Smart Manufacturing Market Size, Share, Trends and Forecast by Component, Technology, End Use, and Region, 2025-2033

Smart Manufacturing Market Size and Share:

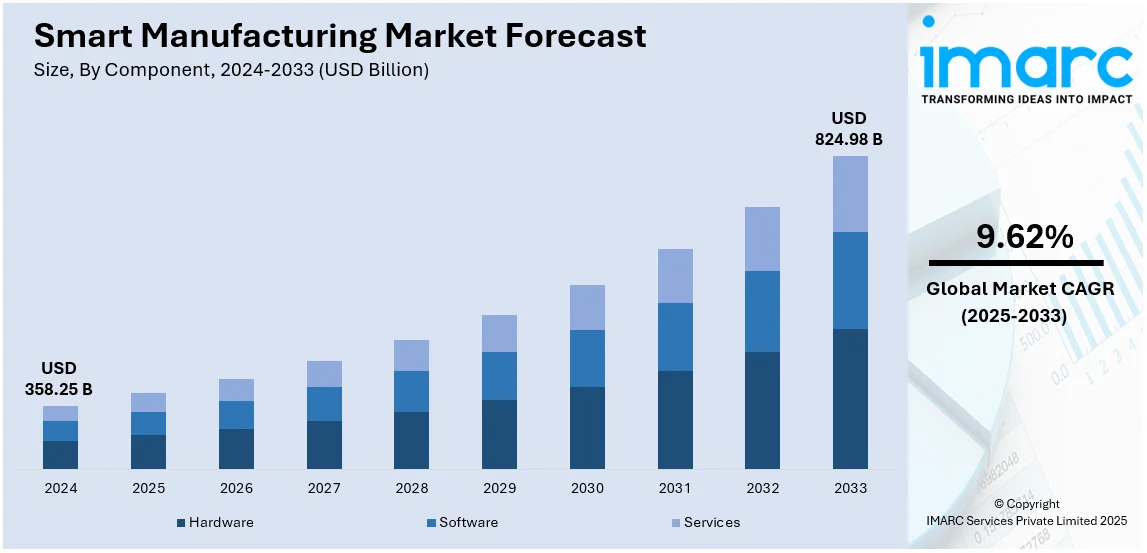

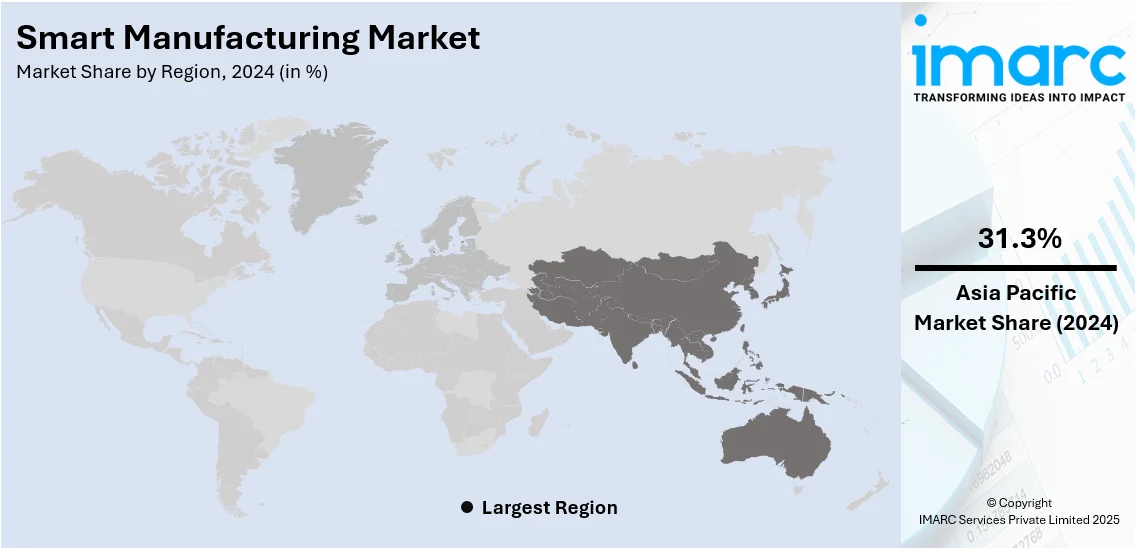

The global smart manufacturing market size was valued at USD 358.25 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 824.98 Billion by 2033, exhibiting a CAGR of 9.62% from 2025-2033. Asia Pacific currently dominates the market holding a significant smart manufacturing market share of 31.3%, owing to the heightened need for automation in several industries, increasing adoption of advanced solutions to reduce the need for human supervision, and rising utilization of industrial internet of things (IIoT) are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 358.25 Billion |

