoT, AI, and smart mobility solutions, are reshaping the transportation landscape in Europe. Moreover, the European Union's ambitious targets for reducing greenhouse gas emissions and promoting sustainable mobility are driving innovation and collaboration among industry players, governments, and research institutions.

Key Regional Takeaways:

United States Smart Transportation Market Analysis

In 2024, the United States accounts for over 86.00% of the smart transportation market in North America. Urbanization is one of the key growth drivers for the United States smart transportation market, as the share of the population is increasing in cities, making the demand for efficient and sustainable mobility solutions greater. According to Census Bureau, 83 percent of the population in the U.S. lives in cities, which sharply increased from 64 percent in 1950. Projections note that by 2050, 89 percent of the population living in the United States will be in cities, while at a global level, it is estimated that 68 percent of the population will be urbanized in 2050.

Therefore, the increased urbanization poses much relevance to the development of future-forward means of transportation that can prevent congestion, decrease emissions and increase accessibility. Smart Transportation technologies such as intelligent management of traffic, real time updates of transit, or use of electrified public network are essential in addressing a growing urban population. Indeed, this is in parallel to government initiatives and private funding to develop sustainable urban structure to support economic growth with efficient human habitat standards.

Europe Smart Transportation Market Analysis

Strategic investments and technological advancements are the most significant drivers of the Europe smart transportation market. The European Commission has committed over Euro 7 Billion (USD 7.3 Billion) in grants through the Connecting Europe Facility (CEF), supporting 134 transport projects aimed at modernizing infrastructure and integrating smart mobility solutions. This represents the largest funding allocation under the current CEF Transport programme, underscoring the region's commitment to improving connectivity and sustainability in transportation.

There is also the growth in urban populations that fuels the demand for innovative mobility solutions. The European Union has 447 million inhabitants, of which 75% are reported to live in urban areas. This number is said to exceed 80% by 2050 according to the European Union. With urban growth, there's an increased need for traffic management, electric vehicle usage, and public transport as congestion and emissions are reduced. Leveraging strategic funding and embracing the latest technologies, Europe is becoming a leader in smart transportation around the world.

Asia Pacific Smart Transportation Market Analysis

The Asia-Pacific smart transportation market is growing at a robust pace due to national initiatives and international collaborations that are driving the advancement of intelligent and sustainable mobility solutions. China's 14th Five-Year Plan (2021–2025), as announced by the General Office of Fujian Provincial People's Government, focuses on developing a comprehensive transportation system with green and smart technologies. By 2025, China aims to make significant progress in intelligent transport infrastructure.

Regional collaborations are also driving the pace of adoption in this industry. In December 2022, India and South Korea agreed to develop an intelligent transport system on the Nagpur-Mumbai Expressway with a loan of INR 1,495 Crore (USD 183.14 Million) from South Korea's Economic Development Cooperation Fund (EDCF). Such collaborations reflect the region's commitment to bringing cutting-edge technologies into transportation networks to improve efficiency and sustainability. These efforts also relate to Asia-Pacific's bigger goals, such as enabling rapid urbanization and economic growth through innovative transport solutions.

Latin America Smart Transportation Market Analysis

Latin America and the Caribbean is considered the most urbanized region globally, with 80% of its population being in urban areas, based on United Nations statistics. Such high levels of urbanization have created a massive demand for smart transportation solutions to overcome congestion, emissions, and mobility issues. The large cities, for instance, include Mexico City, São Paulo, Buenos Aires, and Rio de Janeiro, and they are increasingly embracing novel transport technologies. For instance, Bogotá has introduced 1,485 electric buses in the public transport system since 2019, according to Industry Reports. This indicates that the region is embracing sustainability and smart transportation solutions. Other cities are also investing in electric and autonomous vehicles, intelligent traffic management, and integrated transport networks, which are fueling the growth of the smart transportation market in Latin America. These initiatives are important to meet needs in rapidly growing urban population and to address environmental issues.

