Smart Irrigation Market Report by Component (Hardware, Software), Technology (Evapotranspiration, Soil Moisture), Application (Agricultural, Non-Agricultural), System Type (Weather-Based System, Sensor-Based System), and Region 2026-2034

Smart Irrigation Market Size & Trends:

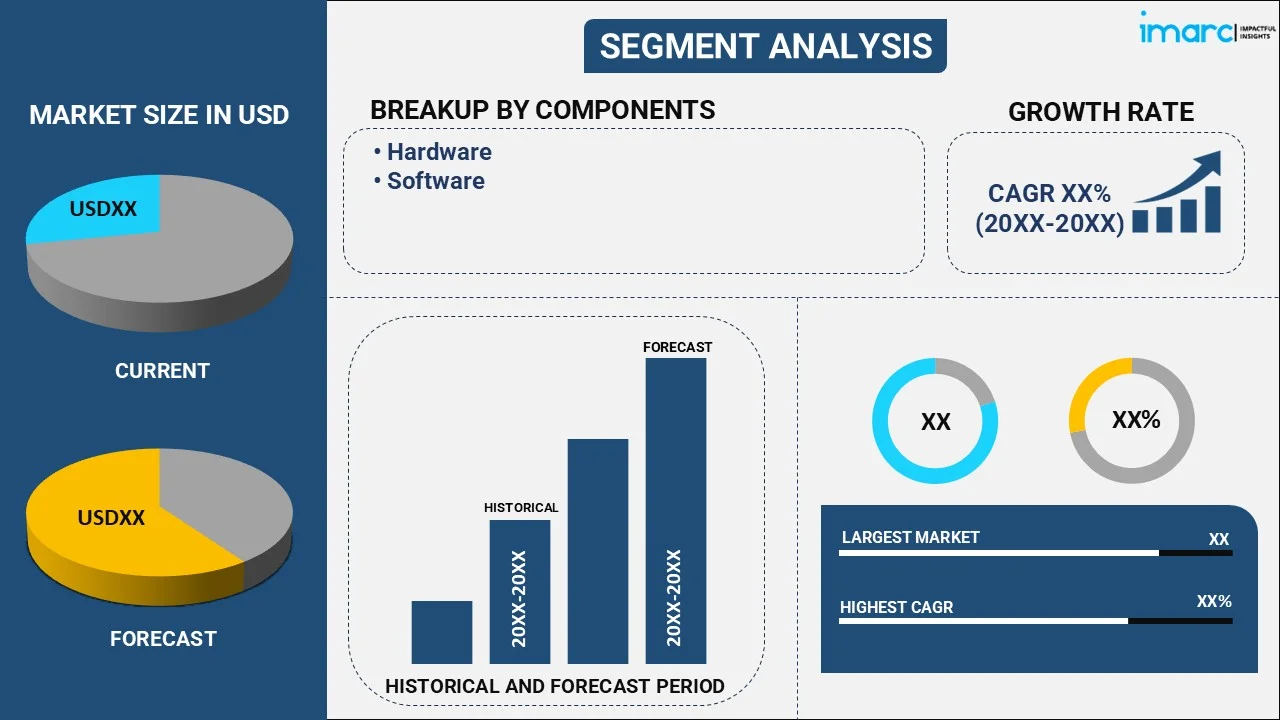

The global smart irrigation market size reached USD 2.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.8 Billion by 2034, exhibiting a growth rate (CAGR) of 12.68% during 2026-2034. The increasing awareness of water conservation, advancements in sensor technology and data analytics, government initiatives to promote sustainable agriculture, surging awareness regarding smart irrigation's cost-effectiveness, and incentives for water-saving technologies are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.0 Billion |

|

Market Forecast in 2034

|

USD 5.8 Billion |

| Market Growth Rate 2026-2034 | 12.68% |

Global Smart Irrigation Market Analysis:

- Major Market Drivers: Growing environmental consciousness, regulations promoting sustainable water usage, and the escalating water scarcity issues across the world are primary smart irrigation market drivers.

- Technological Advancements: Ongoing advancements such as improved sensor technology, artificial intelligence (AI-driven) analytics, and mobile app integrations, are enhancing system efficiency and user experience in the smart irrigation market.

- Key Market Trends: The integration of artificial intelligence (AI) and machine learning (ML) algorithms for precise irrigation scheduling is one of the significant trends of the smart irrigation market. Additionally, the escalating adoption of solar-powered smart irrigation systems for sustainability, and utilization of drones for aerial monitoring and data collection in agriculture are also contributing to the smart irrigation market demand.

- Geographical Trends: North America dominates the global smart irrigation market on account of its advanced technology infrastructure and a focus on water conservation. Developing nations in Asia-Pacific are also experiencing rapid growth, driven by urbanization and agriculture modernization.