|

Market Forecast in 2033

|

USD 824.98 Billion |

| Market Growth Rate (2025-2033) | 9.62% |

A key factor driving the smart manufacturing market is the growing implementation of Industry 4.0 technologies, which combine the Internet of Things (IoT), artificial intelligence (AI), robotics, and data analytics to enhance production workflows. Additionally, sectors such as automotive and aerospace are leading the way in adopting smart manufacturing innovations. The shift towards automation and digitalization is further fueled by the need for improved supply chain visibility and agility in a competitive global market. Additionally, government initiatives promoting smart factories and industrial innovation, particularly in developed economies, are accelerating investments in these technologies, enabling manufacturers to achieve higher productivity, energy efficiency, and customization capabilities in their operations thus strengthening the smart manufacturing market growth.

The U.S. plays a pivotal role in the smart manufacturing market, driven by its robust industrial base and rapid adoption of advanced technologies such as IoT, AI, and robotics. The country is home to key innovators and technology providers that facilitate the integration of smart solutions into manufacturing processes. Strong government initiatives, such as the Manufacturing USA program, encourage the development of smart factories through funding and research collaborations. The U.S. manufacturing sector prioritizes efficiency, supply chain optimization, and sustainability, prompting investments in automation and data-driven operations. Additionally, sectors such as automotive and aerospace are leading the way in adopting smart manufacturing innovations. However, in FY 2022, the Manufacturing USA network included 16 institutes, with a 25% increase in participation in advanced manufacturing education and workforce programs over the prior year.

Smart Manufacturing Market Trends:

Growing Emphasis on Sustainability and Energy Efficiency

One of the prominent smart manufacturing market trends, is the push for smart manufacturing solutions is gaining serious momentum across a variety of industries, driven by a heightened focus on sustainability and energy efficiency, as highlighted in the smart manufacturing industry outlook. An increasing number of companies worldwide feel pressure to ensure that their approaches are sustainable at a time of growing environmental angst. Green manufacturing startups secured over $10 billion dollars in funding,. Emerging smart manufacturing technologies that bring such energy-efficient processes into reality have gained traction in recent years. These innovations reduce waste, of course, but also the environmentally degrading impacts from manufacturing. This is achieved as manufacturers use smart sensors and data analytics to carefully observe energy consumption while pinpointing improvements.

Technological Advancements in Automation and Robotics

The relentless requirement of automation and robotics is vital for keeping manufacturing processes smoothly running. Businesses are witnessing a systemic shift in production lines across several industries, owing to the addition of cutting edge robotic systems and automatic machinery. This revolution is increasing efficiency and precision, eliminating concerns about human errors, and dramatically accelerating manufacturing cycles. As a result, productivity and substantial cost savings are rising. By enabling seamless real time communication between machines and systems, IIoT ensures constant monitoring and control. For example, the global number of connected IoT devices is expected to grow by 13%, reaching 18.8 billion. Moreover, robots powered by artificial intelligence and machine learning (ML) are highly capable of tackling complex tasks with minimal supervision, making operations smoother. These technological marvels do not just boost efficiency but also guarantee consistent product quality, which is essential for staying competitive. In a notable leap forward, Techman Robot unveiled its latest collaborative robot, the TM30S in 2024. This powerhouse is a high-payload robotic arm designed for heavy-duty tasks like palletizing. It's a testament to how far technology has come in blending human ingenuity with robotic precision.

