Smart Motors Market Size, Share, Trends and Forecast by Component, Product, Application, and Region, 2025-2033

Smart Motors Market Size and Share:

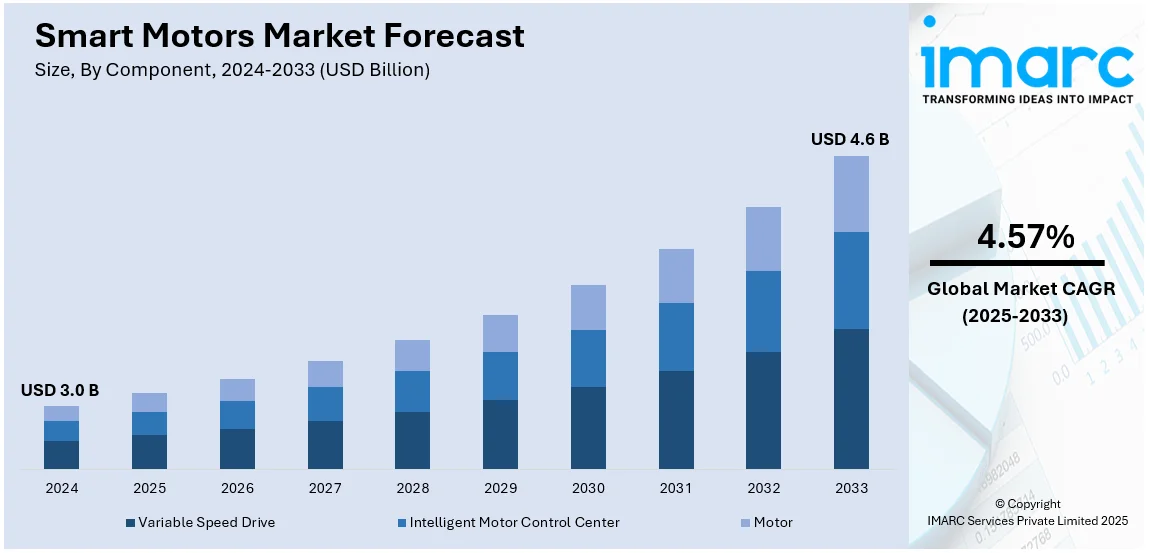

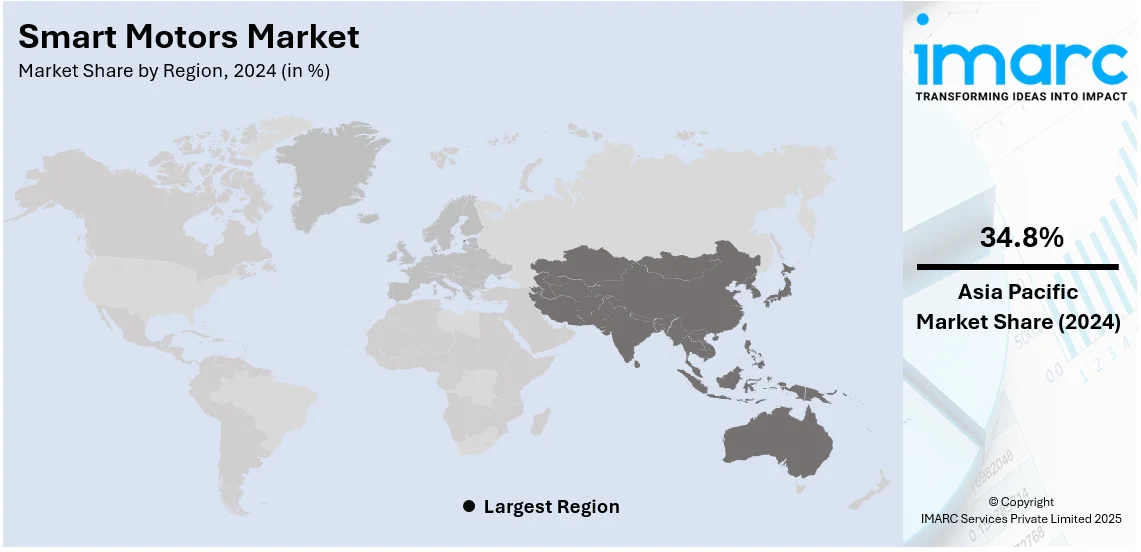

The global smart motors market size was valued at USD 3.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.6 Billion by 2033, exhibiting a CAGR of 4.57% during 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 34.8% in 2024. The increasing demand for energy efficiency, rapid technological advancements in motor control systems, growing industrial automation, imposition of government sustainability initiatives, and the rising adoption of electric vehicles (EVs), are boosting the expansion of the smart motors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Market Growth Rate (2025-2033) | 4.57% |

As industries and consumers focus on reducing energy consumption, the smart motors market demand is increasingly significantly. Power demand in the United States is predicted to increase to 4,101 billion kilowatt-hours (kWh) in 2024 and 4,185 billion kWh in 2025, fueled by data centers, manufacturing, and the electrification of transportation and buildings. This increase leads to the heightened use of smart motors as they offer better performance by optimizing energy use, thus helping reduce power consumption and lowering operational costs. Smart motors can adjust their speed and power requirements based on demand, making them far more efficient compared to traditional motors that operate at fixed speeds. In sectors like manufacturing, heating, ventilation, and air conditioning (HVAC), and transportation, this adaptability translates into significant energy savings. The drive for more sustainable practices is encouraging businesses to invest in technologies that reduce their carbon footprints, making smart motors an attractive option.

The United States stands out as a key market disruptor in North America with 84.70% share. This dominance is due to the escalating demand for electric vehicles (EVs) in the country. In 2023, there were 1.4 million new electric car registrations, representing a more than 40% increase over 2022 levels. Automotive manufacturers are progressively using innovative technologies, such as electric seats and automated mirror systems, which are powered by efficient motors. Smart motors are critical components of modern electric vehicles. Moreover, with inflating spending capacities and elevating standards of living, the adoption of hybrid and electric vehicles is increasing. As a result, the automotive industry's increased reliance on smart motors is expected to create lucrative prospects for the smart motors market growth in the future years.

