Smart Office Market Size, Share, Trends and Forecast by Component, Office Type, Technology, and Region, 2025-2033

Smart Office Market Size and Share:

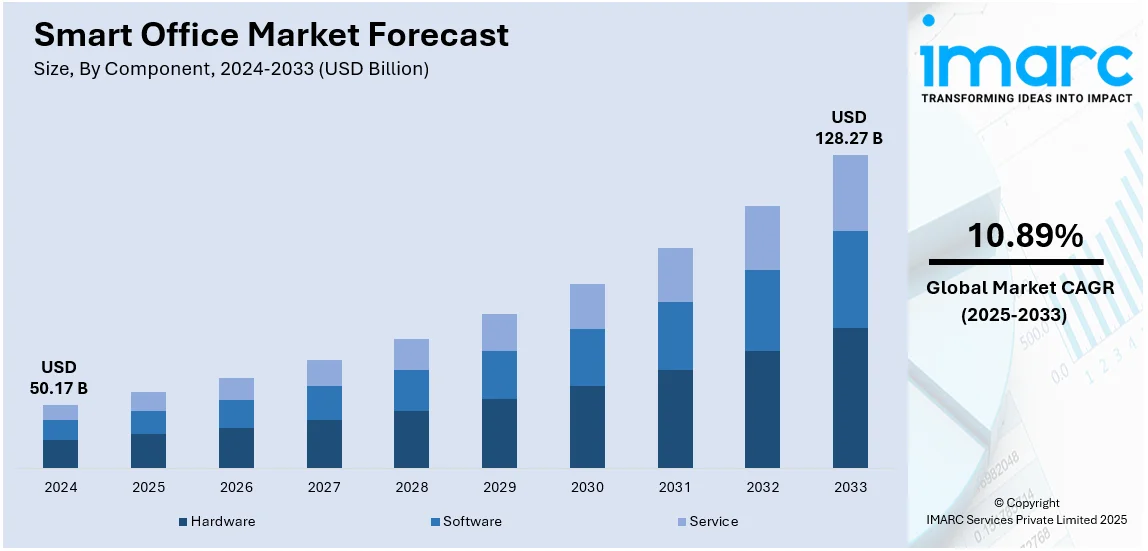

The global smart office market size was valued at USD 50.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 128.27 Billion by 2033, exhibiting a CAGR of 10.89% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.8% in 2024. The speedy technological developments, new remote work patterns, growing energy efficiency issues, expanding focus on employee health, rising technology implementation to deliver competitive advantage, and growing demand for space-efficient and adaptable office solutions, are some of the major drivers boosting the smart office market share. Currently, North America dominates the smart office market share due to the early adoption of sophisticated technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 50.17 Billion |

|

Market Forecast in 2033

|

USD 128.27 Billion |

| Market Growth Rate 2025-2033 | 10.89% |

Smart office is driven by an increasing requirement of automation and effectiveness in the business environment. Due to corporations being interested in driving productivity while decreasing operational costs, the deployment of smart office solutions, such as IoT-driven gadgets, auto-operating light installations, and thermostat systems, is increasing rapidly. These tools ensure maximum consumption of energy, automatize business spaces, and enable better office use. The growing uptake of hybrid work patterns, particularly after the COVID-19 pandemic, has further propelled the demand for smart office solutions to facilitate flexible spaces, virtual collaboration platforms, and remote monitoring. The growing emphasis on sustainability is also compelling businesses to invest in energy-efficient smart devices with a lower carbon footprint. Government policies and programs promoting energy saving and sustainable processes also drive the market's growth. Overall, the smart office market is expanding due to businesses' focus on productivity, cost reduction, and sustainability.