Increasing Adoption of Industrial Internet of Things (IIoT)

The excessive use of industrial Internet of Things (IIoT) is transforming the landscape of smart manufacturing market revenue. By linking numerous industrial devices via the Internet, IIoT facilitates effortless data exchange and communication, presenting a significant upliftment in the market revenue in this sector. This web of connectivity paves the way for sophisticated data analytics, predictive maintenance, and real time monitoring for numerous manufacturing elements. IIoT elevates operational efficiency by providing deeper insights into machine performance and aids in forecasting and preventing equipment failures before they happen. This proactive approach eliminates downtime occurrence and cuts maintenance costs, resulting in a notable uptick in overall productivity. It ensures manufacturers stay ahead of various market trends, maximizing efficiency and minimizing disruptions in their productivity. Furthermore, the integration of IIoT with numerous other technologies enhances its capabilities. As per the prediction made by the IMARC Group, the global industrial IoT market will reach USD 806.0 Billion by 2032.

Smart Manufacturing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart manufacturing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, technology, and end use.

Analysis by Component:

- Hardware

- Software

- Services

Software solutions play a key role in driving the growth with a significant market share of 46.8% of the smart manufacturing market by facilitating the smooth integration of advanced technologies such as IoT, AI, and data analytics into production operations. These solutions offer real-time monitoring, predictive analytics, and process automation, greatly boosting operational efficiency and minimizing downtime. Technologies like Manufacturing Execution Systems (MES), Enterprise Resource Planning (ERP), and digital twins are commonly used to streamline supply chains and enhance decision-making. The growing demand for customized, flexible, and scalable solutions has further aiding the smart manufacturing market demand. Besides this, the software enables better interoperability among connected devices, fostering smart factory ecosystems. The growing emphasis on sustainability and energy management further drives the demand for software that aids in optimizing resource use and ensuring compliance.

Analysis by Technology:

- Machine Execution Systems

- Programmable Logic Controller

- Enterprise Resource Planning

- SCADA

- Discrete Control Systems

- Human Machine Interface

- Machine Vision

- 3D Printing

- Product Lifecycle Management

- Plant Asset Management

Discrete control systems represent the largest smart manufacturing market share of 16.34% due to their critical role in automating and optimizing manufacturing processes. These systems, including Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA), enable precise control over discrete processes, such as assembly lines and packaging. They support high-speed operations, ensuring accuracy and consistency in production. The increasing adoption of modular and flexible manufacturing practices further drives demand for discrete control systems, which facilitate quick reconfiguration and scalability. The integration of IoT and AI enhances their capabilities, allowing for real-time monitoring, fault detection, and predictive maintenance. Industries such as automotive, electronics, and aerospace heavily rely on these systems to improve productivity, quality, and overall operational efficiency.

Analysis by End Use:

- Automotive

- Aerospace and Defense

- Chemicals and Materials

- Healthcare

- Industrial Equipment

- Electronics

- Food and Agriculture

- Oil and Gas

- Others

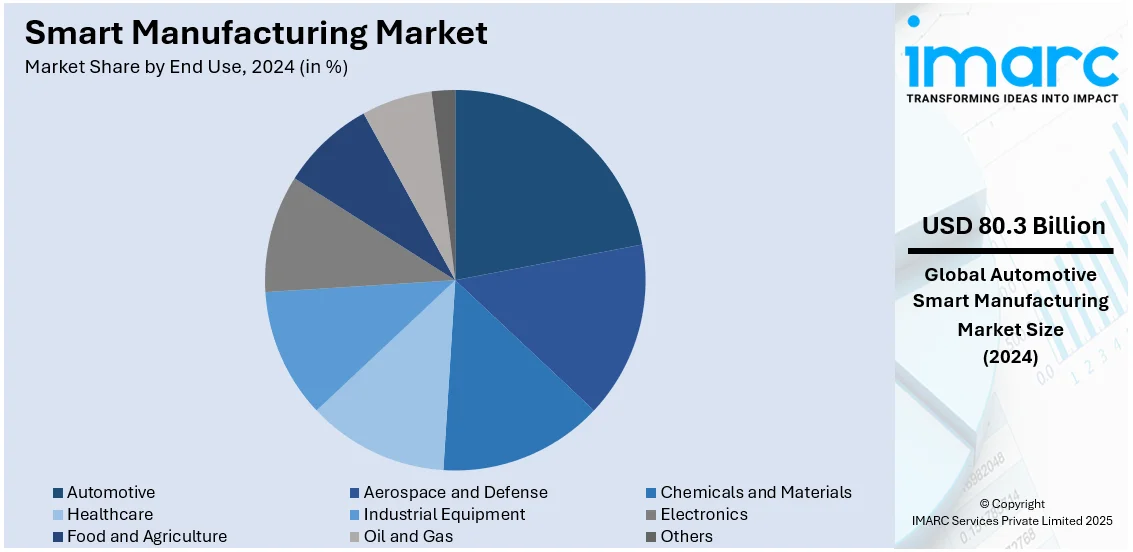

The automotive sector exhibits clear dominance in the smart manufacturing market holding a share of 22.4% owing to its early adoption of advanced technologies and the need for high precision and efficiency in production. Smart manufacturing solutions, such as robotics, IoT-enabled devices, and AI-driven analytics, are extensively utilized for assembly lines, quality control, and inventory management. The industry's emphasis on large-scale production of electric and autonomous vehicles has accelerated the adoption of automated systems and digital twins, improving design, prototyping, and production efficiency. Moreover, the growing push for sustainability is driving the integration of energy-efficient processes and enhanced resource optimization. The sector's reliance on just-in-time manufacturing and supply chain automation strengthens its dominance, making it a key driver of smart manufacturing market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the smart manufacturing market forecast, Asia Pacific holds the largest share of 31.3% due to its strong industrial base, rapid technological advancements, and significant government initiatives supporting digital transformation. The region benefits from the presence of major manufacturing hubs, particularly in countries like China, Japan, South Korea, and India, which have heavily invested in automation and smart technologies. The extensive use of IoT, AI, and robotics across industries like automotive, electronics, and pharmaceuticals propels market expansion. Government initiatives supporting Industry 4.0, such as China’s "Made in China 2025" and Japan’s "Society 5.0," boost innovation and the implementation of smart factories. Additionally, the increasing emphasis on sustainability and cost efficiency accelerates the adoption of advanced manufacturing solutions in the region.

Key Regional Takeaways:

North America Smart Manufacturing Market Analysis

The North America smart manufacturing market is driven by advanced technological adoption, a robust industrial base, and strong government initiatives promoting innovation. The region benefits from its well-established infrastructure and high levels of automation across industries such as automotive, aerospace, and electronics. Technologies such as IoT, AI, cloud computing, and robotics are extensively used to improve operational efficiency, minimize downtime, and enable real-time monitoring. The U.S. dominates the regional market thanks to substantial investments in R&D and the presence of major technology providers. eGovernment programs such as Manufacturing USA encourage collaboration between public and private sectors, driving the integration of smart technologies. Moreover, the rising demand for customized products and adaptable manufacturing systems drives the adoption of digital solutions. The focus on sustainability and energy efficiency further boosts the market as manufacturers strive to optimize resource use while complying with environmental regulations. Together, these factors position North America as a dominant force in the smart manufacturing sector.

United States Smart Manufacturing Market Analysis

The integration of smart manufacturing in the chemicals and materials industries has surged, driven by increasing demand for efficient production methods. The U.S. exported more than USD 494 billion worth of chemicals in 2022, according to the International Trade Administration. As a global leader in chemical production, the U.S. accounts for over 13% of the world’s chemicals. The industry, with its 14,000 establishments, manufactures more than 70,000 products. Advanced systems such as predictive analytics and process automation optimize resource utilization and minimize waste, enabling manufacturers to meet stringent environmental and operational standards. Smart factories facilitate precision in blending, mixing, and material processing, addressing the need for consistent quality in end products. The application of iot-enabled sensors and robotics enhances monitoring capabilities, ensuring adherence to dynamic industry requirements. The rising complexity of material formulations has spurred the adoption of modular production setups, allowing flexibility in output. Real-time data analytics further empowers stakeholders to make informed decisions, reducing downtime and enhancing production throughput. This paradigm shift is fuelling innovation and competitiveness within the sector, marking a notable transformation in the industrial landscape.