Smart Motors Market Trends:

Emergence of Industry 4.0 Trends

The growth of the smart motors market share is mostly being driven by the industrial sector's growing need for robots and smart manufacturing. Additionally, manufacturers from various industries are increasingly adopting smart motors for material handling operations to enhance the operational efficiency and streamline the industrial processes. These motors are essential to the robotics sector because they can offer accurate motion control and smooth task adaptation. Furthermore, advances in electronics and data analytics are resulted in the development of smart devices with built-in intelligence. Their integration with communication technology and the Internet has led to the development of the Internet of Things (IoT). Cisco projected that by 2023, there would be 8.7 billion handheld or personal mobile-ready devices and 4.4 billion M2M connections. Mobile M2M connections facilitated a wide range of IoT applications, accounting for 34% of all mobile devices and connections by 2023. Furthermore, the growing use of Industry 4.0 and the approval of IoT are encouraging businesses to use agile, more brilliant smart motors to improve production using technologies. As a result, the market's growth is expected to accelerate in the future years.

Continuous Technological Advancements

As per the smart motors market forecast, numerous companies are extensively investing in the development of more advanced smart motors since these motors offer tremendous benefits in industrial applications. For example, in September 2023, CG Smart Motors debuted Smart Motors with next-generation technology, allowing industries to monitor the condition of their motors and take preventive measures to avoid downtime or breakdowns. By integrating IIoT-enabled communication, this technology enables smart communication for organizations, increasing efficiency and production in industrial operations. Such innovations are attracting various industry players to deploy smart motors in manufacturing practices. According to IFR, in 2022, the installation of industrial robots rose by 5 percent compared to the previous year, totaling over 553,000 units deployed around the world. Of these new robots, 73 percent were installed in Asia; 15 percent in Europe and 10 percent in America. Thus, the market is expected to expand by 7 percent in 2023. Growth is expected to also hit a major milestone through reaching 600,000 units. These positive developments are boosting investment in the robotics industry and opening up new potential for the smart motors market.

