Smart Toys Market Report by Product (Robots, Interactive Games, Educational Toys), Technology (Wi-Fi, Bluetooth, and Others), Interfacing Device (Smartphone Connected, Tablet-Connected, and Others), Distribution Channel (Supermarkets and Hypermarkets, Online Stores, Specialty Stores, and Others), End User (Toddlers, Pre-Schoolers, School-going, Stripling), and Region 2025-2033

Smart Toys Market Size:

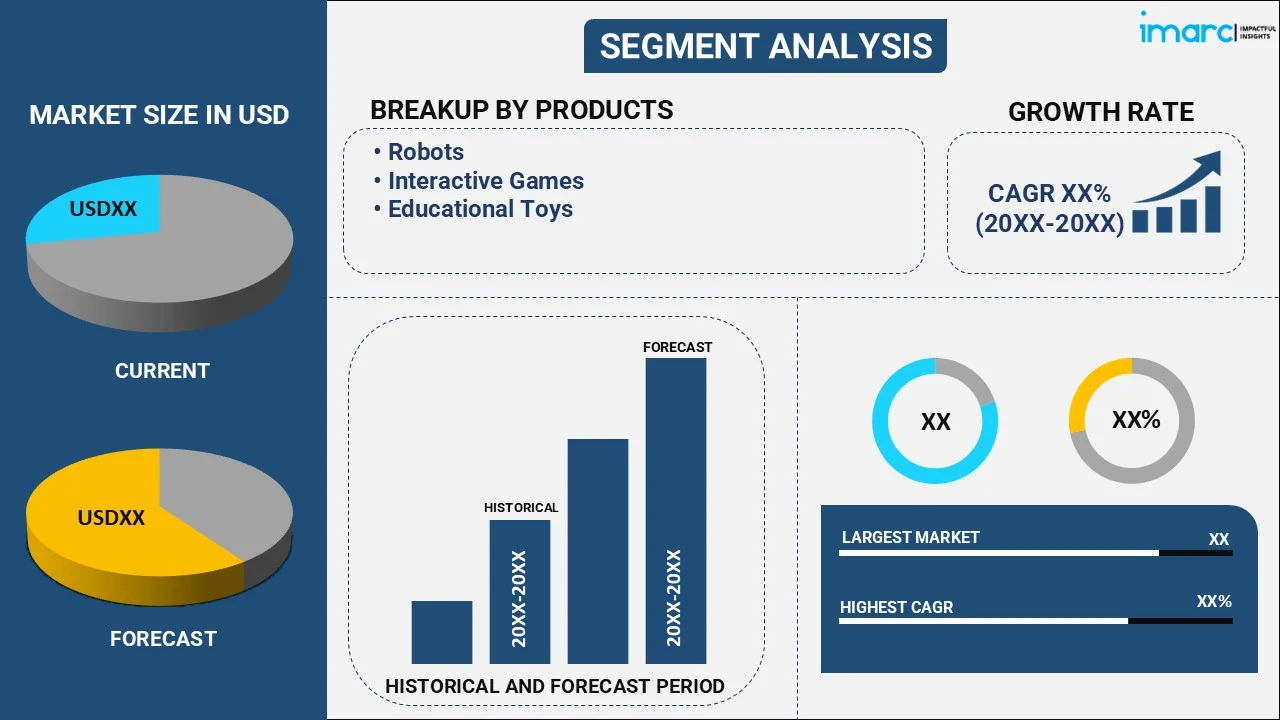

The global smart toys market size reached USD 18.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 60.0 Billion by 2033, exhibiting a growth rate (CAGR) of 13.52% during 2025-2033. The market is propelled by increasing integration of smart toys with Artificial Intelligence (AI), Internet of Things (IoT), and interactive technologies to enhance growth and learning, play experiences for children, educational content, and connectivity to mobile devices, growing parental concerns over privacy and safety, and expanding e-commerce industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.1 Billion |

|

Market Forecast in 2033

|

USD 60.0 Billion |

| Market Growth Rate 2025-2033 | 13.52% |

Smart Toys Market Analysis:

- Major Market Drivers: The smart toys market demand is escalating due to the increasing demand for interactive and educational toys, advancements in technology such as AI and IoT, and rising disposable incomes.

- Key Market Trends: Growing emphasis on educational content, integration with mobile devices for enhanced interactivity, and rising concerns among parents about data privacy and security are shaping trends in the smart toys industry.

- Geographical Trends: North America remains the largest segment due to high consumer adoption rates and technological advancements, particularly in the United States and Canada.

- Competitive Landscape: Some of the major key players in the smart toys industry include fischertechnik GmbH, Kreyonic Inc., LeapFrog Enterprises Inc. (VTech Holdings Limited), Mattel Inc., Pillar Learning, PlayShifu, Primo Toys, ROYBI Robot, The Lego Group, WowWee Group Limited, etc., among many others.