To get more information on this market, Request Sample

The United States is a dominant market disruptor, fueled by its quick technological developments, early embracement of innovation, and large-scale corporate investments. As a technological leader of the world, the US has been pioneering the adoption of smart office solutions like IoT devices, artificial intelligence (AI), cloud-based collaboration platforms, and energy-efficient systems in offices. The increasing trend of remote and hybrid work models, fueled by the COVID-19 pandemic, has also created demand for flexible, connected office spaces. Large US companies are embracing smart office technologies to increase employee productivity, streamline operational efficiency, and maximize energy utilization. In addition, the sustainability and green building agenda of the US government has fueled the demand for energy-efficient smart office solutions. The synergistic effect of technological advancements, corporate needs, and regulatory impetus makes the United States a key disruptor in determining the future of the smart office market outlook.

Smart Office Market Trends:

Integration of Artificial Intelligence and Workplace Automation

Artificial intelligence has emerged as a transformative force reshaping smart office environments in 2025, fundamentally altering how organizations manage operations and enhance employee experiences. Smart offices are increasingly deploying AI-powered systems for intelligent climate control, automated lighting adjustments, and space utilization optimization. Furthermore, human resources departments have experienced one of the most dramatic adoption surges, with AI implementation jumping from 19% in June 2023 to an impressive 61% by January 2025, demonstrating the technology's ability to address persistent operational bottlenecks throughout employee lifecycles. Organizations implementing AI report measurable improvements across core business functions, including enhanced decision-making, streamlined workflows, and significant time savings—with studies showing that 91% of businesses use AI to cut administrative time by 3.5+ hours weekly.

Focus on Employee Wellness and Biophilic Design

Employee wellness has evolved from a peripheral concern to a central pillar of smart office design strategy in 2025, with biophilic design principles delivering measurable returns on investment and transforming workplace environments. Research consistently demonstrates that offices incorporating biophilic elements—including natural light, indoor plants, living walls, and organic materials—experience up to 15% higher productivity, 35% fewer employee absences, and 15% improvements in overall wellbeing. These nature-inspired workspaces address the fundamental human need for connection with the natural environment, creating calming atmospheres that reduce stress levels by lowering cortisol production and improving concentration spans. Organizations are strategically implementing wellness rooms, meditation spaces, and outdoor access areas alongside biophilic features to support mental health and physical comfort. The British Safety Council reports that incorporating indoor planting schemes helps purify air, reduce indoor pollutants, and maintain optimal humidity levels, while research shows that employees in biophilic offices report feeling healthier, more comfortable, and more satisfied compared to traditional sterile environments. Water features such as fountains introduce soothing sounds that reduce workplace anxiety, while maximizing natural daylight through skylights and floor-to-ceiling windows boosts mood and energy efficiency. A field experiment demonstrated that when greenery and daylight were added to office spaces, there were notable increases in perceived productivity, faster task completion, and even boosts in creativity among employees. Companies implementing these wellness-centric designs are experiencing tangible business benefits including lower healthcare costs, improved employee retention rates, and enhanced ability to attract top talent in competitive markets.

Adoption of Energy Management Systems and Sustainability

Energy management systems have become critical components of smart office infrastructure as organizations confront mounting pressure to reduce carbon footprints and operational costs while meeting increasingly stringent environmental regulations. Buildings in the United States currently consume approximately three-quarters of the country's electricity and contribute to 39% of all greenhouse gas emissions, creating urgent demand for intelligent energy optimization solutions. Modern EMS platforms integrate sophisticated sensors and meters to track real-time consumption of electricity, water, gas, and other utilities across entire office campuses, enabling organizations to maximize energy usage, capitalize on dynamic pricing tariffs, and restrict demand during peak periods. The global energy management system market demonstrates the scale of this transformation—valued at USD 54.3 Billion in 2023 and projected to reach USD 146.6 Billion by 2032, growing at a CAGR of 11.4% according to IMARC Group research.

Smart Office Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart office market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, office type, and technology.

