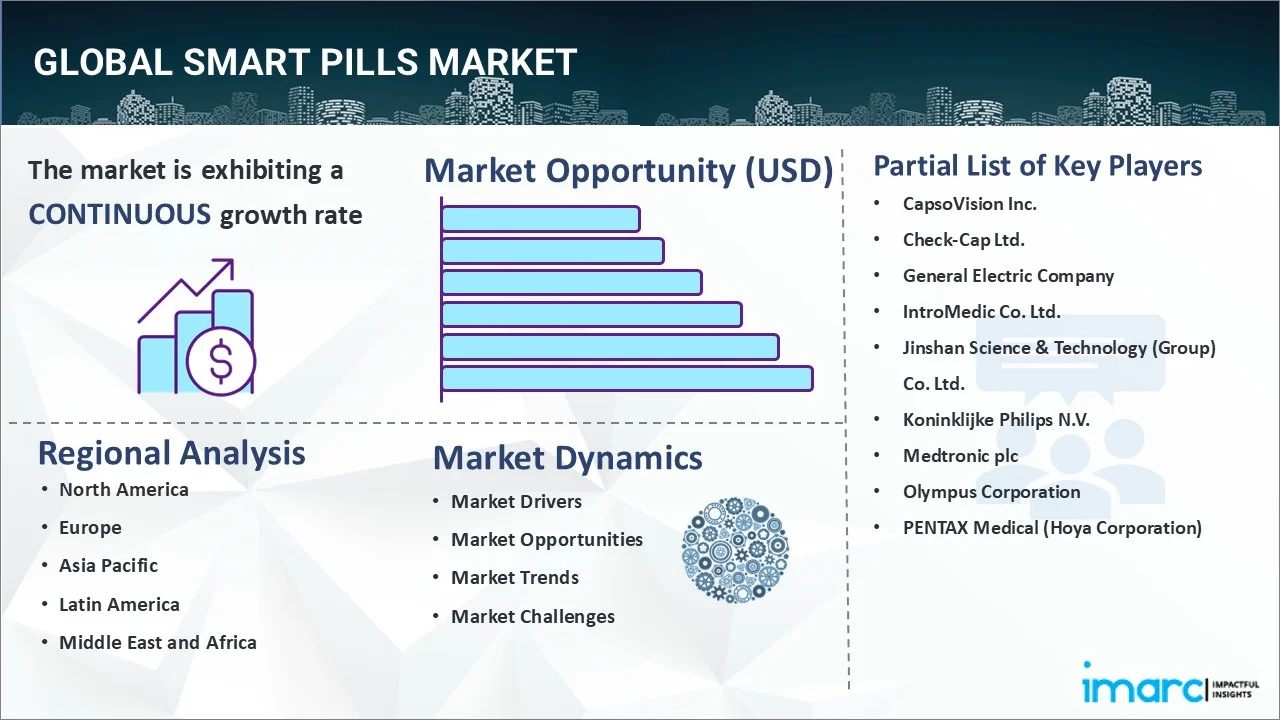

Smart Pills Market Report by Target Area (Esophagus, Small Intestine, Large Intestine, Stomach), Disease Indication (Esophageal Diseases, Small Bowel Diseases, Colon Diseases, and Others), Application (Capsule Endoscopy, Drug Delivery, Patient Monitoring), End User (Hospitals, Diagnostic Centers, Research Institutes), and Region 2025-2033

Market Overview:

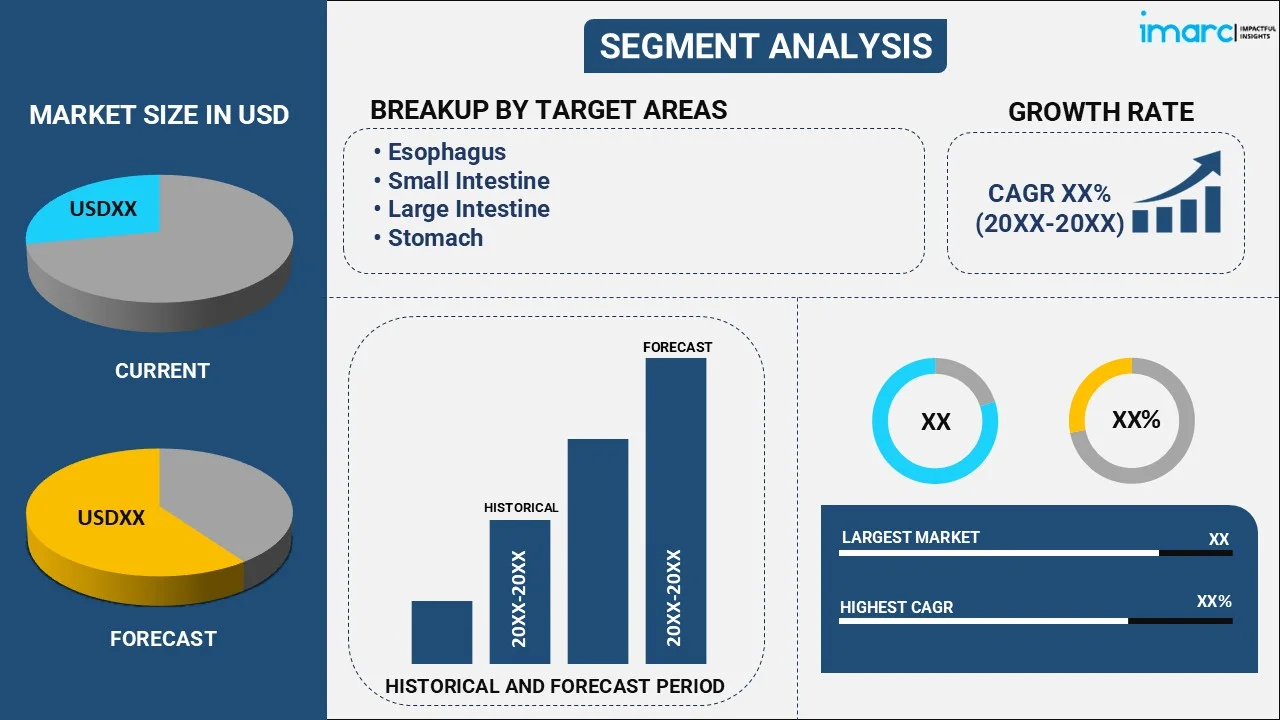

The global smart pills market size reached USD 4.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. The increased demand for chronic disease management among the geriatric population, rapid technological advancements, emerging trend of minimally invasive surgeries (MIS), the increasing focus of pharmaceutical industry on personalized medicine and drug delivery are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.9 Billion |

|

Market Forecast in 2033

|

USD 8.9 Billion |

| Market Growth Rate 2025-2033 | 6.55% |

Smart pills, also known as digital pills or ingestible sensors, are innovative pharmaceuticals equipped with tiny electronic components that enable remote monitoring and data collection. These pills typically contain sensors, microchips, and transmitters, which are ingested by patients. Once inside the body, they interact with bodily fluids, sending real-time data about a patient's health metrics, medication adherence, and physiological responses to external devices. Healthcare providers and researchers use this data to enhance patient care, optimize treatment plans, and improve drug development. Smart pills offer potential benefits in personalized medicine, chronic disease management, and clinical trials by enhancing monitoring and data acquisition capabilities.

The global smart pills market is experiencing substantial growth driven by the aging population across the globe has resulted in an increased prevalence of chronic diseases, requiring continuous monitoring and management of patient's health. Smart pills offer a non-invasive and efficient way to collect real-time health data, making them a valuable tool for remote patient monitoring and disease management. Moreover, advancements in miniaturized electronics and wireless communication technologies have made it more cost-effective to develop and produce smart pills, increasing their accessibility to healthcare providers and patients, which is creating a positive outlook for market expansion. In addition to this, the rising demand for personalized medicine and the need for precise drug delivery systems prompting pharmaceutical companies and researchers to invest in smart pill technology, are contributing to the market growth. Furthermore, the COVID-19 pandemic has fueled the adoption of telehealth and remote monitoring solutions, further boosting the market for smart pills.

