Smart Oven Market Size, Share, Trends and Forecast by Type, Distribution Channel, Capacity, Structure, Connectivity, Application, and Region, 2025-2033

Smart Oven Market Size and Share:

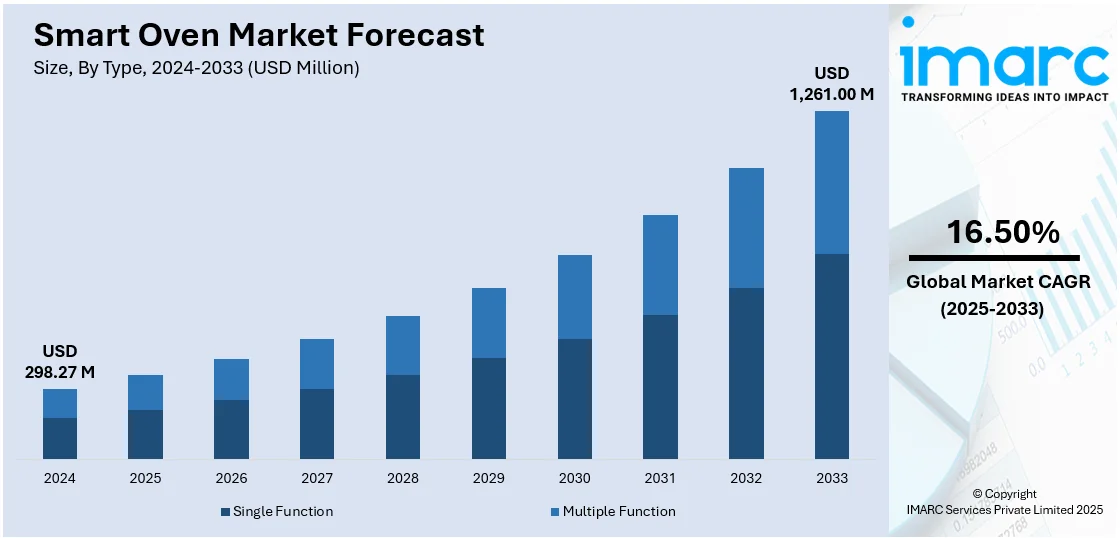

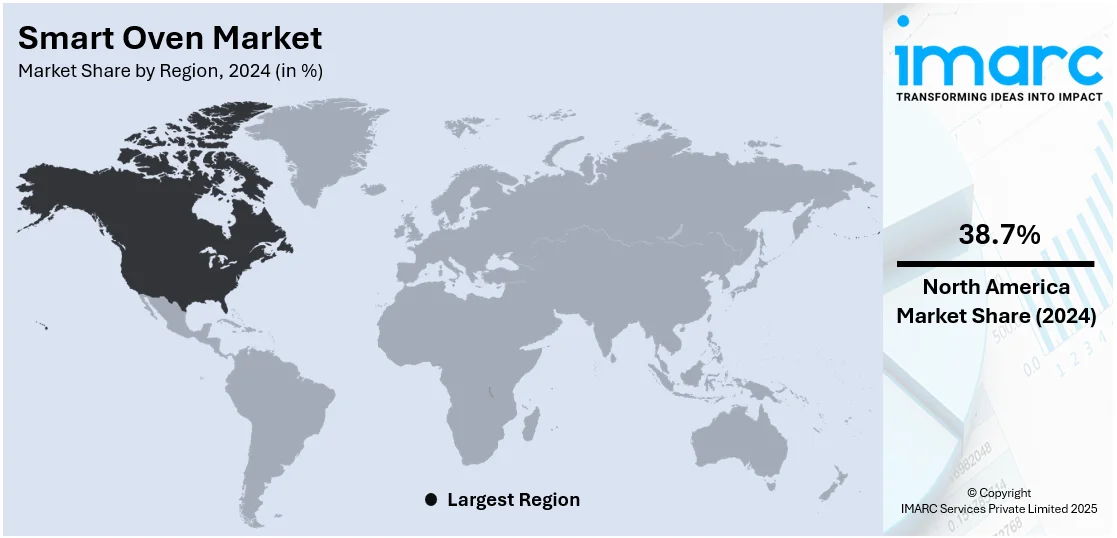

The global smart oven market size was valued at USD 298.27 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,261.00 Million by 2033, exhibiting a CAGR of 16.50% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.7% in 2024. The North America smart oven market share is fueled by high consumer adoption of technology, desire for convenience, compatibility with smart home systems, and emphasis on energy-efficient, healthy cooking. Strong distribution channels and innovation from top appliance manufacturers also support long-term market growth in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 298.27 Million |

| Market Forecast in 2033 | USD 1,261.00 Million |

| Market Growth Rate (2025-2033) | 16.50% |

The smart oven industry is being propelled by the growing need of consumers for convenience, automation, and healthy cooking options. As lives become increasingly hectic, consumers are looking for appliances that ease the meal-making process with precision and time saving. Smart ovens with Wi-Fi connectivity, app operation, and voice assistant compatibility address this requirement by enabling consumers to remotely monitor and control cooking. In addition to the wide appeal of meal solutions among consumers, the increasing popularity of multifunctional appliances, including ovens that can bake, air fry, and grill, strengthens market appeal, particularly for urban dwellers with cramped kitchens. Increased awareness regarding energy efficiency and sustainability also promotes the use of smart ovens, which are frequently equipped with features such as energy-saving modes and intelligent temperature control. Furthermore, growing smart home ecosystems and technology advances in AI-based personalization are enhancing smart ovens' interactivity and ease of use. These factors combined are fueling innovation and adoption in residential and commercial segments of the global smart oven market.