Analysis by Component:

- Hardware

- Security System and Controls

- Smart Lighting and Controls

- Energy Management Systems

- HVAC Control Systems

- Audio-Video Conferencing Systems

- Software

- Service

Software stands as the largest component in 2024, holding around 52.0% of the market. Software is leading the market as it acts as the foundation that links and integrates different devices, allowing them to exchange data instantly. This interconnectedness improves the general effectiveness and performance of the smart office environment. Additionally, it is essential for gathering, interpreting, and converting the data produced by IoT sensors and devices into practical insights. This data-centric strategy enables companies to make educated choices regarding resource distribution, space usage, energy expenditure, and other factors. For example, in January 2024, WeWork India, a provider of flexible workspaces, introduced 'WeWork Workplace', a software as a service (SaaS) application for space management, in collaboration with Yardi, a solution for workspace management. The tool's real-time data analysis enables organizations to make knowledgeable choices regarding office space utilization, leading to effective cost savings by optimizing necessary office space and preventing spending on areas that are underused. In addition to this, the software enables customization and personalization of the workspace environment, resulting in enhanced comfort and productivity. Additionally, it allows administrators to manage devices, monitor energy consumption, and resolve maintenance problems from a unified dashboard, improving efficiency and lowering operational costs.

Analysis by Office Type:

- Retrofit

- New Construction

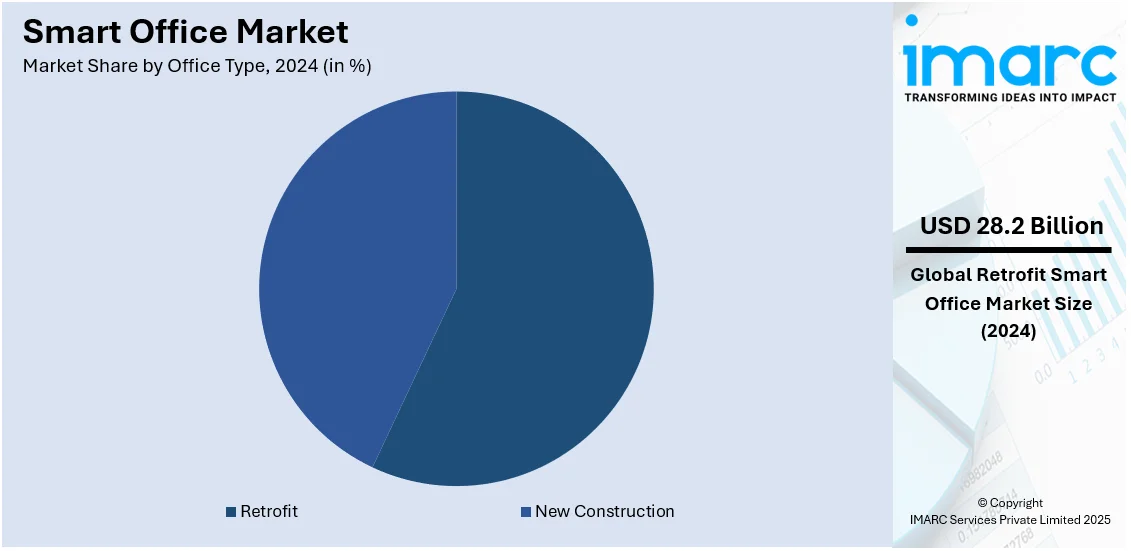

Retrofit leads the market with around 56.2% of market share in 2024. Based on the smart office market analysis, retrofit leads the market due to its cost-effectiveness compared to constructing entirely new smart office buildings. It enables organizations to improve their existing systems without facing the significant expenses tied to new construction. Additionally, it removes the necessity for a total redesign and building procedure, allowing employees to maintain their work without major disruptions. In addition to this, retrofitting supports sustainability objectives by enhancing energy efficiency in existing structures. Additionally, it can be executed fairly swiftly in comparison to building new smart office structures. This quick implementation allows organizations to begin reaping the advantages of smart technologies earlier. In addition to this, retrofitting offers a significant level of customization, enabling organizations to select particular smart features that meet their requirements.