Middle East and Africa Smart Transportation Market Analysis

The completion of the first phase of the Riyadh Metro on December 1, 2024, is a significant milestone in Saudi Arabia's efforts to modernize its transportation infrastructure. This monumental project, valued at billions of dollars, is the cornerstone of the country's Vision 2030 goals for diversifying the economy and enhancing urban mobility. Developed through collaboration among three international consortiums representing 13 countries from North America, Europe, and Asia, the Riyadh Metro is poised to revolutionize urban transit in one of the largest cities in the Middle East. The successful roll-out of the metro system is expected to spur heavy investment in smart transportation solutions across the region. It will drive electric mobility, autonomous vehicles, and new modes of traffic management; it can help drive growth in this smart transportation market across Middle East and Africa regions. Strong push toward sustainable, efficient urban transportation solutions have become the bellwether.

Competitive Landscape:

The key players in the smart transportation market are actively engaged in several strategic initiatives to capitalize on emerging opportunities and address evolving challenges. These players are heavily investing in research and development (R&D) to innovate and enhance their product and service offerings, with a particular focus on technologies such as IoT, AI, and blockchain. They are also forging strategic partnerships and collaborations with other industry stakeholders, including government agencies, technology providers, and transportation operators, to co-create and deploy innovative solutions that address specific market needs. Moreover, these players are expanding their global footprint through mergers and acquisitions, enabling them to access new markets and strengthen their competitive position. Additionally, they are investing in talent development and workforce training to ensure they have the necessary expertise to drive innovation and deliver value to customers. Furthermore, these players are actively engaging with policymakers and regulators to shape the regulatory landscape and advocate for policies that support the widespread adoption of smart transportation solutions.

The report provides a comprehensive analysis of the competitive landscape in the smart transportation market with detailed profiles of all major companies, including:

- Accenture plc

- Alstom SA

- Bentley Systems Incorporated

- Cisco Systems Inc.

- Cubic Corporation

- General Electric Company

- Indra Sistemas S.A.

- International Business Machines Corporation

- Kapsch Aktiengesellschaft

- Siemens AG

- Thales Group

- Xerox Corporation

Latest News and Developments:

- In 2024: Alstom, a worldwide frontrunner in intelligent and eco-friendly transportation, launched Low Emission Access to Public Transport (LEAP), a scheme within its Corporate Social Responsibility program, which seeks to enhance last-mile connectivity and promote increased use of public transport. During the initial phase of the program, MetroRide will introduce electric autorickshaws as a last-mile service from the Yelachenahalli and Indiranagar stations of the Namma Metro in Bengaluru.

- February 2023: AURA AERO executed a contract with Thales to create a next-generation connected avionics system specifically designed for electric and hybrid regional aviation.

- April 2024: smart announced its entry into the Egyptian EV market by providing exclusive and high-end all-EV sales and after-sales services, along with a complete selection of offerings.

- August 2024: smart announced the launch of the smart #1 and smart #3 in the Australian market. smart #1 was designed as a high-end compact city SUV, while the smart #3, an SUV coupe, offers a more spacious and athletic take on the same style.

- January 2024: BYD declared the launch of its Xuanji smart car system to compete with other market players with specialties like automated parking and voice recognition.

Smart Transportation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Hybrid Ticketing Management System, Parking Management and Guidance System, Integrated Supervision System, Integrated Supervision, Traffic Management System, Others |

| Services Covered | Business Services, Professional Services, Cloud Services |

| Transportation Modes Covered | Roadways, Railways, Airways, Maritime |

| Applications Covered | Mobility As a Service, Public Transport, Transit Hubs, Connected Cars, Video Management, others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Alstom SA, Bentley Systems Incorporated, Cisco Systems Inc., Cubic Corporation, General Electric Company, Indra Sistemas S.A., International Business Machines Corporation, Kapsch Aktiengesellschaft, Siemens AG, Thales Group, Xerox Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart transportation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart transportation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global smart transportation market was valued at USD 118.3 Billion in 2024.

The market is estimated to reach USD 269.5 Billion by 2033, exhibiting a CAGR of 10.84% from 2025-2033.

The increasing urbanization, need for efficient transportation systems, government initiatives prioritize modernization and sustainability, smart city initiatives, and the advent of fifth generation (5G) technology are some of the factors fueling the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global smart transportation market include Accenture plc, Alstom SA, Bentley Systems Incorporated, Cisco Systems Inc., Cubic Corporation, General Electric Company, Indra Sistemas S.A., International Business Machines Corporation, Kapsch Aktiengesellschaft, Siemens AG, Thales Group, Xerox Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)