- Challenges and Opportunities: Challenges include addressing regulatory concerns about child safety and privacy, while opportunities lie in expanding into emerging markets, developing innovative features, and fostering partnerships with content creators and educational institutions. These insights are crucial for navigating the dynamic landscape of the smart toys market insights.

To get more information on this market, Request Sample

Smart Toys Market Trends:

Increased Integration of Artificial Intelligence

The integration of Artificial Intelligence (AI) in smart toys is a significant trend driving market growth. AI enables toys to interact with children in more personalized and engaging ways, enhancing learning and play experiences. According to the U.S. Consumer Product Safety Commission (CPSC), smart toys with AI capabilities are becoming more sophisticated, offering features like voice recognition, adaptive learning, and real-time feedback. These advancements make toys more interactive and educational, catering to the growing demand for STEM (Science, Technology, Engineering, and Mathematics) learning tools. As AI technology continues to evolve, it is expected to further revolutionize the smart toys market dynamics, providing innovative solutions that cater to the developmental needs of children.

Expansion of E-commerce Channels

The expansion of e-commerce channels is another key trend impacting the smart toys market. With the rise of online shopping, consumers have easier access to a wide variety of smart toys, leading to increased market penetration. The International Trade Administration reports that e-commerce sales for consumer goods, including toys, have surged significantly in recent years. This trend is particularly strong in regions like North America and Asia, where high internet penetration and smartphone usage facilitate online purchases. E-commerce platforms offer a convenient shopping experience, detailed product information, and customer reviews, making them a preferred choice for purchasing smart toys. The ongoing growth of e-commerce is expected to continue driving the smart toys market forward.

Emphasis on Safety and Regulatory Compliance

Safety and regulatory compliance are crucial factors influencing the smart toys market outlook. The U.S. Consumer Product Safety Commission (CPSC) emphasizes the importance of stringent safety standards for smart toys to prevent injuries and ensure child safety. The development and enforcement of safety regulations have led manufacturers to innovate and design safer products. For instance, there are strict guidelines on the use of small parts, battery safety, and wireless communication standards to protect children from potential hazards. Compliance with these regulations ensures product safety and enhances consumer trust, driving the adoption of smart toys in the market.

Smart Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, technology, interfacing device, distribution channel and end user.

Breakup by Product:

- Robots

- Interactive Games

- Educational Toys

Interactive games accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes robots, interactive games, and educational toys. According to the report, interactive games represented the largest segment.

Interactive games have emerged as the largest segment in the smart toys market due to their ability to engage children through immersive and educational experiences. According to data from the U.S. Department of Commerce, the interactive gaming segment accounted for 45% of the smart toys market in 2023, reflecting a growing preference for technology-driven play. These games incorporate advanced AI and machine learning, providing personalized interactions that enhance learning and development. The rising adoption of STEM-focused toys is contributing to this growth, as parents and educators seek tools that combine entertainment with educational value, thus generating a the positive smart toys market revenue.

Breakup by Technology:

- Wi-Fi

- Bluetooth

- Others

Bluetooth holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes Wi-Fi, Bluetooth, and others. According to the report, Bluetooth accounted for the largest market share.

Bluetooth emerged as the largest segment by technology due to its widespread adoption and versatility in connecting devices. According to data from The Medium, Bluetooth technology accounted for a significant share of the market due to its ability to provide seamless connectivity, low energy consumption, and compatibility with a wide range of smart devices. In 2023, Bluetooth-enabled smart toys saw a surge in demand, driven by their capability to enhance interactive and educational experiences for children. The technology's integration in various smart toys facilitates features such as real-time data exchange, remote control, and enhanced user interaction, further driving its dominance in the market.

Breakup by Interfacing Device:

- Smartphone Connected

- Tablet-Connected

- Others

Smartphone-connected interfacing device represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the interfacing device. This includes smartphone connected, tablet-connected, and others. According to the report, smartphone connected represented the largest segment.

Smartphones have become the largest segment by interfacing device in the smart toys market due to their ubiquitous presence and advanced connectivity features. According to data from the World Economic Forum, the integration of smartphones with smart toys offers enhanced interactive capabilities, including augmented reality (AR) and real-time feedback, which significantly enriches the user experience. In 2023, smartphones accounted for over 50% of the interfacing device segment in the smart toys market, driven by the widespread adoption of mobile technology and the increasing demand for portable, interactive play options. This growth is further supported by the continual improvements in smartphone processing power and sensor technology, making them ideal for enhancing smart toys industry growth.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Online Stores

- Specialty Stores

- Others

Online stores exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, online stores, specialty stores, and others. According to the report, online stores accounted for the largest market share.

Online stores have become the largest distribution channel due to the increasing consumer preference for the convenience and variety offered by e-commerce platforms. According to the International Trade Administration, the growth of online retail has been driven by factors such as enhanced internet penetration, widespread use of smartphones, and improved digital payment systems. In 2023, online sales channels accounted for a significant share of the smart toys market, reflecting the shift towards digital shopping habits accelerated by the coronavirus (COVID-19) pandemic. This trend is expected to continue as more consumers turn to online platforms for their shopping needs.

