Smart Labels Market Report by Technology (Radio-Frequency Identification (RFID), Electronic Article Surveillance (EAS), Electronic Shelf Label (ESL), Sensing Labels, Near Field Communication (NFC)), Component (Batteries, Transceivers, Microprocessors, Memories, and Others), End-User (Retail, Logistics and Transportation, Healthcare, Food and Beverage, Aerospace, Data Centers and Libraries, and Others), and Region 2025-2033

Smart Labels Market Size and Share:

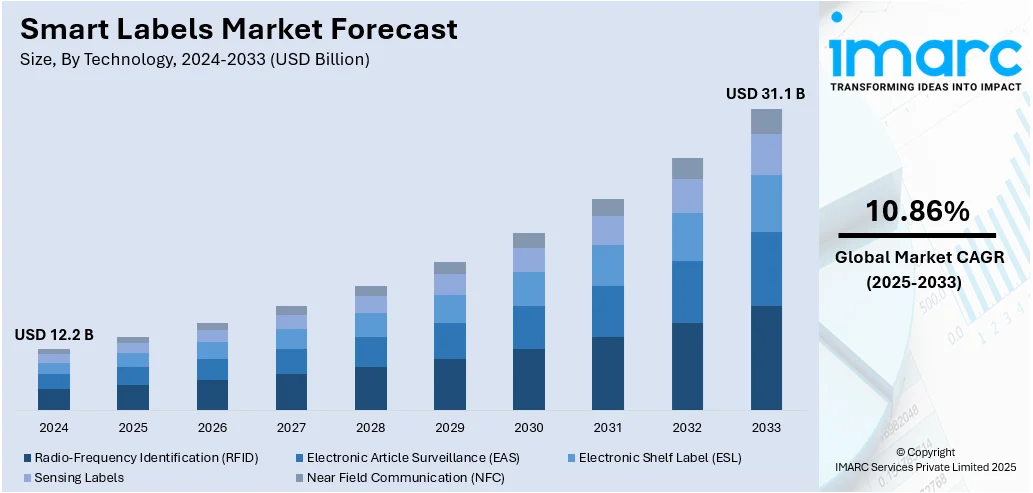

The global smart labels market size reached USD 12.2 Billion in 2024. It is expected to reach USD 31.1 Billion by 2033, exhibiting a growth rate (CAGR) of 10.86% during 2025-2033. The market growth is driven by increasing product demand in security and tracking solutions, rising consumer demand for enhanced tracking and authentication, implementation of stringent regulatory requirements for product tracking, advancements in NFC and RFID technologies, and a shifting preference towards sustainable development.

Market Insights:

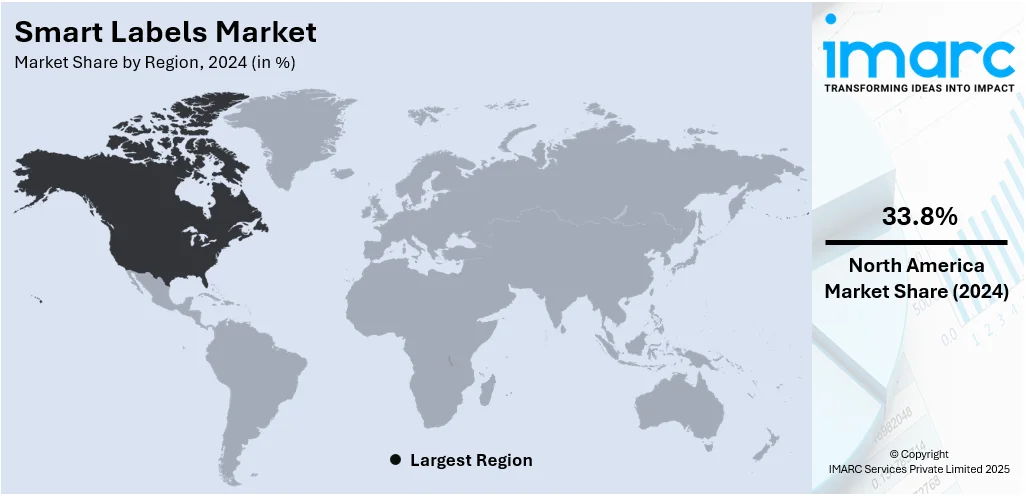

- North America dominates the smart labels market due to its advanced technological infrastructure and high adoption rates.