- Competitive Landscape: Some of the leading market players in the global smart irrigation market include, AquaSpy, Inc., Banyan Water, Inc., Caipos GmbH, Calsense, Delta-T Devices Ltd., Jain Irrigation, Inc., Galcon Ltd., Hunter Industries Incorporated, HydroPoint Data Systems, Inc., Netafim Limited, Rachio, Inc., Rain Bird Corporation, Soil Scout Oy, The Toro Company, and Weathermatic, among others.

- Challenges and Opportunities: Addressing regulatory requirements for water usage and ensuring system reliability is one of the significant challenges in the global smart irrigation market. However, the rising demand for sustainable irrigation solutions and precision agriculture is anticipated to offer lucrative growth opportunities to the overall market.

Global Smart Irrigation Market Trends:

Increasing Awareness of Water Conservation

In the smart irrigation market overview, the rising awareness regarding the need for water conservation is acting as another significant growth-inducing factor. With water becoming an increasingly scarce resource, especially in arid regions, smart irrigation system is emerging as a solution to minimize wastage. Moreover, government authorities of various nations are taking initiatives to develop efficient irrigation systems to improve agricultural productivity. For instance, the National Bank for Agriculture and Rural Development (NABARD) in India allocated US$ 100 Billion to develop micro-sprinkler irrigation. The government has set a target of covering 100 lakh hectares for micro-irrigation within the next five years. Additionally, the government of Colorado declared a serious water crisis in the south basin of the Colorado River in 2022. Ms. Kyrsten Sinema, Colorado's agricultural minister, announced a US$ 4 Billion compensation to help alleviate the adverse effects of the drought on the Colorado River. These funds were granted for renovating the dams of the river, its infrastructural development, and adequate water usage using drip irrigation. Apart from this, various private entities operating in the global smart irrigation market are increasingly investing in advanced irrigation technologies to effectively utilize water and facilitate sustainable development. For instance, in October 2021, Hunter Industries, a prominent player in the smart irrigation market, collaborated with the environmental technology company, Phyn. Together, they introduced "Phyn Plus," a smart water monitoring and leak detection system that can be integrated with irrigation systems. Innovations and collaborations like these are anticipated to create a positive outlook for the future of the smart irrigation market.

Growing Global Population and Food Demand

The increasing global population is exerting pressure on the agriculture sector to produce more food. Smart irrigation systems are playing a crucial role in improving crop yields while optimizing water usage. According to a study by the World Bank in 2017, the demand for food will rise due to the increasing population. Hence, to meet the food requirement agricultural production will need to expand 70% by 2050. Consequently, to achieve this target smart irrigation methods are needed to increase crop production by enhancing its productivity, as many areas don't have enough irrigation facilities. In addition to this, various concerned authorities and private entities across the world are forming partnerships and collaborations to increase crop yield by applying an accurate amount of water during the irrigation process. For instance, WaterSense is a partnership program sponsored by the U.S. Environmental Protection Agency (EPA) to encourage water-efficient products and resources helpful for saving water. Similarly, the European Union announced a program "Water and Energy Advanced Management for Irrigation (WEAM4i)" to improve water usage efficiency and reduce the energy costs in irrigation systems and also help in ensuring food security on a global basis. Additionally, AGCO, a global leader in the design, manufacture and distribution of agricultural machinery and precision ag technology, collaborated with Robert Bosch GmbH, BASF Digital Farming and Raven Industries Inc., with the objective of evaluating targeted spraying technology to make the application of crop protection products more effective and efficient by reducing crop input costs while driving farm and environmental sustainability.

Advancements in Sensor Technologies and Data Analytics

Advancements in sensor technologies and data analytics are revolutionizing the irrigation industry. Various key market players are launching smart irrigation systems equipped with sophisticated sensors that can measure soil moisture levels, detect weather conditions, and assess plant requirements with precision. According to the smart irrigation market statistics, IBM and Texas A&M AgriLife are working together to help farmers receive insights for water usage, which can further crop yield increases while decreasing economic and environmental costs. Texas A&M AgriLife and IBM will deploy and scale Liquid Prep, a tech solution that provides “when to water” decision support to farmers, in arid regions of the United States. Similarly, in July 2020, Lindsay Corporation, a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology, acquired Net Irrigate, LLC, an agriculture Internet of Things (IoT) technology company that provides remote monitoring solutions for irrigation customers. The acquisition furthers the two companies' shared goals of delivering innovative real-world solutions to help growers increase water and energy efficiency and exercise more sustainable farming practices while operating and maintaining irrigation systems. In addition to this, in July 2023, Deere & Company acquired Smart Apply, Inc., a precision spraying equipment company based in Indianapolis, Indiana. This move will help Deere & Company to expand a portfolio of solutions to help farmers address their biggest challenges around labor, input costs, and regulatory requirements, and achieve environmental goals. Technological advancements like these are anticipated to offer lucrative growth opportunities to the overall market in the coming years.