Analysis by Technology:

- Wireless Technology

- Wired Technology

Wireless technology leads the market share in 2024. According to the smart office market outlook, wireless technology eliminates the constraints of physical connections, allowing devices and systems to be placed and moved more freely within the office environment. Furthermore, it requires minimal infrastructure changes compared to wired setups, thus reducing installation time and disruption to office operations. Apart from this, wireless solutions are highly scalable, allowing organizations to easily expand or modify their smart office setups without the need for extensive rewiring. Besides this, it can lead to cost savings in terms of installation, maintenance, and operational efficiency. Additionally, wireless technology enables a more agile approach to office design, thus fostering a workspace that is responsive to changing requirements. Moreover, it seamlessly integrates with the Internet of Things (IoT) devices and cloud-based platforms, enabling centralized control and management.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8%. North America hosts numerous tech giants, startups, research institutions, and venture capitalists. This innovative ecosystem fosters the development and adoption of cutting-edge smart office technologies. Furthermore, the region is an early adopter of smart office solutions, as regional companies have recognized the benefits of integrating technology into office spaces to enhance efficiency, sustainability, and employee well-being. In addition, the robust economy of North America provides organizations with the financial resources to invest in smart office technologies. Besides this, the region has a vast corporate landscape with diverse industries, such as technology, finance, healthcare, and manufacturing, among others. These industries recognize the potential of smart offices to optimize operations, enhance employee experiences, and gain a competitive edge. Apart from this, IoT consumer device adoption on smartphones is increasing, thereby strengthening the market for smart workplaces in the United States. For instance, GSMA Intelligence projects that the North American region would have over 5.4 Billion IoT connections by 2025.

Key Regional Takeaways:

United States Smart Office Market Analysis

In 2024, the United States accounted for 80.00% of the smart office market in North America, with regional growth driven substantially by heightened adoption of Internet of Things sensors deployed across diverse office elements including lighting, furniture, heating, and ventilation systems. Organizations are implementing sophisticated IoT-based systems throughout operations to optimize energy efficiency, enhance workplace management capabilities, and maximize employee productivity through data-driven insights. Advanced IoT sensors enable real-time office monitoring that maintains adaptive lighting levels responding to occupancy and natural light availability, automatic climate control adjusting to environmental conditions and user preferences, and seamless communication processes supporting hybrid work models. American companies are leveraging data-driven intelligence from IoT devices to increase operational efficiency, reduce energy expenditures substantially, and design intelligent workspaces that adapt dynamically to employee needs. The convergence of IoT-equipped office furniture with connected devices is revolutionizing workplace ergonomics, enabling flexible work patterns, and significantly enhancing employee wellbeing through personalized environmental controls. Firms are concentrating investments on intelligent security solutions including IoT-based access control systems, facial recognition technology, and comprehensive monitoring platforms to increase workplace safety and protect sensitive assets. The proliferation of cloud-based IoT platforms is accelerating deployment timelines for smart office solutions, enabling highly connected and data-centric work environments that support remote collaboration. Major technology companies headquartered in the United States—including Cisco, Microsoft, IBM, and Honeywell—are driving continuous innovation in smart office technologies, establishing research hubs that develop cutting-edge solutions adopted globally. Government initiatives supporting digital transformation and energy efficiency are providing additional momentum, with regulations encouraging sustainable building practices and smart technology integration across commercial real estate developments.

Asia Pacific Smart Office Market Analysis

The increasing adoption of smart offices in the region is driven by the increasing investment in smart cities, which results in the incorporation of intelligent workplace solutions. Governments and businesses are proactively implementing connected technologies to develop digitally empowered office spaces that are aligned with urban development plans. Smart building infrastructure is increasingly integrating smart lighting, automated climate control, and adaptive workplaces to enhance operational efficiency and worker productivity. Businesses are using cloud-based platforms and data analytics to maximize workspace usage, improve security systems, and facilitate real-time monitoring of office resources. The growth of smart city projects is creating the need for integrated office solutions that cater to sustainability, energy efficiency, and easy collaboration. Companies are investing in smart office systems to enable remote work, enhance communications networks, and promote employee experience. Technologically advanced commercial building developments are propelling the integration of smart office solutions, promoting workspace innovation, and enhancing efficiency in contemporary workplaces.