- By technology, RFID holds the largest market share, driven by its accuracy, real-time tracking, and automatic data collection.

- By component, batteries lead the market, powering RFID tags and enabling extended operational periods without frequent replacements.

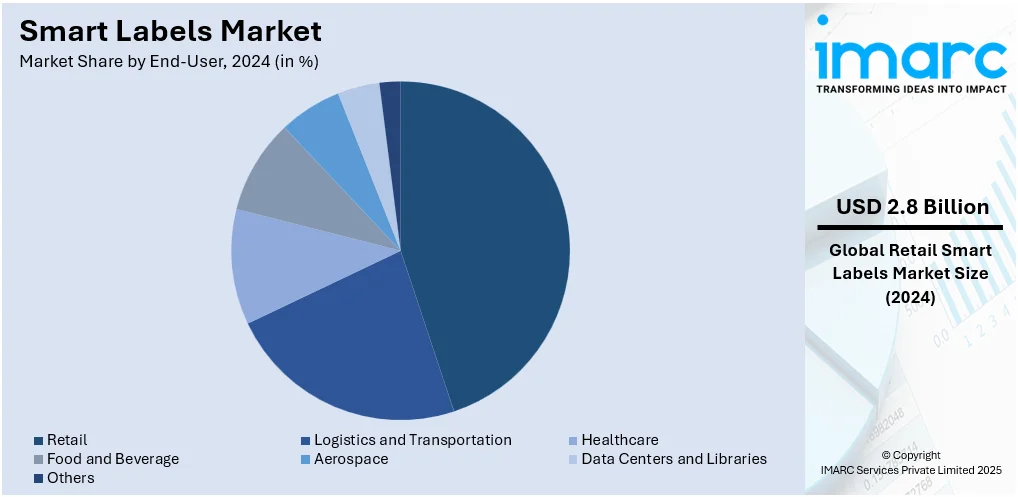

- By end-user, retail holds the largest share, benefiting from improved inventory management and real-time data integration with IoT technology.

Market Size & Forecast:

- 2024 Market Size: USD 12.2 Billion

- 2033 Projected Market Size: USD 31.1 Billion

- CAGR (2025-2033): 10.86%

- North America: Largest market in 2024

Smart Labels Market Analysis:

- Major Market Drivers: The rise in consumer demand for enhanced tracking and authentication in logistics is propelling the smart labels market growth. Additionally, the increasing adoption of IoT and RFID technologies for inventory management is also driving the smart labels market share. Furthermore, regulatory requirements for product tracking are contributing to the market expansion.

- Key Market Trends: Some of the market trends include rapid advancements in NFC (Near Field Communication) and RFID technologies, the rising integration with mobile applications for real-time tracking and consumer interaction, and the shifting consumer preference towards sustainable development.

- Geographical Trends: North America is dominating the market due to its advanced technological infrastructure and high adoption rates, thereby creating a positive smart labels market outlook. Europe is experiencing significant growth driven by stringent regulatory policies and increasing demand for traceability. The Asia-Pacific region is emerging as a lucrative market due to rapid industrialization and rising consumer markets.

- Competitive Landscape: Some of the key players having the majority of the smart labels market share include Avery Dennison Corporation, CCL Industries Inc., Checkpoints Systems, Inc., Zebra Technologies Corporation, Intermec Inc., Invengo Technology Pte. Ltd., Sato Holdings Corporation, Thin Film Electronics ASA (Ensurge Micropower ASA), Smartrac N.V., and Muehlbauer Holding AG. These companies are focusing on innovations in label technology and expanding their product portfolios.

- Challenges and Opportunities: Some of the challenges in the market include high initial costs of smart label technology and integration complexities with existing systems. However, opportunities lie in the growing demand for supply chain visibility and the expansion of the e-commerce sector. The development of cost-effective and versatile smart label solutions presents significant growth potential.

Smart Labels Market Overview:

The smart labels market is experiencing strong growth, driven by growing demand for sophisticated product tracking, authentication, and inventory management solutions for various industries like retail, healthcare, and logistics. Some of the major growth drivers are the growing use of RFID and NFC technologies for real-time tracking of data, increasing embedding of IoT in supply chain functions, and increased consumer consciousness about product authenticity and sustainability. Yet, high cost of implementation, integration issues with legacy systems, and data privacy issues still hinder market growth. However, technological advancements in recent times, such as collaborations between smart label producers and IoT platforms, combined with improvements in printed electronics and batteries, are facilitating increasing operational effectiveness, product traceability, and personalization, driving long-term growth potential.