The United States stands out as a key market disruptor of the smart oven market share, driven by its early embracement of cutting-edge technologies, strong consumer demand for convenience, and competitive market environment that encourages innovation. Consumers in America value smart connectivity, energy efficiency, and multifunctionality in kitchen appliances, which leads manufacturers to incorporate features such as Wi-Fi connectivity, AI-based cooking presets, and voice assistant compatibility. Firms like Tovala and Brava are at the forefront of this change with cloud-connected ovens featuring automated cooking cycles and customized meal choices, meeting the increasing trend of health-aware and time-constrained households. Apart from this, partnerships with meal kit providers and IoT-based platforms are making user experiences more robust and market growth stronger. The emphasis in the US market on innovation, together with a well-established retail structure and consumer desire to integrate with smart homes, make it a global trend driver within the smart oven market.

Smart Oven Market Trends:

Smart Home Ecosystem Integration

Another prominent trend in the smart oven industry is the integration of these appliances into larger smart home ecosystems seamlessly. Smart ovens today are more compatible with voice assistants such as Amazon Alexa, Google Assistant, and Apple HomeKit, and users can manage cooking features through easy voice commands. This integration provides greater user convenience, permitting features such as preheating, temperature setting, and timer setting without having to physically interact with them. With the advent of the Internet of Things (IoT) and rising penetration of intelligent home assistants, smart ovens can be controlled through mobile applications, which send real-time status updates to users. For instance, according to the IMARC Group, the global internet of things (IoT) market size reached USD 1,022.6 Billion in 2024 and is further expected to reach USD 3,486.8 Billion by 2033, exhibiting a growth rate (CAGR) of 14.6% during 2025-2033. This represents one of the most crucial factors bolstering the growth of the market across the globe. Additionally, smart ovens are also being integrated with other smart kitchen devices and home automation systems. With this integration, coordinated functions, like synchronizing the oven with smart refrigerators to recommend recipes based on contents or with smart dishwashers to initiate cleaning after cooking, are made possible. This connected method makes kitchen tasks easier and also helps in creating a more efficient and customized cooking experiences. As consumers embrace smart home devices, the market for smart ovens that have seamless connectivity with other devices will expand.