Smart Pills Market Trends/Drivers:

Aging population and chronic disease management

One significant driver is the increasing geriatric population across the globe. As the average age of the population rises, so does the prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular diseases. Managing these conditions often requires continuous monitoring and medication adherence. Smart pills provide an innovative solution by offering non-invasive, real-time data collection on a patient's health metrics. This remote monitoring capability is particularly valuable for elderly patients who may have difficulty with conventional monitoring methods. Healthcare providers can use the data from smart pills to make timely interventions, adjust treatment plans, and ensure better disease management, improving the quality of care for aging populations.

Ongoing technological advancements

Advancements in miniaturized electronics, sensors, and wireless communication technologies have significantly contributed to the growth of the smart pills market. These technological strides have led to the development of smaller, more easily ingestible smart pills, enhancing patient comfort and compliance while reducing the potential for discomfort or resistance during ingestion. Moreover, the miniaturization of components has not only reduced manufacturing costs but also improved the overall efficiency and longevity of smart pills. As a result, healthcare providers and patients benefit from more accessible and cost-effective solutions, while the enhanced accuracy and reliability of the data collected by smart pills have garnered increased acceptance within the medical community, aiding in market expansion.

Growing demand for personalized medicine and novel drug delivery

The pharmaceutical industry's growing interest in personalized medicine and precise drug delivery systems is another driving factor. Smart pills offer a unique way to administer medications directly to the target site in the body. This targeted drug delivery can enhance the efficacy of treatments while minimizing side effects. Pharmaceutical companies are increasingly investing in smart pill technology as a means to improve drug development, ensuring that medications are tailored to individual patient needs. Apart from this, smart pills can be used in clinical trials to gather real-time data on the drug's effects, streamlining the research process and potentially speeding up the introduction of new therapies to the market.

Smart Pills Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on target area, disease indication, application and end user.

Breakup by Target Area:

- Esophagus

- Small Intestine

- Large Intestine

- Stomach

Small intestine dominate the market

The report has provided a detailed breakup and analysis of the market based on the target area. This includes esophagus, small intestine, large intestine, and stomach. According to the report, small intestine represented the largest segment.

The demand for smart pills targeting the small intestine is propelled by their unique ability to access and monitor this specific area of the digestive tract. The small intestine plays a crucial role in nutrient absorption, making it a focal point for various gastrointestinal disorders and drug delivery challenges. Smart pills designed to operate in this region offer precise insights into nutrient absorption efficiency, allowing for tailored dietary recommendations and treatments for conditions, such as malabsorption syndromes. Furthermore, their application extends to drug delivery optimization, ensuring medications reach the intended site of action, which is especially relevant for treatments that require absorption in the small intestine. As a result, the demand for smart pills tailored to the small intestine continues to rise, driven by their potential to address specific healthcare needs and enhance therapeutic outcomes.

Breakup by Disease Indication:

- Esophageal Diseases

- Small Bowel Diseases

- Colon Diseases

- Others

A detailed breakup and analysis of the market based on the disease indication have also been provided in the report. This includes esophageal diseases, small bowel diseases, colon diseases, and others.

The surging demand for smart pills in addressing esophageal, small bowel, and colon diseases owing to their capacity to provide precise, real-time data in these specific areas of the gastrointestinal tract is strengthening the market growth. Moreover, the growing prevalence of esophageal diseases such as gastroesophageal reflux disease (GERD), wherein smart pills help monitor pH levels and track acid reflux patterns, aiding in the diagnosis and management of these conditions. Apart from this, in small bowel diseases like Crohn's disease or celiac disease, these pills can help track the passage and transit time, enabling clinicians to assess motility and inflammation, while in colon diseases, particularly colorectal cancer screening, smart pills equipped with imaging capabilities can capture detailed images, enhancing early detection and reducing the need for invasive procedures. This targeted monitoring and diagnostic potential are propelling the demand for smart pills in the context of esophageal, small bowel, and colon diseases, improving patient care and outcomes.