Government Initiatives Promoting Sustainable Agriculture

Governments across the globe are increasingly focusing on sustainable agricultural practices to ensure food security and conserve natural resources, which is further catalyzing the market for smart irrigation across the globe. The concerned regulatory authorities, banks, and private entities are collaborating to provide smart irrigation solutions to farmers at subsidized rates. For instance, in 2021-2022, the Indian government decided to double the money in a special fund for small-scale irrigation to US$ 1.32 Billion. This fund, set up with the help of the National Bank for Agriculture and Rural Development (NABARD), is part of a bigger plan called the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) to help farmers water their crops more effectively. Moreover, in August 2021, the Consulate General of Israel to South India, in collaboration with the United Planters' Association of Southern India (UPASI), Jain Irrigation Systems, and NaanDanJain Irrigation, launched the Smart IoT Irrigation Project in Tea Plantation in Ooty, Tamil Nadu. Smart IoT Irrigation is an innovative Israeli technique that uses water judiciously and helps farmers achieve higher levels of crop yield with minimal water wastage. The convergence of government policies with sustainable agriculture practices is a significant driver in the adoption of smart irrigation solutions.

Smart Irrigation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on component, technology, application, and system type.

Breakup by Component:

- Hardware

- Sensors

- Controllers

- Sprinkler Nozzles

- Water Flow Meters

- Others

- Software

The hardware segment holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (sensors, controllers, sprinkler nozzles, water flow meters, and others) and software. According to the report, hardware holds the majority of the market share.

The hardware segment (sensors, controllers, sprinkler nozzles, water flow meters, others) is driven by the increasing demand for advanced sensor technologies and the Internet of Things (IoT-enabled) devices. Various leading market players are increasingly investing in research and development activities to launch improved irrigation systems. For instance, in August 2021, Rachio, a leading provider of smart sprinkler controllers, launched an enhanced version of its smart irrigation controller, the Rachio 3e. This upgraded model featured improved compatibility with smart home ecosystems, including Apple HomeKit and Google Home, allowing users to integrate their irrigation system with other smart devices. Furthermore, the adoption of smart irrigation systems in both agricultural and non-agricultural sectors fuels hardware sales, as users seek efficient solutions to manage water resources effectively.

Breakup by Technology:

- Evapotranspiration

- Soil Moisture

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes evapotranspiration and soil moisture.

Breakup by Application:

- Agricultural

- Greenhouse

- Open field

- Non-Agricultural

- Residential

- Turf & Landscape

- Golf Course

- Others

Agricultural holds the largest share in the industry

The report has provided a detailed breakup and analysis of the market based on the application. This includes agricultural (greenhouse, open field), non-agricultural (residential, turf & landscape, golf course, others). According to the report, agricultural accounted for the largest market share.

The agricultural (greenhouse, open field) segment is driven by the increasing need for precision agriculture practices. As global population growth continues, the demand for food production rises exponentially. Moreover, government authorities are taking initiatives to develop irrigation systems for farmers to enhance the crop yield. For instance, the Indian Agricultural Research Institute (IARI) developed a new system called the design of a micro-irrigation system (DOMIS). It is a web-based application that helps design customized micro-irrigation systems for efficient water utilization under different agro-climatic conditions. The institute plans to develop devices that utilize low amounts of water to help farms. Additionally, government support in the form of subsidies and incentives for adopting water-efficient practices also bolstering the growth of smart irrigation in agriculture.

Breakup by System Type:

- Weather-Based System

- Sensor-Based System

Sensor-based system represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the system type. This includes weather-based system and sensor-based system. According to the report, sensor-based system represented the largest segment.

The sensor-based system segment is primarily driven by the growing demand for real-time data and analytics in agriculture. They utilize an array of sensors to monitor soil moisture levels, plant health, and other critical parameters. Moreover, various key market players are continuously introducing advanced irrigation systems equipped with improved sensor technologies to enhance irrigation. For instance, in December 2021, Toro Manufacturing LLC launched Tempus Automation system for agricultural irrigation. The system features 4G/wi-fi/LoRa/Bluetooth technology and outperforms the competition in range, ease of installation, and functionality. The launch aims to help farmers reduce overall labor, improve crop irrigation fertigation, and remotely monitor the entire system and agronomic conditions. Similarly, in August 2021, Netafim Ltd. launched the Portable Drip Kit. This complete all-in-one irrigation solution is easy to install, affordable, and is specifically designed for small farmers with up to one acre of farmland. The drip kit is suitable for various Rabi and Kharif crops, including vegetables, cucurbits, and close-spaced crops. The launch aims to irrigate 10,000 hectares of land and reach 25,000 farmers across India in 2022.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

North America leads the market, accounting for the largest smart irrigation market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Others). According to the report, North America accounted for the largest market share.