Emphasis on Energy Efficiency and Sustainability

According to the International Energy Agency, during the COP28 summit in late 2023, nearly 200 nations achieved a significant agreement to collaboratively double the global average yearly rate of advancements in energy efficiency by 2030. Global advancements in energy efficiency – indicated by the change in primary energy intensity – are expected to experience only a slight enhancement of roughly 1% in 2024. This rate matches that of 2023 and is approximately half of the average rate for the period from 2010 to 2019. Hence, energy efficiency and sustainability are emerging as key considerations in the creation of smart ovens. As energy prices rise and people become increasingly environmentally conscious, consumers are looking for appliances that use less energy without sacrificing performance. Smart ovens are being engineered with adaptive cooking technology, automatic turn-off features, and energy monitoring to minimize power consumption. Smart oven market companies are also putting emphasis on implementing environmentally friendly materials in the manufacture of smart ovens, another draw for environmentally aware consumers. These technologies minimize the carbon footprint associated with cooking and also fit within the larger cultural movement toward living sustainably. With the growing demand for energy-efficient appliances, smart ovens that combine performance and sustainability are bound to gain a market advantage.

Emergence of AI and Personalization

Artificial intelligence (AI) is increasingly becoming the key to elevating the functionality of smart ovens. AI algorithms allow ovens to learn the user's preferences, recommend recipes according to ingredients on hand, and modify cooking parameters like temperature and time for best results. This degree of personalization not only makes cooking easier but also provides consistent and accurate results. Additionally, AI-powered smart ovens can track cooking in real-time, giving users updates and notifications through connected apps. These devices can suggest the temperature, cooking setting, and duration. These ovens utilize computer vision to identify food and detect burning. It can identify various dishes and ingredients to recommend cooking settings. A prime example is Bosch's series 8 oven, which links to an AI cloud server, allowing homeowners to gather settings from comparable ovens. Users can choose the suitable cooking setting and wait for the oven to estimate when the meal is finished. This integration of AI turns cooking from a mundane task to a more interactive and enjoyable experience. With advancements in technology, the function of AI in smart ovens is likely to increase, providing even more customized and efficient cooking options, and positively influencing the smart oven market outlook for the future.

Smart Oven Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart oven market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, capacity, structure, connectivity, and application.

Analysis by Type:

- Single Function

- Multiple Function

Multiple function stands as the largest component in 2024, holding around 65.8% of the market. Multi-function smart ovens have become the top category in the smart oven market as they are versatile, convenient, and appealing to contemporary cooking demands. Smart ovens integrate various cooking modes—baking, grilling, air frying, steaming, and convection—into one appliance, minimizing the use of multiple kitchen appliances. Buyers are increasingly attracted to time-saving, space-saving, and effort-saving appliances that provide a variety of cooking options. The convenience of changing functions easily using digital controls or smartphone apps makes them more desirable, particularly for busy families and tech-friendly consumers. These ovens are made to deliver consistent cooking outcomes while providing customization options such as pre-programmed recipes, temperature control, and timer automation. Their multi-functionality corresponds to the smart, space-saving, and efficient appliance needs of today's consumer. This flexibility renders multiple function smart ovens the most desired category in the expanding smart kitchen market.

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 62.6% of market share in 2024. Offline channels continue to be the dominant distribution segment in the smart oven market because of the experiential and tangible nature of appliance buying. Customers tend to like going to physical stores, electronics shops, or dedicated home appliance showrooms where they can physically examine the product, evaluate its build quality, and learn about its features. The facility to get hands-on demonstrations, see several models side-by-side, and get advice from experienced salespeople gives a degree of confidence which online sites cannot equally provide. Moreover, most customers retain the trust and comfort of brick-and-mortar shopping, particularly when buying high-priced products like smart ovens. Offline stores also often provide bundled packages, post-sales support, and installation assistance, making the overall buying experience better. Even with the increasing popularity of e-commerce, the touch-and-service aspects of offline channels continue to maintain their popularity, especially in markets where in-store interaction and personal consultation continue to dominate.