Europe Smart Office Market Analysis

The rise in smart office adoption across the region is driven by the escalating trend of remote work, causing a shift in workplace dynamics. Intelligent office solutions are being adopted by organizations to facilitate hybrid work models and ensure smooth collaboration and improved operational efficiency. Smart office technology, such as automated lighting, adaptive climate control, and intelligent workstations, is allowing companies to design flexible and responsive workplaces. Cloud-based communication platforms, IoT-enabled security solutions, and remote monitoring software are increasingly in demand as companies focus on digital transformation. Companies are using data-driven insights to improve employee productivity, optimize office resource utilization, and maximize space usage. The transition to remote and hybrid working is driving the adoption of smart office infrastructure, promoting workplace innovation and design, and functionality. The growth of digital workplace solutions is providing for easy integration between in-office and off-site workers, improving workflow automation and communication effectiveness. Growing dependence on technology-enabled office management is remodeling contemporary workplaces.

Latin America Smart Office Market Analysis

The concept of "smart office" is rapidly gaining traction in Latin America, with the market for smart spaces and buildings experiencing significant growth, driven by increasing adoption of technology, urbanization, and a focus on improving workplace efficiency across the region, particularly in emerging tech hubs like Mexico, Brazil, and Chile. Companies are deploying intelligent office solutions, including automated lighting, smart HVAC systems, and connected workspaces, to enhance energy efficiency and optimize resource management. The rise in disposable income is supporting the adoption of IoT-enabled office automation, improving workplace productivity and employee comfort. Organizations are integrating digital workplace solutions to enable seamless collaboration and improve operational efficiency. The expansion of cloud-based office platforms is facilitating real-time data monitoring and adaptive workspace management. The rising focus on employee-centric smart office environments is fostering innovation in workspace design.

Middle East and Africa Smart Office Market Analysis

The growing smart office adoption in the region is supported by increasing construction projects and investment in real estate, driving the demand for intelligent workplace solutions. Businesses are integrating smart office technologies, including connected lighting, automated climate control, and intelligent security systems, to enhance workplace efficiency. The expansion of commercial real estate developments is fuelling the deployment of IoT-enabled office automation, optimizing energy consumption and resource utilization. Organizations are leveraging digital workplace solutions to improve collaboration, streamline operations, and support workforce productivity. The rising emphasis on sustainable and technologically advanced office spaces is fostering innovation in modern work environments.

Competitive Landscape:

Major players in the smart office space are making strong attempts to foster innovation, improve functionality, and hasten the adoption of smart technology in workspaces. Industry leaders like Cisco Systems, Philips Lighting, Honeywell, and Johnson Controls are making substantial investments in creating cutting-edge IoT-based solutions, AI-powered automation, and energy-saving devices. These technologies streamline office operations by bringing lighting, HVAC systems, security, and office equipment into centralized, intelligent platforms that provide real-time analysis of data and remote management. In addition, these companies are working on making seamless and intuitive interfaces and offering solutions that enable hybrid work models, which have become extremely popular following the pandemic. The firms are also emphasizing heavily on sustainability by encouraging energy-efficient solutions, like intelligent lighting solutions that save power and state-of-the-art climate control solutions that maximize heating and cooling. In order to further strengthen their market share, major players are cooperating with real estate developers, providing integrated smart building technologies supporting green construction and building management. In addition, collaborations with cloud service providers facilitate remote access and collaboration tools, further enhancing workplace productivity. Through ongoing innovation and meeting the increasing demand for flexible, sustainable, and efficient workspaces, these firms are driving the future of the smart office market.

The report provides a comprehensive analysis of the competitive landscape in the smart office market with detailed profiles of all major companies, including:

- ABB Ltd

- Cisco Systems Inc.

- Crestron Electronics Inc.

- Enlighted Inc

- Honeywell International Inc.

- Johnson Controls International PLC

- Komstadt Systems Limited

- Lutron Electronics Co. Inc.