Asia Pacific Smart Manufacturing Market Analysis

The growing automotive sector is adopting smart manufacturing solutions to optimize production processes and cater to changing consumer demands. According to the India Brand Equity Foundation, the sector attracted a cumulative foreign direct investment (FDI) of approximately USD 35.65 billion between April 2000 and December 2023. Technologies such as autonomous robots, advanced vision systems, and digital twins are being implemented to improve precision and reduce operational inefficiencies. The increasing focus on modular platforms and electrification has necessitated adaptive assembly lines, where smart systems dynamically allocate resources. Improved simulation tools now allow virtual prototyping, resulting in a reduction in time-to-market and expenses in development. Electric and hybrid cars create large pressure upon manufacturers to optimize battery production and assembly with the help of an integrated smart manufacturing system. Predictive maintenance tools are integrated to assure no interruption in machine operations and to minimize delays and increase productivity. These dynamics are revolutionizing the landscape of automobile production, resulting in more cost-effectiveness and operational efficiency while introducing more possibilities towards customization in the region.

Europe Smart Manufacturing Market Analysis

Industrial equipment firms have seen a rise in the uptake of smart manufacturing, which has gained popularity due to the merits of improved efficiency and adaptability. According to reports, industrial production in the EU increased by 8.5% in 2021 compared to 2020. It continued increasing in 2022 by 0.4% compared with 2021. The new advanced technologies include digital twins and automated guided vehicles, which change the way production workflows are organized, ensuring easy transition between the manufacturing stages. Modular machinery and flexible systems are on demand for broader ranges of production needs, particularly because of fluctuations in industrial requirements. Machine learning and predictive analytics make preventive maintenance scheduling more streamlined and reduce the amount of equipment downtime and the repair cost involved. Enhanced robotics and collaborative systems are fostering precision and scalability in the production process, ensuring consistent output quality. Real-time monitoring tools enable better resource allocation and energy optimization, addressing sustainability objectives. These innovations are contributing to a shift toward more dynamic and resilient manufacturing environments, bolstering industrial equipment capabilities in response to increasing production demands.

Latin America Smart Manufacturing Market Analysis

The smart manufacturing technology is being adopted in healthcare facilities for the improvement of medical device and pharmaceutical product manufacturing. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), 62% of the 7,191 hospitals in Brazil are privately owned. The automated assembly lines and IoT-enabled systems provide for high accuracy and adherence to very strict quality standards. Since real-time data monitoring is encouraged through the use of real-time data systems, inventory management improves, and productivity and efficiency in the supply chain increase. Increased demand for medical equipment is met by using additive manufacturing technologies like 3D printing for rapid prototyping and even custom solutions for demanding products like surgically related instruments. As a solution to errors and inaccuracy caused by human involvement, robotics has been introduced into production lines. All of these advancements enhance operational efficiency, but they are also supporting innovation within the healthcare manufacturing ecosystem, propelling the integration of smart technologies.

Middle East and Africa Smart Manufacturing Market Analysis

With more deployment of smart manufacturing technologies into the oil and gas sector, enhancing the efficiency of operations and optimized use of resources are being brought to the scene. In total, 668 oil and gas projects are expected to come online across the Middle East over 2024-2028. Automated and IoT-based systems are currently transforming drilling and extraction processes. This is complemented by real-time monitoring and predictive maintenance. Digital twins and simulation tools lead to better planning and execution. Downtime and operational risks are reduced with the improved use of advanced robotics for inspection and maintenance tasks in hazardous environments. Data analytics tools greatly help streamline supply chain management and optimize logistics, thus supporting good decisions. All these factors drive productivity gains with cost reduction to be a part of a more efficient landscape for energy production-more sustainable. The sector is thus transitioning towards smart manufacturing, and this is promoting innovation and enhancing resilience in the face of dynamic industry challenges.

Competitive Landscape:

The smart manufacturing market's competitive landscape is intense innovation with advanced technologies, including IoT, AI, robotics, and cloud computing. Industry players are focusing on developing comprehensive solutions that offer real-time monitoring, predictive maintenance, and process automation. To enhance their technological expertise and market presence, strategic collaborations, mergers, and acquisitions are commonly pursued within the sector. Entry of technology providers that offer software and hardware solutions catering to various industries shapes the landscape further. Regional players compete by using local market insights and cost-effective solutions, while global firms focus on scalable and interoperable systems. Continuous investments in R&D and partnerships with manufacturing firms drive advancement and maintain competitive positioning.