Breakup by Application:

- Capsule Endoscopy

- Drug Delivery

- Patient Monitoring

Capsule endoscopy dominate the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes capsule endoscopy, drug delivery, and patient monitoring. According to the report, capsule endoscopy represented the largest segment.

Unlike traditional endoscopy, smart pills equipped with imaging technology provide a painless and patient-friendly alternative for visualizing the gastrointestinal tract. This has led to increased acceptance and patient compliance, especially in cases where traditional endoscopy may be uncomfortable or challenging. Additionally, capsule endoscopy using smart pills is particularly valuable for diagnosing and monitoring conditions such as obscure gastrointestinal bleeding, Crohn's disease, and small bowel tumors. The high-quality images and real-time data captured by these smart pills allow for early detection and precise localization of abnormalities, thereby facilitating timely interventions and improving patient outcomes. Consequently, the demand for smart pills in capsule endoscopy continues to grow, enhancing the diagnostic capabilities of healthcare professionals and patient experiences.

Breakup by End User:

- Hospitals

- Diagnostic Centers

- Research Institutes

Diagnostic centers hold the largest share in the market

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes hospitals, diagnostic centers, and research institutes. According to the report, diagnostic centers accounted for the largest market share.

The rising demand for smart pills in diagnostic centers is bolstering market expansion by offering a patient-friendly, non-invasive approach to enhance diagnostic procedures. These devices provide real-time gastrointestinal data, aiding precise diagnoses, especially for conditions like gastrointestinal bleeding, motility disorders, and small bowel diseases. Smart pills' imaging capabilities, pH assessment, and transit monitoring provide clinicians with a comprehensive view of GI health, reducing the need for uncomfortable invasive procedures. This improves patient comfort, compliance, and diagnostic accuracy, benefiting both patients and healthcare providers, and contributing to the growing adoption of smart pills in diagnostic centers.