Government Initiatives and Strategic Collaborations

As per the smart motors market outlook, government bodies and concerned regulatory authorities of various nations are taking initiatives to develop sustainable smart cities. Rising environmental concerns and an expanding carbon footprint are driving up demand for low-voltage electrical equipment, motivating many companies to develop energy-efficient and compact electrical equipment and gadgets, further fueling the growth of smart motors. For example, in July 2023, Moog Animatics introduced its most recent product, the Class 6 D-style SmartMotor range. This redesigned line features a smaller footprint, a lower total cost, and a more straightforward design. The new SmartMotor consists of a motor, multiturn absolute encoder, amplifier, and controller. It also supports a variety of communication options, including as USB, dual-port Industrial Ethernet, and traditional RS-232/RS-485 and CAN interfaces. Aside from that, government initiatives such as the 'Make in India' program, an initiative by the Indian government to place India on the world map as a manufacturing hub and give global recognition to the Indian economy, are boosting demand for smart motors to establish smart factory infrastructure. Similarly, China is focused on renewable energy and sustainability, which is driving up the demand for smart motors. Smart motors are increasingly being utilized in renewable energy generation and distribution systems to enhance efficiency, control, and integration with smart grids. Government initiatives, such as "Make in China 2025," are expected to accelerate their adoption in a variety of industries, resulting in an increase in market demand.

Smart Motors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart motors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, product, and application.

Analysis by Component:

- Variable Speed Drive

- Intelligent Motor Control Center

- Motor

Based on the smart motors market trends, variable speed drive (VSD) stands as the largest component in 2024. VSDs are essential for managing the speed and torque of electric motors by varying the frequency and voltage supplied to them. This control increases energy efficiency by allowing motors to operate only when necessary, resulting in significant cost savings. The growing adoption of VSDs is driven by industries like manufacturing, HVAC, and automotive, where energy optimization and reduced wear and tear are essential for improving operational efficiency and minimizing maintenance costs. With the increasing focus on energy conservation, VSDs are playing a key role in driving the widespread adoption of smart motors across various industrial applications.

Analysis by Product:

- 24V

- 18V

- 36V

- 48.24V

24V leads the market with around 40.0% of market share in 2024. The 24V smart motors are widely used in applications where compactness, low power consumption, and cost-effectiveness are essential. These motors are commonly found in robotics, automation, HVAC systems, and small machinery, offering the ideal balance between power and energy efficiency. The 24V motors are especially popular in the automotive and consumer electronics industries, where they are used in electric vehicles, smart appliances, and even drones. Their low voltage requirement makes them suitable for environments with limited power sources, further boosting their demand in various portable and mobile applications. With advancements in battery technologies and the growing trend toward energy-efficient solutions, 24V motors are expected to maintain their dominance in the market.