The North America smart irrigation market is driven by the increasing focus on water conservation and sustainable agriculture practices. As a region facing water scarcity challenges the government authorities are taking initiative to encourage the adoption of water-saving technologies. Various agricultural organizations have come together to form the North America Climate Smart Agriculture Alliance (NACSSA), a platform for educating and equipping the cultivators for sustainable agricultural productivity. With the rising concern for water conservation, government authorities in North America are providing subsidies to improve the application of smart irrigation. For instance, the government of California has provided rebates on smart controllers. Moreover, private entities in North America are also forming partnerships to offer advanced products in the region. For instance, Lumo, a smart irrigation company announced its exclusive retail partnership with Central Valley, a leading supplier of vineyard equipment and materials in Northern California. Lumo is the only irrigation automation solution sold by Central Valley, marking a significant milestone in advancing sustainable viticulture practices and enhancing water management in the region.

Leading Key Players in the Smart Irrigation Industry:

The market research report has provided a comprehensive analysis of the competitive landscape and smart irrigation market outlook. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AquaSpy, Inc.

- Banyan Water, Inc.

- Caipos GmbH

- Calsense

- Delta-T Devices Ltd.

- Jain Irrigation, Inc.

- Galcon Ltd.

- Hunter Industries Incorporated

- HydroPoint Data Systems, Inc.

- Netafim Limited

- Rachio, Inc.

- Rain Bird Corporation

- Soil Scout Oy

- The Toro Company

- Weathermatic

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Smart Irrigation Market News:

- March 2024: Water Ways Technologies Inc., a global provider of Israeli-based agriculture technology, providing water irrigation solutions to agricultural producers, announced that it received two new orders totaling over CAD$140,000 from clients in South America for smart irrigation equipment.

- February 2024: Lumo, a smart irrigation company announced its exclusive retail partnership with Central Valley, a leading supplier of vineyard equipment and materials in Northern California. Lumo is the only irrigation automation solution sold by Central Valley, marking a significant milestone in advancing sustainable viticulture practices and enhancing water management in the region.

- November 2023: The Asian Development Bank (ADB) approved a US$ 48 Million loan to modernize agriculture irrigation systems and support institutional reforms in Georgia. The Climate Smart Irrigation Sector Development Program, ADB’s first initiative in the agriculture sector, aims to increase climate resilience and productivity. It will offer a modernized piped irrigation network covering about 7,000 hectares of the Kvemo Samgori irrigation scheme area in the agricultural region of Kakheti.

- November 2023: ImoLaza, a high-tech company specializing in futuristic irrigation technology, launched the latest addition to its smart irrigation series – ImoLaza PRO. ImoLaza PRO is anticipated to bring a next-generation smart irrigation technology that has received widespread acclaim from millions of households.

Global Smart Irrigation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Technologies Covered | Evapotranspiration, Soil Moisture |

| Applications Covered |

|

| System Types Covered | Weather-Based System, Sensor-Based System |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia |

| Companies Covered | AquaSpy, Inc., Banyan Water, Inc., Caipos GmbH, Calsense, Delta-T Devices Ltd., Jain Irrigation, Inc., Galcon Ltd., Hunter Industries Incorporated, HydroPoint Data Systems, Inc., Netafim Limited, Rachio, Inc., Rain Bird Corporation, Soil Scout Oy, The Toro Company, Weathermatic, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart irrigation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart irrigation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart irrigation industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global smart irrigation market to exhibit a CAGR of 12.68% during 2025-2033.

The increasing penetration of automated, digital monitoring systems in the agriculture sector, is primarily driving the global smart irrigation market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous manufacturing units and disrupted supply for smart irrigation components.

Based on the application, the global smart irrigation market has been divided into agricultural and non- agricultural, where agricultural exhibits a clear dominance in the market.

Based on the system type, the global smart irrigation market can be categorized into weather-based system and sensor-based system. Currently, sensor-based system accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global smart irrigation market include AquaSpy, Inc., Banyan Water, Inc., Caipos GmbH, Calsense, Delta-T Devices Ltd., Jain Irrigation, Inc., Galcon Ltd., Hunter Industries Incorporated, HydroPoint Data Systems, Inc., Netafim Limited, Rachio, Inc., Rain Bird Corporation, Soil Scout Oy, The Toro Company, and Weathermatic.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)