To get more information on this market, Request Sample

Smart Labels Market Trends:

Increasing need to access nutritional facts and other product-related information

The rising need to check nutritional facts and other product-related information is facilitating market growth. With the widespread availability of information on the internet and the rising prevalence of chronic diseases, an increasing number of individuals are intentionally paying attention to product labeling in order to comprehend the nutrition facts. As per smart labels market research report, there is an increase in demand for smart labels that include allergen information, third-party certifications, usage instructions, social compliance programs, and safe handling. Smart labels also provide smart traceability for a product and assist in retaining its validity. This growing emphasis on detailed and accessible product information exhibits the significance of the smart labels market overview in understanding current trends and future prospects.

Rising usage of RFID labels to reduce food wastage

The expansion of the organized retail industry and a growing e-commerce sector are driving the demand for smart labels. In addition, technological advancements in RFID and NFC technologies are making smart labels more efficient and cost-effective. Retailers and manufacturers are increasingly adopting these technologies to enhance inventory management, improve supply chain transparency, and extend the shelf life of perishable goods. The integration of IoT with smart labels is also contributing to market growth by enabling real-time tracking and monitoring of products. Furthermore, the rising demand for perishable products is creating opportunities for businesses. Moreover, with an enhanced focus on reducing food waste, the transformation of the pharmaceutical business is helping to bolster market growth and offer lucrative business opportunities in the smart labels market.

Growing product adoption in primary packaging solutions

The majority of the revenue in the market is contributed by firms that provide these labels for the main packaging to avoid drug counterfeits. Syringes currently account for the highest share of the smart label market in main packaging. This can be attributable to the increasing demand for syringes, which are widely regarded as the most favored primary packaging container for the delivery of medicines and biologics worldwide. In November 2022, Schreiner MediPharm and Schott Pharma collaborated to create a smart label for prefilled syringes utilizing RFID technology. Another company, NP Plastibell, launched a smart prefilled syringe with an embedded NFC tag from STMicroelectronics. As a result, the growing product adoption in primary packaging solutions is significantly impacting the smart labels market drivers, emphasizing the role of advanced technologies in enhancing packaging solutions.

Smart Labels Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on technology, component, and end-user.

Breakup by Technology:

- Radio-Frequency Identification (RFID)

- Electronic Article Surveillance (EAS)

- Electronic Shelf Label (ESL)

- Sensing Labels

- Near Field Communication (NFC)

Radio-frequency identification (RFID) dominates the market

The report has provided a detailed breakup and analysis of the market based on the technology. This includes radio-frequency identification (RFID), electronic article surveillance (EAS), electronic shelf label (ESL), sensing labels, and near field communication (NFC). According to the report, radio-frequency identification (RFID) represented the largest segment.

According to the smart labels market forecast, radio-frequency identification (RFID) is dominating the market due to the characteristics provided, which include information accuracy, real-time tracking, and automatic data gathering. RFID is widely used to maintain synchronized records for inventory and supply chain management. Several firms are creating RFID smart labels for a variety of applications. These RFID tags are characterized as either passive or active. These tags are further divided according to the type of RFID frequency band. Ultra-high frequency / UHF RFID labels are the most prevalent tags, with many manufacturers supplying them for pharmaceutical applications. Pharmaceutical firms, like Hanmi Pharmaceutical, are using Impinj RAIN RFID tags with an Impinj Monza tag chip to trace each product throughout the supply chain. RFID's ability to provide unique identification for each item in the supply chain allows for enhanced traceability, minimizing errors and fraud. The ability to read RFID tags from a distance without the need for line-of-sight has made it especially valuable in complex environments like warehouses and manufacturing plants, where operational efficiency is critical. The ability of RFID tags to support long-range scanning and the integration of RFID with cloud-based systems further boosts its appeal for businesses looking to streamline their operations and enhance transparency across global supply chains.

Breakup by Component:

- Batteries

- Transceivers

- Microprocessors

- Memories

- Others

Batteries hold the largest share in the market

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes batteries, transceivers, microprocessors, memories, and others. According to the report, batteries accounted for the largest market share.