Analysis by Capacity:

- 20-25 Liters

- 26-30 Liters

- Above 30 Liters

26-30 liters leads the market with around 46.7% of market share in 2024. The 26–30 liters capacity category dominates the market for smart ovens, as it provides the optimal size, functionality, and versatility, which makes it appropriate for most consumers. The capacity, which addresses small and medium family needs, provides sufficient capacity to prepare or roast food for multiple individuals without taking up too much kitchen area. It offers various cooking options like baking, grilling, and air frying, and users can try out different recipes while being energy efficient. Consumers prefer the convenience of this size since it easily accommodates the majority of contemporary kitchens and does not need to be installed in a special way. Additionally, smart ovens in this category tend to feature advanced technologies like touch screens, smartphone app compatibility, and voice assistant compatibility. Their compact but efficient capacity design resonates with city dwellers and those looking for a multifunctional, technologically advanced cooking solution that meets modern kitchen design and lifestyle needs, hence making it popular.

Analysis by Structure:

- Built-in

- Countertop

Countertop stands as the largest component in 2024, holding around 68.9% of the market. Countertop smart ovens lead the structure segmentation of the smart oven market owing to their convenience, space savings, and flexibility. Easy to install on kitchen countertops, these models especially attract urban residents, small families, and renters who usually have compact or restricted room in the kitchen. Its plug-and-play feature further eliminates the inconvenience of installation, making them a perfect fit for users who prefer portability and simplicity of use. Countertop smart ovens provide numerous innovative features like app control, pre-programmed cooking modes, and voice assistant compatibility, all packed into a minimal footprint. They enable various functionalities like baking, roasting, air frying, and reheating, addressing the multifaceted cooking needs of contemporary consumers. Additionally, the relative affordability of countertop compared to built-in units contributes to their universal application. As the demand for smart, flexible, and space-efficient kitchen appliances increases among consumers, the countertop form remains at the forefront of the market, particularly among space-conscious and tech-savvy consumers.

Analysis by Connectivity:

- Bluetooth

- Wi-Fi

- NFC

- Others

Wi-Fi leads the market with around 58.7% of market share in 2024. Wi-Fi connectivity is the dominant segment in the smart oven segment as it can offer smooth remote control, increased functionality, and compatibility with larger smart home platforms. Wi-Fi-enabled smart ovens enable consumers to track and manage the cooking process via specialized mobile applications, providing real-time alerts, recipe recommendations, and personalization capabilities. This connectivity revolutionizes the cooking process by introducing convenience and flexibility, allowing users to preheat ovens, change settings, or switch them off remotely perfect for hectic lifestyles. Wi-Fi-connected smart ovens also enable voice assistant integration with platforms such as Amazon Alexa and Google Assistant, further improving hands-free use. Moreover, manufacturers are constantly improving Wi-Fi features to include automatic software updates, diagnostic capabilities, and cloud-based recipe libraries. This extent of smart connectivity enhances the user experience and also enhances product longevity and flexibility, giving consumers a reason to prefer Wi-Fi as the go-to option for fast, connected, and forward-thinking kitchen appliances.