Breakup by End User:

- Toddlers

- Pre-Schoolers

- School-going

- Stripling

Toddlers dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes toddlers, pre-schoolers, school-going, and stripling. According to the report, toddlers represented the largest segment.

As per the smart toys market forecast, toddlers have become the largest end user in the market due to their critical developmental stage and the demand for educational and interactive toys that support early learning. According to the Consumer Product Safety Commission (CPSC), toys designed for toddlers focus on safety, educational value, and the ability to engage children in developmental activities such as language learning, motor skills, and cognitive development. In 2023, the smart toys market saw a significant increase in products targeting toddlers, driven by the need for toys that foster growth in a safe and stimulating environment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest smart toys market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest regional market for smart toys.

North America holds the largest position in the smart toys market due to high consumer demand, technological advancements, and the significant market presence of key industry players. Additionally, the region's high disposable income levels enable consumers to spend more on advanced toys that offer enhanced learning experiences for children. The growing popularity of e-commerce further boosts sales, making North America a dominant market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the smart toys market. Detailed profiles of all major companies have also been provided. Some of the major market players in the smart toys industry include fischertechnik GmbH, Kreyonic Inc., LeapFrog Enterprises Inc. (VTech Holdings Limited), Mattel Inc., Pillar Learning, PlayShifu, Primo Toys, ROYBI Robot, The Lego Group, WowWee Group Limited, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- In the smart toys market research report, key players such as Fisher-Price (a subsidiary of Mattel Inc.) and LeapFrog Enterprises Inc. (owned by VTech Holdings Limited) are focusing on integrating advanced technologies such as AI and IoT into their products to enhance educational and interactive experiences for children. Companies like The Lego Group are leveraging their strong brand reputation to innovate with robotics and programmable toys. For instance, The LEGO Group announced a new partnership to replace fossil-based materials in plastic production. The newly formed partnership will enable the two companies to replace some fossil-based plastic with lower-carbon alternatives in the future. While startups like PlayShifu and Primo Toys are pioneering augmented reality and STEAM-focused educational toys. These players drive innovation by combining traditional toy concepts with cutting-edge technology, catering to evolving consumer preferences for engaging, educational, and safe play experiences.

Smart Toys Market News:

- In April 2023, Mattel Inc. announced an update to the Mattel Creations Virtual Collectibles Platform. As part of this update, the platform will introduce its own peer-to-peer marketplace, allowing owners of Mattel virtual collectibles to showcase, trade, and sell their assets.

- In February 2023, Mattel, Inc., in partnership with Velan Studios, announced the launch of Hot Wheels: Rift Rally, an exciting mixed-reality racing experience that will be available on the App Store for iOS, PlayStation 4, and PlayStation 5.

Smart Toys Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Robots, Interactive Games, Educational Toys |

| Technologies Covered | Wi-Fi, Bluetooth, Others |

| Interacting Devices Covered | Smartphone-Connected, Tablet-Connected, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Specialty Stores, Others |

| End Users Covered | Toddlers, Pre-Schoolers, School-Going, Stripling |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | fischertechnik GmbH, Kreyonic Inc., LeapFrog Enterprises Inc. (VTech Holdings Limited), Mattel Inc., Pillar Learning, PlayShifu, Primo Toys, ROYBI Robot, The Lego Group, WowWee Group Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart toys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart toys market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart toys industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global smart toys market to exhibit a CAGR of 13.52% during 2025-2033.

The rising parental concerns toward the development of motor skills, spatial reasoning, cognitive flexibility, etc., in their kids, along with the growing popularity of IoT-based smart toys, that integrate learning and entertainment, are primarily driving the global smart toys market.

The sudden outbreak of the COVID-19 pandemic had led to the increasing adoption of smart toys, such as educational robots for storytelling and play-to-learn interactive tablet toys for delivering superior gaming and learning experience, particularly during the temporary closure of numerous schools.

Based on the product, the global smart toys market can be segmented into robots, interactive games, and educational toys. Currently, interactive games hold the majority of the total market share.

Based on the technology, the global smart toys market has been divided into Wi-Fi, Bluetooth, and others, where Bluetooth currently exhibits a clear dominance in the market.

Based on the interfacing device, the global smart toys market can be categorized into smartphone connected, tablet-connected, and others. Currently, smartphone connected accounts for the majority of the global market share.

Based on the distribution channel, the global smart toys market has been segregated into supermarkets and hypermarkets, online stores, specialty stores, and others. Among these, online stores currently hold the largest market share.

Based on the end user, the global smart toys market can be bifurcated into toddlers, pre-schoolers, school-going, and stripling. Currently, toddlers exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global smart toys market include fischertechnik GmbH, Kreyonic Inc., LeapFrog Enterprises Inc. (VTech Holdings Limited), Mattel Inc., Pillar Learning, PlayShifu, Primo Toys, ROYBI Robot, The Lego Group, and WowWee Group Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)