According to the report, batteries accounted for the largest market share as they power the radio signal transceiver incorporated in smart label tags. The presence of batteries in active smart labels allows them to operate even when a reader or interrogator is nearby. Furthermore, battery-powered smart labels are extremely beneficial for tracking high-value commodities that need to be scanned over long distances. The easy availability of compact and long-lasting batteries has made it possible to create labels that can operate for extended periods without requiring frequent battery replacements. These factors exhibit the smart labels market dynamics, highlighting how technological advancements and operational needs drive the development and adoption of these labels in various applications. The use of long-life, rechargeable batteries in smart labels allows for better sustainability and reduces the need for constant battery replacements, making them more cost-effective in the long run. Additionally, advancements in battery technologies, including the development of smaller, more energy-efficient batteries, have expanded the range of devices that can utilize smart labels. The continuous innovations in battery technology are enabling the creation of even more compact and durable tags, contributing to the growing adoption of smart labels in industries that require high-performance, long-term solutions like pharmaceuticals and logistics.

Breakup by End-User:

- Retail

- Logistics and Transportation

- Healthcare

- Food and Beverage

- Aerospace

- Data Centers and Libraries

- Others

Retail holds the maximum share in the market

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes retail, logistics and transportation, healthcare, food and beverage, aerospace, data centers and libraries, and others. According to the report, retail accounted for the largest market share.

According to the research report, retail accounted for the largest market share since enterprises in the retail sector profit greatly from smart label technology. They can utilize the data to understand customers' mindsets and create products accordingly. Furthermore, enterprises can save a significant amount of time, which leads to lower labor expenses because they no longer need to rely on a handheld scanner to extract product information. The growing product usage in retail inventory is being driven by the need for improved inventory management, greater demand for real-time data, and the expanding acceptance of IoT technology. The product enables merchants to manage their inventory in a more efficient and accurate manner, give real-time data for better decision-making, and integrate seamlessly with other IoT devices. Smart labels also help retailers optimize supply chain processes by offering real-time tracking of goods from warehouses to retail outlets, reducing stockouts, and enabling dynamic pricing strategies based on demand and inventory levels. The integration of smart labels with customer-facing technologies, such as mobile apps and loyalty programs, provides an enhanced shopping experience by offering product information, promotions, and personalized recommendations directly to consumers. With the increasing need for enhanced customer engagement and operational efficiency, the retail sector continues to be the largest market for smart labels.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America leads the market, accounting for the largest smart labels market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, North America represents the largest regional market for smart labels.

North America holds the largest market revenue for these labels. Some of the factors driving the market across the region are the increased use of the labels in goods and asset tracking applications, rising labor costs and price integrity concerns, and growing product demand among big manufacturers and wholesalers. Furthermore, the market is being influenced positively by the increasing use of digital technology, as well as the growing need for the product in a variety of industries, including healthcare, pharmaceuticals, logistics, retail, and food and beverage (F&B). The proliferation of smart cities and the development of connected infrastructures further drive demand for smart labels, as they play an essential role in ensuring seamless communication between products, consumers, and businesses. In addition, the increasing emphasis on sustainability and the need to reduce waste in industries such as retail and logistics are encouraging the adoption of smart labels for their efficiency in tracking and managing products throughout their lifecycle. The trend toward automation and IoT-enabled devices across various sectors, including healthcare and logistics, ensures that North America will maintain its leadership in the smart labels market over the coming years.

Competitive Landscape:

- The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include Avery Dennison Corporation, CCL Industries Inc., Checkpoints Systems, Inc., Zebra Technologies Corporation, Intermec Inc., Invengo Technology Pte. Ltd., Sato Holdings Corporation, Thin Film Electronics ASA (Ensurge Micropower ASA), Smartrac N.V. and Muehlbauer Holding AG.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Prominent smart labels companies are broadening their scope to encompass industries beyond conventional sectors, such as manufacturing and healthcare. Additionally, businesses are providing tailored solutions to meet specific client needs and preferences. They are also strengthening their alliances with distributors and resellers to reach a broader audience. In addition to this, the major industry participants are broadening their technological offerings beyond RFID to include printed electronics, NFC, and other upcoming technologies. They are adapting their systems to meet specific industry requirements such as pharmaceutical traceability, food safety, and asset tracking. Industry participants are also collaborating with software developers, IoT platforms, and system integrators to facilitate comprehensive solutions, which is creating lucrative opportunities in the market.