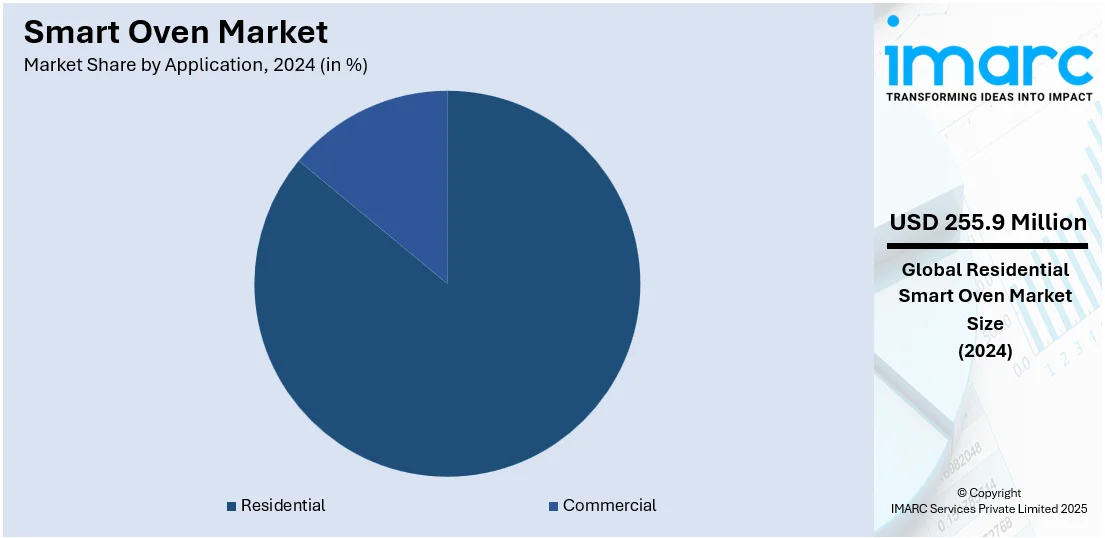

Analysis by Application:

- Residential

- Commercial

Residential leads the market with around 85.8% of market share in 2024. The residential segment is the dominant player as per the smart oven market analysis, where homeowners are increasingly opting for convenient, efficient, and connected cooking solutions. Smart ovens are being adopted by contemporary homes to make meal preparation easier, save time, and enhance cooking results with capabilities such as app control, voice control, and pre-set cooking modes. These appliances have broad appeal, from working professionals to health-oriented families, with multiple cooking functions like baking, air frying, and roasting in a single compact appliance. The increasing trend of smart home integration also fuels residential demand, with smart ovens becoming integral parts of smart kitchens. Moreover, increasing awareness regarding energy efficiency and healthy eating habits also fuels the transition toward sophisticated appliances that provide precision cooking. The availability of countertop models and mid-capacity sizes also renders smart ovens a convenient option for apartments and small houses. With technology becoming increasingly user-friendly and cost-effective, residential use is likely to continue its market leadership.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.7%. North America is at the forefront according to the smart oven market overview, as a result of its early technology adoption of smart home devices, strong consumer purchasing power, and highly developed infrastructure for connected devices. Consumers in North America are looking for advanced kitchen solutions that match their fast-paced lifestyles and convenience preference, thus fueling demand for smart ovens with features such as Wi-Fi connectivity, voice control, and mobile app integration. The established presence of luxury appliance players and technology giants in North America supports swift innovation and product penetration. Furthermore, the increased tendency toward energy conservation and health-based cooking has gone a long way in driving demand for multifunctional smart ovens among households in the United States and Canada. Retailers and manufacturers are also supported by strong e-commerce platforms and offline distribution channels to ensure universal access. The region’s penchant for upgrading living spaces and the inclusion of intelligent appliances keeps North America ahead of the worldwide smart oven industry's development and expansion.

Key Regional Takeways:

United States Smart Oven Market Analysis

In 2024, the United States accounted for 87.80% of the smart oven market in North America. The United States is witnessing increased interest in smart ovens as a result of growing adoption of smart kitchen appliances across households and modern foodservice environments. According to reports, 65% of Americans have at least one smart device in their homes. Consumers are embracing smart kitchen appliance integration due to enhanced convenience, energy efficiency, and multifunctional capabilities. Advanced connectivity features, such as Wi-Fi-enabled controls and voice command compatibility, are aligning with smart kitchen appliance trends, driving widespread smart oven installation. Rising consumer awareness, coupled with the preference for connected appliances, supports demand for multifunctional smart ovens. In addition, the expansion of home automation systems is reinforcing the preference for smart kitchen appliances, supporting long-term adoption patterns. This demand shift is further amplified by evolving consumer lifestyles focused on ease, efficiency, and customization. The United States continues to set the pace in modernizing kitchen technology with smart oven solutions.