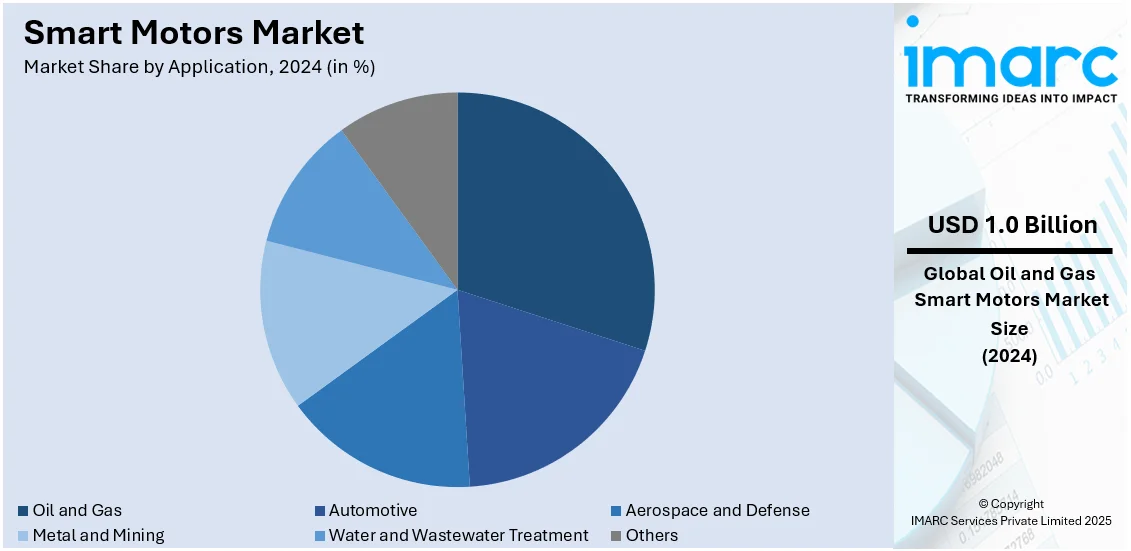

Analysis by Application:

- Automotive

- Aerospace and Defense

- Oil and Gas

- Metal and Mining

- Water and Wastewater Treatment

- Others

The oil and gas sector dominates the global market with an approximate share of 18.6% in 2024. The sector depends on smart motors for important applications such as drilling, pumping, and refining processes where high accuracy, reliability, and efficiency are required. Smart motors in this segment facilitate the optimization of performance, decrease energy usage, and enhance safety due to the provision of real-time monitoring and predictive maintenance capabilities. These motors have the ability to perform in adverse environmental conditions such as extreme temperatures and corrosive exposure, so are used widely in offshore rigs, pipeline systems, and refineries. As the oil and gas industry is constantly adopting automation and digitalization, there will be further growth of demand for smart motors, hence pushing further the research and innovation on motor control and energy management in this specific field.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific held the biggest market share, accounting for more than 34.8%. The region's supremacy stems from fast industrialization, major infrastructure development, and increasing demand for energy-efficient solutions in nations such as China, India, Japan, and South Korea. Asia Pacific is one of the significant contributors to the global smart motors market, given the rapid growth in manufacturing, automotive, and energy sectors that focus on automation and energy optimization. Government initiatives in China and India, among others, in terms of sustainability and green technologies, are driving the adoption of smart motors further. The growth of smart motors is also expected to be fueled by the increasing usage in emerging industries such as robotics and renewable energy in the region, making Asia Pacific a significant market for the manufacturers of smart motors.

Key Regional Takeaways:

North America Smart Motors Market Analysis

The North American smart motors market is experiencing steady growth, driven by the region's advanced manufacturing capabilities, a strong emphasis on energy efficiency, and the increasing adoption of automation across industries. The U.S. and Canada are key players, with significant demand for smart motors in sectors such as automotive, HVAC, oil and gas, and industrial automation. The region benefits from stringent government regulations promoting energy-saving technologies and sustainability, as well as the rapid integration of Industrial Internet of Things (IIoT) in manufacturing processes. Additionally, North American industries are investing in smart motors to reduce operational costs, enhance system performance, and achieve real-time monitoring and predictive maintenance. With technological advancements and a push for greener solutions, the North American market is poised for continued expansion, supported by increasing awareness and investments in smart motor technology.