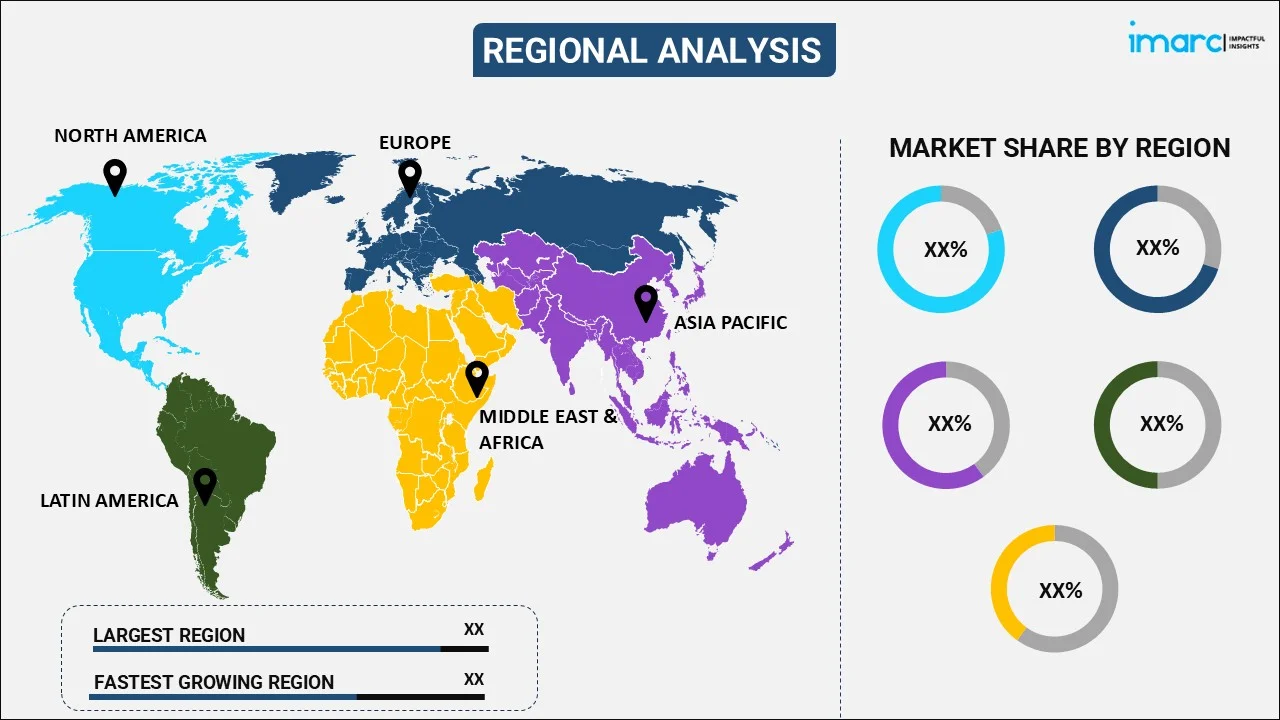

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest smart pills market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America's robust healthcare infrastructure, including advanced diagnostic centers and research institutions, is facilitating the adoption of smart pills for innovative diagnostic and research purposes. Concurrently, the increasing prevalence of gastrointestinal disorders, such as inflammatory bowel disease and colorectal cancer, has created a high demand for non-invasive diagnostic tools like smart pills, which offer improved patient comfort and compliance. Moreover, the region's aging population, with a growing need for chronic disease management, sees smart pills as an invaluable solution for remote patient monitoring. Besides this, favorable reimbursement policies and regulatory frameworks in North America are encouraging healthcare providers and pharmaceutical companies to invest in smart pill technology. Apart from this, the region's technological innovation and early market entry by leading companies have established a strong foundation for the growth of the North America smart pills market.

Competitive Landscape:

The global smart pills market presents a competitive landscape characterized by a mix of established players and emerging entrants striving to capitalize on the growing demand for remote patient monitoring and innovative healthcare solutions. Leading companies hold substantial market shares, primarily due to their early market entry, robust R&D capabilities, and extensive distribution networks. They offer a diverse range of smart pill products, incorporating advanced sensor technologies and data analytics platforms. Moreover, partnerships and collaborations with healthcare providers and pharmaceutical companies have further solidified their market position. At the same time, numerous startups and smaller companies, are actively contributing to market growth with disruptive technologies and novel applications of smart pills, intensifying competition and driving innovation in the industry.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- CapsoVision Inc

- Check-Cap Ltd.

- General Electric Company

- IntroMedic Co. Ltd.

- Jinshan Science & Technology (Group) Co. Ltd.

- Koninklijke Philips N.V.

- Medtronic plc

- Olympus Corporation

- PENTAX Medical (Hoya Corporation).

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- In 2020, CapsoVision Inc. (US) attained ISO 27001 security certification for both its headquarters and CapsoCloud software, reaffirming its unwavering dedication to safeguarding customer data.

Smart Pills Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Target Areas Covered | Esophagus, Small Intestine, Large Intestine, Stomach |

| Disease Indications Covered | Esophageal Diseases, Small Bowel Diseases, Colon Diseases, Others |

| Applications Covered | Capsule Endoscopy, Drug Delivery, Patient Monitoring |

| End Users Covered | Hospitals, Diagnostic Centers, Research Institutes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CapsoVision Inc., Check-Cap Ltd., General Electric Company, IntroMedic Co. Ltd., Jinshan Science & Technology (Group) Co. Ltd., Koninklijke Philips N.V., Medtronic plc, Olympus Corporation, PENTAX Medical (Hoya Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global smart pills market performed so far, and how will it perform in the coming years ?

- What are the drivers, restraints, and opportunities in the global smart pills market ?

- What is the impact of each driver, restraint, and opportunity on the global smart pills market ?

- What are the key regional markets ?

- Which countries represent the most attractive smart pills market ?

- What is the breakup of the market based on the target area ?

- Which is the most attractive target area in the smart pills market ?

- What is the breakup of the market based on the disease indication ?

- Which is the most attractive disease indication in the smart pills market ?

- What is the breakup of the market based on the application ?

- Which is the most attractive application in the smart pills market ?

- What is the breakup of the market based on the end user ?

- Which is the most attractive end user in the smart pills market ?

- What is the competitive structure of the global smart pills market ?

- Who are the key players/companies in the global smart pills market ?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart pills market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart pills market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart pills industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)