Asia Pacific Smart Oven Market Analysis

Asia-Pacific smart oven adoption is accelerating due to rising e-commerce activities, which enable easier access to a wide variety of smart kitchen products. Digital marketplaces are playing a critical role in increasing consumer exposure to smart ovens, offering competitive pricing, product variety, and doorstep delivery options. The influence of e-commerce is also shaping consumer behavior, making it convenient to compare, review, and purchase advanced cooking technologies. As more households turn to online channels for kitchen upgrades, smart ovens become a prominent choice for tech-savvy consumers. Promotions, seasonal discounts, and bundled deals further boost smart oven interest through online platforms. The digital transformation of shopping behaviors supports steady growth in smart oven demand across the Asia-Pacific region, where connectivity and efficiency are the prime smart oven market growth drivers.

Europe Smart Oven Market Analysis

Europe is experiencing robust smart oven market expansion fueled by the growing food processing sector, which increasingly emphasizes precision and efficiency in cooking technologies. The European Commission states that the food and beverage sector is the largest manufacturing industry in the EU regarding employment and value added. Over the past decade, EU exports of food and beverages have increased twofold, surpassing €182 billion and yielding a favorable balance of nearly €30 billion. As foodservice establishments and commercial kitchens evolve, the demand for smart ovens rises due to their ability to streamline preparation processes. The growing food processing sector values smart oven features such as temperature automation, programmable cooking modes, and energy optimization. These capabilities align with modern industrial culinary requirements, reinforcing the relevance of smart ovens. Enhanced productivity, consistent food quality, and reduced human error are key benefits attracting food processors to integrate smart ovens. As sustainability and operational cost-efficiency gain importance in the growing food processing sector, smart ovens become a strategic investment. Europe’s innovation-driven food industry is playing a pivotal role in supporting smart oven growth.

Latin America Smart Oven Market Analysis

According to the IMARC Group, the Latin America consumer electronics market size reached USD 78.44 Billion in 2024, and is further expected to reach USD 145.43 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. Hence, Latin America is witnessing an increased adoption of devices like smart ovens driven by growing disposable income, which allows more consumers to invest in high-tech kitchen solutions. Rising purchasing power encourages households to adopt appliances that deliver both functionality and convenience. As growing disposable income reshapes spending patterns, smart ovens are increasingly viewed as attainable lifestyle enhancements. Enhanced awareness and aspiration toward modern living also contribute to the positive trend.

Middle East and Africa Smart Oven Market Analysis

The Middle East and Africa are experiencing a steady increase in smart oven demand due to growing supermarkets and hypermarkets that promote high-end kitchen appliance accessibility. As per industry reports, retailers in the Gulf Cooperation Council (GCC) area have gained from a positive macroeconomic climate. Grocery, clothing, electronics, and various retail sectors have realized profits and returns that exceed the worldwide industry average. Saudi Arabia recorded the highest consumer expenditure in the area, exceeding 16 billion U.S. dollars. The area represented approximately 1.3% of the top 250 retailers globally. Hence, with expanding retail chains, consumers have more exposure to innovative cooking technologies. The growing supermarkets and hypermarkets sector facilitates in-person product demonstrations and attractive financing, supporting smart oven uptake.

Competitive Landscape:

Several major companies in the smart oven industry are aggressively pushing innovation and adoption through a range of strategic initiatives designed to improve functionality, convenience, and integration into smart home ecosystems. Top brands are spending a lot on research and development to launch ovens with cutting-edge features like AI-driven cooking presets, voice assistant support, and real-time monitoring through smartphone apps. These innovations are aimed at addressing the increasing consumer need for smart appliances that make cooking easier while providing precision and consistency. Firms are also partnering with technology companies and software developers to improve connectivity and user experience. Additionally, there is an attempt to create energy-efficient models that fit sustainability objectives, targeting environmentally conscious consumers. Marketing efforts concentrate on informing users regarding the advantages of smart ovens, typically taking advantage of web-based channels and social media. Furthermore, leaders are broadening their product portfolios to meet the needs of varied consumer segments, such as budget buyers and premium users. A few firms also provide periodic software updates, allowing for long-term product pertinence and enhanced functionality in the future. While these collective efforts assist in distinguishing brands in a competitive marketplace, they also go a long way in the overall development and growth of the smart oven market globally.