United States Smart Motors Market Analysis

The United States is leading the market in North America with 84.70% share. The smart motors market in the United States is fueled by the increasing adoption of energy-efficient technologies and automation across industries. Federal initiatives, such as those from the U.S. Department of Energy, actively promote sustainability and energy conservation, encouraging the deployment of smart motors in industrial and commercial applications. A key driver is the growing electric vehicle (EV) market, with the National Renewable Energy Laboratory projecting that 30 to 42 Million EVs could be on U.S. roads by 2030. This rapid EV adoption is creating substantial demand for advanced motor systems designed for optimal performance and energy efficiency. Furthermore, the growth of renewable energy projects, particularly in wind and solar power generation, is driving up the demand for smart motors in energy production and distribution networks. The HVAC sector is also contributing to growth as sustainable construction practices and smart buildings continue to rise. Furthermore, advancements in IoT-enabled motor solutions, coupled with the presence of leading manufacturers, are driving innovation and adoption across various sectors. These factors collectively position the United States as a dominant market for smart motor technologies, supported by a focus on efficiency, automation, and sustainability.

Asia Pacific Smart Motors Market Analysis

The Asia-Pacific smart motors market benefits from rapid industrialization, urbanization, and the region's leadership in the electric vehicle (EV) sector. According to industry reports, China accounted for 58% of global EV sales and an impressive 70% of total EV production in 2023, solidifying its position as a global EV leader. This dominance is fueling demand for smart motor technologies in EV manufacturing and operation. Government initiatives like China's "Made in China 2025" and India's "Make in India" drive investment in energy-efficient technologies across industries such as automotive, electronics, and textiles. The region's adoption of IoT and automation enhances operational efficiency and productivity. Furthermore, expanding renewable energy projects, including wind and solar power, contribute to market growth as smart motors play a critical role in optimizing energy generation and consumption. The region's robust manufacturing ecosystem further supports widespread adoption of advanced motor solutions.

Europe Smart Motors Market Analysis

The smart motors market in Europe is propelled by the region's commitment to energy efficiency and sustainability, aligned with stringent environmental regulations. According to the European Environment Agency (EEA), renewable energy sources accounted for an estimated 24.1% of the European Union's final energy consumption in 2023. This highlights the growing focus on integrating energy-efficient technologies, including smart motors, into industrial and commercial applications. The automotive sector significantly drives market growth, with rising production of electric vehicles (EVs) and the incorporation of intelligent motor systems in EV components. Additionally, Europe’s advanced manufacturing industries are increasingly adopting IoT-enabled smart motors to optimize operations under the principles of Industry 4.0. The region's strong emphasis on renewable energy and grid modernization further supports demand for smart motors in applications like wind turbines, solar panels, and energy storage systems. The presence of leading players and innovation hubs ensures continued advancements in motor technologies, boosting adoption across the continent.

Latin America Smart Motors Market Analysis

Latin America’s smart motors market is bolstered by increasing industrial automation and infrastructure development, particularly in Brazil and Mexico. The region’s growing focus on energy efficiency to combat rising energy costs is driving adoption across industries such as manufacturing, mining, and oil and gas. Additionally, with 622 Million potential consumers across 20 countries, Latin America presents a lucrative market for consumer electronics, further fueling demand for smart motors in production and operational processes. Government initiatives promoting renewable energy, including wind and solar projects, along with growing IoT adoption, are enabling wider integration of smart motor technologies across the region.

Middle East and Africa Smart Motors Market Analysis

Smart motor market in the Middle East is increasing due to growing industrial and construction activities supported by major infrastructure projects. Renewed emphasis on energy efficiency in the region is also triggered by greater investments in solar and wind power and, therefore, tends to generate a massive demand for cutting-edge motor technologies. In line with this, the oil and gas market of the UAE is predicted to grow at a CAGR of 6.30% over the period of 2025-2033, yet again fueling the uptake of smart motors for higher operational efficiency in this critical sector. Apart from these factors, IoT-enabled solutions and government initiatives, such as Saudi Arabia's Vision 2030, are boosting demand in the market throughout the region.

Competitive Landscape:

Key players in the market focus on innovation in technology, partnerships, and expansion of their product portfolios to continue gaining market share advantage. Companies continuously invest in R&D to integrate the advanced features of artificial intelligence (AI), IoT, and machine learning (ML) into their motor control systems that enable predictive maintenance and real-time performance optimization. Some of the new players have already developed IoT-enabled smart motors which are designed for easy integration into automation systems with remote monitoring and energy management features. Others focus on sustainability by emphasizing energy-efficient solutions and digitalization to maximize performance and lengthen the lifetime of motors. The smaller companies are expanding by strategic acquisitions and partnerships to become more significant market players.