- Schneider Electric SE

- SensorSuite Inc.

- Siemens AG

- Signify N.V.

Latest News and Developments:

- January 2025: LIC has revealed its intention to set up 1,000 smart offices across the country, incorporating cutting-edge digital technologies to improve customer service and operational effectiveness. These intelligent offices will include automated workflows, AI-powered support, and enhanced accessibility for policyholders. The effort is in harmony with LIC’s plan to upgrade its infrastructure and broaden its digital presence.

- November 2024: Logitech has introduced innovative smart office solutions, such as Auto Book and Auto Release, aimed at simplifying room reservations and minimizing booking inconveniences. Logitech View, a digital office map that is interactive, improves navigation within the office, creating a more user-friendly work environment. These intelligent office solutions, compatible with platforms such as Microsoft and Zoom, assist companies in maximizing space efficiency and enhancing employee productivity.

- June 2024: Hyundai Motor Group unveiled the DAL-e Delivery Robot and Parking Robot at Factorial Seongsu, an advanced smart office structure located in Seoul. These sophisticated robots optimize package delivery and parking operations, improving workplace productivity. Using AI-powered navigation, they effortlessly blend into intelligent office settings for enhanced operations. This introduction highlights Hyundai's perspective on smart automation in contemporary workplaces.

- May 2024: ZKDIGIMAX showcased its transformative smart retail solutions at GITEX Africa 2024, emphasizing innovations in digital signage, supermarket management, and electronic shelf labeling. The event highlighted Africa’s growing digital landscape, where ZKTeco and OPENTECH captivated audiences with their cutting-edge technologies. These advancements align with the evolution of smart office environments, integrating security and intelligent management for seamless operations.

- May 2024: Hanvon unveiled the Smart Office Notebook, an innovative E-Ink tablet tailored for office professionals seeking efficiency. Designed for seamless notetaking, document management, and cloud integration, it enhances productivity in smart office settings. Its lightweight build and eye-friendly display make it an ideal choice for long work hours. This launch reinforces Hanvon’s commitment to simplifying digital workflows in modern workplaces.

- May 2024: Huawei expanded its product lineup by introducing new wearable, audio, and smart office solutions at a Dubai event. These innovations, including high-performance laptops and wireless accessories, enhance connectivity and workplace efficiency. With AI-powered features and cross-device integration, Huawei strengthens the smart office ecosystem. This launch highlights the company’s focus on intelligent collaboration tools for dynamic work environments.

Smart Office Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Office Types Covered | Retrofit, New Construction |

| Technologies Covered | Wireless Technology, Wired Technology |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Cisco Systems Inc., Crestron Electronics Inc., Enlighted Inc, Honeywell International Inc., Johnson Controls International PLC, Komstadt Systems Limited, Lutron Electronics Co. Inc., Schneider Electric SE, SensorSuite Inc., Siemens AG, Signify N.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart office market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart office market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart office industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart office market was valued at USD 50.17 Billion in 2024.

The smart office market is projected to exhibit a CAGR of 10.89% during 2025-2033, reaching a value of USD 128.27 Billion by 2033.

The smart office market is driven by increasing demand for automation, energy efficiency, and enhanced workplace productivity. Advancements in IoT, AI, and cloud technologies, along with the rise of hybrid work models, are boosting adoption. Additionally, sustainability goals and regulatory pressure for eco-friendly solutions further propel market growth.

North America currently dominates the smart office market, accounting for a share of 36.8%. The North America smart office market is driven by growing demand for automation, energy efficiency, and improved workplace productivity. Increased adoption of IoT devices, AI technologies, and cloud-based solutions, along with the rise of hybrid work models, are fueling market growth.

Some of the major players in the smart office market include ABB Ltd, Cisco Systems Inc., Crestron Electronics Inc., Enlighted Inc, Honeywell International Inc., Johnson Controls International PLC, Komstadt Systems Limited, Lutron Electronics Co. Inc., Schneider Electric SE, SensorSuite Inc., and Siemens AG, Signify N.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)