The report provides a comprehensive analysis of the competitive landscape in the smart oven market with detailed profiles of all major companies, including:

- Breville Group Limited

- Bsh Home Appliances Corporation (Robert Bosch GmbH)

- Electrolux AB

- Haier Group

- LG Electronics Inc.

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- Sharp Corporation

- Sub-Zero Group Inc.

- Whirlpool Corporation

Latest News and Developments:

- March 2025: Panasonic introduced the HomeCHEF Connect 4-in-1 Multi-Oven, a countertop appliance combining Microwave, Air Fry, Convection Bake, and Broil functions. This oven connects with the Panasonic Kitchen+ app through Fresco Integration, enabling guided cooking with personalized recipes.

- September 2024: Midea launched its One Oven Series at IFA 2024, unveiling two multifunctional built-in oven models—the 7NT30E4 and TR850E-TV0E00. These ovens integrate microwave, steam, bake, and air fry functions into a single unit, elevating kitchen efficiency and design.

- August 2024: Bühler India unveiled its SmartLine solutions to support the rising demand in the biscuit and cracker market. Central to this launch was the DirectBake Smart, a Direct Gas Fired oven designed for versatile baking performance. The oven caters to a wide variety of product needs, ensuring efficiency and consistency in production.

- July 2024: Samsung launched a new range of smart microwave ovens in the UK, featuring its largest capacity oven yet. The lineup includes models that combine baking, roasting, steaming, grilling, air frying, and fermenting in one oven. Highlighted models include the Combi Smart Microwave Oven with Air Fry offer voice control, Wi-Fi connectivity, and SmartThings app integration for personalized cooking.

- January 2024: Panasonic expanded its partnership with Fresco to integrate smart kitchen technology into its HomeCHEF 4-in-1 multi-oven. The oven now features Fresco’s AI-powered cooking assistant, enabling users to customize recipes, substitute ingredients, and adjust settings with ease.

Smart Oven Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Function, Multiple Function |

| Distribution Channels Covered | Online, Offline |

| Capacities Covered | 20-25 Liters, 26-30 Liters, Above 30 Liters |

| Structures Covered | Built-in, Countertop |

| Connectivities Covered | Bluetooth, Wi-Fi, NFC, and Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Breville Group Limited, Bsh Home Appliances Corporation (Robert Bosch GmbH), Electrolux AB, Haier Group, LG Electronics Inc., Panasonic Corporation, Samsung Electronics Co. Ltd., Sharp Corporation, Sub-Zero Group Inc., Whirlpool Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart oven market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart oven market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart oven industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart oven market was valued at USD 298.27 Million in 2024.

The smart oven market is projected to exhibit a CAGR of 16.50% during 2025-2033, reaching a value of USD 1,261.00 Million by 2033.

The smart oven industry is fueled by increasing demand for kitchen convenience, energy efficiency, and automation. App control, voice integration, and preset cooking modes are features that attract technologically proficient, health-focused consumers looking for convenience and improved cooking accuracy in smart connected home applications.

North America currently dominates the smart oven market, driven by high tech adoption, demand for convenience, integration with smart homes, and growing interest in energy-efficient, multifunctional, and health-focused kitchen appliances.

Some of the major players in the smart oven market include Breville Group Limited, Bsh Home Appliances Corporation (Robert Bosch GmbH), Electrolux AB, Haier Group, LG Electronics Inc., Panasonic Corporation, Samsung Electronics Co. Ltd., Sharp Corporation, Sub-Zero Group Inc. and Whirlpool Corporation etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)