The report provides a comprehensive analysis of the competitive landscape in the smart motors market with detailed profiles of all major companies, including:

- ABB Ltd

- Dunkermotoren GmbH (AMETEK Inc.)

- Fuji Electric Co. Ltd. (Furukawa Co. Ltd.)

- General Electric Company

- Moog Inc.

- Nidec Corporation

- RobotShop Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Technosoft SA

Latest News and Developments:

- December 2024: Turntide Technologies established new partnerships with FridgeWize and Copec to increase the distribution of its Smart Motor System for HVAC applications. In the U.S. and Canada, Turntide exclusively partnered with FridgeWize, which is an energy-efficient HVAC and refrigeration solutions provider.

- January 2024: Dentsply Sirona introduced the new X-Smart Pro+ endodontic motor, which is intended to replace the X-Smart Plus and VDW.Gold motors. The strong X-Smart Pro+ portable motor improves the performance of both Dentsply Sirona and VDW's endodontic file systems, which include ProTaper Ultimate, WaveOne Gold, TruNatomy, VDW.ROTATE, and RECIPROC. This motor's integrated apex locator and Dynamic Accuracy technology provide optimal performance in both rotary and reciprocating modes, with torques of up to 7.5 Ncm and 3,000 rpm.

- September 2023: CG Smart Motors introduced Smart Motors, a next-generation technology that allows companies to monitor the health of their motors and take preventative measures to reduce downtime or breakdowns.

- July 2023: Moog Animatics launched its newest product, the Class 6 D-style SmartMotor series. The new generation boasts a reduced footprint, a lower total cost, and an easier design. The new SmartMotor combines a motor, multiturn absolute encoder, amplifier, and controller in a single device. It also supports a wide range of communication protocols, such as USB, dual-port Industrial Ethernet, and traditional RS-232/RS-485 and CAN interfaces.

- April 2023: Applied Motion Products Inc. announced a new space-saving CSM34 Conveyor Smart Motor, an integrated gearless, DC StepSERVO decentralized drive that streamlines design and building of a conveying system. An all-in-one drive, this mounts directly onto the conveyor eliminating the need for machine wiring while also getting rid of any necessity for motion control to reside elsewhere.

Smart Motors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Variable Speed Drive, Intelligent Motor Control Center, Motor |

| Products Covered | 24V, 18V, 36V, 48.24V |

| Applications Covered | Automotive, Aerospace and Defense, Oil and Gas, Metal and Mining, Water and Wastewater Treatment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Dunkermotoren GmbH (AMETEK Inc.), Fuji Electric Co. Ltd. (Furukawa Co. Ltd.), General Electric Company, Moog Inc., Nidec Corporation, RobotShop Inc., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Technosoft SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart motors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart motors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart motors market was valued at USD 3.0 Billion in 2024.

The smart motors market is projected to exhibit a CAGR of 4.57% during 2025-2033, reaching a value of USD 4.6 Billion by 2033.

Key factors driving the smart motors market include the rising demand for energy efficiency, rapid technological advancements in motor control systems, increased industrial automation, government sustainability initiatives, integration of IIoT for real-time monitoring, growing adoption in electric vehicles, and cost reductions due to economies of scale.

Asia Pacific currently dominates the smart motors market, accounting for a share of 34.8%. The market is driven by rapid industrialization, strong demand for energy-efficient solutions, and increasing automation across key sectors.

Some of the major players in the smart motors market include ABB Ltd, Dunkermotoren GmbH (AMETEK Inc.), Fuji Electric Co. Ltd. (Furukawa Co. Ltd.), General Electric Company, Moog Inc., Nidec Corporation, RobotShop Inc., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Technosoft SA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)