Smart Labels Market News:

- June 3, 2025: Linxens and Dracula Technologies announced a strategic collaboration to develop battery-free smart labels powered by Dracula’s LAYER organic photovoltaic (OPV) technology. These autonomous IoT solutions harvest ambient indoor light for energy, addressing environmental and lifespan challenges posed by battery-reliant connected labels. This partnership strengthens innovation in sustainable traceability, advancing the global smart labels market with durable, reusable, and energy-independent solutions.

- May 1, 2025: Identiv and InPlay announced a partnership to develop next-generation BLE-enabled smart labels tailored for high-value logistics, cold-chain, and healthcare applications. Powered by InPlay’s ultra-low-power IN100 NanoBeacon™, these labels will offer real-time tracking, integrated sensors, extended range, and advanced encryption, with pricing projected between USD 1–2 per unit. This innovation further accelerates advancements in the global smart labels market, enhancing efficiency and scalability across critical IoT-driven sectors.

- September 24, 2024: Swiss startup truvami unveiled a flexible, battery-free smart label powered by ambient light at The Things Conference in Amsterdam. Leveraging organic photovoltaic (OPV) technology from Dracula Technologies and LoRaWAN® connectivity co-developed with CSEM, the label enables autonomous asset tracking with precise indoor and outdoor localization. This innovation highlights growing global momentum in smart labels for sustainable logistics and asset management, directly boosting the smart labels market.

- September 7, 2023: Avery Dennison announced that Sumitomo Rubber Industries Motorsport Department, a leading manufacturer of tires, has selected the AD Maxdura Tire Tag to be used for endurance racing teams using its Falken tires. This smart label technology helps in tracking and managing tires during endurance racing.

- August 1, 2023: CCL Industries Inc., a global leader in specialty label, security, and packaging solutions, announced the acquisition of the entire intellectual property suite of Imprint Energy Inc. for USD 27.0 million. This strategic move also brings Imprint Energy’s R&D team into CCL’s fold, enhancing its capabilities in developing advanced labeling technologies.

- April 4, 2023: Checkpoint Systems, a global leader in RFID and RF technology solutions, announced the acquisition of Denmark-based Alert Systems. This acquisition strengthens Checkpoint’s portfolio by integrating advanced detection technologies, enhancing its smart label and tracking solutions.

Smart Labels Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Radio-Frequency Identification (RFID), Electronic Article Surveillance (EAS), Electronic Shelf Label (ESL), Sensing Labels, Near Field Communication (NFC) |

| Components Covered | Batteries, Transceivers, Microprocessors, Memories, Others |

| End-Users Covered | Retail, Logistics and Transportation, Healthcare, Food and Beverage, Aerospace, Data Centers and Libraries, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Avery Dennison Corporation, CCL Industries Inc., Checkpoints Systems, Inc., Zebra Technologies Corporation, Intermec Inc., Invengo Technology Pte. Ltd., Sato Holdings Corporation, Thin Film Electronics ASA (Ensurge Micropower ASA), Smartrac N.V. Muehlbauer Holding AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart labels market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart labels market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart labels industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global smart labels market was valued at USD 12.2 Billion in 2024.

We expect the global smart labels market to exhibit a CAGR of 10.86% during 2025-2033.

The rising demand for smart labels in security and tracking solutions, as they help in reducing shoplifting and theft, is primarily driving the global smart labels market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for smart labels.

Based on the technology, the global smart labels market can be segmented into Radio-Frequency Identification (RFID), Electronic Article Surveillance (EAS), Electronic Shelf Label (ESL), sensing labels, and Near Field Communication (NFC). Currently, Radio-Frequency Identification (RFID) holds the majority of the total market share.

Based on the component, the global smart labels market has been divided into batteries, transceivers, microprocessors, memories, and others. Among these, batteries currently exhibit a clear dominance in the market.

Based on the end-user, the global smart labels market can be categorized into retail, logistics and transportation, healthcare, food and beverage, aerospace, data centers and libraries, and others. Currently, retail accounts for the majority of the largest market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global smart labels market include Avery Dennison Corporation, CCL Industries Inc., Checkpoints Systems, Inc., Zebra Technologies Corporation, Intermec Inc., Invengo Technology Pte. Ltd., Sato Holdings Corporation, Thin Film Electronics ASA (Ensurge Micropower ASA), Smartrac N.V., Muehlbauer Holding AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)