The report provides a comprehensive analysis of the competitive landscape in the smart manufacturing market with detailed profiles of all major companies, including:

- 3D Systems Inc.

- ABB Ltd.

- Emerson Electric Co.

- Fanuc Corporation

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Latest News and Developments:

- July 2024: 3D Systems Inc. and Precision Resources joined forces to advance additive manufacturing through a strategic partnership. The collaboration combines the expertise of both organizations with 3D Systems' Direct Metal Printing (DMP) technology. This strategy aims to speed up the development of applications in key industries, ensuring a quicker route to market. The partnership highlights a mutual dedication to innovation and manufacturing excellence.

- June 2024: Honeywell launched the Battery MXP, an AI-powered software platform aimed at revolutionizing large-scale battery production. The tool optimizes processes by reducing material waste and shortening ramp-up times by up to 60%. By employing advanced machine learning, it proactively identifies and resolves quality issues. This platform is poised to enhance efficiency and productivity in battery manufacturing.

- January 2024: ABB acquired Sevensense Robotics to strengthen its AI-driven mobile robotics capabilities. The integration of Sevensense's Visual SLAM technology enhances navigation and autonomy in ABB's AMRs. This merger enables precise navigation even in dynamic and complex environments. ABB's investment marks a significant step in advancing industrial robotics.

- June 2024: ABB introduced OmniCore, a state-of-the-art automation platform focused on speed, precision, and sustainability. The platform is designed to future-proof businesses by offering advanced capabilities for a wide range of industrial applications. OmniCore emphasizes efficiency while reducing the environmental footprint of automation processes. This innovation aligns with ABB's vision of sustainable industrial transformation.

- April 2024: Cisco acquired Isovalent, enhancing its cloud-native capabilities with advanced Kubernetes networking and security technologies. Isovalent's Cilium project plays a pivotal role in this integration, boosting Cisco's competitive edge in the Kubernetes market. This acquisition strengthens Cisco's position in delivering secure, scalable solutions for modern cloud infrastructures.

- February 2024: In order to upgrade its aircraft engine repair facility in Singapore into a cutting-edge smart factory, General Electric Company announced an investment of USD 11 million. The upgrade will incorporate advanced technologies, such as automation and digital tools, to improve operational efficiency and precision. This move aligns with GE's strategy to strengthen its global aviation capabilities and improve customer support. The upgraded facility is expected to boost productivity and reduce turnaround times for engine repairs.

Smart Manufacturing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Technologies Covered | Machine Execution Systems, Programmable Logic Controller, Enterprise Resource Planning, SCADA, Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Product Lifecycle Management, Plant Asset Management |

| End Uses Covered | Automotive, Aerospace and Defense, Chemicals and Materials, Healthcare, Industrial Equipment, Electronics, Food and Agriculture, Oil and Gas, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3D Systems Inc., ABB Ltd., Emerson Electric Co., Fanuc Corporation, General Electric Company, Honeywell International Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart manufacturing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart manufacturing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart manufacturing market was valued at USD 358.25 Billion in 2024.

The smart manufacturing market was valued at USD 824.98 Billion in 2033.

IMARC estimates the smart manufacturing market to exhibit a CAGR of 9.62% during 2025-2033.

Key factors driving the smart manufacturing market include the adoption of Industry 4.0 technologies like IoT, AI, and robotics, growing demand for automation and operational efficiency, government initiatives promoting digital transformation, and the need for real-time data-driven decision-making, enhancing productivity, supply chain optimization, and sustainability across diverse industries.

Asia Pacific leads the smart manufacturing market with a 31.3% share, driven by rapid industrialization, strong technological adoption, and government initiatives supporting automation and digitalization. Countries like China, Japan, and South Korea are key players, investing heavily in advanced manufacturing technologies to enhance production efficiency and competitiveness.

Some of the major players in the Smart Manufacturing market include 3D Systems Inc., ABB Ltd., Emerson Electric Co., Fanuc Corporation, General Electric Company, Honeywell International Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)